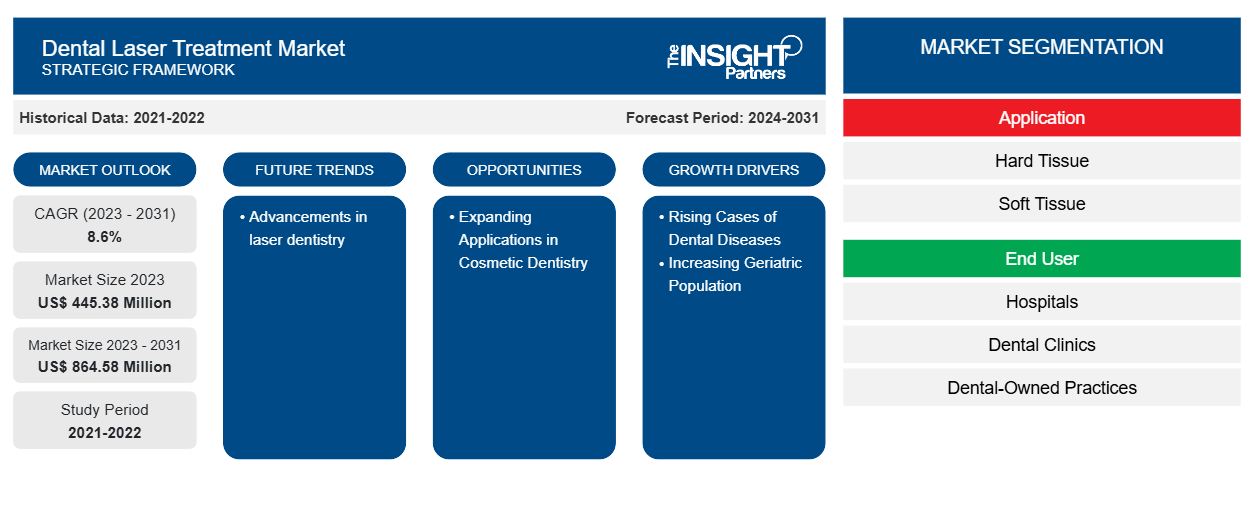

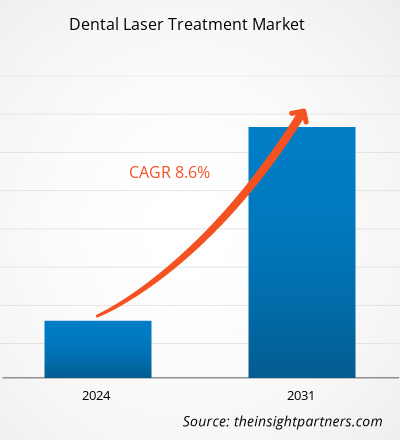

The dental laser treatment market size is projected to reach US$ 864.58 million by 2031 from US$ 445.38 million in 2023. The market is expected to register a CAGR of 8.6% during 2023–2031. Advancements in laser dentistry are likely to bring new trends to the market.

Dental Laser Treatment Market Analysis

Major factors contributing to the market expansion include rising cases of dental diseases, increasing geriatric population, and increasing product launches and product developments. The dental laser treatment market is mainly driven by rising demand for aesthetic dentistry, growing awareness about oral health, and regulatory approvals of dental lasers. In addition, expanding applications in cosmetic dentistry are expected to provide a growth opportunity for the dental laser treatment market.

Dental Laser Treatment Market Overview

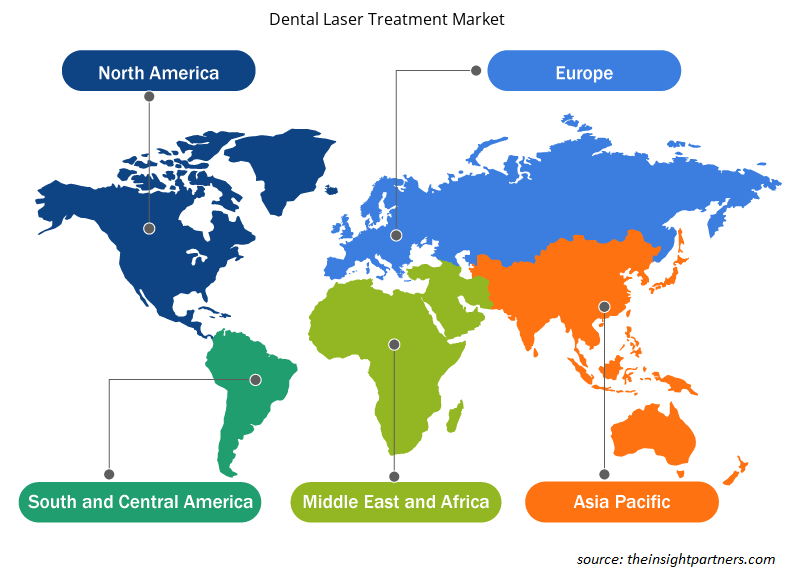

Asia Pacific is the fastest-growing market for dental laser treatment due to the increased prevalence of dental diseases and tooth loss, the rise in the aging population, and the presence of organizations working toward offering better solutions in dentistry. In addition, medical tourism in India and Southeast Asia is also expected to be responsible for the rapid growth of the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Dental Laser Treatment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Dental Laser Treatment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Dental Laser Treatment Market Drivers and Opportunities

