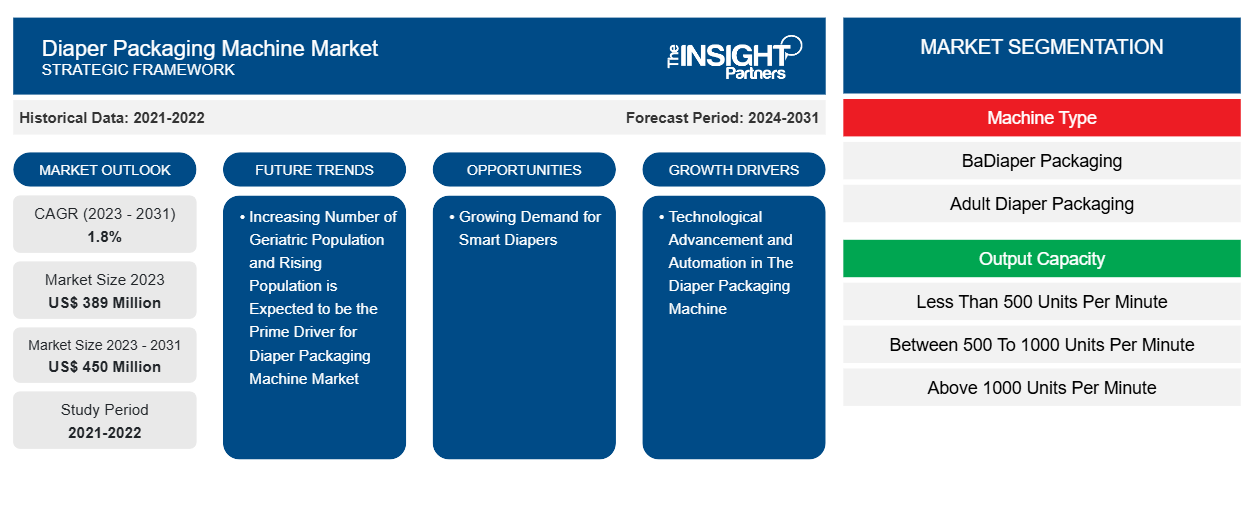

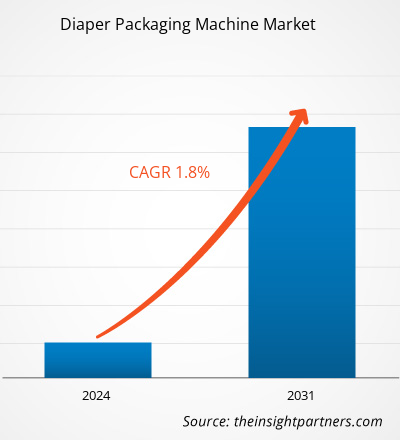

The Diaper Packaging Machine Market size is projected to reach US$ 450 million by 2031 from US$ 389 million in 2023. The market is expected to register a CAGR of 1.8% in 2023–2031. The increasing number of babies born globally, growing emphasis on hygiene and sanitation, rise in consumer spending, and urbanization in developing nations are projected to boost the evolution of the market across the globe.

Diaper Packaging Machine Market Analysis

The rising birth count and growing focus on hygiene are projected to steer the growth of the diaper packaging machine market globally. The accelerating requirement for environment friendly packaging and acceptance of advanced technologies in baby diaper manufacturing is projected to direct the companies to offer advanced diaper variations. Constant developments in the comfortable diaper fabric increased absorption capabilities, are boosting the demand for new diapers, which is also having a positive impact on the diaper packaging machines market.

Diaper Packaging Machine Market Overview

The diaper packaging market is by machine type into baby diaper packaging and adult diaper packaging. In addition, based on output capacity, into less than 500 units per minute, between 500 to 1000 units per minute, and above 1000 units per minute. Furthermore, based on operation, the diaper packaging machinery market is segmented into semi-automatic and fully-automatic. Based on distribution channels, the market is bifurcated into direct sales and indirect sales. The growing urbanization and rising population are anticipated to drive the diaper packaging machine market globally.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Diaper Packaging Machine Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Diaper Packaging Machine Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Diaper Packaging Machine Market Drivers and Opportunities

Increasing Number of Geriatric Population and Rising Population is Expected to be the Prime Drivers for the Diaper Packaging Machine Market

The growing population and increasing number of geriatric populations are major driving factors for the diaper packaging market globally. The geriatric population encountering bladder leakage issues due to old age or medical issues requires adult diapers for maintaining proper hygiene, which is also driving the growth of the market. Thus, the increase in demand for diapers is accelerating the growth of the market. Additionally, consumer awareness of hygiene and cleanliness is also acting as a major driver for the growth of the market worldwide. Increasing consumer spending on hygiene and sanitation products is also positively impacting the growth of the diaper packaging machine market globally.

Technological Advancement and Automation in The Diaper Packaging Machine

The diaper manufacturing sector is focusing on investing high amounts in the adoption of smart and automated industrial solutions. In addition, data-driven solutions have obtained considerable recognition among various leading manufacturers as they support mitigating unexpected human errors and damage through analytical techniques. Likewise, stringent government policies and regulatory bodies to reduce workplace hazards are also predicted to encourage the deployment of smart and automated diaper packaging machines over the forecast period.

