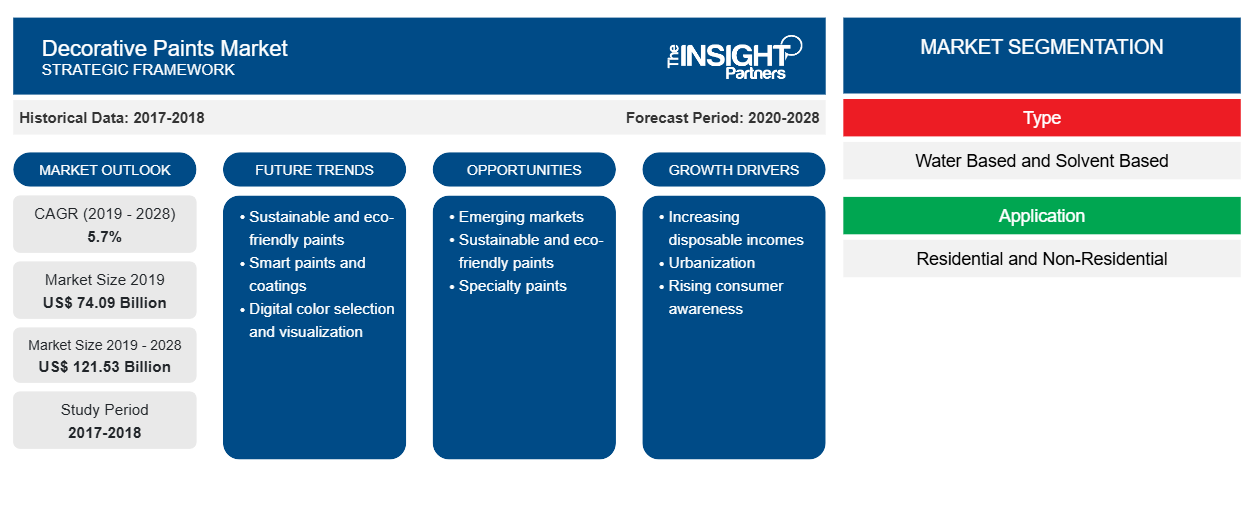

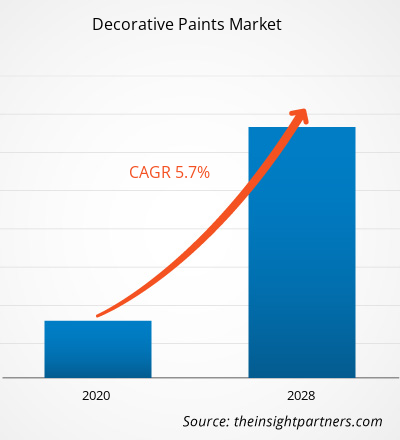

The decorative paints market was valued at US$ 74,091.54 million in 2019 and is projected to reach US$ 121,531.91 million by 2028; it is expected to grow at a CAGR of 5.7% from 2020 to 2028.

Decorative paints are defined as acrylic paints that help impart aesthetic designs and distinctive textures in interior and exterior applications. The demand for decorative paints is rising due to the changing consumer living patterns and growing focus on the appearance of home, office, complexes, and other such spaces. With the growth of the paints industry, the application of decorative paints in infrastructural and architectural sector has been recognized as they help embellish both exterior and interior spaces of a building. Such paints are embedded with matte finish along with eggshell, gloss, or satin finish and much more, which helps them provide unique artistic pieces. Additionally, decorative paints are known for their various functional characteristics such as light absorption and reflection, heat insulation, and low volatile organic compounds emission.

