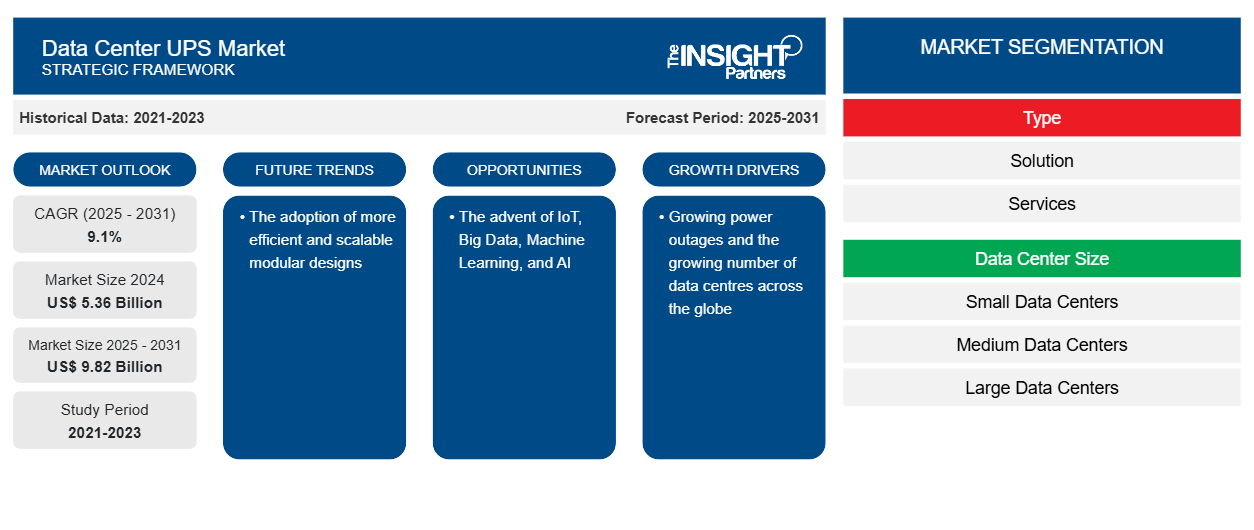

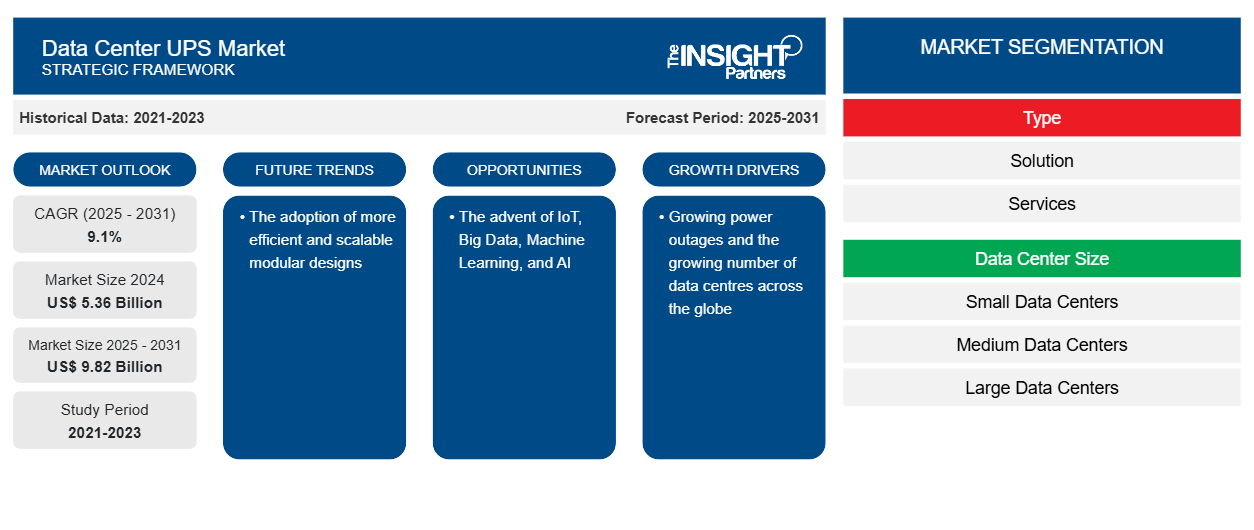

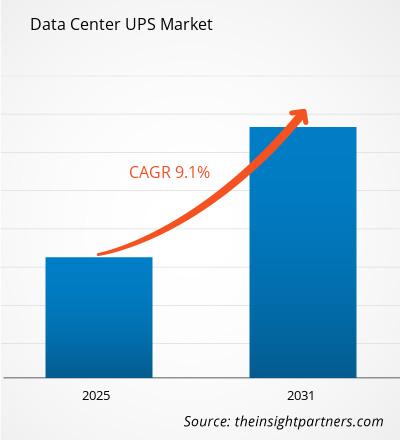

The data center UPS market size is projected to reach US$ 9.82 billion by 2031 from US$ 4.91 billion in 2023. The market is expected to register a CAGR of 9.1% during 2023–2031. The adoption of more efficient and scalable modular designs is likely to remain a key trend in the market.

