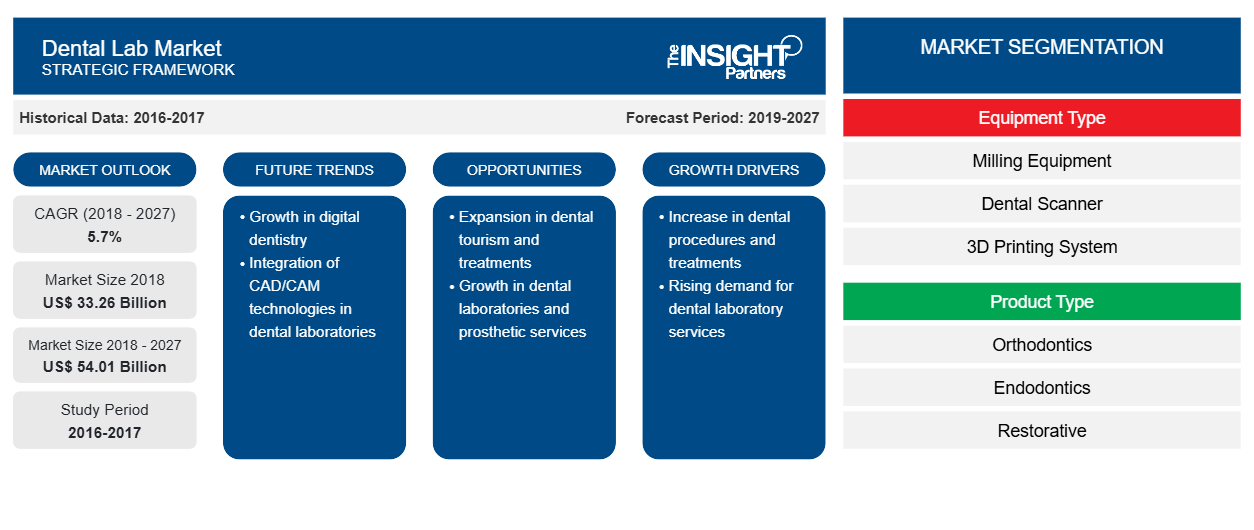

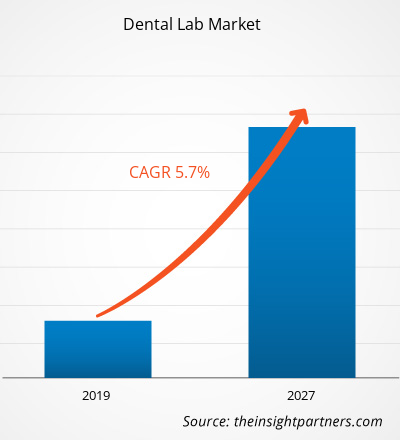

[Research Report] The dental lab market size was estimated to reach US$ 54,008.10 million by 2027 from US$ 33,264.24 million in 2018; it is estimated to grow at a CAGR of 5.7% during 2019-2027.

Market Insights and Analyst View:

Dental laboratories are those laboratories that have a primary role in restorative dentistry. These laboratories perfectly copy all of the functional and aesthetic parameters that the dentist has defined into a therapeutic solution. The dental laboratory includes a technician who fabricates crowns, bridges, dentures, and orthodontic appliances based on a dentist's prescription. The global dental lab market is driven by the rising geriatric population associated with dental disorders and technological advancements in dental materials and equipment. In addition, technology disrupting the dental lab is increasing the demand for cosmetic procedures, and the 3D printing of dental prostheses fuels the market growth.

Growth Drivers and Restraints:

The advent of Digitalization and Technological Advancements in Dental Industries

The emergence of automation worldwide has increased the demand for dental products in the market. The rapid development of digitally integrated technologies in manufacturing dental materials is further expected to boost the dental laboratories market. Moreover, with the advent of digitization within the traditional dental workflow, dental laboratories have witnessed an upward trend in recent years. Dental laboratories are used for surgery, orthodontia, and other dental applications. Digital platforms like unified digital simulations and virtual planning for dentistry operations help provide treatment steps and workflow with software intimation.

