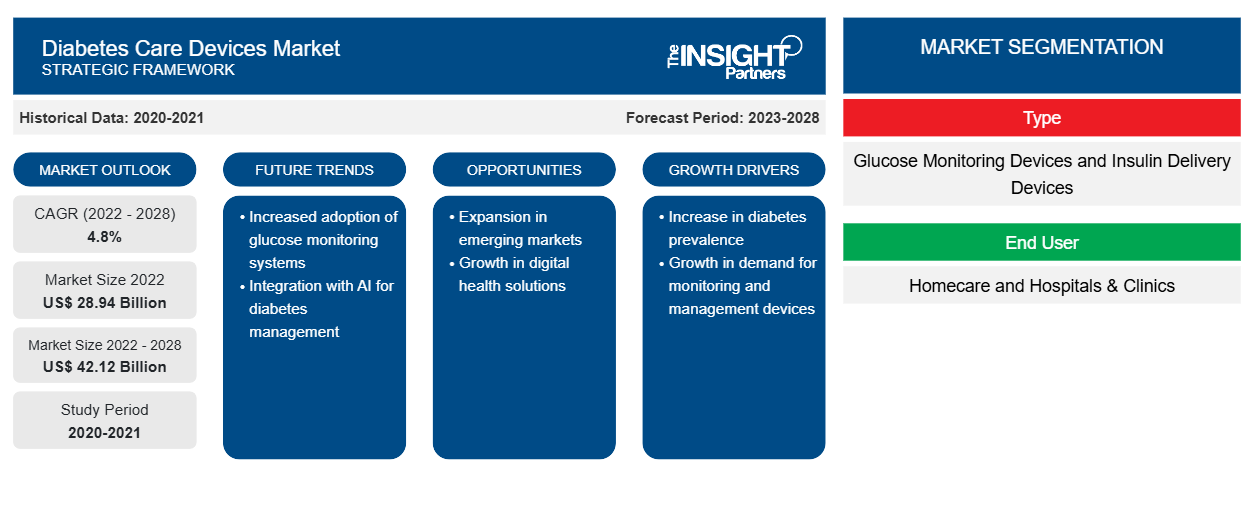

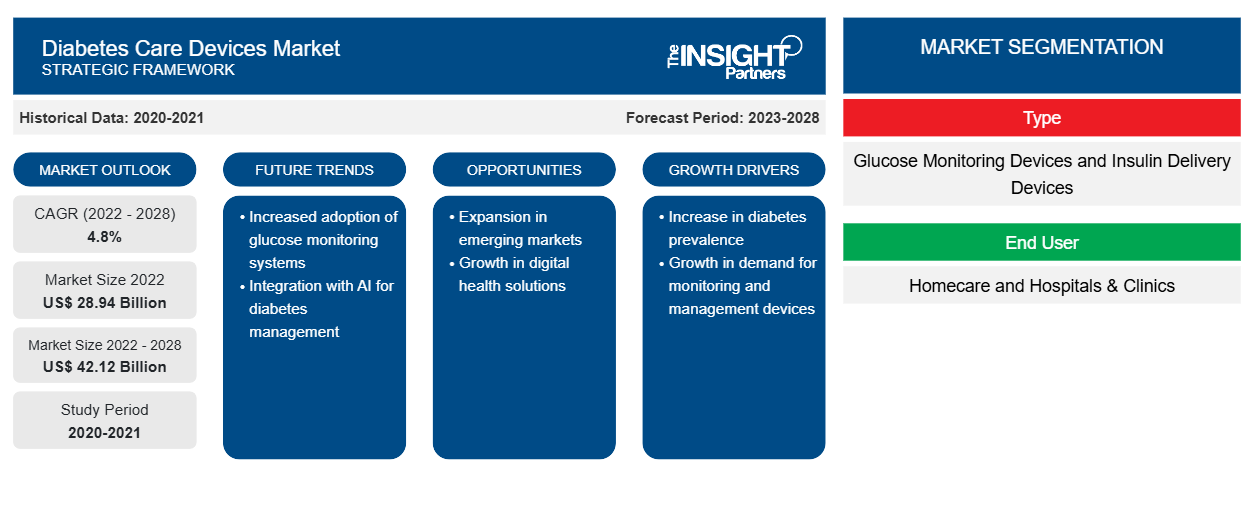

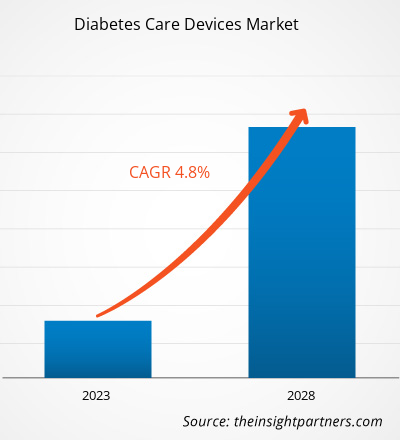

[Research Report] The diabetes care devices market is expected to grow from US$ 28,942.1 million in 2022 to US$ 42,119.3 million by 2028; it is estimated to grow at a CAGR of 4.8% from 2022 to 2028.