Rising Cases of Dental Diseases and Increasing Geriatric Population

Oral diseases, including dental diseases, are highly preventable. However, dental diseases can be a major health issue in many countries and affect people throughout their lives. A few common dental problems include periodontal diseases, dental caries (tooth decay), and gum problems. Dental lasers are used to treat these problems. Dental lasers provide accurate, less invasive treatment alternatives for a range of treatments, including tooth whitening, soft tissue management, and cavity preparation. According to the WHO Global Oral Health Status Report (2022), oral diseases affect ~3 out of 4 individuals globally, out of which about 3.5 billion people live in middle-income countries. Further, as per the same source, about 2 billion people globally suffer from caries of permanent teeth, and more than 514 million children suffer from primary teeth caries. Gum or periodontal disease is a significant cause of dental health and the most common cause of tooth loss. According to the National Center for Health Statistics (US), in April 2021, ~13.2% of children (5–19 years) and 25.9% of adults (20–44 years) had untreated dental caries in North America. As per Gum Disease Facts published in May 2024, almost half of adults in the US aged 30 and above have some form of periodontal disease. More than 42% of all adults aged 30 and over have some form of gum disease, and almost 8% have severe periodontal disease.

As people age, they are more likely to encounter dental issues, including tooth loss, which increases the demand for dental implants. The rate at which the world's population is aging is unparalleled. According to the WHO facts published in October 2022, one in six individuals worldwide will be aged 60 or over by 2030. By then, the number of people aged 60 and above will increase from 1 billion in 2020 to 1.4 billion. The population of people aged 60 years and above will quadruple to 2.1 billion by 2050. Furthermore, it is anticipated that the population of those aged 80 or older will triple between 2020 and 2050, reaching 426 million. The rate of gum disease increases with age, and adults aged 65 years and above have some form of gum disease. As per the Centers for Disease Control and Prevention, in the US, ~70.1% of adults over the age of 65 had periodontal disease in 2020. Hence, the need for dental procedures rises as people get older and experience dental problems, increasing the demand for dental lasers. As dental lasers minimize bleeding, are quiet, shorten healing time, and may reduce the need for numbing agents, there is an increase in demand for dental laser treatment.

Expanding Applications in Cosmetic Dentistry

The dental cosmetic industry has gained substantial popularity and traction. Cosmetic dentistry also includes procedures involving smile correction and other aesthetic procedures. Cosmetic dentistry aims to enhance the appearance of teeth, gums, and bites. Majorly, millennials and baby boomers are responsible for the demand for cosmetic dentistry. The American Academy of Cosmetic Dentistry (AACD) has been conducting the biennial State of the Cosmetic Dentistry Industry Survey for the past 16 years. A survey conducted by the AACD in 2022 stated that cosmetic procedures continue to be popular with patients seeking cosmetic treatments. Additionally, as per the Bureau of Labor Statistics, dental cosmetic procedures are expected to increase by 19% from 2016 to 2026.

The use of dental lasers in cosmetic treatments is expected to increase during the forecast period as dental lasers target specific tissues with unparalleled precision and minimal invasiveness and provide aesthetic outcomes. Dental lasers' quiet operation and patient-friendly nature make them an optimal choice for cosmetic dental enhancements. Dental lasers can also be used for gum contouring to eliminate excessive gum tissue to create a more uniform and visually pleasing gum line. Laser technology is effective in resolving tongue-tied or lip-tied conditions resulting from a tight frenulum. It can result in an improved range of motion, speech, and smile aesthetics. In addition, the use of digital tools such as CAD/CAM systems and smile design software for defining the required outcome and the use of dental lasers to actualize the envisioned changes are expected to create growth opportunities for the dental laser treatment market.

Dental Laser Treatment Market Report Segmentation Analysis

Key segments that contributed to the derivation of the dental laser treatment market analysis are application, end user, and clinical indication.

- Based on application, the dental laser treatment market is segmented into hard tissue, soft tissue, and others. The soft tissue segment held the largest share of the market in 2023.

- By end user, the market is segmented into hospitals, dental clinics, dental-owned practices, and others. The dental clinics segment dominated the market in 2023.

