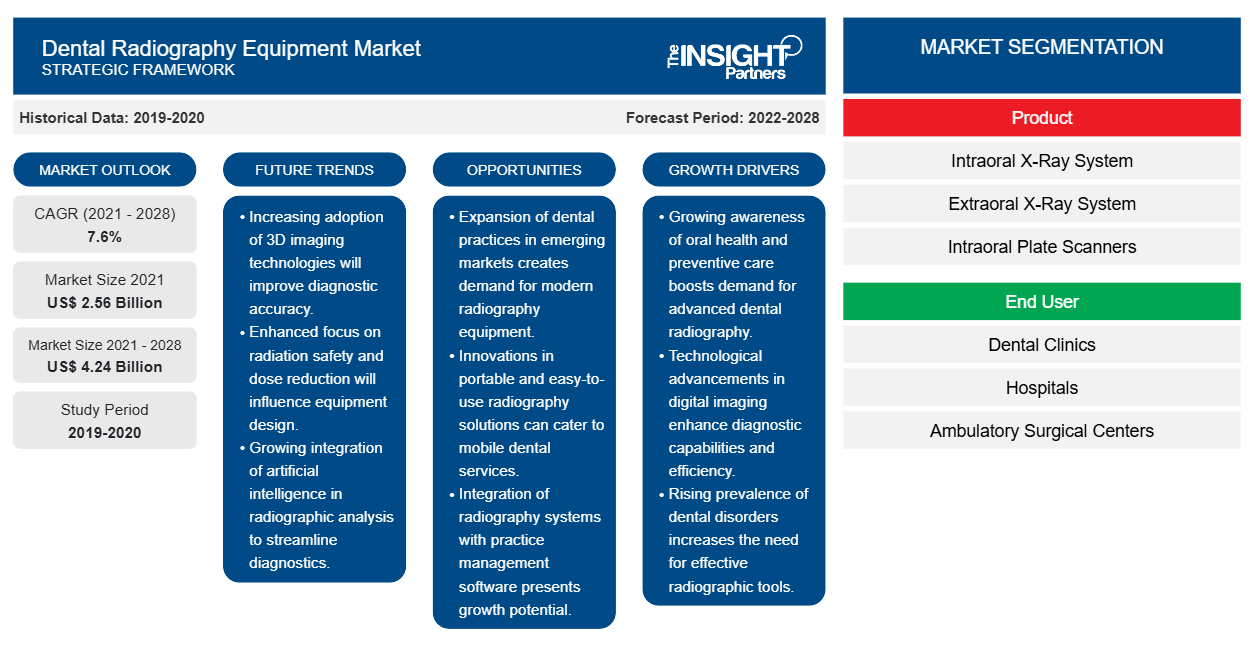

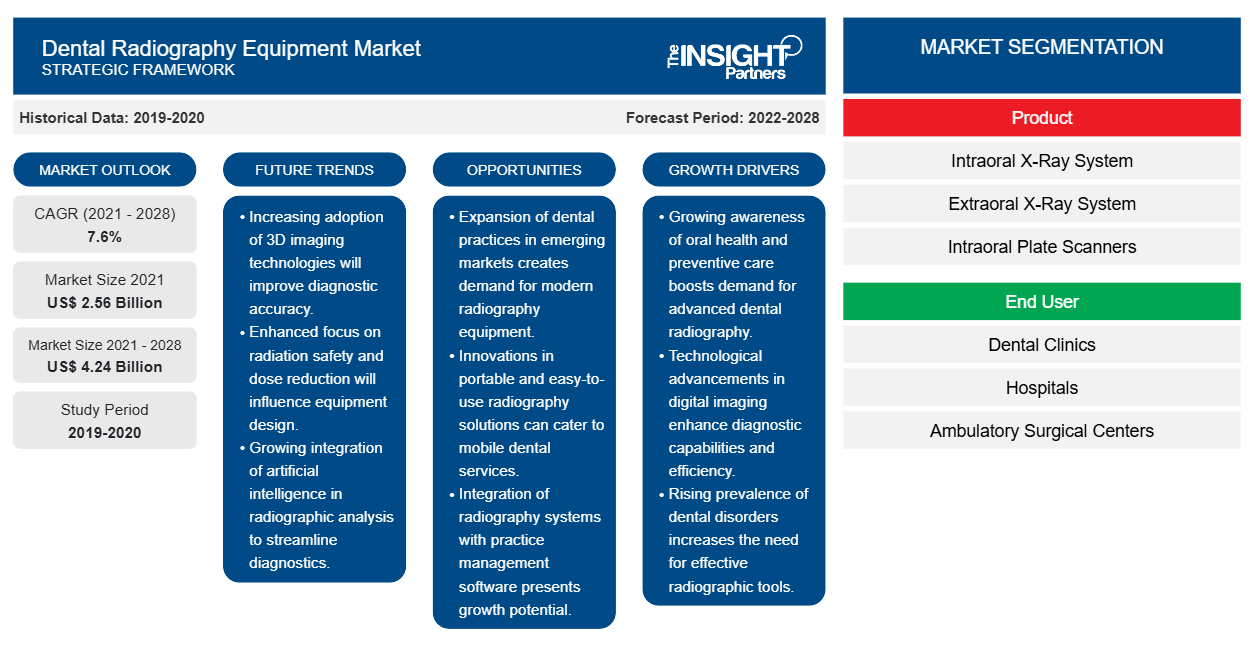

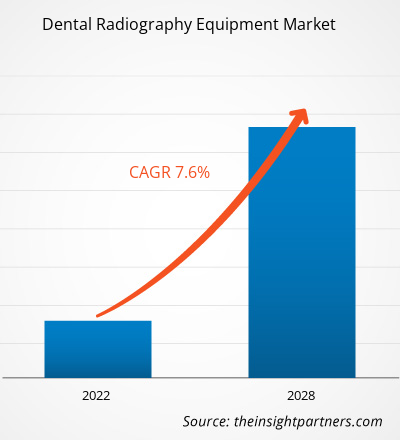

The dental radiography equipment market was valued at US$ 2,559.09 million in 2021; it is expected to register a CAGR of 7.6% from 2022 to 2028.

Dental radiology equipment is widely used in hospitals, dental clinics, and diagnostic centers for dental imaging to diagnose dental disorders, cavities, and conditions such as tooth decay, gingivitis, and dental caries. These instruments are used with low radiation levels to capture images.

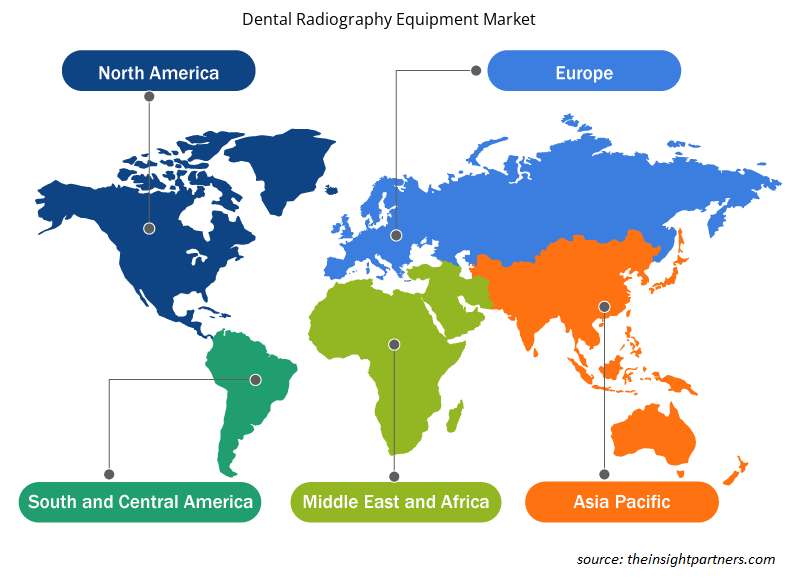

The dental radiography equipment market is segmented on the basis of product, end user, and geography. By geography, the market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The dental radiography equipment market report offers insights and in-depth analysis of the market emphasizing market trends, technological advancements, market dynamics and the competitive analysis of the globally leading market player.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Dental Radiography Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Dental Radiography Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rising Awareness of Oral Diseases to Boost Dental Radiography Equipment Market in Coming Years