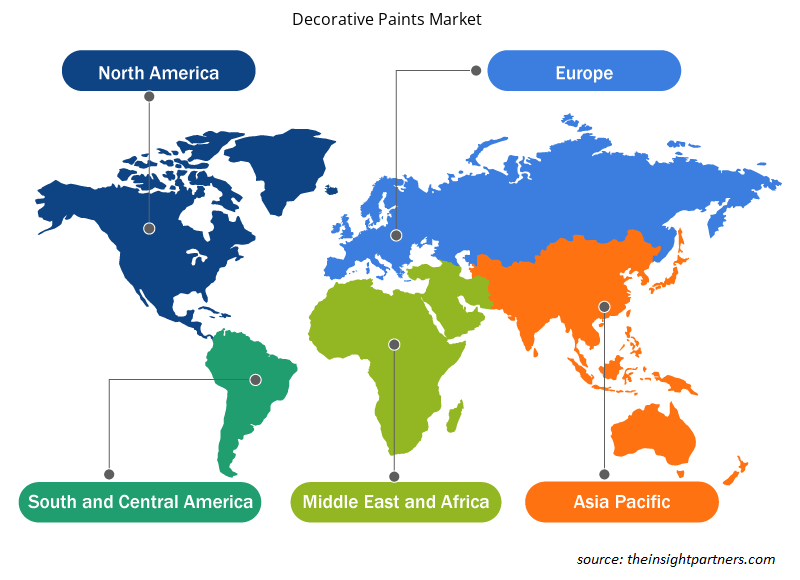

The decorative paints market in Europe is expected to grow at the highest rate during the forecast period. The rise in the number of infrastructure projects, due to the increasing investments and economic recovery, drives the demand for decorative paints in the region. The construction practices and pavement design mostly require high-quality materials to meet various infrastructure standards. Increasing demand for better living standards from a new middle-class population has a positive effect on the adoption of decorative paints. Architectural paints consumed and produced in Western Europe are nearly exclusively medium to premium products, as the consumer interest in home decoration remains high. Also, economical products have traditionally been popular in Russia and Central Eastern Europe. The increasing consumption of paint is historically correlated with the rising standard of living. Currently, the decorative paints market in Western Europe is relatively mature, and sales are anticipated to increase moderately. In addition, in Central Eastern Europe and the CIS countries, the current decorative paint consumption per capita is notably lower than in western Europe.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Decorative Paints Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Decorative Paints Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Decorative Paints Market

The ongoing COVID-19 outbreak pandemic has drastically altered the status of the chemical industry and hindered the growth of the decorative paints market. The crisis has distorted operational efficiency and disrupted the value chains due to the sudden closure of national and international boundaries, creating revenue loss and damage. In addition, decorative paints are majorly utilized in construction applications; thus, halt in such activities due to the pandemic has declined the demand for decorative paints. For instance, the construction activities across India have indeed taken a massive hit due to lockdown and the restrictions under COVID-19 crisis. As per the latest update by the Statistics Ministry in India, the construction projects are running behind the schedule by an average of 3.5 years. Moreover, the cost of nearly 1,682 ongoing infrastructure projects has surged by US$ 54 trillion. The halt in the construction activities in various countries and limitations on the raw material supply due to disruptive value chain are also restraining the growth of the market. However, as the economies are planning to revive their operations, the demand for decorative paints is expected to rise globally in the coming months. Although the focus over just in time production is another concerning factor hindering market growth. With the growing focus over developing economy in post-pandemic times, the demand for decorative paints is expected to take huge leaps due to expanding application bases. Further, positive measures undertaken by government along with distributed generations and incorporation of advanced technology is yet another factor expected to bolster market growth during the forecast period.

Market Insights

Growing Construction Industry

Construction is one of the most dynamic industrial sectors, which are significantly related to the evolution of better societies across the world. With the rise in disposable income along with shift in lifestyle and change in working demographics, the need for better residential and commercial spaces, and architectural facilities have risen, which is driving the growth of the construction industry. The growth of global decorative paints market is driven by increasing government expenditure on the construction sector coupled with recovering labor market, strong credit growth, and positive measures undertaken by government. The growth in residential and commercial sector along with new renovation activities promotes the demand for decorative paints.

Type Insights

Based on type, the decorative paints market is bifurcated into water based and solvent based. The water-based segment accounted for a larger market share in 2019. Water based decorative paints contain 80% water content as a solvent. These paints are mostly used due to their properties such as low VOC emissions. The demand for water-based decorative paint is increasing due to the rising spending on construction and restoration activities. Pigments, surfactants, synthetic resins, and additives are the mostly used raw materials in the manufacturing process of water-based decorative paints. A water-based decorative paint is very quick to dry, is easy to clean up, and does not have harsh odor like oil paints. The paints are available in two types – Latex and acrylic. Both of these paints are used to paint spaces, homes, and structures. Acrylic paint provides better durability, resilience, and adhesions. Latex paint basically provides greater coverage than the acrylic paint; it is more eco-friendly and less expensive as well. Water-based decorative paints provide durability and color retention, and they are versatile, which means the paint can be used for a variety of substances such as brick, concreter, wood, aluminum siding, and vinyl siding.

