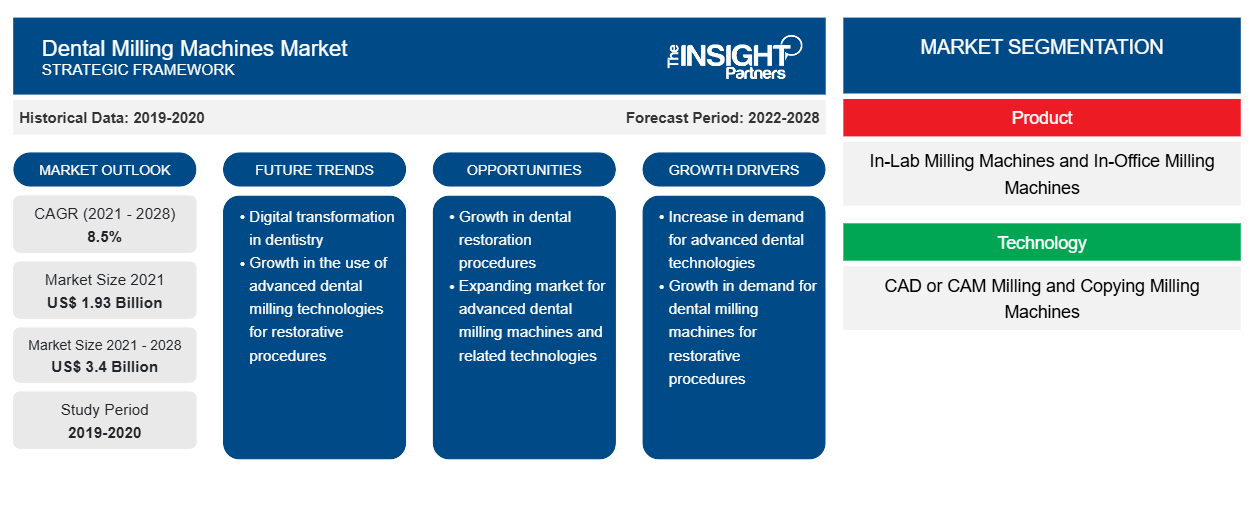

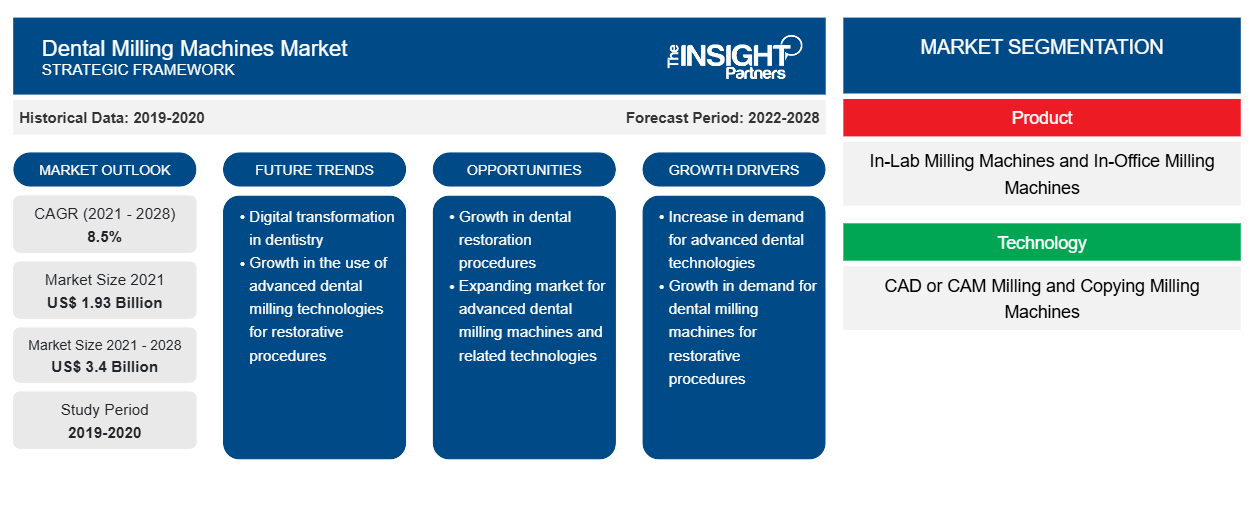

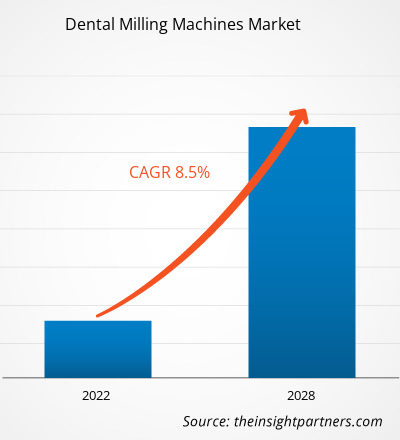

The dental milling machines market is expected to grow from US$ 1,934.83 million in 2021 to US$ 3,398.72 million by 2028; it is estimated to grow at a CAGR of 8.5% from 2022 to 2028.

The dental milling machines market is segmented on the basis of product type, technology, application, end user, and geography. The report offers insights and in-depth analysis of the market, emphasizing various parameters such as dynamics, trends, and opportunities of the market and competitive landscape analysis of leading market players across various regions. It also includes the impact analysis of COVID–19 pandemic across the regions.

Market Insights

Rising Burden of Dental Diseases and Increasing Geriatric Population Drives Market Growth

Oral diseases, including dental diseases, are highly preventable. However, these diseases can be a major health burden for many countries and affect people throughout their lifetime. A few common dental problems include dental caries (tooth decay), periodontal diseases, and tooth loss. The rising incidence of dental diseases is boosting the demand for teeth replacement, dental crowns, copings, and dental bridges. According to the WHO Global Oral Health Status Report (2022), oral diseases affect approximately 3 out of 4 people globally, out of which ~3.5 billion people live in middle-income countries. Further, ~2 billion people globally suffer from caries of permanent teeth, and 514 million children suffer from primary teeth caries. Furthermore, the prevalence of major oral diseases continues to increase globally with growing urbanization and changing lifestyles.

