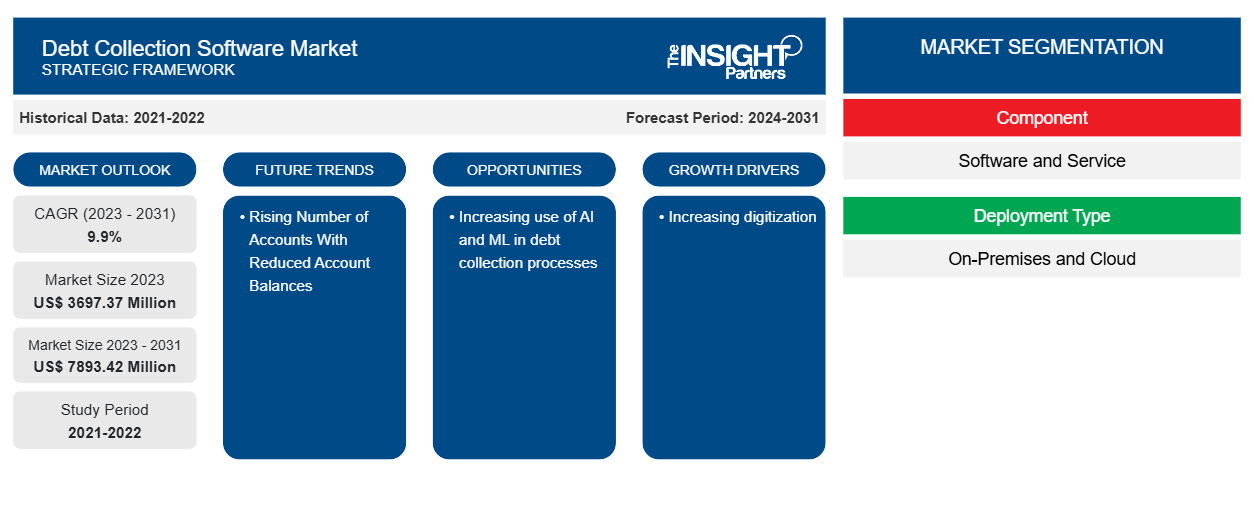

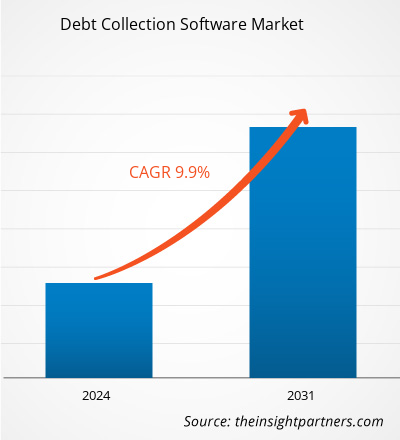

The debt collection software market size is projected to reach US$ 7893.42 million by 2031 from US$ 3697.37 million in 2023. The market is expected to register a CAGR of 9.9% during 2023–2031. The rising number of accounts with reduced account balances is likely to remain a key trend in the market.

Debt Collection Software Market Analysis

The debt collection software offers various benefits. It compiles all debtor profiles into a single location, including their address, credit card information, current balance, and a comprehensive report about the debt's delinquent payments, such as amount, age of debt, etc. It is essential to exchange information between creditors and DCA regarding the debtor's profile, location, contact information, additional information regarding their debts, etc. BPO is another name for this data-sharing process. Software and API for debt recovery can be employed to collect charges from both businesses and consumers. Therefore, with such benefits, the debt collection software market is growing.

Debt Collection Software Market Overview

Debt collection software is employed for the automation of various processes involved in debt recovery. This business process automation streamlines many of the components of the debt collection process removing friction to enable more effective and efficient collection efforts. Connecting and engaging in their channel at the right time improves how customers perceive the business and determines the likelihood of a successful outcome. By adding all the elements that provide effective and effective conversations like digital channels. Automation, blended engagement, APIs, and AI will transform how customers interact and generate more payments faster.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Debt Collection Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Debt Collection Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Debt Collection Software Market Drivers and Opportunities

Increasing digitization

The COVID-19 pandemic accelerated the introduction of cashless transactions. Digital banking is the norm, and since debt collection involves financial transactions, it is evident that digitization is responsible for banks and debt collection agencies. As delinquencies increase, lending institutions worldwide are increasingly utilizing digital debt collection techniques to boost their recovery rates in a cost-effective manner. Therefore, the increasing digitization is driving the debt collection software market.

Increasing use of AI and ML in debt collection processes

Using AI and ML, Digital Debt collection platforms utilize various strategies to increase efficiency. A few acquire critical data from multiple sources and channels. This data could include information such as borrowers' profile, their income, choices, credit and financial history, and payment track records to create smart micro-segments, enhancing the efficiency of traditional collection strategies employed by the lender. Thus, increasing the use of AI and ML in debt collection processes is increasing opportunities for the market.