Application Insights

Based on application, the decorative paints market is bifurcated into residential and non-residential. The residential segment accounted for a larger market share in 2019, and the non-residential segment is expected to register a higher CAGR in the market during the forecast period. Residential application basically includes painting of the interiors as well as exteriors of houses or residences. Decorative paints are used for residence purposes as it provides an aesthetic appeal to the walls and other surfaces and helps enhance the appeal. The residential sector is growing as there is an increase in the residential construction across South and Central America. The rise in the per capita income has led to an increase in the home ownerships, which is propelling the demand for decorative paintings for residential purpose. The rapid urbanization in this region is also going to drive the decorative paints market growth in the coming years.

A few players operating in the decorative paints market are Nippon Paint, Akzo Nobel N.V., BASF SE, Dow Inc., Axalta Coating Systems, Asian Paints, PPG Industries Inc., RPM International Inc, Kansai, and The Sherwin-Williams. The key companies adopt mergers and acquisitions, and research and development strategies to expand customer base and gain significant share in the global market, which also allows them to maintain their brand name globally.

Decorative Paints Market Regional Insights

The regional trends and factors influencing the Decorative Paints Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Decorative Paints Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Decorative Paints Market

Decorative Paints Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 74.09 Billion |

| Market Size by 2028 | US$ 121.53 Billion |

| Global CAGR (2019 - 2028) | 5.7% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Decorative Paints Market Players Density: Understanding Its Impact on Business Dynamics

The Decorative Paints Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Decorative Paints Market are:

- Nippon Paint

- Akzo Nobel N.V.

- BASF SE

- Dow Inc.

- Axalta Coating Systems

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Decorative Paints Market top key players overview

Report Spotlights

- Progressive industry trends in the decorative paints market to help players develop effective long-term strategies.

- Business growth strategies adopted by developed and developing markets.

- Quantitative analysis of the decorative paints market from 2018 to 2028

- Estimation of global demand for decorative paints

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry.

- Recent developments to understand the competitive market scenario.

- Market trends and outlook as well as factors driving and restraining the growth of the decorative paints market.

- Assistance in decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth.

- The size of the decorative paints market size at various nodes

- Detailed overview and segmentation of the market, as well as the decorative paints industry dynamics

- Size of the decorative paints market in various regions with promising growth opportunities

Decorative Paints Market, by Type

- Water Based

- Solvent Based

Decorative Paints Market, by Application

- Residential

- Non-Residential

Company Profiles

- Nippon Paint

- Akzo Nobel N.V.

- BASF SE

- Dow Inc.

- Axalta Coating Systems

- Asian Paints

- PPG Industries Inc.

- RPM International Inc

- Kansai

- The Sherwin-Williams

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Dry Eye Products Market

- Social Employee Recognition System Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Digital Language Learning Market

- Constipation Treatment Market

- Mice Model Market

- Influenza Vaccines Market

- Advanced Planning and Scheduling Software Market

- Adaptive Traffic Control System Market

- High Speed Cable Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The growth of the water based segment is primarily attributed to surging demand for water based decorative paint has increased due to the rise in the spending on construction and restoration activities. Pigments, surfactants, synthetic resins, and additives are mostly the raw materials which are used in the manufacturing process of water based decorative paints. Water based decorative paint dries very quickly, cleaning up is easy and does not have harsh odor like oil paints.

The major players operating in the global decorative paints market are Nippon Paint, Akzo Nobel N.V., BASF SE, Dow Inc., Axalta Coating Systems, Asian Paints, PPG Industries Inc., RPM International Inc, Kansai, and The Sherwin-Williams and among others.

In 2019, the decorative paints market was dominated by Europe region at the global level. The largest market share of the Asia Pacific region is primarily attributed to the rising focus on infrastructural development in countries like China, Japan, and India. The government of developing countries, especially India, is investing heavily in infrastructure development, such as buildings and other physical structures.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Decorative Paints Market

- Nippon Paint

- Akzo Nobel N.V.

- BASF SE

- Dow Inc.

- Axalta Coating Systems

- Asian Paints

- PPG Industries Inc.

- RPM International Inc

- Kansai

- The Sherwin-Williams

Get Free Sample For

Get Free Sample For