Moreover, according to WHO, losing teeth can be psychologically traumatic, socially damaging, and functionally limiting. It can be caused due to various oral diseases such as dental caries, severe periodontal disease, and trauma. As per the same source, the estimated global average prevalence of complete tooth loss is ~7% among people aged 20 years or older while for people aged 60 years or older, the global prevalence of complete tooth loss is ~23%. Moreover, according to data from United Nations World Population Prospects: the 2019 Revision, by 2050, 1 in every 6 people in the world will be over age 65, i.e., 16%, up from 9% in 2019. Thus, the increasing global geriatric population and rising burden of dental diseases are boosting the demand for teeth replacement and other restoration procedures, which is fueling the dental milling machines market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Dental Milling Machines Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Dental Milling Machines Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Product Type-Based Insights

Based on product type, the dental milling machines market is bifurcated into in-lab milling machines and in-office milling machines. In 2021, the in-lab milling machines segment held a larger share of the dental milling machines market. However, the in-office milling machines segment is anticipated to register a higher CAGR during the forecast period. The dental laboratory milling units are used for the fabrication of complete or partial dental restorations. The in-lab dental mills are used to cut dental crowns, copings, frameworks, bridges, and abutments made of materials such as zirconia, resins, ceramics, and wax. The in-lab dental milling machines are designed to meet the requirements of dental laboratories through cost-effective production. Most of the in-lab milling machines are featured with multiple processed disk heights as well as working angles that offer flexibility in the restorations supported by dental milling machines. A few of the companies providing in-lab milling machines include Dentsply Sirona, CadBlu Inc., AmannGirrbach GmbH, Ivoclar Vivadent Inc., and Jensen Dental.

