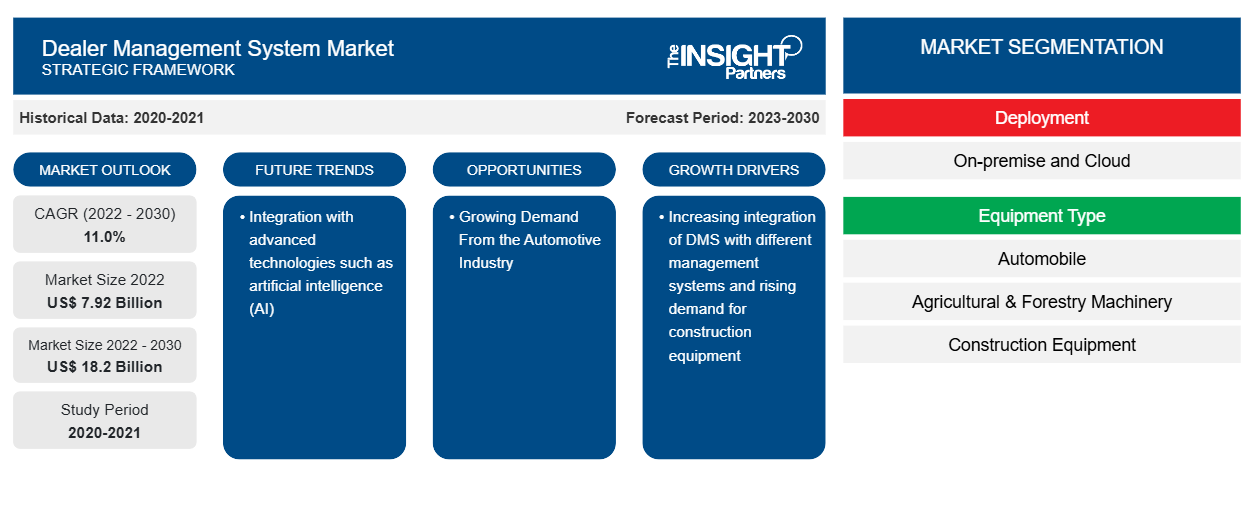

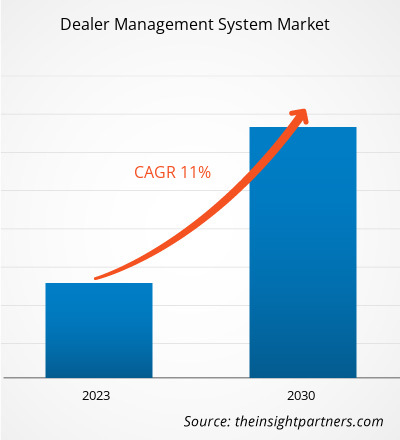

The dealer management system market size is projected to reach US$ 18.2 billion by 2030 from US$ 7.92 billion in 2022. The market is expected to register a CAGR of 11% during 2022–2030. Integration with advanced technologies such as artificial intelligence (AI) is likely to remain a key trend in the market.

Dealer Management System Market Analysis

With an increased demand for dealer management systems coupled with low entry barriers to the market, the market continuously witnesses a rise in the number of emerging players. These market players are entering partnerships to develop advanced solutions or add features to existing systems to attract more customers. For instance, in December 2022, Dealer-Pay and Dealertrack collaborated to add advanced payment tools to an automotive dealer management system. Dealer-P advanced payment tools were integrated with Dealertrack’s dealer management system, enabling automotive dealerships to process payments in all departments. The advanced system offers flexibility and convenience to pay customers via links in texts, emails, or other online platforms. The constantly rising emphasis on the enhancement of customer satisfaction is leading to increased development of dealer management systems. Pertaining to the risk of customer loss, the end users are increasingly focusing on procuring and deploying advanced technologies in the existing system to gain customer satisfaction by smoothly managing their purchasing processes. All these factors are anticipated to fuel the dealer management system market growth in the coming years.

Dealer Management System Market Overview

The growing technology and changing market demands made it important for businesses to enhance their efficiency in all aspects of their business. The dealer management system simplifies dealer networking, sales and customer tracking, product orders, and inventory management. The major stakeholders in the dealer management system ecosystem comprise software providers, system integrators, and end users. With the advancement of cloud technology, the systems integrator also incorporates on-premises IT systems with cloud applications. The software offered by the providers is integrated as per the specific requirements of the end users, including auto dealers who sell vehicles. Auto dealers are distinct and mostly independent from the auto manufacturers. They procure this system to track inventory in real-time and maintain the relationship with their customers; this allows them to run the business efficiently.

