Deep Brain Stimulation Market Growth Opportunities and Forecast by 2030

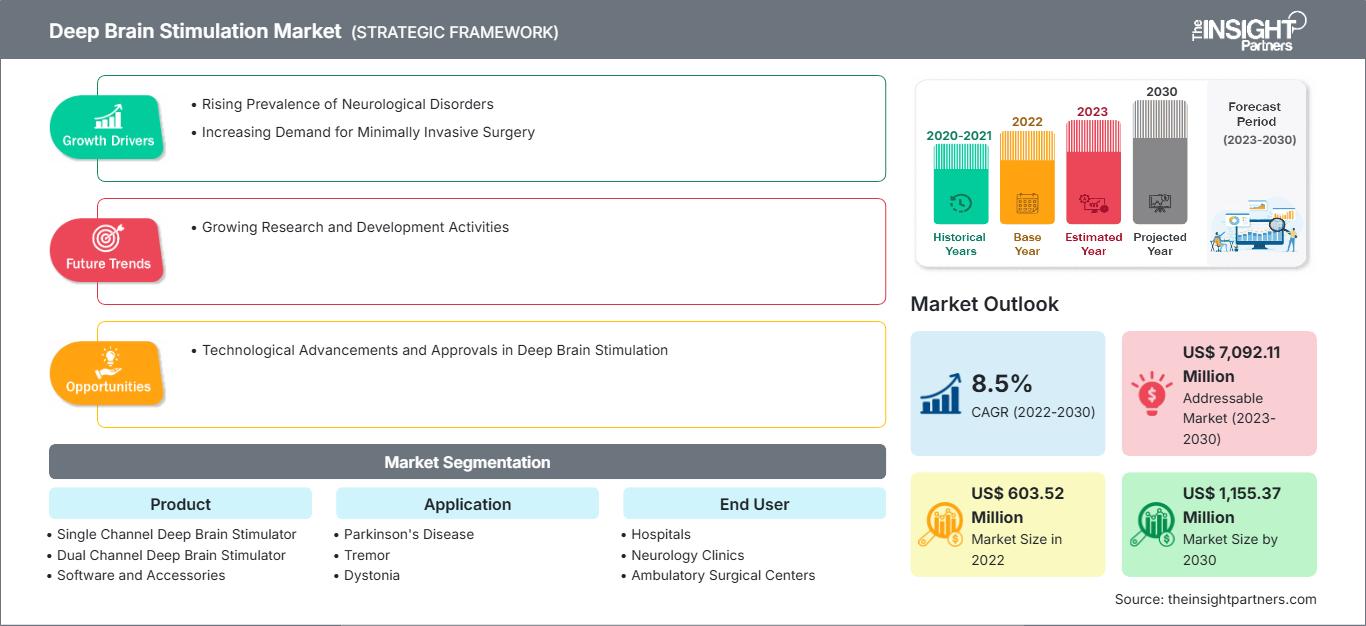

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030Deep Brain Stimulation Market Forecast to 2030 - Global Analysis by Product (Single Channel Deep Brain Stimulator, Dual Channel Deep Brain Stimulator, and Software and Accessories), Application (Parkinson's Disease, Tremor, Dystonia, Epilepsy, Alzheimer's Disease, and Others), and End User (Hospitals, Neurology Clinics, Ambulatory Surgical Centers, and Others)

- Report Date : Aug 2023

- Report Code : TIPHE100000996

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 168

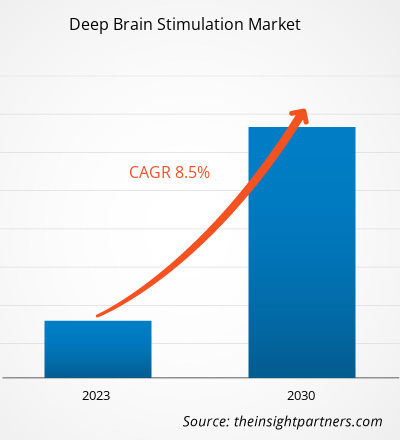

[Research Report] The deep brain stimulation market is expected to grow from US$ 603.52 million in 2022 and is expected to reach a value of US$ 1,155.37 million by 2030; it is anticipated to record a CAGR of 8.5% from 2022 to 2030.