Diaper Packaging Machine Market Report Segmentation Analysis

Key segments that contributed to the derivation of the diaper packaging machine market analysis are machine type, ouput capacity, operation, and distribution channel.

- Based on machine type, the Diaper Packaging Machine Market has been divided into baby diaper packaging and adult diaper packaging. The baby diaper packaging segment held a larger market share in 2023.

- In terms of output capacity, the market has been segmented into less than 500 units per minute, between 500 to 1000 units per minute, and above 1000 units per minute. The between 500 to 1000 units per minute segment dominated the market in 2023.

- In terms of operation, the market has been segmented into semi-automatic and fully-automatic. The semi-automatic segment dominated the market in 2023.

- In terms of distribution channels, the market has been segmented into direct sales and indirect sales. The direct sales segment dominated the market in 2023.

Diaper Packaging Machine Market Share Analysis by Geography

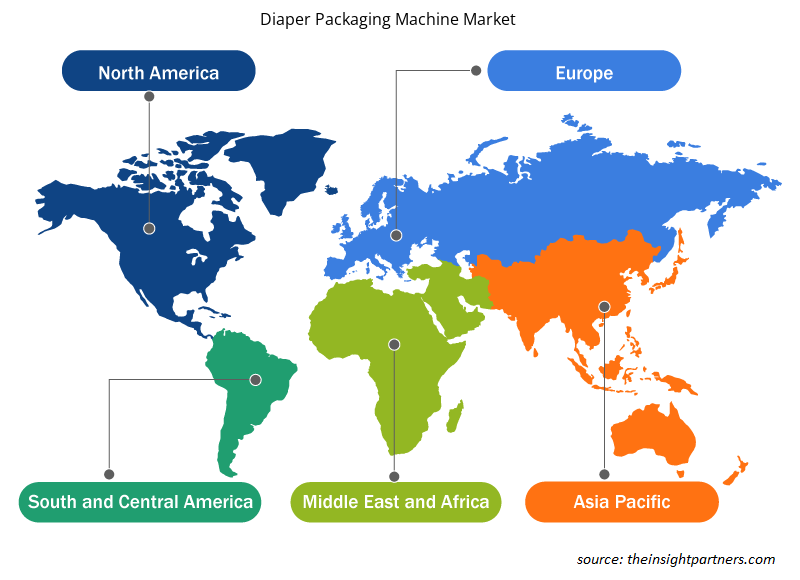

The geographic scope of the Diaper Packaging Machine Market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific dominated the diaper packaging machine market in 2023. The Asia Pacific region includes China, Australia, India, Japan, and South Korea. The increasing population and rising number of old populations are anticipated to act as a major driver for the market globally. The high presence of diaper packaging machine manufacturers and growing consumer awareness towards sanitary and hygiene is also boosting the growth of the market globally. The growing economic development and industrialization are also having a positive impact on the diaper packaging machine market. Rapid urbanization, proper government support, and increasing awareness, along with increasing household incomes, are among the key factors driving the diaper packaging machine market in the Asia Pacific.

Diaper Packaging Machine Market Regional Insights

The regional trends and factors influencing the Diaper Packaging Machine Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Diaper Packaging Machine Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Diaper Packaging Machine Market

Diaper Packaging Machine Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 389 Million |

| Market Size by 2031 | US$ 450 Million |

| Global CAGR (2023 - 2031) | 1.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Machine Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

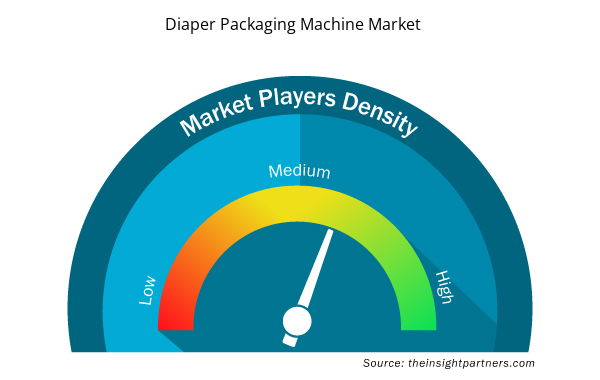

Diaper Packaging Machine Market Players Density: Understanding Its Impact on Business Dynamics

The Diaper Packaging Machine Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Diaper Packaging Machine Market are:

- COESIA S.P.A

- CURT G. JOA, Inc.

- Delta SRL Unipersonale

- Edson Packaging Machinery Ltd

- Fameccanica Data SPA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Diaper Packaging Machine Market top key players overview

Diaper Packaging Machine Market News and Recent Developments

The Diaper Packaging Machine Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for Diaper Packaging Machine Market and strategies:

- On August 2023, Edson Packaging Machinery Ltd. exhibited its KDF Infeed Management System, which is a robotic cell that automates the infeed area of packaging machines at PACK EXPO 2023. (Source: Edson Packaging Machinery Ltd, Press Release/Company Website/Newsletter)

- On August 2023, Optima Packaging Group strengthened its consumer business unit in North America. The company increased its sales of filling and packaging equipment for the consumer goods market in North America and North America. (Source: Optima Packaging Group, Press Release/Company Website/Newsletter)

Diaper Packaging Machine Market Report Coverage and Deliverables

The “Diaper Packaging Machine Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Operation, Distribution Channel, Output Capacity, and Machine Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For