The dealer management system market is fragmented. Market players are expanding their business by employing various methods, such as product portfolio expansion, service expansion, and mergers & acquisitions (M&A). In May 2023, e-Emphasys Technologies Inc. announced the merger with CDK Global Heavy Equipment to address the end-to-end business optimization needs of equipment dealers and rental companies. The mergers also facilitate the company to drive innovation in the industry.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Dealer Management System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Dealer Management System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Dealer Management System Market Drivers and Opportunities

Increasing Integration of DMS with Different Management Systems to Favor Market

Challenges associated with synchronization among workplaces, individuals, and administrative centers can be devastating in handling multiple businesses, such as filing reports and fulfilling the requirements of demanding customers, as well as maintaining an inventory. With increased focus on improved customer connection and communication, several manufacturers are looking for integrated ways to manage their business. This boosts the need to have systems that streamline enhanced interactions between customers, dealers, and OEMs. Dealer management systems integrated with various features—such as CRM, service management, spare part management, sales tracking, and inventory management features—meet the growing requirements of the modern manufacturing industry. Dealer management systems collect data about customers, inventory, and products and make inventory management more efficient. These systems facilitate the visibility of dealer operations across different countries. Companies are widely integrating their services with a dealer management system to offer enhanced customer experience. A few of such instances are mentioned below:

- In June 2022, ABCoA Inc. launched new and revolutionary DST Dealership Sales Tools for managing inventory. It is a new browser-based dealer management software (DMS) specifically designed for retail used car dealers. The software helps car dealers easily manage inventory and promote cars on websites, attain instant funding and desk deals, pull credit transactions, and print contracts. DST offers many standard integrations at no charge. Further, the software helps car dealers to provide their customers with a complete online shopping experience. DST Dealership Sales Tools is easy to use and affordable, offering less upfront cost to the car dealers, which increases its demand in the market.

With a robust dealer management system integrated with different management systems, dealers can manage operations from inventory management to customers and product sales to services. This factor is driving the dealer management system market across the globe.

Growing Demand From the Automotive Industry

Dealer management system for the automotive industry provides a comprehensive solution to efficiently handle inventory, sales, customer relationships, and business processes. A dealer management system in the automotive industry streamlines operations attracts the target audience, and fosters customer loyalty for sustained success. Furthermore, the coming years will be of autonomous and connected cars. With the advancement in sensors, IoT and machine learning, a dealer management system provides vehicle details in terms of actual mileage, kilometers run, performance of the vehicle, issues, if any, etc., through sensors.

Dealer Management System Market Report Segmentation Analysis

Key segments that contributed to the derivation of the dealer management system market analysis are deployment and equipment type.

- Based on the deployment, the dealer management system market is divided into on-premise and cloud. The cloud segment will hold a significant market share in 2022.

- In terms of equipment type, the market is segmented into automobile, agricultural & forestry machinery, construction equipment, gardening equipment, heavy trucks, material handling & lifting equipment, mining equipment, and others. The automobile segment held a significant market share in 2022.

