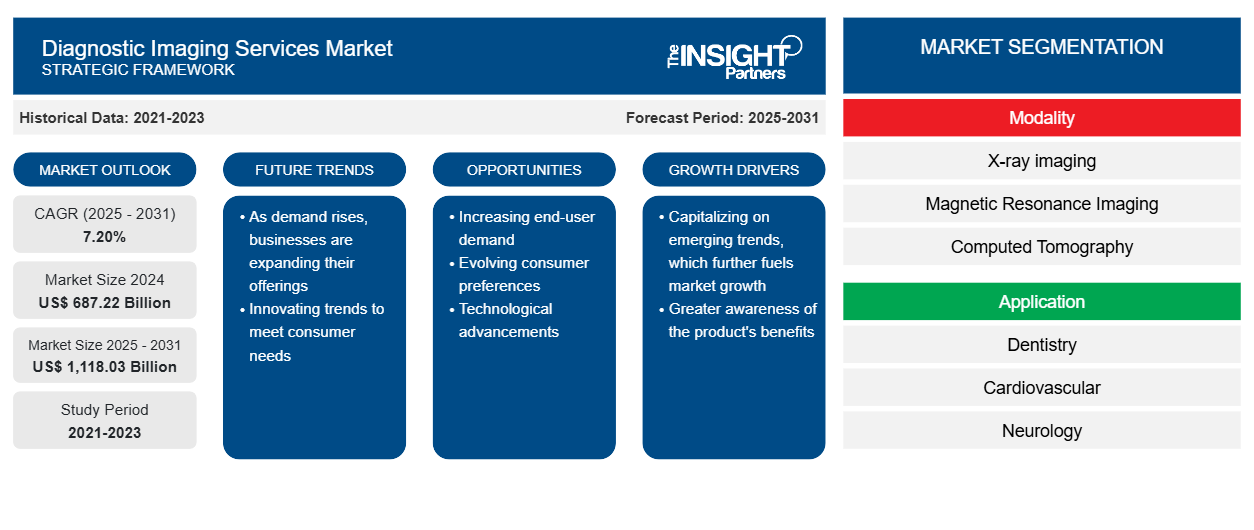

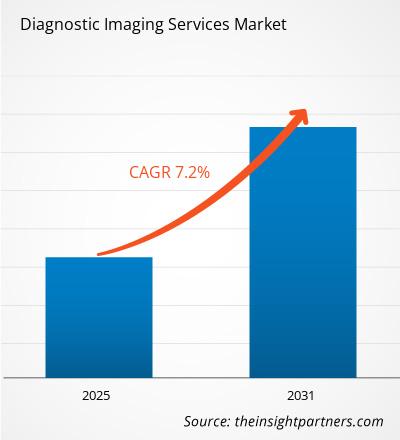

[Research Report] The diagnostic imaging services market size is expected to grow from US$ 598.0 billion in 2022 to US$ 860.2 billion by 2031; it is estimated to register a CAGR of 7.2% from 2022 to 2031.

Analyst’s ViewPoint

The diagnostic imaging services market analysis explains market drivers, such as the rising prevalence of non-communicable or chronic diseases, a standalone factor responsible for influential market growth. Further, technological advancement is expected to introduce new trends in the market during 2022–2031. The X-ray imaging segment held a larger market share in 2022 based on modality. Based on application, the global diagnostic imaging services market is segregated into dentistry, cardiovascular, neurology, orthopedics, oncology, and others. The neurology segment will account for a major share of the segment growth in 2022. Furthermore, based on end users, the global diagnostic imaging services market is segmented into hospitals and clinics, ambulatory surgical centers, and others. The hospital segment will account for the largest diagnostic imaging service market share.

