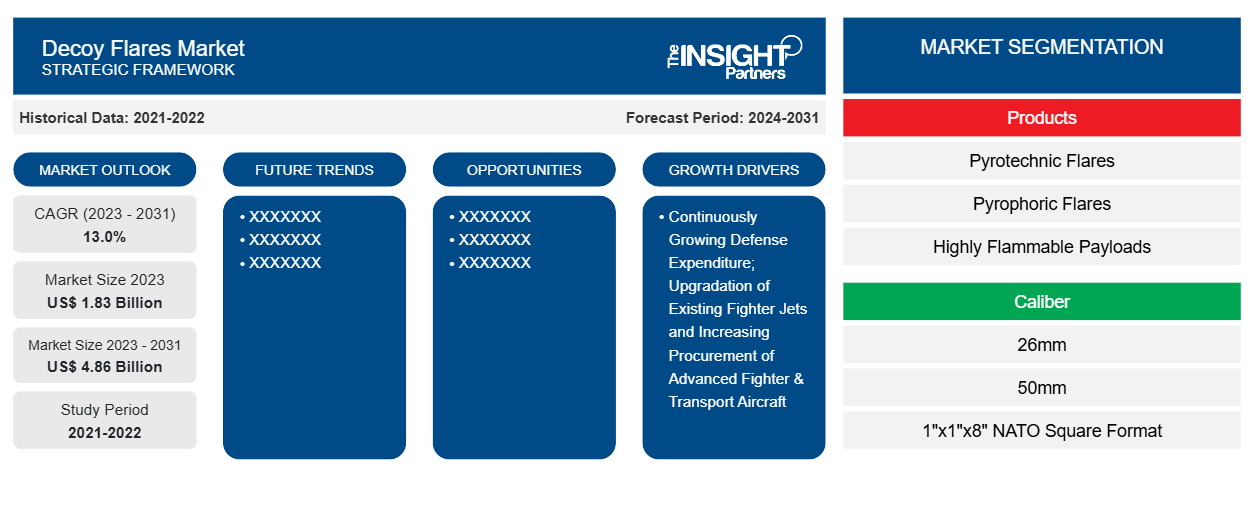

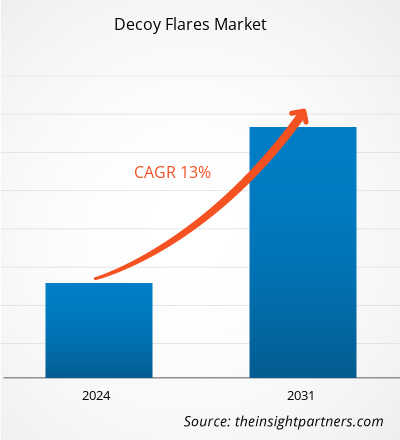

The Decoy Flares Market size is projected to reach US$ 4.86 billion by 2031 from US$ 1.83 billion in 2023. The market is expected to register a CAGR of 13.0% in 2023–2031. The introduction of smart decoy flares and missile jamming decoys is one of the major trends likely to drive the market for decoy flares in the coming years. Several countries have been integrating the same into their respective armed forces for advancing their weaponries.

Decoy Flares Market Analysis

The 1x1x8 inches NATO square format decoy flares are among the most widely accepted decoy flare calibers. This is due to the versatility of the caliber to integrate itself onto various aircraft models. The North American and European (except Russia) aircraft manufacturers highly prefer integrating 1x1x8 inches NATO square format decoy flares. Some of the aircraft models that are capable of carrying 1x1x8 inches NATO square format decoy flares include; Apache AH-64, F-16, A-10, Ch-47 Chinook, C-130, and A400M. The production volumes of the above-mentioned aircraft models continue to surge each year, which reflects the rise in demand for 1x1x8 inches NATO square format decoy flares, which drives the decoy flares market.

Decoy Flares Market Overview

The key stakeholders in the decoy flare market are raw material suppliers, decoy flare manufactures, and end users. The manufacturers of decoy flares constantly procure raw material from the suppliers in order to produce increased volumes of decoy flare with an objective to meet the demands from the customers. The raw materials used in production of decoy flare include chemical energy substance (pyrotechnic components), and shells. The availability of large number of raw material suppliers enable the decoy flares market players to choose the appropriate supplier. This enhances the supply chain of the decoy flare market. Upon procuring raw materials, the decoy flare market players produce significant volumes of decoy flare with varied calibers, thereby, meeting respective customer demands. The end users in the decoy flares market include aircraft/helicopters manufacturers and the defense forces. These end users require significant volumes of decoy flare in order to integrate the same on the newer aircraft models as well as existing fleets.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Decoy Flares Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Decoy Flares Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Decoy Flares Market Drivers and Opportunities

Rising Procurement of Combat Aircraft & Helicopters

The rising procurement of military combat aircraft and combat helicopters across the world is one of the major factors driving the installation of decoy flares across different regions. For instance, in April 2023, the US DoD awarded a contract worth US$ 7.8 billion to Lockheed Martin Corporation for the modification of 126 units of F-35 multi-role aircraft. Similarly, in December 2023, the German Bundeswehr and Airbus Helicopters signed a contract for the purchase of up to 82 multi-role H145M helicopters (62 firm orders plus 20 options). Additionally, in June 2022, Spain ordered 20 Eurofighter jets from Airbus under landmark contract to modernise its combat aircraft fleet. Such contracts have been pushing the deployment of decoy flares into the military aircraft and helicopter platforms.