Market Insights and Analyst View:

The diabetes care devices are the medical devices are used to monitor the glucose levels in the blood of the diabetes patients. The monitoring devices are known as continuous glucose monitoring devices or glucometers. The other diabetes care devices are used to deliver insulin in the body, these devices are used by the diabetes patients who are unable to produce insulin by their own. The insulin delivery devices include insulin pumps, insulin pens, insulin syringes and others. Increase in technological advancements, rise in the incidences of obesity, increasing adoption of insulin delivery devices and rising prevalence of diabetes are driving the growth of the diabetes care devices market. Key manufacturers are focusing on technological innovations and development of advanced products to gain substantial share of the market. For instance, in April 2023, Medtronic plc received U.S. Food and Drug Administration (FDA) approval for its MiniMed 780G system. This system features the lowest glucose target setting (as low as 100 mg/dL) in any automated insulin pump on the market and one that more closely reflects the average glucose of person not living with diabetes.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Diabetes Care Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Diabetes Care Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Growth Drivers and Opportunities:

Diabetes is a deadly chronic disease with no specialized cure. It is primarily caused by the body’s inability to produce or effectively use the hormone insulin. This inability prevents the body from adequately regulating blood glucose levels. There are two forms of diabetes—diabetes type-I or diabetes insipidus and diabetes type-2 or diabetes mellitus. The incidences of diabetes are steadily increasing globally. Type 2 diabetes is the most prevalent type of diabetes and has increased with cultural and societal changes. In high-income countries, ~91% of adults have type 2 diabetes. In 2021, as per the International Diabetes Federation (IDF), diabetes will affect ~537 million persons aged 20-79. Similarly, the total number of diabetics is expected to surge to 643 million by 2030 and 783 million by 2045.

Prevalence of Diabetes Worldwide among People aged 20-79 Years, 2021 vs 2030 vs 2045 (In Millions)

Region | 2021 | 2030 | 2045 |

North America & Caribbean | 51 | 57 | 63 |

South & Central America | 32 | 40 | 49 |

Africa | 24 | 33 | 55 |

Europe | 61 | 67 | 69 |

Middle East & North Africa | 73 | 95 | 136 |

South-East Asia | 90 | 113 | 152 |

Western Pacific | 206 | 238 | 260 |

Source: International Diabetes Federation (2022)

Diabetes can lead to several complications in various body parts and raise the overall risk of premature death. Heart attack, stroke, kidney failure, leg amputation, vision loss, and nerve damage are a few major complications associated with diabetes. Hence, patients suffering from this disease require frequent monitoring and external administration of insulin. The growing prevalence of diabetes is fuelling the growth of the diabetes care devices market worldwide during the forecast period.

Report Segmentation and Scope:

The “Global Diabetes Care Devices Market” is segmented based on product, end user, and geography. Based on product, the diabetes care devices market is segmented into glucose monitoring devices and insulin delivery devices. Based on end user, the diabetes care devices market is segmented into homecare and hospitals & clinics. The diabetes care devices market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

The global diabetes care devices market, based on product is segmented into glucose monitoring devices and insulin delivery devices. In 2022, the glucose monitoring devices segment hold the largest share of the market, by product. Moreover, the glucose monitoring devices segment of diabetes care devices market is also expected to witness growth in its demand at a fastest CAGR of 5.0% during 2022 to 2028. The glucose monitoring devices market consists of components such as glucometers, lancets, testing strips and other glucose monitoring devices. In 2022 testing strips segment hold the largest market share among the glucose monitoring devices segments. The glucose monitoring devices or glucose meters are medical devices are used to determine the approximate levels or the concentration of glucose in the blood of the patients living with diabetes. The concentration of the glucose level can be measured by various means such as through testing strips, lancets, and others.

The global diabetes care devices market, end user was segmented into home care and hospitals & clinics. In 2022, the homecare segment holds the largest share of the market, by end user. In addition, the segment is also expected to grow at the fastest rate during the coming years owing to the rise in the prevalence of the diabetes and it makes patients independent to manage and monitor their diabetes. The hospital is a multifaceted organization and an institute that provides health to people through complication however, the specialized treatments are offered with scientific equipment. The team of trained staff educated in the problems of modern medical science assists in providing better treatments. They are all coordinated together for the common goal of restoring and maintain good health. Hospitals serves a significant role by providing extensive range of medical services to the patient population suffering from wide variety of diseases.