World Oral Health Day is created by the Fédération Dentaire Internationale (FDI) World Dental Federation. It is the largest global awareness campaign on oral health. The annual campaign spreads awareness about oral hygiene practices for adults and children, and illustrates the importance of oral health in general health and well-being. Every year, the Community Dental Services (CDS)raises awareness of oral health in London. The Mouth Cancer Action Month runs for the whole month of November. The campaign by The Mouth Cancer Action raises awareness related to dental disease, its prevalence, and the importance of checking dental health regularly. The Oral Health Promotion team of The Mouth Cancer Action promotes these messages and disseminates the campaign materials widely during the month.

Further, various campaigns are being conducted in the UK to boost awareness about oral diseases. For instance, National Smile Month is the UK's largest and longest-running campaign to promote good oral health. The campaign is primarily organized by the Oral Health Foundation with the goal of improving the oral health of people across the country. In September 2017, the British Society of Pediatric Dentistry (BSPD) launched "Dental Check by One" (DCby1) to encourage early dental attendance. DCby1 is a public health campaign that aims to increase the dental attendance of children aged 0–2 years. In Ireland, Mouth Head and Neck Cancer Awareness Ireland Group observes Mouth Cancer Awareness Day (MCAD) every September. Thus, oral diseases have been receiving considerable attention in recent years. Public awareness campaigns are expected to create ample opportunities for the growth of the dental radiography equipment market in the coming years.