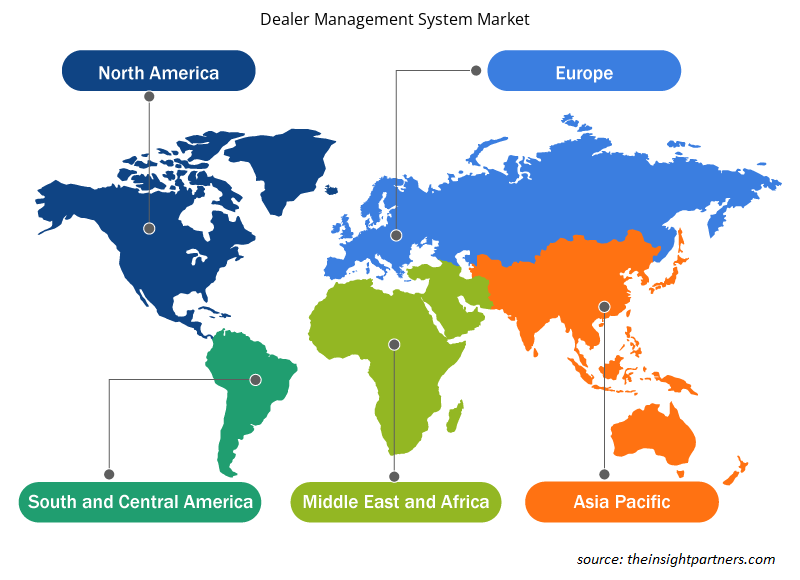

Dealer Management System Market Share Analysis by Geography

The geographic scope of the dealer management system market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The dealer management system market in Asia Pacific is experiencing significant growth. The APAC dealer management system market is segmented into Australia, China, India, Japan, South Korea, and the Rest of APAC. APAC is anticipated to record the highest CAGR in the dealer management system market during the forecast period. The market growth in APAC is attributed to the growing need to manage business operations effectively. Enterprises operating across industry verticals, including transport & logistics, construction, and agriculture, among others, prefer dealer management systems that are easy to integrate, manage, and operate. Further, a cloud-based dealer management system is gaining popularity in the region as it is beneficial to enterprises. For instance, in December 2022, Tata Motors migrated a dealer management software to Oracle Cloud Infrastructure (OCI). The cloud-based system helps Tata Motors to boost its operational efficiency with detailed business insights. The system supports auto dealers to enhance security, increase flexibility, and provide cost-effective solutions to the customers. Moreover, the system helped the company to record customer touch points and engage them through channels such as SMS and social media, thereby improving overall productivity. Several players, such as Hinduja Tech Partners, are entering into partnerships to provide real-time observation of operational processes. This feature issues an alert to automakers when they are receiving issues related to customer complaints and product handling and sales. The system helps them to respond immediately to customer's queries. Thus, the benefits of using a dealer management system in various industries drive the APAC dealer management system market

Dealer Management System Market Regional Insights

The regional trends and factors influencing the Dealer Management System Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Dealer Management System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Dealer Management System Market

Dealer Management System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 7.92 Billion |

| Market Size by 2030 | US$ 18.2 Billion |

| Global CAGR (2022 - 2030) | 11.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Deployment

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

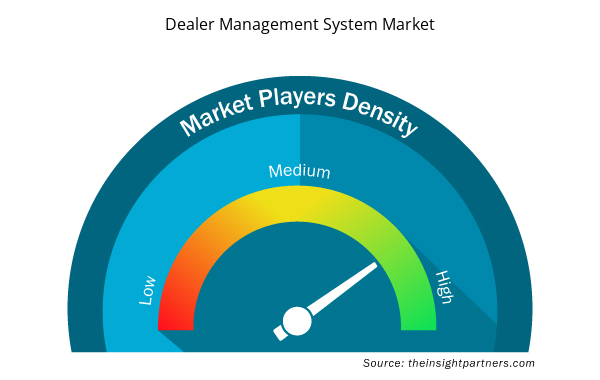

Dealer Management System Market Players Density: Understanding Its Impact on Business Dynamics

The Dealer Management System Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Dealer Management System Market are:

- e-Emphasys Technologies Inc.

- ANNATA Ehf

- DealerBox SAS

- Hitachi Solutions Ltd

- Irium Software SAS

- CDK Global

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Dealer Management System Market top key players overview

Dealer Management System Market News and Recent Developments

The dealer management system market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the dealer management system market are listed below:

- Procede Software, a leading heavy-duty commercial vehicle dealer management system (DMS) and solutions provider, today announced the general release of the latest version of Excede v10.4. The new release was developed in close collaboration with daily Excede users and subject matter experts who participate in the Procede Insider Program, the cornerstone of its user-centered design strategy. (Source: Procede Software, Press Release, January 2024)

- DealerBox SAS partnered with Electric Way to manage the delivery process of Cars. DealerBox SAS’s automotive cloud solution helps Electric Way with internal processes, such as purchasing, sales, registration, and transportation of cars. (Source: DealerBox SAS, Ltd, Press Release, June 2023)

Dealer Management System Market Report Coverage and Deliverables

The “Dealer Management System Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Dealer management system market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Dealer management system market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Dealer management system market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the dealer management system market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Broth Market

- Nuclear Waste Management System Market

- Educational Furniture Market

- Grant Management Software Market

- Bio-Based Ethylene Market

- Identity Verification Market

- UV Curing System Market

- Third Party Logistics Market

- Biopharmaceutical Contract Manufacturing Market

- Blood Collection Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Deployment, and Equipment Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

North America is expected to dominate the dealer management system market with the highest market share in 2022.

The dealer management system market size is projected to reach US$ 18.2 billion by 2030.

The leading players operating in the dealer management system market are e-Emphasys Technologies Inc., ANNATA Ehf, DealerBox SAS, Hitachi Solutions Ltd, Irium Software SAS, CDK Global, Constellation Software, DealerTrack Inc, Tekion Corp, and XAPT Software Consulting LLC

The global dealer management system market is expected to grow at a CAGR of 11% during the forecast period 2022 - 2030.

Integration with advanced technologies such as artificial intelligence (AI) is anticipated to play a significant role in the global dealer management system market in the coming years.

Increasing integration of DMS with different management systems and rising demand for construction equipment are the major factors driving the dealer management system market.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Dealer Management System Market

- e-Emphasys Technologies Inc.

- ANNATA Ehf

- DealerBox SAS

- Hitachi Solutions Ltd

- Irium Software SAS

- XAPT Software Consulting LLC

- CDK Global Inc

- Cox Automotive

- Constellation Software Inc

- Tekion Corp

Get Free Sample For

Get Free Sample For