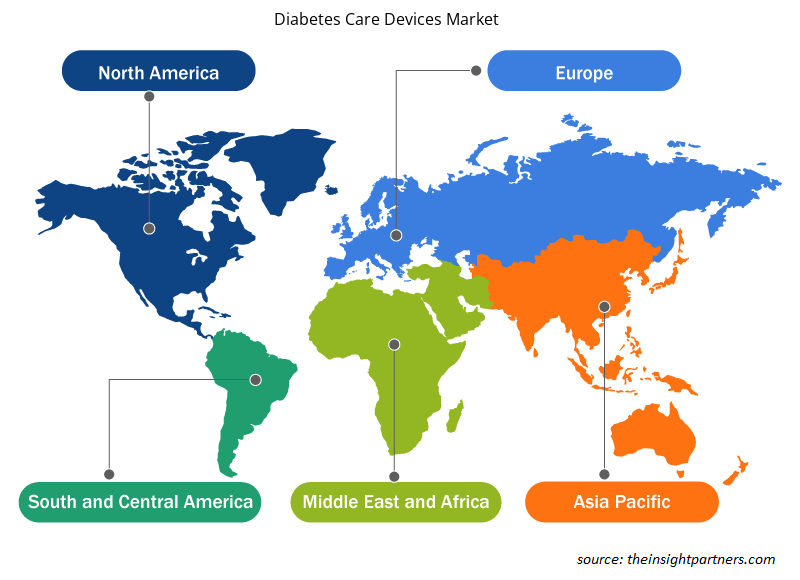

Regional Analysis:

Based on geography, the diabetes care devices market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2020, US held the largest share of the North America diabetes care devices market. The growth of the diabetes care devices market is estimated to have a larger share in the United States. In US diabetes care is among the most common and expensive chronic diseases. The highest rate of diabetes is commonly seen in the elder populations. However, the rise in the prevalence of the diabetes continues across the US and other than the elder population it is seen among the overweight and obese population. In 2021, according to the International Diabetes Federation (IDF), diabetes would affect approximately 32.2 million persons aged 20 to 79 across the US. Similarly, the total number of diabetics is expected to surge to 34.7 million by 2030 and 36.2 million by 2045. In the country the huge investments are being done however the country lags the other developed countries in terms of life expectancy, infant mortality and other related diseases. Nevertheless, the country has is performing well for the diabetes care and it ranks 4th among the other 11 leading developed countries. Although the rising prevalence of the diabetes is enforcing to enhance the care systems towards the diabetes.

The Asia Pacific diabetes care devices market is analyzed on the basis of the five major countries such as China, Japan, India, Australia, South Korea, and rest of Asia Pacific. However, Asia Pacific is estimated to register the highest CAGR during the forecast period. The diabetes care devices market in the region is largely held by countries such as China, Japan, and India. The growth of the market is majorly contributed by China, and the growth is attributed by the maximum production of diabetes care products and the availability of the product through the widest e-commerce chain. The prevalence of diabetes is significantly higher in China, the incidences for type 2 diabetes has rapidly increased in the country in the last few decades. The type 2 diabetes has become a leading problem in the country as it is more commonly found in the lower age group people. The leading causes that are contributing to the growth of the type 2 diabetes are genetic and environmental factors.

The rise in the prevalence of the diabetes is the important factors that is likely to drive the growth of the market. The world's most populous country has the highest number of diabetics compared to any other country globally – about 116 million in 2019. By 2045, this number is anticipated to reach 147 million. Additionally, as approximately 95% of patients with diabetes in China have type 2 diabetes, the rapid increase in the prevalence of diabetes in China may be attributed to the increasing rates of overweight and obesity and the reduction in physical activity, which is driven by economic development, lifestyle changes, and diet.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global diabetes care devices market are listed below:

- In April 2023, Medtronic plc received U.S. Food and Drug Administration (FDA) approval of its MiniMed 780G system with the Guardian 4 sensor requiring no fingersticks while in SmartGuard technology.

- In April 2022, BD (Becton, Dickinson and Company) a leading global medical technology company, announced that it has completed its spinoff of Embecta Corp. (embecta), which holds BD's former Diabetes Care business and is now one of the largest pure-play diabetes management companies in the world.

- In March 2022, Medtronic plc, a global leader in healthcare technology, announced reimbursement for continuous glucose monitoring (CGM), a key diabetes technology has been expanded or initiated in several countries throughout North and South America. CGM systems provide critical information on glucose levels to help simplify the management of diabetes. Automated insulin pump system reimbursement has progressed in Europe as well.