Data Center UPS Market Analysis

The global data center UPS market is primarily driven by the rising demand for continuous power supply worldwide. This can be attributed to the high dependency on technology for performing business operations, resulting in an increasing demand for 24/7 availability of data centers. The data center UPS market has witnessed significant growth in recent years, driven by rapid digitalization, growing incidences of power outages, and increasing demand for eco-friendly solutions by reducing power consumption. Moreover, the growing number of data centers across the globe and the emerging trend of edge computing are driving the market during the forecast period. However, the rising adoption of modular UPS systems and growing investment in 5G edge data centers are creating lucrative opportunities in the market growth.

Data Center UPS Market Overview

Data Center UPS (uninterruptible power supply) is a device specially designed to give data center equipment as backup power when the main power source is lost. Data Center UPS allows computers to stay running for a few hours during a power blackout and protects them from power surges. These devices help the user guarantee smooth functioning and safeguard against loss or damage to the data center. The main purpose of a data center UPS is to supply essential data center equipment with power backup, preventing data loss, equipment damage, and downtime. Data Center UPS offers one of the most important features is its capacity, which is based on the system's runtime that specifies how long backup power is provided with its kilovolt-amperes (kVA) or megavolt-amperes (MVA) rating. Data Center UPS can control the voltage and frequency to provide equipment with a consistent and reliable power supply. Furthermore, these devices also offer numerous product variations, such as remote monitoring and administration management features, which provide data center operators with a centralized way to monitor, manage, and control the functioning of the UPS.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Data Center UPS Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Data Center UPS Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Data Center UPS Market Drivers and Opportunities

Growing Power Outrages to Favor Market

Data centers across the globe are facing high amounts of power outages, which increases the demand for data center UPS among users and drives the global market during the forecast period. For instance, according to CBRE Group, in September 2022, the power supply in under-construction data centers reached 1.9 gigawatts in the US, which is an increase of 52.8% compared to the previous year's supply. These trends increase the demand for data centers UPS among users, which further drives the global data center UPS market. Moreover, according to the Uptime Institute Survey, in March 2023, 78% of data centers faced power outages in 78% during the previous three years, which resulted in lost revenue and additional expenses. The power outrage creates issues in software and networking of the data center, which is the most frequently caused by power problems. This increases the adoption of data center UPS among users for supplying power throughout the data center.

Moreover, power outrage in the data center may also hamper the business productivity from data loss. Loss of data makes it difficult for users and employees to access files and perform their essential job duties. Meanwhile, many small and large businesses are dependent on the regular operation of their business, and providing regular data security to its customers increases the demand for data centers UPS among users to reduce outages and downtime. This encourages market players to develop solutions for reducing the frequency of power outages in the data center. For instance, Amazon Web Services provides in-rack UPS systems to the data center to prevent power outages and downtime, which is driving the market during the forecast period.

The advent of IoT, Big Data, Machine Learning, and AI

The Internet of Things (IoT), big data, machine learning, and artificial intelligence (AI) are a few technologies that generate massive amounts of data, require low latency processing, and demand localized computing resources. According to IoTExpress Technologies Pvt. Ltd., in APAC, IoT devices are expected to surpass 15 billion by the end of 2023, a 55% increase from 2021. Additionally, these devices are expected to generate 79.4 zettabytes (ZB) of data by 2031, according to IoTExpress Technologies Pvt. Ltd. IoT generates a huge amount of data that must be processed, stored, and analyzed in real-time. IoT devices are widely used across the region, connecting various physical objects and enabling data collection and communication. Such advent of the Internet of Things (IoT), big data, machine learning, and artificial intelligence will drive the need for data centers, which in turn will increase the demand for data center UPS.

Data Center UPS Market Report Segmentation Analysis

Key segments that contributed to the derivation of the data center UPS market analysis are type, data center size, application, and end user.

- Based on type, the data center UPS market is divided into solution and services. The solution segment is further sub-segmented into standby UPS, line interactive UPS, and double conversion online UPS. The service segment is further sub-segmented into managed and professional. The solution segment held a larger market share in 2023.

- By data center size, the market is segmented into small data centers, medium data centers, and large data centers. The large data centers segment is expected to hold the largest share of the market in 2023.

- In terms of application, the market is segmented into cloud storage, enterprise resource planning (ERP) systems, data warehouses, file servers, application servers, and customer relationship management (CRM) systems. The cloud storage segment is expected to grow with the highest CAGR over the forecast period.

- In terms of end-users, the market is segmented into banking and financial services, information technology, manufacturing, energy, healthcare, government, entertainment and media, and others. The information technology segment is expected to hold the largest share of the market in 2023.