- Based on clinical indication, the dental laser treatment market is segmented into conservative dentistry, root canal (endodontic treatment), oral surgery, implantology, peri-implantitis, periodontics, and others. The conservative dentistry segment held the largest share of the market in 2023.

Dental Laser Treatment Market Share Analysis by Geography

The geographic scope of the dental laser treatment market report is mainly divided into five regions: North America, Asia Pacific, Europe, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the market in 2023. The high prevalence of dental diseases and technological advancements in dental tools and solutions are projected to accelerate the growth of the market in the region. In addition, the market is driven by expanding awareness among patients regarding the advantages of laser treatments, rising dental tourism, and the existence of major market players in the regions. The US is the largest and fastest-growing market for dental laser treatment. Several market players focus on technological advancements in dental tools and solutions that allow companies to launch new and innovative products. For instance, in February 2024, Biolase, the world's recognized leader in dental laser technology, introduced its state-of-the-art all-tissue laser system, Waterlase iPlus Premier Edition, which was launched at the 2024 Chicago Dental Society Midwinter Meeting. The new laser system is an extraordinary update to the industry-leading Waterlase iPlus and represents the pinnacle of innovation in dentistry.

Dental Laser Treatment Market Regional Insights

The regional trends and factors influencing the Dental Laser Treatment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Dental Laser Treatment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Dental Laser Treatment Market

Dental Laser Treatment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 445.38 Million |

| Market Size by 2031 | US$ 864.58 Million |

| Global CAGR (2023 - 2031) | 8.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

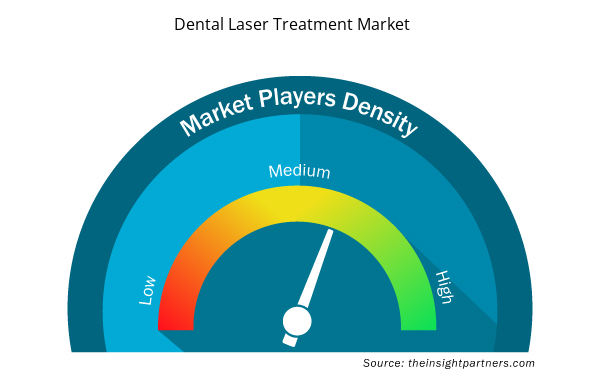

Dental Laser Treatment Market Players Density: Understanding Its Impact on Business Dynamics

The Dental Laser Treatment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Dental Laser Treatment Market are:

- Dentsply Sirona Inc

- BIOLASE Inc

- Fotona

- Garda Laser

- Hyper Photonics s.r.l.

- Convergent Dental Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Dental Laser Treatment Market top key players overview

Dental Laser Treatment Market News and Recent Developments

The dental laser treatment market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- BIOLASE, Inc. launched its state-of-the-art all-tissue laser system, Waterlase iPlus Premier Edition. The Waterlase iPlus Premier Edition is an extraordinary update to the industry-leading Waterlase iPlus and represents the pinnacle of innovation in dental care. (Source BIOLASE, Inc, Company Website, February 2024)

- Sonendo launched the second-generation cleanflow procedure instrument for heightened efficacy and ease of use. The updated procedure instrument includes an optimized design and enhanced matrix system to improve the effectiveness and ease of use of the GentleWave Procedure. This redesigned matrix facilitates a more congruent, secure, and lasting seal, which provides a heightened level of consistency, further simplifying the root canal treatment process for clinicians and improving the overall patient experience. Combined with its optimized design, these changes now allow doctors to use one procedure instrument for all teeth. (Source: Sonendo, Company Website, September 2023)

Dental Laser Treatment Market Report Coverage and Deliverables

The "Dental Laser Treatment Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Dental laser treatment market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Dental laser treatment market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Dental laser treatment market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the dental laser treatment market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is expected to register a CAGR of 8.6% during 2023–2031.

The dental laser treatment market value is expected to reach US$ 864.58 million by 2031.

Dentsply Sirona Inc, BIOLASE Inc, Fotona, Garda Laser, Hyper Photonics s.r.l., Convergent Dental Inc, BISON MEDICAL, Sonendo Inc, Lazon Medical Laser, AMD LASERS, and DEKA Dental Lasers are among the key players in the market.

Advancements in laser dentistry are expected to bring new trends in the market in the coming years.

The increasing cases of dental diseases, growing geriatric population, and increasing product launches and product developments are among the most significant factors fueling the market growth.

North America dominated the market in 2023.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Dental Laser Treatment Market

- Dentsply Sirona Inc

- BIOLASE Inc

- Fotona, Garda Laser

- Hyper Photonics s.r.l.

- Convergent Dental Inc

- BISON MEDICAL

- Sonendo Inc

- Lazon Medical Laser

- AMD LASERS

- DEKA Dental Lasers

Get Free Sample For

Get Free Sample For