Diagnostic imaging has transformed healthcare and allows for earlier diagnosis of medical conditions to create better patient outcomes. Also, diagnostic imaging describes several techniques of visuals inside the body to help figure out the causes of an illness or injury and confirm a patient's diagnosis.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Diagnostic Imaging Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Diagnostic Imaging Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rising Prevalence of Non-Communicable or Chronic Diseases

According to the International Atomic Energy Agency (IAEA) report, diagnostic imaging tests utilize advanced techniques such as radiographs, ultrasound, fluoroscopy, or nuclear medicine to create visual images of the patient's body interior to deal with several non-communicable or chronic diseases. The four most important types of non-communicable or chronic diseases where diagnostic imaging services are utilized include cardiovascular diseases, cancer, chronic respiratory diseases, and diabetes.

Disease Type | Mortality Statistics (2021 and 2021) |

Cardiovascular Diseases (CVDs) | 17.9 million |

Cancer | 10 million |

Chronic Respiratory Diseases | 8.9 million |

Diabetes | 422 million |

Source: World Health Organization (WHO)

According to the WHO, CVDs are the most common cause of death globally. Diagnostic imaging procedures for the detection of CVDs involve ionizing radiation and have contributed significantly to a decrease in morbidity and mortality rates. The diagnostic imaging services for CVDs are majorly non-invasive cardiac imaging techniques involving radiation and coronary computed tomography, a heart imaging test that helps determine a patient's coronary arteries. Other non-invasive techniques include ultrasound, cardiac resonance imaging, and so on.

Likewise, "Positron Emission Tomography (PET)" is the most suitable diagnostic imaging technique for cancer. Additionally, computed tomography (CT) is one of the most commonly used tools for screening, diagnosis, and treatment of cancer for lung and colorectal cancer. Further, magnetic resonance imaging (MRI) plays an important role in cancer diagnosis, staging, and treatment planning. Also, mammography is an effective tool for the detection of breast cancer. Mammography is a specific type of imaging that utilizes a low-dose X-ray system to examine breast tissue. Radiologists use mammography as a screening tool to identify tumors or abnormal tissues in the breast, and the most common types of mammography include digital mammography and breast tomosynthesis.

According to the National Institute of Health (NIH) report, CT has become the standard mortality method for objectively visualizing lung disease. Moreover, newer techniques such as optical computed tomography (OCT) and MRI provide exciting imaging techniques for detecting lung disease. Further, the NIH report reveals that medical imaging technologies assist clinicians in the diagnosis and treatment of patients. Therefore, MRI plays a vital role in diagnosing diabetes among patients. Also, MRI plays a vital role in monitoring and treating diabetes-related conditions such as diabetic cardiomyopathy, diabetic foot complications, kidney failure, dementia, and other brain disorders. Therefore, rising non-communicable or chronic diseases among the population are standalone factors responsible for the influential growth of the market in the forecast period 2021-2031.

Future Trend

Technological Advancements

Further, the NIH report reveals that medical imaging technologies assist clinicians in diagnosing and treating patients. Therefore, MRI plays a vital role in diagnosing diabetes among patients. Also, MRI plays a vital role in monitoring and treating diabetes-related conditions such as diabetic cardiomyopathy, diabetic foot complications, kidney failure, dementia, and other brain disorders. Further, the latest advances in medical imaging include vascular imaging with ultrasound, high-resolution computed tomography of the thorax, magnetic resonance imaging applications, and picture archiving and communication systems. Also, several top companies are launching innovative diagnostic imaging products. For instance, in May 2023, Koninklijke Philips N.V. announced the launch of a new product, "Philips CT 3500," a new high throughput CT system targeting routine radiology and a high volume screening program. The Philips CT 3500 includes a range of image-reconstruction and workflow-enhancing features that help to deliver the consistency, speed, and first-time-right image quality needed for diagnoses by clinicians and high-volume care settings. The aforementioned factors are responsible for creating lucrative market opportunities for diagnostic imaging services in the forthcoming years.

Report Segmentation and Scope

Modality-Based Insights

Based on modality, the diagnostic imaging services market is segmented as X-ray imaging, MRI, CT, ultrasound nuclear imaging, and mammography. The X-ray imaging segment held a larger market share in 2022. X-ray imaging is a quick and painless procedure that produces images of the structure inside the body, particularly bones. Diagnostic X-rays or radiography are special methods for taking visual images inside the patient's body. Also, several top manufacturers are launching innovative X-ray imaging products for better patient outcomes and diagnoses. For records, in July 2022, Siemens Healthineers announced the launching of a new mobile X-ray system. The new system combines all the benefits of a mobile X-ray system for imaging at the patient's bedside with full digital integration and economical price.

