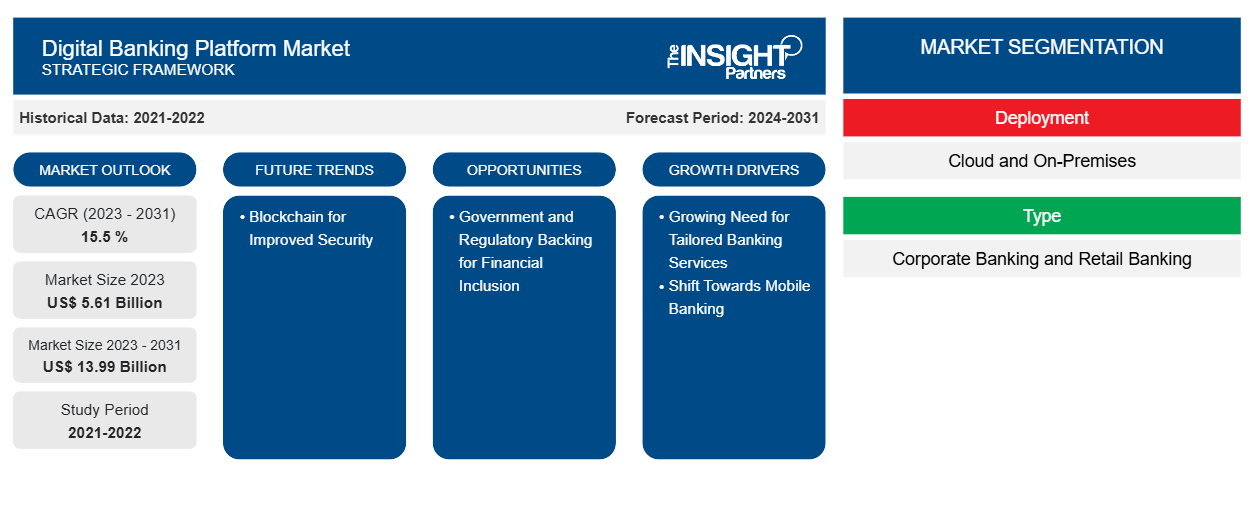

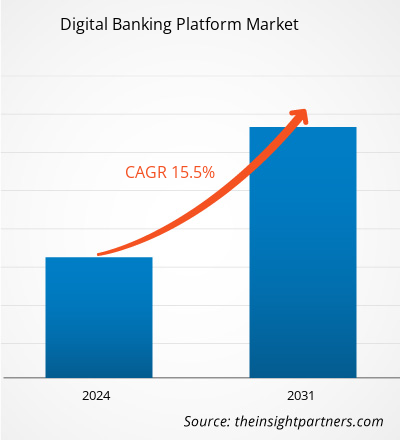

The digital banking platform market size is projected to reach US$ 13.99 billion by 2031 from US$ 5.61 billion in 2023. The market is expected to register a CAGR of 15.5 % in 2023–2031. The growing need for tailored banking services and regulatory backing for financial inclusion is likely to remain key digital banking platform market trends.

Digital Banking Platform Market Analysis

As the use of mobile phones increases, more people are choosing to use mobile banking due to its convenience. This change has encouraged banks to create digital banking systems that can be used on mobile devices, allowing users to do their banking while on the go. Furthermore, these systems assist banks in making their operations more efficient, cutting expenses, and integrating modern technologies like AI and data analysis to personalize services and improve decision-making.

Digital Banking Platform Market Overview

A digital banking platform is an electronic system available through the Internet or mobile apps, allowing consumers to remotely carry out various banking tasks and financial transactions. These tasks include account management, payments, loan applications, and access to a wide array of banking services. The platform also offers features such as account management, mobile deposits, digital wallets, budgeting tools, and customer support through chatbots or messaging services. The main advantages of digital banking platforms are convenience, accessibility, and efficiency for both clients and banks. Users can conveniently conduct banking transactions without visiting a physical branch, leading to higher customer satisfaction and engagement.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Digital Banking Platform Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Digital Banking Platform Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Digital Banking Platform Market Drivers and Opportunities

Increasing Need for Tailored Banking Services to Favor Market

There is an increasing trend where customers seek personalized financial services, leading banks to adopt digital platforms for tailored experiences. Through digital banking, banks can offer specialized financial products and services, enhancing loyalty and customer satisfaction. The rising demand for personalized banking services reflects a shift in consumer preferences toward tailored financial solutions. Customers now desire personalized experiences that meet their specific needs, prompting banks to turn to digital platforms for a more individualized banking experience.

Government and Regulatory Backing for Financial Inclusion

The worldwide effort to promote digital banking is motivated by the understanding of its significant potential to enhance financial inclusion. Through the use of digital platforms, individuals who have historically been barred from the formal financial system, such as those who are unbanked or underbanked, can now access crucial financial services. This extension of financial access not only reduces the disparity between those with and without banking services but also boosts economic growth by enabling more people to engage in the formal economy. Consequently, regulatory backing for digital banking serves not only as a way to enhance financial inclusion but also as a strategy to foster overall economic progress and minimize societal inequalities.