Dental laboratories and systems can effectively manage the spread of infectious diseases using manual interventions. In addition, the rising adoption of digital impression techniques in dental laboratories helps improve patient compliance and reduces the risk of infection. This technique is used for the aging population with respiratory illnesses, such as chronic or acute mucosa diseases.

Additionally, full-lab automation is gaining traction, and a significant rise in 3D printing technology within dentistry is further projected to fuel the overall market growth. This technology also enables dental laboratories to deliver their patients with the fully automated fabrication of customized plans. It can be used for treatment and offered with personalized dental devices and aids. The automated inventory management systems promote production efficiency within dental laboratories, providing lucrative growth opportunities for the global market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Dental Lab Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Dental Lab Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Rising Geriatric Population and Product Launch by the Companies

According to the data published in OSHA in 2023, the global population share aged 65 years or above is projected to rise from 10% in 2022 to 16% in 2050. By 2050, the global population aged 65 years or over will likely be more than twice that of children under 5 and 12. Similarly, in June 2022, according to the United States Census Bureau, the 65-and-older population grew by over 34.2% and by 3.2% from 2018 to 2019. Hence, an increase in the geriatric population and rising demand for cosmetic dental procedures are major factors driving the dental lab market. Dental laboratories provide customized dental solutions with advanced technological support, and the latest equipment may support the growth of dental labs in the future. Such factors are anticipated to increase the adoption of dental labs, thereby contributing to the studied market growth.

In addition, new product launches and strategic activities by dental laboratory companies have resulted in positive market growth. For instance, in June 2022, ZimVie Inc. launched the US FDA- T3 PRO Tapered Implant and Encode Emergence Healing Abutment in the United States. Similarly, in July 2021, 3M Oral Care launched Clarity Aligners Flex + Force. This new aligner system allows orthodontists to choose from two unique aligner materials in one treatment design and gives patients a customized treatment. Thus, increasing product launches by the key players of the studied market are expected to have noteworthy growth over the forecast period.

Report Segmentation and Scope:

The Dental Lab market, by product, is segmented into Equipment Type, i.e., Milling Equipment, Dental Scanner, 3D Printing Systems, CAD/CAM Systems, Casting Machines, Radiology Equipment, and Others. The milling equipment segment held the largest market share in 2022. The segment is anticipated to register the highest CAGR from 2022 to 2030. The market growth of this segment can be attributed to Factors such as computer-aided design, laser welding, growing adoption of computer-aided manufacturing, and laser sintering, which is expected to augment segment growth. Dental lasers have a wide range of applications in diagnostic and surgical procedures. These devices' key advantages include bone and ligament tissue regeneration, minimal bleeding, and reduced surgery discomforts. Hence, these lasers will witness lucrative growth over the forecast period. The Dental Lab market, by product type, is segmented into Orthodontics, Endodontics, Restorative, Oral Care, Implants, and Prosthodontics. The oral care segment dominated the dental lab market and followed the oral care segment regarding revenue share. Factors such as increased awareness related to oral care, the technological advancements in dental material such as digital radiography, CAD/CAM implant dentistry intraoral imaging, and caries diagnosis have enhanced the accuracy of restorations, thus fueling segmental growth.