Additionally, in November 2023, Carestream Health announced the launch of a new x-ray system, "Horizon," for small- to midsize imaging centers, orthopedic facilities, urgent care centers, and hospitals. The new product launch is a compact, manual analog system designed for smaller healthcare facilities, ease of use, equipment reliability, low maintenance costs, and a low level of investment. Therefore, new product launches accelerate demand for x-ray imaging intended for routine clinical examinations of patients responsible for influential segment growth for the forecast period 2022-2031.

Application-Based Insights

Based on application, the global diagnostic imaging services market is segregated into dentistry, cardiovascular, neurology, orthopedics, oncology, and others. The neurology segment will account for a major share of the segment growth in 2022. As per the NIH report, the application of neuroimaging techniques such as MRI and PET provided clinicians with an understanding of complex neurological disorders for better treatment. The MRI uses radiofrequency techniques, powerful magnets, and a computer interface to offer a clear and detailed view of soft tissue and organs in the body, including the brain. PET utilizes a nuclear medical imaging technique that shows the structure and function of the brain by monitoring cell activity and the onset of certain diseases, such as cancer. Also, CT provides better patient outcomes for neurological disorders. For example, CT scans capture the cross-sectional views of the brain and surrounding structures by combining a CT scan with an injection or a contrast medium to produce images of blood vessels and tissues. Further, Electroencephalograms (EEG) record the brain's electrical activity and are a part of diagnosis for detecting epilepsy and other neurological disorders. Such advanced technological influx for detecting neurological disorders contributes to significant segment growth for the forecast period 2022-2031.

End User-Based Insights

Based on end users, the global diagnostic imaging services market is segmented into hospitals and clinics, ambulatory surgical centers, and others. The hospital segment will account for the largest share of the diagnostic imaging service market. Rising numbers of patients suffering from respiratory viruses and bacterial infections are the contributing factors responsible for the growing demand for diagnostic imaging procedures in hospitals. Additionally, surging cases of healthcare-associated infections (HAIs) in acute care hospital raises the utilization of diagnostic imaging services products in hospitals, thereby dominating the market growth for the forecast period 2021-2031.

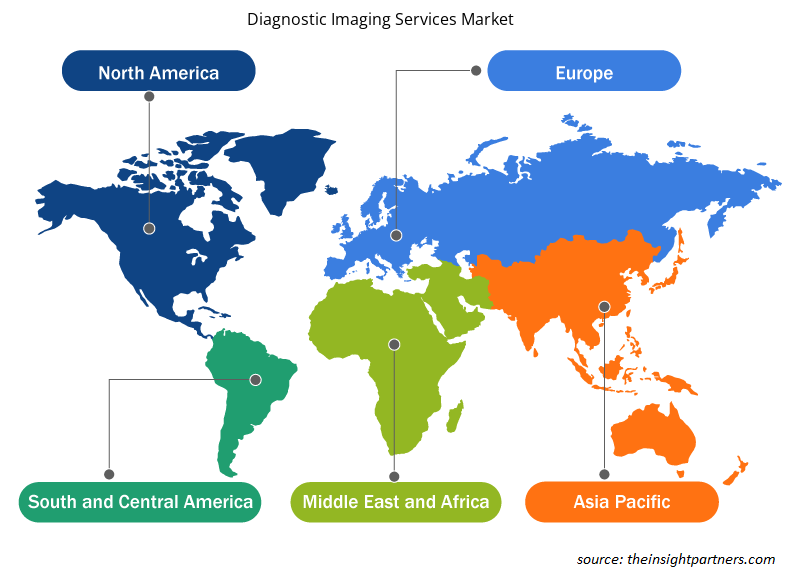

Regional Analysis

The North American diagnostic imaging services market is segmented into the US, Canada, and Mexico. The market growth in this region is attributed to the rising infectious or non-communicable diseases and new product launches by the top manufacturers as a standalone factor positively influencing the growth of the market. In November 2022, Canon Medical Systems USA Inc., a subsidiary of Canon Medical Systems Corporation, announced the launching of an innovative diagnostic imaging technology, "SP Configurations, Orian SP and Galan SP." This recently launched new product features AI-driven workflow solutions, an intelligent ceiling camera, and a tablet UX mobile interface designed to deliver high-end daily performance.