Market Insights and Analyst View:

A deep brain stimulator (DBS) is a brain stimulation device comprising a brain-oriented pacemaker (an implantable pulse generator) that sends electrical stimulation via surgically implanted electrodes to specific targets in the brain. DBS is generally used to treat movement disorders and neuropsychiatric disorders. The rising prevalence of neurological disorders and increasing demand for minimally invasive surgery are driving the deep brain stimulation market size. However, side effects associated with deep brain stimulation hinder the deep brain stimulation market growth. The rising prevalence of neurological disorders and increasing demand for minimally invasive surgery are expected to propel the deep brain stimulation market growth during the forecast period.

Growth Drivers and Challenges:

The geriatric population is susceptible to neurological diseases. Neuropathy, Parkinson's disease, Alzheimer's disease, and dystonia are among the most common neurological disorders affecting older people. According to the National Institutes of Health (NIH), 8.5% of the world's population (i.e., ~617 million people) are 65 and above. The prevalence of movement disorders and psychiatric disorders is high among the geriatric populations in countries such as the US and Canada. According to the World Health Organization (WHO), neurological diseases contribute 6.3% to the global disease burden and are one of the leading causes of death across the world. In addition, 13.2% of deaths in developed countries and 16.8% of deaths in low- and middle-income countries are reported due to neurological diseases.

Deep brain stimulation is a minimally invasive targeted surgery used to treat movement disorders in dystonia, Parkinson's disease, and essential tremor. Minimally invasive surgeries (MIS) offer several advantages over traditional surgical techniques. MIS minimizes trauma to the body, reduces postoperative pain, increases recovery speed, and improves outcomes. Also, these procedures require tiny incisions large enough to insert thin tubes and cameras. These benefits of MIS are increasing inpatients and have encouraged older patients who face high operative morbidity and mortality to seek surgery. Therefore, growing awareness regarding the burden of neurological disorders, the rising geriatric population, the increasing prevalence of neurological diseases, and the rising demand for minimally invasive surgeries due to their advantages propel the demand for deep brain stimulators as a therapy.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Deep Brain Stimulation Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Deep brain stimulation (DBS) effectively treats multiple neurological and psychiatric indications; however, surgical and hardware-related adverse events (AEs) can negatively impact the quality of life. Patients may experience side effects depending on their medication and initial programming in the initial weeks and months after a DBS procedure. Patients often experience discomfort related to the device's neurostimulator (or battery pack) implanted under the skin near the collarbone. The side effects were significantly more common in patients who underwent bilateral DBS than in patients who underwent unilateral DBS. There are various risks associated with deep brain stimulation procedures, such as lead misplacement and bleeding in the brain. The implanted pulse generator (IPG) is a basic energy source and a configurable component of DBS devices. The risk of infection from IPG limits the use of deep brain stimulation devices for Parkinson's disease. Therefore, the side effects of deep brain stimulation hinder the deep brain stimulation market growth.

Report Segmentation and Scope:

The global deep brain stimulation market is segmented on the basis of product, application, end user, and geography. Based on product, the deep brain stimulation market is segmented into single channel deep brain stimulator, dual channel deep brain stimulator, and software and systems. Based on application, the deep brain stimulation market is segmented into Parkinson's disease, tremor, Alzheimer’s disease, dystonia, epilepsy, and others. Based on end user, the deep brain stimulation market is segmented into hospitals, neurology clinics, ambulatory surgical centers, and others. The deep brain stimulation market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Spain, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on product, the deep brain stimulation market is segmented into single channel deep brain stimulator, dual channel deep brain stimulator, and software and systems. The dual channel deep brain stimulator segment held the largest market share in 2022; moreover, the same segment is anticipated to register the highest CAGR of 9.5% during the forecast period. Dual channel DBS offers the best overall support as well as efficiently reduces patient tremors. The Kinetra internal pulse generator (IPG) by Medtronic was the first dual-channel IPG, which became available in 1998. The growing adoption of dual channel DBS for the treatment of various neurological disorders, such as dystonia, Parkinson’s disease, Alzheimer’s disease, and epilepsy, is a key factor fueling the segment growth. Moreover, product approvals are propelling the growth of the dual channel stimulators segment. For instance, in January 2020, Abbott’s Infinity DBS system received FDA approval for the treatment of Parkinson's disease. This system specifically targets the brain called internal globus pallidus (GPi), which is associated with Parkinson's disease symptoms. In addition, Vercise, Vercise PC, & Vercise Gevia DBS systems by Boston Scientific; Activa PC & Activa RC by Medtronic; and Infinity by Abbott are a few of the key offerings in the segment. Thus, the advantages of dual channel stimulation, along with product approvals, are expected to boost the dual channel deep brain stimulator segment growth during the forecast period.

Based on application, the deep brain stimulation market is segmented into Parkinson's disease, tremor, Alzheimer’s disease, dystonia, epilepsy, and others. The Parkinson's disease segment held the largest market share in 2022, and the same segment is anticipated to register the highest CAGR of 8.5% during the forecast period. Parkinson's disease (PD) is a neurological disorder that causes difficulty in walking, coordinating, and balancing, as well as shaking and stiffness. A few factors such as the rising number of deep brain stimulation therapies that the US Food and Drug Administration (FDA) has approved, the surge in patients suffering from PD worldwide, and the growing approval for DBS products are expected to support the segment growth in the coming years. For instance, according to the Parkinson’s Foundation estimates, ~60,000 Americans are diagnosed with PD yearly. In addition, 1 million people in the US are suffering from PD, and the number is expected to reach 1.2 million by 2030. There are various innovative product launches across the globe. For instance, in January 2021, Medtronic launched the First-of-its kind Adaptive deep brain stimulation (aDBS) trial for evaluating the safety and efficacy of adaptive deep brain stimulation in PD patients. Hence, the above-mentioned factors significantly augment the segment growth in deep brain stimulation market growth during the forecast period.

Based on end user, the deep brain stimulation market is segmented into hospitals, neurology clinics, ambulatory surgical centers, and others. The hospitals segment held the largest market share in 2022, and the same segment is anticipated to register the highest CAGR of 9.1% during the forecast period. The hospitals segment is expected to grow significantly owing to the rising prevalence of various neurological conditions such as Parkinson's and Alzheimer's disease and other disorders that can be treated effectively by skilled professionals in hospital settings. There is an increase in the number of deep brain stimulation (DBS) surgeries performed in hospitals and the presence of state-of-the-art facilities across hospital settings. As per a study titled “Single-Stage Deep Brain Stimulator Placement for Movement Disorders,” published in 2021—approximately 160,000 patients worldwide have undergone DBS for various neurological and non-neurological conditions, and ~12,000 new patients receive DBS annually. In addition, hospitals also employ the highest quality of professional staff, including skilled and experienced neurologists, nurses, and technicians, that work together to provide patients with the best surgical care in a pleasant environment. Hence, the availability of technologically advanced DBS devices, along with favorable reimbursement policies, is expected to propel the hospital segment during the forecast period.

