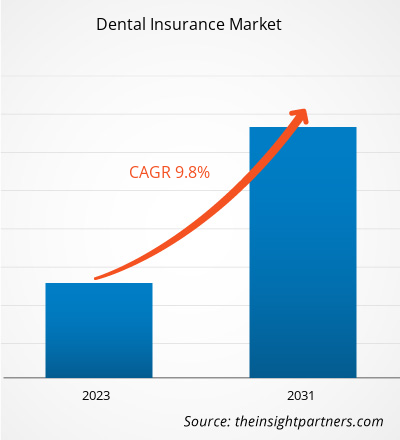

The dental insurance market size is expected to grow from US$ 172.51 billion in 2023 to US$ 364.45 billion by 2031; it is anticipated to expand at a CAGR of 9.8% from 2023 to 2031. The dental insurance industry is continuously expanding, owing to increased awareness of oral health and rising dental care expenditures. As people seek full coverage for preventive, diagnostic, and treatment services, the need for dental insurance policies grows. Furthermore, governmental initiatives mandating dental coverage, together with employer-sponsored insurance packages, drive market growth. Technological improvements, such as tele-dentistry, are also influencing the market by giving easy access to dental treatments. With an emphasis on preventative care and affordability, the dental insurance industry is expected to continue to grow, providing opportunities for insurers to innovate and satisfy changing customer expectations.

Dental Insurance Market Analysis

The dental insurance market forecast is estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. Economic growth, an expanding middle class, innovation, and regulatory assistance are propelling the insurance business forward. The revenue of the global dental insurance market is a function of the economic conditions of developed and developing economies. There has been a rise in awareness about oral hygiene in these economies. According to the World Health Organization (WHO), periodontal disease affects around 3.5 billion individuals, with cavities in permanent teeth being the most frequent. Dental caries in primary teeth (milk teeth) are also common in children, impacting around 530 million children worldwide. This is one of the major factors driving the dental insurance market growth globally.

Dental Insurance

Industry Overview

- Dental care costs are on the rise. According to a survey by the Agency for Healthcare Research and Quality, the cost of dental care for a single individual increased 23% when adjusted for inflation between 1996 and 2015. According to the U.S. Bureau of Labor Statistics consumer price index, dental costs rose 5.4% between October 2021 and October 2022. This is pushing young consumers and employers to buy dental insurance as risk management related to oral healthcare

- Governments across many countries are undertaking initiatives to improve the accessibility to healthcare, including dental care. For instance, the Federal Employees Dental and Vision Program (FEDVIP) offers supplementary dental and vision insurance coverage. The FEDVIP is a separate program from the Federal Employee Health Benefits (FEHB) Program.

- Dental plans provide an extensive range of services. The 100% Santé program allows patients in the French healthcare system with top-up insurance to get for free a limited variety of dental prostheses (implants, crowns, bridges, dentures, etc.), hearing aids, and prescription glasses. Such factors are driving the dental insurance market growth. Moreover, the integration of AI and ML technologies in Insurtech platforms is providing future dental insurance market trends.

Strategic Insights

Dental Insurance Market Driver

Convergence of health and dental insurance to Drive the Dental Insurance Market

- In the current market the health insurance providers are keen on converging the health and dental insurance services. For instance, according to a 2020 report by West Monroe, the amount of health insurers selling dental insurance policies has increased from 68% in 2018 to 80% in 2020, while the percentage offering adult dental coverage has more than doubled to 48%, indicating an accelerating shift toward convergence.

- To compete and attract new clients, dental insurers are integrating their systems with a multichannel technology environment that is user-friendly, accessible, and mobile. This is increasing competition in the market and enabling dental insurance products to be more customer-centric and affordable. This drives the adoption of dental insurance across the market.

Dental Insurance

Market Report Segmentation Analysis

- Based on coverage, the dental insurance market is segmented into dental health maintenance organizations (DHMO), dental preferred provider organizations (dppo), dental Indemnity plans (DIP), dental exclusive provider organizations (DEPO), and dental point of service (DPS)).

- The dental health maintenance organizations (DHMO) segment is expected to hold a substantial dental insurance market share in 2023.

- Dental DHMO is a sort of dental health insurance. DHMO is prepaid dental insurance that aims to reduce dental expenses. Dental DHMOs provide in-network dentists, allowing you to choose any dentist in your insurance network for a variety of dental services.

Dental Insurance

Market Share Analysis by Geography

The scope of the Dental Insurance market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific (APAC) is experiencing rapid growth and is anticipated to hold a significant dental insurance market share. The region's significant economic development, growing population, and increasing focus on risk management and insurance have contributed to this growth. APAC is home to many developing countries like India and China, driving the growth of the market.

Dental Insurance

Market Report Scope

The "Dental Insurance Market Analysis" was carried out based on coverage, procedure, end user, and geography. In terms of coverage, the market is segmented into dental health maintenance organizations (DHMO), dental preferred provider organizations (DPPO), dental Indemnity plans (DIP), dental exclusive provider organizations (DEPO), and dental point of service (DPS). Based on procedure, the market is segmented into preventive, major, and basic. Based on end users, the Dental Insurance market is segmented into individuals and corporates. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Dental Insurance

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the dental insurance market. A few recent key market developments are listed below:

- In August 2023, Cigna Healthcare revealed that dental patients can now use their smartphones to scan for potential oral health issues, including cavities and gum disease. The free screenings, enabled by SmartScan, seek to inspire millions of individuals who are anxious about dental visits to learn more about their oral health from the comfort of their own homes.

[Source: Cigna Healthcare, Company Website]

- In August 2023, Cigna announced the launch of a new, free technology that will allow up to 16.5 million of its customers to use their cellphones to check for oral health issues, such as cavities and gum disease. The free screenings, enabled by SmartScan, are designed to assist people who are anxious about dental visits to learn more about their oral health.

[Source: Cigna Healthcare, Company Website]

- In May 2022, PNB MetLife India Insurance Co Ltd established a dental care plan, India's first insurance plan to cover fixed-benefit outpatient fees as well as financial aid with overall oral health costs.

[Source: PNB MetLife India Insurance Co Ltd, Company Website]

Dental Insurance

Market Report Coverage & Deliverables

The market report "Dental Insurance Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Dental Insurance Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 172.51 Billion |

| Market Size by 2031 | US$ 364.45 Billion |

| Global CAGR (2023 - 2031) | 9.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By End-Users

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Coverage, Procedure, End-Users, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global dental insurance market are Aetna; AFLAC Inc; Allianz; AXA; Cigna; HDFC Ergo Health Insurance Limited; United Concordia; and Metlife

The global dental insurance market is expected to reach US$ 364.45 billion by 2031.

The global dental insurance market was estimated to be US$ 172.51 billion in 2023 and is expected to grow at a CAGR of 9.8% during the forecast period 2023 - 2031.

Developments in tele-dentistry are impacting dental insurance, which is anticipated to play a significant role in the global dental insurance market in the coming years.

The convergence of health and dental insurance, rising oral health awareness, and rising dental care costs are the major factors that propel the global dental insurance market.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Aetna

- AFLAC Inc

- Allianz

- AXA

- Cigna

- HDFC Ergo Health Insurance Limited

- United Concordia

- Metlife

- Delta Dental Plans Association

- United Health Care Services Inc.

Get Free Sample For

Get Free Sample For