Technology-Based Insights

Based on technology, the dental milling machines market is bifurcated into CAD or CAM milling and copying milling machines. The CAD or CAM milling segment held the largest share of the market in 2021, and it is expected to grow at a higher CAGR during the forecast period. In the dental industry, CAD/CAM includes the use of software for designing and milling dental prosthetics. Computer-aided designing (CAD) involves the digital scanning of prosthetics, and computer-aided manufacturing (CAM) sends final models to output devices and manufacture them with the help of 3D printing or milling machines. CAD/CAM is becoming a promising technology in the field of dentistry as it enables the delivery of well-fitted aesthetic and durable prostheses for patients. Dentistry uses additive and subtractive processes to produce physical instances from 3D models. The CAD/CAM milling machines are likely to witness significant growth in the coming years as the technique has helped to improve the quality of prostheses and standardize the production process in the dentistry.

Application-Based Insights

Based on application, the dental milling machines market is segmented into crowns, dentures, bridges, veneers, and inlays or onlays. In 2021, the bridges segment held the largest share of the market and is anticipated to register the highest CAGR during the forecast period. Dental bridges are custom-made teeth that help to fill the space of one or more missing teeth. These are fixed implants or prosthetic devices that are cemented onto the existing implants or teeth by a certified dental professional. Apart from strengthening a damaged tooth, bridges are helpful as they improve a tooth’s appearance, shape, alignment, and dental occlusion (bite). There are four major types of dental bridges, namely traditional dental bridges, cantilever bridges, Maryland bridges, and implant supported bridges. Traditional dental bridges are among the most used and popular types of dental bridges. Implant supported bridges are supported by dental milling machines instead of being supported by crowns or frameworks. The high demand for bridges in dental milling machines acts as a standalone factor responsible for the growth of the dental bridges segment in the dental milling machines market

End User-Based Insights

Based on end user, the dental milling machines market is segmented into dental laboratories, dental clinics, and research and academic institutes. In 2021, the dental laboratories segment held the largest share of the market. Also, the same segment is expected to grow at highest CAGR during the forecast period. Dental Laboratories refer to commercial labs and operating workrooms that engage in various dental-related activities and procedures. These laboratories consist of full-service dental lab services that fabricate a wide variety of implants, including crowns, bridges, flexible and cast dentures, aligners, and other products. Dental laboratories are gaining popularity as these labs offer quick and accurate results, such as a same-day turnaround in many situations. The labs use advanced technologies such as 3D printing for the preparation of dental products. This helps in accurate designing as per the patient's requirements.

The dental milling machines market players adopt organic strategies, such as product launch and expansion, to expand their footprint and product portfolio across the world and meet the growing demand. Inorganic growth strategies witnessed in the market are partnerships and collaborations. These growth strategies have allowed the dental milling machines market players to expand their businesses and enhance their geographic presence. Additionally, acquisitions, partnerships, and other growth strategies help strengthen the company’s customer base and increase its product portfolio.

In June 2021, Dentsply Sirona entered into a partnership with 3Shape, a developer and manufacturer of 3D scanners and CAD/CAM software solutions based in Copenhagen, Denmark. The first step of this partnership focuses on a facilitated collaboration between 3Shape’s intraoral scanner, 3Shape TRIOS, and Dentsply Sirona’s SureSmile Clear Aligners. As part of their steps to innovate dentistry, lead the digital transformation, and improve digital dentistry and oral health, Dentsply Sirona and 3Shape have planned to work on multiple strategic opportunities.

In February 2021, Ivoclar Vivadent expanded its milling line with the launch of PrograMill DRY. It is the ideal entry-level machine for zirconium oxide milling. The 5-axis dry milling unit is available in a compact design and can be ideally placed in every laboratory..