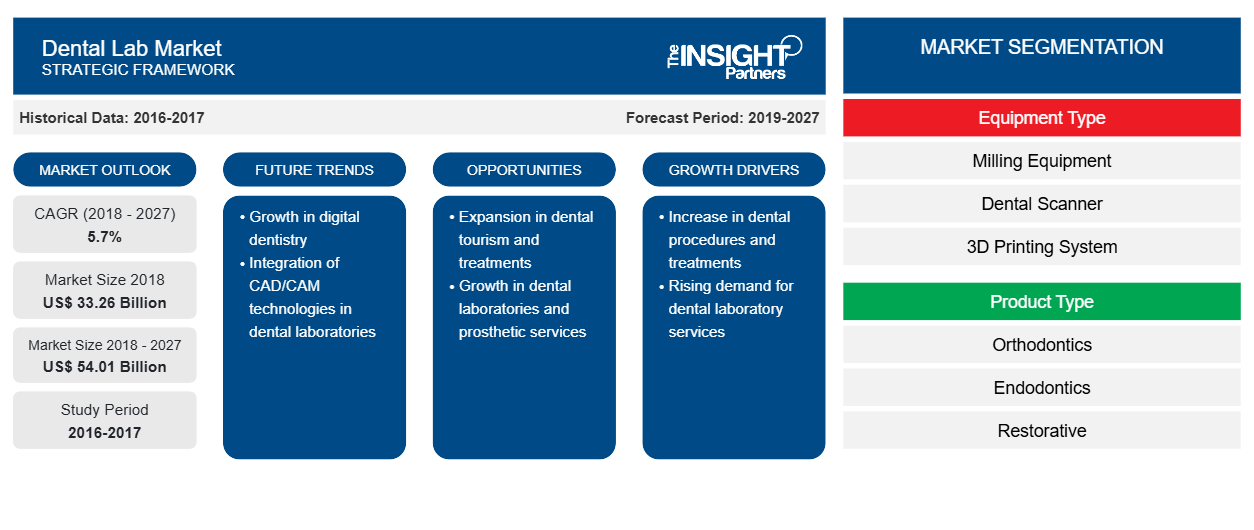

The Dental Lab market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South and Central America (Brazil, Mexico, and the Rest of SCAM).

Segmental Analysis:

The Dental Lab market, by equipment type, is segmented into Milling Equipment, Dental Scanners, 3D Printing Systems, CAD/CAM Systems, Casting Machines, Radiology Equipment, and Others. The milling equipment segment held the largest market share in 2022. The segment is anticipated to register the highest CAGR from 2022 to 2030. Dental systems and parts include milling equipment, scanners, furnaces, and articulators. These are important for traditional dental technicians.

The Dental Lab market, by product, is segmented into Orthodontics, Endodontics, Restorative, Oral Care, Implants, and Prosthodontics. The oral care segment dominated the dental lab market and followed the oral care segment in terms of revenue share. Rapid technological advancements in dental laboratories, the increasing patient population prone to oral disease, and the role of dental lab technicians in the use of bone morphogenic proteins and hydroxyapatite coatings as implant materials have resulted in faster healing, reduced chair time, and painless procedures, thereby driving the segmental growth.

Regional Analysis:

Based on geography, the global dental lab market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, North America held the largest global Dental Lab market share. Asia Pacific is estimated to register the highest CAGR from 2022 to 2030. The North American Dental Lab market has experienced substantial growth in the past few years due to an increase in the prevalence of dental diseases, an increasing number of dental procedures, technology in the dental lab market, and rising awareness regarding oral health. Additionally, there has been a rise in the number of dental practitioners and improved awareness regarding the growth of the oral health market. An increasing prevalence of dental diseases is another factor boosting the market growth of the dental laboratory market. Numerous dental conditions such as oral cancer, dental caries, and periodontal infections are another driving factor of the market growth in this region. Tooth decay is becoming more common despite efforts to decrease the number of instances. Many developed countries are witnessing an increase in the prevalence of oral cancer. From the year 2018 to 2040, there is an approximate 54% increase in the global incidence of lip and oral cavity cancer cases reported by experts.

Moreover, Asia Pacific is likely to witness the highest growth over the forecast period due to the growing dental tourism, lower cost of dental laboratory work, improved awareness regarding oral health, and development in the dental industry due to technological advancement in dental materials in the region. In Asia Pacific, the dental lab market is expected to witness lucrative growth due to a progressive economy, increasing disposable income, increasing awareness regarding oral healthcare among the population, larger untapped opportunities, and rapidly improving healthcare infrastructure are factors driving the market in the region.

Dental Lab Market Regional Insights

The regional trends and factors influencing the Dental Lab Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Dental Lab Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Dental Lab Market

Dental Lab Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 33.26 Billion |

| Market Size by 2027 | US$ 54.01 Billion |

| Global CAGR (2018 - 2027) | 5.7% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Equipment Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Dental Lab Market Players Density: Understanding Its Impact on Business Dynamics

The Dental Lab Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Dental Lab Market are:

- Dentsply Sirona

- Danaher

- Zimmer Biomet

- 3M

- BEGO GmbH & Co. KG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Dental Lab Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global dental lab market are listed below:

- In March 2022, Ultradent Products introduced a line of premium accessories for VALO Grand curing lights. The addition of six new lenses allows clinicians to use their VALO Grand light increasingly expressively to provide optimal patient care.