- In January 2022, Drug firm Novo Nordisk India launched a first of its kind diabetes treatment medication in the country. The company introduced the world's first and only oral semaglutide, a game-changer in diabetes management

- In March 2022, Terumo Corporation, a global leader in medical technology, and Glooko, a global leader in data management, remote patient monitoring and mobile apps for people with chronic conditions, have announced a technology integration to deliver new diabetes data sharing solutions together globally. This new integration will enable people with diabetes to transfer recorded data from MEDISAFE WITHTM insulin patch pump into the Glooko platform, thus helping them to visualize insulin dosage, food, and activities in graphs more easily and to realize personalized remote patient monitoring and patient care more effectively.

Diabetes Care Devices Market Regional Insights

The regional trends and factors influencing the Diabetes Care Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Diabetes Care Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Diabetes Care Devices Market

Diabetes Care Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 28.94 Billion |

| Market Size by 2028 | US$ 42.12 Billion |

| Global CAGR (2022 - 2028) | 4.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

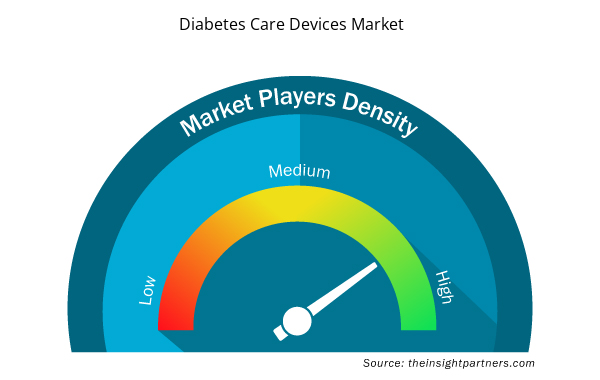

Diabetes Care Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Diabetes Care Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Diabetes Care Devices Market are:

- BD

- Novo Nordisk A/S

- B. Braun Melsungen AG

- Medtronic

- Tandem Diabetes Care Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Diabetes Care Devices Market top key players overview

Covid-19 Impact:

The COVID-19 pandemic affected economies and industries in various countries across the globe. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) hampered the growth of several industries, including the healthcare industry. As a result, health care systems are overburdened, and the delivery of medical care to all patients has become a challenge in the region. In addition, medical device industry is also facing negative impact of this pandemic. As the COVID-19 pandemic continues to unfold, medical device companies are finding difficulties in managing their operations. Many companies offering diabetes care devices have their business operations in the United States and business are adversely being affected by the effects of a widespread outbreak of COVID-19. This has disrupted and restricted company’s ability to distribute products, as well as temporary closures of company’s facilities. However, gradually hospitals have started resuming elective procedures as the COVID-19 recovery rate is increasing the demand for medical equipment like diabetes care is expected to increase.

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global diabetes care devices market include BD; Novo Nordisk A/S; Medtronic; B. Braun Melsungen AG; Tandem Diabetes Care Inc.; Insulet Corporation; Eli Lilly and Company; Dexcom, Inc.; Terumo Corporation; F. Hoffmann-LA Roche LTD among others. These diabetes device companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, which provides them to serve a large set of customers and subsequently increases their market share. The report offers trend analysis of the diabetes care device market emphasizing on various parameters such as technological advancements, market dynamics, and competitive landscape analysis of leading market players across the globe.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global diabetes care devices market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. The largest market for diabetes care devices is held by the North American region. The United States held the largest market for diabetes care devices. The Asia-Pacific region is expected to be the fastest-growing region during the forecast period.

The homecare segment are expected to be the leading end user segment in the diabetes care devices market in 2021.

The glucose monitoring devices segment is expected to be the leading type segment in the diabetes care devices market in 2021.

The diabetes care devices market majorly consists of the players such as BD; Novo Nordisk A/S; B. Braun Melsungen AG; Medtronic; Tandem Diabetes Care Inc.; Insulet Corporation; Eli Lilly and Company; DEXCOM, INC.; Terumo Corporation; F. HOFFMANN-LA ROCHE LTD.; among others.

The diabetes care devices are the medical devices used to monitor the glucose levels in the blood of diabetic patients. The monitoring devices are known as continuous glucose monitoring devices or glucometers. Insulin delivery devices are used to deliver insulin in the body, these devices are used by the diabetes patients who are unable to produce insulin by their own. These devices include pens, pumps, syringes and others.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Diabetes Care Devices Market

- BD

- Novo Nordisk A/S

- B. Braun Melsungen AG

- Medtronic

- Tandem Diabetes Care Inc.

- Insulet Corporation

- Eli Lilly and Company

- DEXCOM, INC.

- Terumo Corporation

- F. HOFFMANN-LA ROCHE LTD.

Get Free Sample For

Get Free Sample For