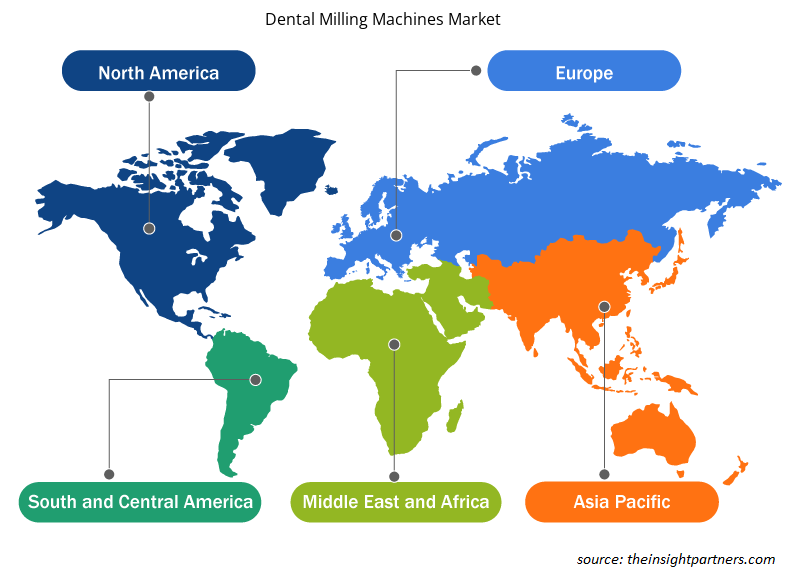

Dental Milling Machine Dental Milling Machines Market Regional Insights

The regional trends and factors influencing the Dental Milling Machines Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Dental Milling Machines Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Dental Milling Machines Market

Dental Milling Machines Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1.93 Billion |

| Market Size by 2028 | US$ 3.4 Billion |

| Global CAGR (2021 - 2028) | 8.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Dental Milling Machines Market Players Density: Understanding Its Impact on Business Dynamics

The Dental Milling Machines Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Dental Milling Machines Market are:

- Amann Girrbach AG

- Dentsply Sirona Inc

- Ivoclar Vivadent Inc

- Dentium Co Ltd

- imes-icore GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Dental Milling Machines Market top key players overview

Dental Milling Machines - Company Profiles

- Amann Girrbach AG

- Dentsply Sirona Inc

- Ivoclar Vivadent Inc

- Dentium Co Ltd

- imes-icore GmbH

- DATRON Dynamics Inc

- B&D Dental Corp

- Zubler USA LLC

- Zirkonzahn SRL

- Interdent doo

- Mecanumeric SAS

- 3M Co.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Technology, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, UAE, UK, US

Frequently Asked Questions

The global dental milling machines based on regions is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In 2021, the North American area held the largest market share. However, the Asia Pacific region is estimated to grow at the fastest CAGR of 9.1% during the forecast period

The global dental milling machines based on the product are segmented into lab milling machines and in office milling machines. The in lab milling machines segment held a largest share of the market in 2021. However, the in-office milling machines segment registers the highest CAGR in the market during the forecast period.

The dental milling machines majorly consist of the players, such as Amann Girrbach AG, Dentsply Sirona Inc, Ivoclar Vivadent Inc, Dentium Co Ltd, imes-icore GmbH, DATRON Dynamics Inc, B&D Dental Corp, Zubler USA LLC, Zirkonzahn SRL, Interdent doo, Mecanumeric SAS, and 3M Co.

High cost of dental milling machines and unfavorable reimbursement policies are hampering the market growth..

The factors driving the growth of dental milling machines are The rising burden of dental diseases, increase in geriatric population and growing demand for cosmetic dentistry are the key driving factors behind the market development.

A dental milling machine is utilized to design and make simulated dental prosthetics by milling and grinding three-dimensional objects from a digital file using a computer-guided machine. The dental milling machine can produce extensions, removable dental prostheses, temporary prostheses, complete dentures, restoration, crowns, etc. Dental CAD-CAM milling machines use different kinds of blocks and blanks available in the market and are made of different materials according to the need of the prostheses.

Trends and growth analysis reports related to Life Sciences : READ MORE..

List of Companies - Dental Milling Machines Market

- Amann Girrbach AG

- Dentsply Sirona Inc

- Ivoclar Vivadent Inc

- Dentium Co Ltd

- imes-icore GmbH

- DATRON Dynamics Inc

- B&D Dental Corp

- Zubler USA LLC

- Zirkonzahn SRL

- Interdent doo

- Mecanumeric SAS

- 3M Co.

Get Free Sample For

Get Free Sample For