Product Insights

Based on product, the dental radiography equipment market is segmented into intraoral X-ray systems, extra-oral x-ray systems, intraoral plate scanners, and cone-beam computed tomography (CBCT) imaging systems. The intraoral X-ray systems segment is likely to hold the largest share of the market in 2022. However, the cone-beam computed tomography imaging segment is anticipated to register the highest CAGR of 8.7% in the market during the forecast period. Dental CBCT X-ray images provide three-dimensional (3D) information, unlike the two-dimensional (2D) information provided by a traditional X-ray imaging system. This may help dentists diagnose, plan, and evaluate certain dental conditions.

End User Insights

Based on end user, the dental radiography equipment market is segmented into dental clinics, hospitals, ambulatory surgical centers, and others. The hospitals segment is likely to hold the largest share of the market in 2022. However, the dental clinics segment is anticipated to register the highest CAGR of 8.0% in the market during the forecast period. Dental clinics are smaller facilities than hospitals, however, they also provide specific services to visitors. Many dental clinics are also associated with universities and offer cost-effective services.

Dental Radiography Equipment Market Regional Insights

The regional trends and factors influencing the Dental Radiography Equipment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Dental Radiography Equipment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Dental Radiography Equipment Market

Dental Radiography Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2.56 Billion |

| Market Size by 2028 | US$ 4.24 Billion |

| Global CAGR (2021 - 2028) | 7.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Dental Radiography Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Dental Radiography Equipment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Dental Radiography Equipment Market are:

- Zimed Healthcare Ltd

- Envista Holdings Corporation

- General Electric Co

- Carestream Dental LLC.

- Dentsply Sirona Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Dental Radiography Equipment Market top key players overview

Company Profiles

The dental radiography equipment market is mainly dominated by Zimed Healthcare Ltd; Envista Holdings Corporation; General Electric Co; Carestream Dental LLC; Dentsply Sirona Inc.; Planmeca; Koninklijke Philips NV; Acteon Group; Siemens Healthcare GmbH; and Vatech Co., Ltd.

Example of development undertaken by these players to promote the growth of the dental radiography equipment market are listed below:

- In September 2020, Carestream Dental launched the CS 8200 3D imaging system. It is a multimodality system that features capabilities of CBCT imaging, 2D panoramic imaging, optional cephalometric imaging, and 3D object scanning with a larger field of view (FOVs), along with advanced algorithms, which enable doctors to see better.

- In March 2022, Envista Holdings Corporation acquired the Intraoral Scanner business of Carestream Dental. The acquired business was rebranded as DEXIS, and it now operates as part of the Envista Equipment and Consumables segment.

- In September 2020, Carestream Dental launched its CS 8200 3D imaging system. It is a multi-modality system that offers CBCT imaging, 2D panoramic imaging, optional cephalometric imaging, and 3D object scanning with the added enhancements of a larger field of view (FOVs) and advanced algorithms, aiding better visibility for doctors.

- In October 2019, Dentsply Sirona launched Orthophos Systems providing efficient and reliable diagnoses, intuitive digital workflows, and high image quality at a low dose, thereby offering premium solutions for multiple applications

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Biopharmaceutical Tubing Market

- Machine Condition Monitoring Market

- Automotive Fabric Market

- Visualization and 3D Rendering Software Market

- Precast Concrete Market

- Industrial Inkjet Printers Market

- Compounding Pharmacies Market

- Integrated Platform Management System Market

- Mobile Phone Insurance Market

- Ketogenic Diet Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global dental radiography equipment market, by product is categorized into intraoral X-ray systems, extra oral X-ray systems, intraoral plate scanners, and Cone-Beam Computed Tomography (CBCT) imaging. The intraoral X-ray systems segment held the largest share of the market in 2021. However, the Cone-Beam Computed Tomography (CBCT) imaging segment is anticipated to register the highest CAGR in the market during the forecast period.

The dental radiography equipment market majorly consists of the players such as Zimed Healthcare Ltd; Envista Holdings Corporation; General Electric Co; Carestream Dental LLC.; Dentsply Sirona Inc.; Planmeca; Koninklijke Philips NV; Acteon Group; Siemens Healthcare GmbH; and Vatech Co., Ltd.

Dental radiology equipment refers to the equipment that is used for dental imaging to diagnose various dental disorders, dental cavities, and dental diseases such as tooth decay, gingivitis, dental caries and others. Dental X-rays (radiographs) are images of one's teeth that dentist use to evaluate oral health.

Factors such as the rising prevalence of cancer and increasing awareness regarding cancer are propelling the market growth. However, the elevated risk of adverse effects due to dental radiography equipment is hampering the market's growth.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Dental Radiography Equipment Market

- Zimed Healthcare Ltd

- Envista Holdings Corporation

- General Electric Co

- Carestream Dental LLC.

- Dentsply Sirona Inc.

- Planmeca

- Koninklijke Philips NV

- Acteon Group

- Siemens Healthcare GmbH

- Vatech Co., Ltd

Get Free Sample For

Get Free Sample For