- In February 2021, Dentsply Sirona introduced the CEREC SW 5.1.3 update, which includes 17 newly validated materials for the CEREC Primemill, including PMMA for surgical guides and bridge blocks for grinding processes.

- In February 2021, Dentsply Sirona unveiled upgrades to its CEREC system, which offers improved processes in terms of materials, convenience, and performance.

- In September 2021, Planmeca Group announced plans to purchase the KaVo Treatment Unit & Instrument Company, bolstering its position as a leading provider of advanced dental solutions.

- In June 2021, Dentsply Sirona acquired Propel Orthodontics. This acquisition is a critical step in the company's strategy to improve its position in the rapidly expanding clear aligner sector.

- In July 2021, 3M Oral Care introduced Clarity Aligners Flex + Force. This new aligner system empowers orthodontists to choose from two unique aligner materials in one treatment design and gives patients a customized treatment experience.

Competitive Landscape and Key Companies:

Envista Holdings Corporation, Dentsply Sirona, A-dec Inc., Straumann AG, Henry Schein, Inc., Champlain Dental Laboratory, Inc., Knight dental design, National Dentex Corporation, 3M Health Care

Dental Services Group is provided in this report. There are some important players in the market, such as 3M, Ultradent Products Inc., Planmeca Oy, Biolase Inc., Carestream Health, GC Corporation, A-dec Inc., Dental Imaging Technologies Corporation, Septodont Holding, VOCO GmbH - The Dentalists, are a few key companies operating in the Dental Lab market. These companies adopt product innovation strategies to meet evolving customer demands, which allows them to maintain their brand name in the Dental Lab market. The dental labs market is fragmented in nature due to the presence of several companies operating globally as well as regionally. The major market players focus on technological advancements to acquire maximum market share.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Diaper Packaging Machine Market

- Mesotherapy Market

- Piling Machines Market

- Wire Harness Market

- Health Economics and Outcome Research (HEOR) Services Market

- Intraoperative Neuromonitoring Market

- Sweet Potato Market

- Underwater Connector Market

- Data Annotation Tools Market

- Grant Management Software Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material ; Equipment ; Prosthetics ; Application , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

During recent years, the rise in the use of 3D printing has been observed in dental laboratories. A 3D printed model is more accurate in matters of size and shape and can be taken directly from a doctor-supplied intraoral scan. Through this technique, a large number of models can also be printed simultaneously, which highly saves the amount of time required. Also, 3D printing technology continues to advance; moreover, the prices are expected to come down during the future years. For instance, the cost incurred by dental laboratories to develop a 3D printed model using an intraoral scan and CAD/CAM processes is less compared to the expenses of making it conventionally. Moreover, the technicians involved require less time to carry out the procedure, which reduced the labor cost.

A dental lab is an organization that manufactures or customizes dental products such as dentures, implants, a crown (cap), veneers, and others. Dental laboratory plays a vital role in the restorative dentistry. It is responsible for manufacturing and providing outsourcing of dental aesthetic products. It is owned by a dentist, and dental technicians are employed for assistance.

The high cost of equipment and installation and dearth of skilled professionals in the dental laboratories across the globe are the major factors expected to hamper the market growth in the coming years. The cost of equipment required in the dental laboratories is much higher; the cost associated with installation is also higher. For instance, the cost of dental CAD/CAM equipment is approximately US$ 100,000. The dentist or the owner of the dental laboratory incurs additional cost to install the equipment and train a technician. Thus, the high cost is responsible for the expensive usual and customized fees for making crowns, bridges, and others.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies in Dental Lab Market

- Dentsply Sirona

- Danaher

- Zimmer Biomet

- 3M

- BEGO GmbH & Co. KG

- Ultradent Products Inc

- GC Corporation

- Mitsui Chemicals, Inc.

- PLANMECA OY

- Ivoclar Vivadent AG.

Get Free Sample For

Get Free Sample For