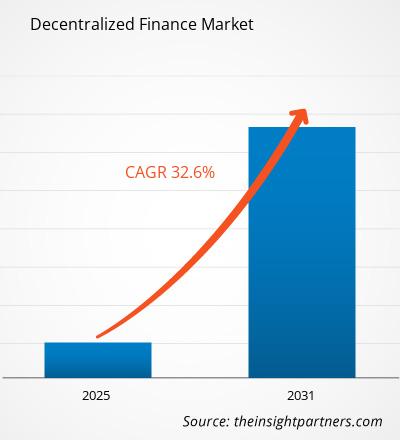

The Decentralized Finance market is expected to register a CAGR of 32.6% in 2023–2031. Integration with traditional finance and focus on security and audit are likely to remain key Decentralized Finance market trends.

Decentralized Finance Market Analysis

Decentralized finance, or DeFi, is an emerging digital ecosystem that enables people to transfer, buy, and exchange financial assets without relying on banks, brokerages, or exchanges. DeFi avoids the regular channels for doing financial transactions. DeFi's emergence might be pretty significant. It not only foreshadows a new type of financial technology, but it also promises an entirely new financial horizon.

Decentralized Finance Market Overview

The finance industry is undergoing fundamental transformation, most of which is being driven by new forms of financial technology (FinTech). Blockchain is perhaps one of FinTech's most breakthrough fields. Blockchain-based technologies such as cryptocurrencies and DeFi are enabling whole new financial products and services, potentially reducing reliance on legacy gatekeepers and traditional finance industry stakeholders. Decentralized finance (DeFi) has had a dramatic effect on finance today, as outlined below. The widespread adoption of DeFi technology has resulted in a new paradigm of financial goods and services that use blockchain and tokenized digital assets.

REGIONAL FRAMEWORK

Decentralized Finance Market Drivers and Opportunities

Decentralized Exchange Platforms to Favor Market

A decentralized exchange (DEX) is a peer-to-peer marketplace for cryptocurrency buyers and sellers. In contrast to centralized exchanges (CEXs), decentralized platforms are non-custodial, which means that a user retains custody of their private keys when dealing on a DEX platform. In the absence of a central authority, DEXs use smart contracts that execute themselves under predetermined conditions and record each transaction on the blockchain. Uniswap, Sushiswap, 1inch, and PancakeSwap are examples of popular DEX protocols.

Non-fungible tokens – An Opportunity in Decentralized Finance

Non-fungible tokens (NFTs) are immutable, verifiable cryptographic assets that can represent anything from trading cards to artwork to VIP passes. Recently, NFTs have increased their market share and are soon becoming one of DeFi's largest markets. Blockchain platforms such as Axie Infinity, The Sandbox, and Illivium use in-game play-to-earn systems to reward gamers with various sorts of NFTs. Leading NFT marketplaces, such as Nifty Gateway, have established themselves as the preferred platforms for purchasing and trading NFT cryptoart.

Decentralized Finance Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Decentralized Finance market analysis are component and application.

- Based on the component, the Decentralized Finance market is divided into blockchain technology, decentralized applications, and smart contracts. The blockchain technology segment held a larger market share in 2023.

- By application, the market is segmented into compliance and identity, assets tokenization, payments, marketplaces and liquidity, Decentralized exchanges, data and analytics, stablecoins, prediction industry, and others.

Decentralized Finance Market Share Analysis by Geography

The geographic scope of the Decentralized Finance Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America has dominated the Decentralized Finance market. North America is one of the worlsd’s largest crypto market. It is one of the very early adopter of DeFi. The United States, the region's largest market, topped Chainalysis' DeFi Adoption Index, which tracks "grassroots adoption" of DeFi. Between July 2021 and June 2021, North American addresses received $750 billion in cryptocurrency, or 18.4% of global transactions. Central, Northern, and Western Europe received $1 trillion during that time span, accounting for 25% of worldwide volume, according to Chainalysis' "2021 Geography of Cryptocurrency Report".

MARKET PLAYERS

DECENTRALIZED FINANCE Market Report Scope

Decentralized Finance Market News and Recent Developments

The Decentralized Finance market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for Decentralized Finance and strategies:

- Coinbase stated that it now offers decentralized finance (defi) services to consumers in over 70 countries. The development follows the company's statement last week that it had purchased BRD wallet and Unbound Security. According to Coinbase, qualifying customers in these countries can now earn yield on Makerdao's defi stablecoin, DAI. (Source: Coinbase, Press Release, 2021)

Decentralized Finance Market Report Coverage and Deliverables

The “Decentralized Finance Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Decentralized Finance Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 32.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global Decentralized Finance market is expected to grow at a CAGR of 32.6% during the forecast period 2023 - 2031.

Elimination of intermediaries and decentralized exchange platforms are the major factors that propel the global Decentralized finance market growth.

Integration with traditional finance and focus on security and audit are anticipated to bring new Decentralized finance market trends in the coming years.

The key players holding majority shares in the global Decentralized Finance market are Compound, Uniswap, Suffescom Solutions, and Ethereum

In terms of revenue, the blockchain technology segment held the major market share in 2023.

Get Free Sample For

Get Free Sample For