Additionally, in November 2021, FUJIFILM Healthcare Americas announced the launching of a new product, "Persona CS Mobile Fluoroscopy Systems," which is a new, compact mobile C-arm imaging solution designed for rapid and seamless positioning in an operating room (OR) environment. The new product is also designed to offer enhanced live image guidance with a wide range of applications in surgeries, including orthopedics, complicated surgeries, pain management (anesthetics), and emergency procedures.

Likewise, Asia Pacific will account for the highest CAGR for the diagnostic imaging services market for the forecast period 2021-2031. In China, during the outbreak of COVID-19 in 2021, timely diagnosis was a crucial step for infection control. The rising prevalence of infectious diseases in China in 2021 accelerated the demand for diagnostic imaging with CT procedures as it possesses high sensitivity for diagnosis and stands as a potential tool for COVID-19 detection. The rising prevalence of infectious diseases like COVID-19 raises demand for diagnostic imaging services, thereby dominating the segment growth for the forecast period 2022-2031.

The report profiles leading players operating in the global diagnostic imaging services market. These include Radnet, Inc., Sonic Healthcare, Akumin Inc., Healius Limited, RAYUS Radiology, Dignity Health, Novant Health, Alliance Medical, InHealth Group, Apex Radiology, and other market participants. The companies in diagnostic imaging services are involved in new organic and inorganic developments, focusing on new product launches, mergers, and collaboration.

In January 2022, Radnet, Inc. announced the acquisition of Aidence Holding B.V. and Quantib B.V. to provide high-quality, cost-effective, fixed-site outpatient diagnostic imaging services. Through this acquisition, Aidence and Quantib will provide RadNet’s AI division that will highly focus on breast cancer screening and detection. The acquisition will further enable RadNet’s product portfolio in the development and deployment of AI to improve patients' health and care.

Company Profiles

- Radnet, Inc.

- Sonic Healthcare

- Akumin Inc.

- Healius Limited

- RAYUS Radiology

- Dignity Health

- Novant Health

- Alliance Medical

- InHealth Group

- Apex Radiology

Diagnostic Imaging Services Market Regional Insights

The regional trends and factors influencing the Diagnostic Imaging Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Diagnostic Imaging Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Diagnostic Imaging Services Market

Diagnostic Imaging Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 687.22 Billion |

| Market Size by 2031 | US$ 1,118.03 Billion |

| Global CAGR (2025 - 2031) | 7.20% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Modality

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Diagnostic Imaging Services Market Players Density: Understanding Its Impact on Business Dynamics

The Diagnostic Imaging Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Diagnostic Imaging Services Market are:

- RAD NET

- SONIC HEALTHCARE

- DIGNITY HEALTH

- NOVANT HEALTH ALLIANCE MEDICAL

- MEDICA GROUP

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Diagnostic Imaging Services Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Energy Recovery Ventilator Market

- Electronic Signature Software Market

- Space Situational Awareness (SSA) Market

- Aerospace Forging Market

- Human Microbiome Market

- Trade Promotion Management Software Market

- Hydrogen Storage Alloys Market

- Aquaculture Market

- Carbon Fiber Market

- Aircraft Wire and Cable Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Modality, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

1. RAD NET

2. SONIC HEALTHCARE

3. DIGNITY HEALTH

4. NOVANT HEALTH ALLIANCE MEDICAL

5. MEDICA GROUP

6. GLOBAL DIAGNOSTICS

7. HEALTHCARE IMAGING SERVICES PTY LTD.

8. CONCORD MEDICAL SERVICES HOLDINGS LIMITED

Get Free Sample For

Get Free Sample For