Deployment of Combat UAVs to Drive the Market Growth in The Coming Years

The rising procurement of military drones for ISR & combat operations is another major factor likely to generate new opportunities for decoy flare market vendors in the coming years. Several countries have started deploying combat drones into their respective military fleets to advance their warfare capabilities which is driving the market for different types of weapons and countermeasure systems as well. Further, as per several defense sector sources, Russia recently (in 2024) have deployed decoy flares-based missile into Ukraine’s territory to surpass the Ukrainian radars. Such emerging applications are likely to generate new opportunities for market vendors during the forecast period.

Decoy Flares Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Decoy Flares Market analysis are products, caliber, application, and geography.

- Based on products, the Decoy Flares Market has been segmented into pyrotechnic flares, pyrophoric flares, highly flammable payloads. The highly flammable payloads segment held a larger market share in 2023.

- By caliber, the Decoy Flares Market has been segmented into 26mm, 50mm, 1”x1”x8” NATO square format, 2”x1”x8” NATO square format. The 1”x1”x8” NATO square format segment held the largest share of the market in 2023.

- Based on application, the Decoy Flares Market has been bifurcated into fixed wing and rotary wing. The fixed wing segment held a larger market share in 2023.

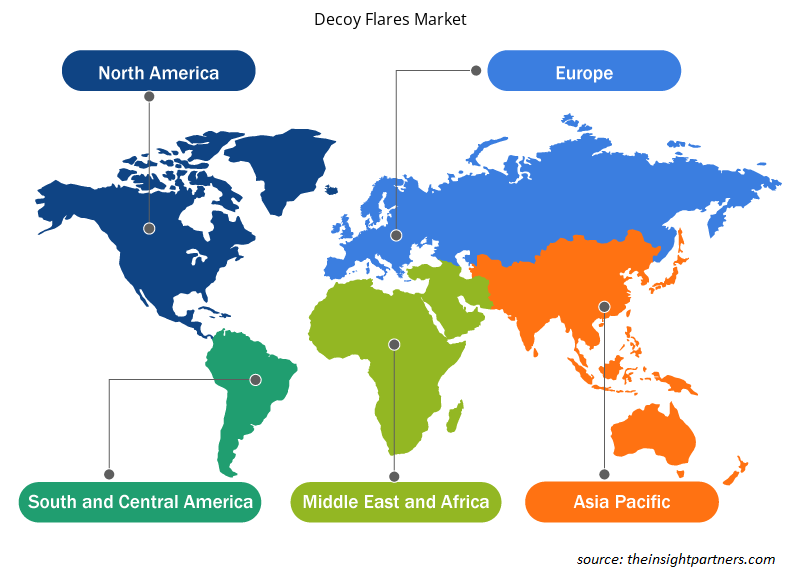

Decoy Flares Market Share Analysis by Geography

The geographic scope of the Decoy Flares Market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the Decoy Flares Market in 2023, whereas, Asia Pacific region is likely to witness a significant growth during the forecast period. Geographically, North America is the major investor in the decoy flares market, due to presence of large number of military aircraft OEMs in the region. The players include companies such as Lockheed Martin Corporation, Boeing, General Dynamics, and Airbus. Further, the demand for decoy flares in North America is also driven by the presence of the US which is the largest military spending country across the world and has largest fleet of military aircraft and helicopters compared to any other country globally. Such factors have been driving the growth of decoy flares market in the North America region.

Decoy Flares Market Regional Insights

The regional trends and factors influencing the Decoy Flares Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Decoy Flares Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Decoy Flares Market

Decoy Flares Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.83 Billion |

| Market Size by 2031 | US$ 4.86 Billion |

| Global CAGR (2023 - 2031) | 13.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Products

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Decoy Flares Market Players Density: Understanding Its Impact on Business Dynamics

The Decoy Flares Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Decoy Flares Market are:

- Armtec Defense Technologies

- Chemring Group PLC

- TARA Aerospace AD

- TransDigm Group Incorporated

- Elbit Systems Ltd.

- LACROIX

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Decoy Flares Market top key players overview

Decoy Flares Market News and Recent Developments

The Decoy Flares Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for decoy flares market and strategies:

- In January 2024, Rheinmetall secured a contract (2024-2029) worth US$ 54.4 million to supply aircraft decoy flares for the German armed forces under which Rheinmetall will be supplying 470,000 decoy flares to the Berlin forces. (Source: Rheinmetall, Press Release/Company Website/Newsletter)

- In October 2021, Chemring Australia received an US$ 18.69 million contract modification (including US$ 2.67 million in FMS funds) from Naval Air Systems Command to produce and deliver 9,728 MJU-68/B IR flare countermeasures: 7,256 for the US Navy and 1,152 for the US Air Force; 528 for Norway; 336 for Japan; 312 for the Netherlands; and 144 for Italy. (Source: Chemring Group, Press Release/Company Website/Newsletter)

Decoy Flares Market Report Coverage and Deliverables

The “Decoy Flares Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Products , Caliber , Application , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, Chile, Colombia, France, Germany, India, Italy, Japan, Mexico, Qatar, Saudi Arabia, South Africa, South Korea, Spain, Thailand, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For