Debt Collection Software Market Report Segmentation Analysis

Key segments that contributed to the derivation of the debt collection software market analysis are component, deployment type, organization size, and industry vertical.

- Based on the component, the debt collection software market is divided into software and service. The customized segment held a larger market share in 2023.

- By deployment type, the market is segmented into on-premises and cloud. The surface-mounted segment held a larger market share in 2023.

- By organization size, the market is segmented into large enterprises and SMEs.

- By organization size, the market is segmented into IT & telecom, BFSI, retail, manufacturing, and others.

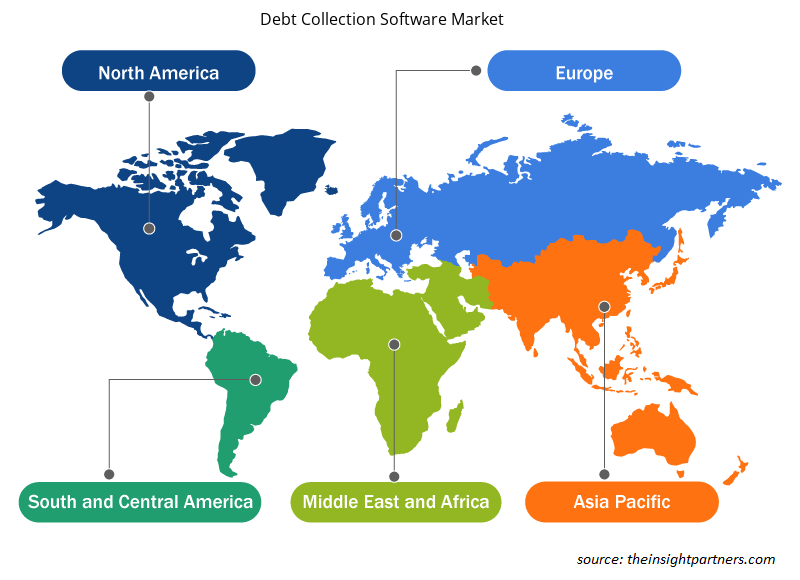

Debt Collection Software Market Share Analysis by Geography

The geographic scope of the debt collection software market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

APAC dominates the debt collection software market. The debt collection software market in this region is growing due to various factors, such as increasing government initiatives to improve the visibility of tunnel lighting and the presence of a well-established transportation industry.

Debt Collection Software Market Regional Insights

The regional trends and factors influencing the Debt Collection Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Debt Collection Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Debt Collection Software Market

Debt Collection Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3697.37 Million |

| Market Size by 2031 | US$ 7893.42 Million |

| Global CAGR (2023 - 2031) | 9.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Debt Collection Software Market Players Density: Understanding Its Impact on Business Dynamics

The Debt Collection Software Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Debt Collection Software Market are:

- Chetu Inc.

- FICO

- CSS Inc.

- Experian Information Solutions Inc.

- EXUS

- Loxon Solutions

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Debt Collection Software Market top key players overview

Debt Collection Software Market News and Recent Developments

The debt collection software market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the debt collection software market are listed below:

- University Hospital Zurich (USZ) replaced its previous SAP-based debt collection software solution with Robo-Inkasso from Tilbago AG. According to USZ, this helps to reduce overall manual effort and, therefore, the total costs involved while also offering a greater scope of services. (Source: University Hospital Zurich (USZ)., Press Release, December 2022)

- Tally, a fintech startup known for helping people diligently pay down their credit card debt, announced the release of its white-labeled credit card debt management software. This B2B offering scales Tally’s mission to give consumers a better path to debt management. Tally’s first partner, a large publicly traded consumer company with more than 50 million users, is slated to launch Tally’s software to its users in July 2024. Tally raised additional capital from existing investors to develop its B2B offering and, to date, has raised over $200 million to build and scale the platform. (Source: Tally, Press Release, April 2022)

Debt Collection Software Market Report Coverage and Deliverables

The “Debt Collection Software Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Debt collection software market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Debt collection software market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- debt collection software market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the debt collection software market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Deployment Type, Organization Size, and Industry Vertical

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The expected CAGR of the global debt collection software market is 9.9%.

The global debt collection software market is expected to reach US$ 7893.42 million by 2031.

The key players holding majority shares in the global debt collection software market are Chetu Inc., FICO, CSS, Inc., Experian Information Solutions Inc., EXUS, Loxon Solutions, FIS, Pegasystems Inc., Quantrax Corporation, Inc., and CGI Inc.

The rising number of accounts with reduced account balances is anticipated to play a significant role in the global debt collection software market in the coming years.

Increasing digitization and increasing use of AI and ML in debt collection processes are the major factors that propel the global debt collection software market.

Europe dominates the debt collection software market.

Get Free Sample For

Get Free Sample For