Regional Analysis:

Based on geography, the deep brain stimulation market is divided into five key regions—North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. North America accounted for the largest share of the global deep brain stimulation market in 2022. The North America deep brain stimulation market is segmented into the US, Canada, and Mexico. The US held the largest deep brain stimulation market share and is anticipated to register the highest CAGR during the forecast period. The market growth is attributed to the rising prevalence of neurological diseases such as Parkinson's disease (PD), rising awareness about neurological disorders, and growing investments in developing transcranial stimulators. According to a study titled “2022 Alzheimer's disease facts and figures” published in the Alzheimer's Association, ~6.5 million Americans aged 65 and above suffered from Alzheimer's disease in 2022, and the number is projected to rise to 13.8 million by 2060. In addition, according to the Parkinson's Foundation, ~1 million people in the US are suffering from Parkinson's disease, which is expected to reach 1.2 million by 2030.

Europe recorded the second-largest market for deep brain stimulation. The Europe deep brain simulation market is witnessing rapid growth due to a rise in innovative product launches by key regional deep brain stimulation companies. In June 2020, Medtronic announced the launch of the PerceptTM PC Neurostimulator with BrainsenseTM technology. The technology simultaneously records and delivers electrical stimulations to the brain to relieve symptoms of Parkinson's disease (PD). Germany and the UK are expected to witness growth in the DBS market in the region. The Asia Pacific deep brain stimulation market is expected to register the highest CAGR during the forecast period. Increasing innovative technology trends in the DBS field and rapid adoption of artificial intelligence (AI) and machine learning (ML) are key factors driving the growth of the market in the region. In February 2023, the China National Medical Products Administration approved NERVTEX, which specializes in developing digital treatments for brain diseases, such as AI-powered software for analyzing movement disorders. Also, Movement Dysfunction Assessment Software (MoDAS) is a medical device to analyze a patient's movement activity recorded with mobile phones. Factual and numeric data is then provided to diagnose and manage the patient's movement.

Deep Brain Stimulation Market Regional InsightsThe regional trends and factors influencing the Deep Brain Stimulation Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Deep Brain Stimulation Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Deep Brain Stimulation Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 603.52 Million |

| Market Size by 2030 | US$ 1,155.37 Million |

| Global CAGR (2022 - 2030) | 8.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Deep Brain Stimulation Market Players Density: Understanding Its Impact on Business Dynamics

The Deep Brain Stimulation Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Deep Brain Stimulation Market top key players overview

COVID-19 Impact:

Brain surgeries were postponed or even canceled to reduce the transmission of COVID-19. According to the Prime Minister’s Decree of March 2020, the containment measures in Italy led to a reduction in routine hospital activities. In the worst-affected nations, such as the US, India, Brazil, France, the UK, Italy, and Spain, neurosurgical operations fell by 55%. The COVID-19 pandemic negatively impacted the deep brain stimulation market. In December 2020, according to the report of the National Center of Biotechnology Information, lockdown restriction measures confined people to their homes and recorded subjective worsening of motor and psychiatric symptoms, such as sleeping problems in patients suffering from Parkinson’s Disease and dystonic patients and being treated with DBS. The restrictions led to an increased burden of neurological disease and chronic stress related to DBS management. With the ease of lockdown restrictions, healthcare professionals recommenced the resumption of brain surgeries. Globally increased activities in tele-consultancy for follow-up and routine check-ups to address the symptoms of PD patients in the post-pandemic period are playing a key role in increasing the demand for treatment options such as deep brain stimulation. Thus, such trends are expected to impact the adoption of DBS in the coming years and continue to grow significantly during the forecast period.

Competitive Landscape and Key Companies:

A few of the prominent players operating in the global deep brain stimulation market include Abbott Laboratories, Aleva Neurotherapeutics SA, Medtronic Plc, Beijing PINS Medical Co Ltd, Boston Scientific Corp, Newronika SpA, and SceneRay Co Ltd. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, which provides them to serve a large set of customers and subsequently increases their deep brain stimulation market share.

Frequently Asked Questions

What are the driving factors for the deep brain stimulation market?

What is meant by the deep brain stimulation?

What was the estimated deep brain stimulation market size in 2022?

What are the growth estimates for the deep brain stimulation market till 2030?

Who are the major players in the deep brain stimulation market?

Which segment is dominating the deep brain stimulation market?

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For