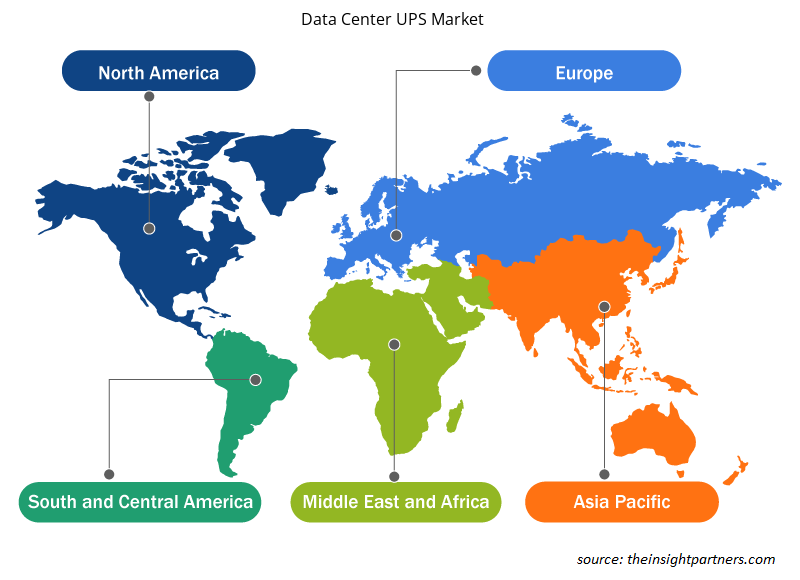

Data Center UPS Market Share Analysis by Geography

The geographic scope of the data center UPS market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the market owing to growing demand for various industries such as healthcare, finance, and insurance, among others. These industries are adopting data center UPS to manage the high availability of computing by maximizing their resources. North America is home to a large number of colocation facilities and data center service providers, particularly in the US. For instance, according to Cloudscene, in December 2022, the US had over 2,000 data centers, which created a substantial market for UPS solutions. Companies like Cologix, Equinix, Inc., CoreSite, US Signal Company, L.L.C., and others are the major colocation facilities and data center service providers in North America. The size and mode of operation performed by wholesale and cloud data centers are creating a unique need for power efficiency, and special requirements for conditioned uninterrupted power supply are driving the market in the region.

Data Center UPS Market Regional Insights

The regional trends and factors influencing the Data Center UPS Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Data Center UPS Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Data Center UPS Market

Data Center UPS Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 5.36 Billion |

| Market Size by 2031 | US$ 9.82 Billion |

| Global CAGR (2025 - 2031) | 9.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Data Center UPS Market Players Density: Understanding Its Impact on Business Dynamics

The Data Center UPS Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Data Center UPS Market are:

- Vertiv Co.

- Delta Power Solutions

- Eaton Corp.

- ABB

- AEG

- General Electric

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Data Center UPS Market top key players overview

Data Center UPS Market News and Recent Developments

The data center UPS market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the data center UPS market are listed below:

- Fuji Electric Co., Ltd. launched the 7500WX Series to expand its high-capacity uninterruptible power supply systems series. 7500WX Series has a single-unit capacity of 2,400 kVA, which contributes to the secure electricity supply by reducing CO2 emissions. (Source: Fuji Electric Co., Ltd, Press Release, July 2023)

- ABB launched a new innovative MegaFlex DPA UPS solution for data centers. The new MegaFlex DPA UPS solution is the most resilient and compact UPS system for the Indian market and has reduced its footprint by up to 45 percent. (Source: ABB, Press Release, July 2023)

Data Center UPS Market Report Coverage and Deliverables

The “Data Center UPS Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Data center UPS market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Data center UPS market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Data center UPS market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the data center UPS market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Lyophilization Services for Biopharmaceuticals Market

- Sandwich Panel Market

- Parking Management Market

- Medical Audiometer Devices Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- HVAC Sensors Market

- Maritime Analytics Market

- Europe Industrial Chillers Market

- Asset Integrity Management Market

- Volumetric Video Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Data Center Size, Application, End-user

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global data center UPS market is projected to reach US$ 9.82 billion by 2031.

The adoption of more efficient and scalable modular designs is anticipated to play a significant role in the global data center UPS market in the coming years.

The leading players operating in the data center UPS market are Vertiv Co., Delta Power Solutions, Eaton Corp., ABB, AEG, General Electric, Schneider Electric SA, Gamatronic Electronic Industries, Emerson Network Power Inc., Toshiba Corp., Mitsubishi Electric Power Products Inc., Cyber Power Systems, Inc., Aspen Systems Inc, Eaton., Legrand SA, Delta Electronics, Inc, Rolls-Royce plc, RPS Spa, Right Power Technology Sdn Bhd, and Numeric.

The major factors driving the data center UPS market are the growing power outages and the growing number of data centres across the globe.

The global data center UPS market is expected to grow at a CAGR of 9.1% during the forecast period 2024 - 2031.

North America is expected to dominate the market in 2023

Get Free Sample For

Get Free Sample For