Digital Banking Platform Market Report Segmentation Analysis

Key segments that contributed to the derivation of the digital banking platform market analysis are deployment and type.

- Based on deployment, the market is bifurcated into cloud and on-premises. The on-premises segment held a significant market share in 2023.

- By type, the market is segmented into corporate banking and retail banking. The corporate banking segment held a substantial share of the market in 2023.

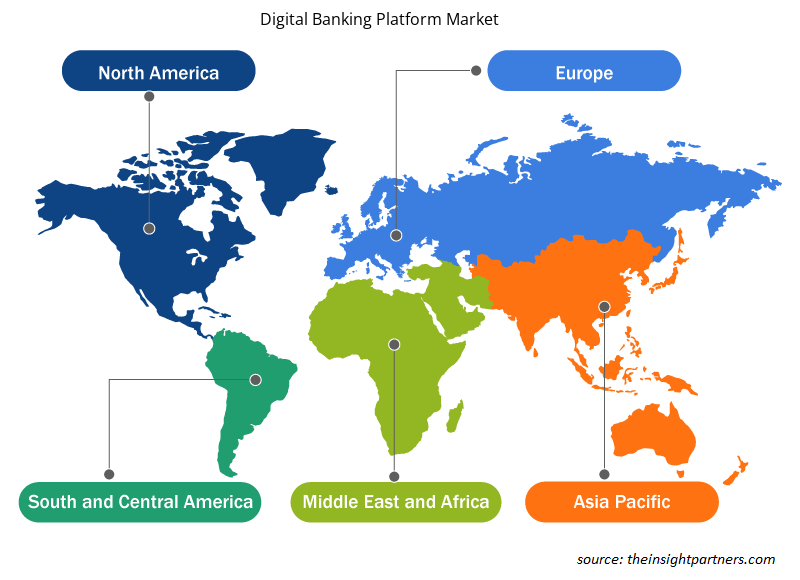

Digital Banking Platform Market Share Analysis by Geography

The geographic scope of the digital banking platform market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America, especially the US, boasts one of the highest rates of technology adoption globally. The widespread use of smartphones and strong internet penetration create an ideal environment for the development and dominance of digital banking services. The region's well-established financial infrastructure fosters innovation in digital banking, supported by a mature banking sector, favorable regulatory environment, and substantial investments in fintech firms. Consumers in North America exhibit a strong preference for digital services, including banking, driven by the desire for quick, easy, and secure online banking transactions. This demand motivates banks and financial institutions to continuously enhance their digital platforms.

Digital Banking Platform Market Regional Insights

The regional trends and factors influencing the Digital Banking Platform Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Digital Banking Platform Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Digital Banking Platform Market

Digital Banking Platform Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.61 Billion |

| Market Size by 2031 | US$ 13.99 Billion |

| Global CAGR (2023 - 2031) | 15.5 % |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Deployment

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Digital Banking Platform Market Players Density: Understanding Its Impact on Business Dynamics

The Digital Banking Platform Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Digital Banking Platform Market are:

- Appway AG

- CREALOGIX Holding AG

- EdgeVerve Systems Limited

- Fiserv, Inc.

- Oracle Corporation

- SAP SE

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Digital Banking Platform Market top key players overview

Digital Banking Platform Market News and Recent Developments

The digital banking platform market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- Apiture, a leading provider of digital banking solutions, today announced that NWSB (The New Washington State Bank), a community financial institution serving customers in Southern Indiana since 1908, has selected the Apiture Digital Banking Platform to power its online and mobile banking solutions. NWSB will implement Apiture’s Consumer Banking, Business Banking, Account Opening, and Data Intelligence solutions to deliver a seamless, innovative experience to its retail and business customers.

(Source: Apiture, Company Website, 2024)

- Alkami Technology, Inc. (Nasdaq: ALKT) (“Alkami”), a leading cloud-based digital banking solutions provider for financial institutions in the U.S., announced today that Elevations Credit Union (“Elevations”) has launched Alkami’s online business and retail banking platform. Following a seamless implementation process, Elevations is now leveraging the platform to grow its retail and business portfolio and gain market share.

(Source: Alkami Technology, Inc., Press Release, 2024)

Digital Banking Platform Market Report Coverage and Deliverables

The “Digital Banking Platform Market Size and Forecast (2023–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Battery Testing Equipment Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Medical and Research Grade Collagen Market

- Glycomics Market

- Sports Technology Market

- Hydrolyzed Collagen Market

- Investor ESG Software Market

- Smart Locks Market

- Legal Case Management Software Market

- Smart Parking Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Deployment and Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

The market is expected to reach US$ 13.99 billion by 2031.

The key players holding majority shares in the market are Appway AG, CREALOGIX Holding AG, EdgeVerve Systems Limited, Fiserv, Inc., and Oracle Corporation.

Blockchain for improved security is anticipated to play a significant role in the digital banking platform market in the coming years.

The growing need for tailored banking services and the shift towards mobile banking are the major factors that propel the digital banking platform market.

The market was estimated to be US$ 5.61 billion in 2023 and is expected to grow at a CAGR of 12.1% during the forecast period 2023 - 2031.

Get Free Sample For

Get Free Sample For