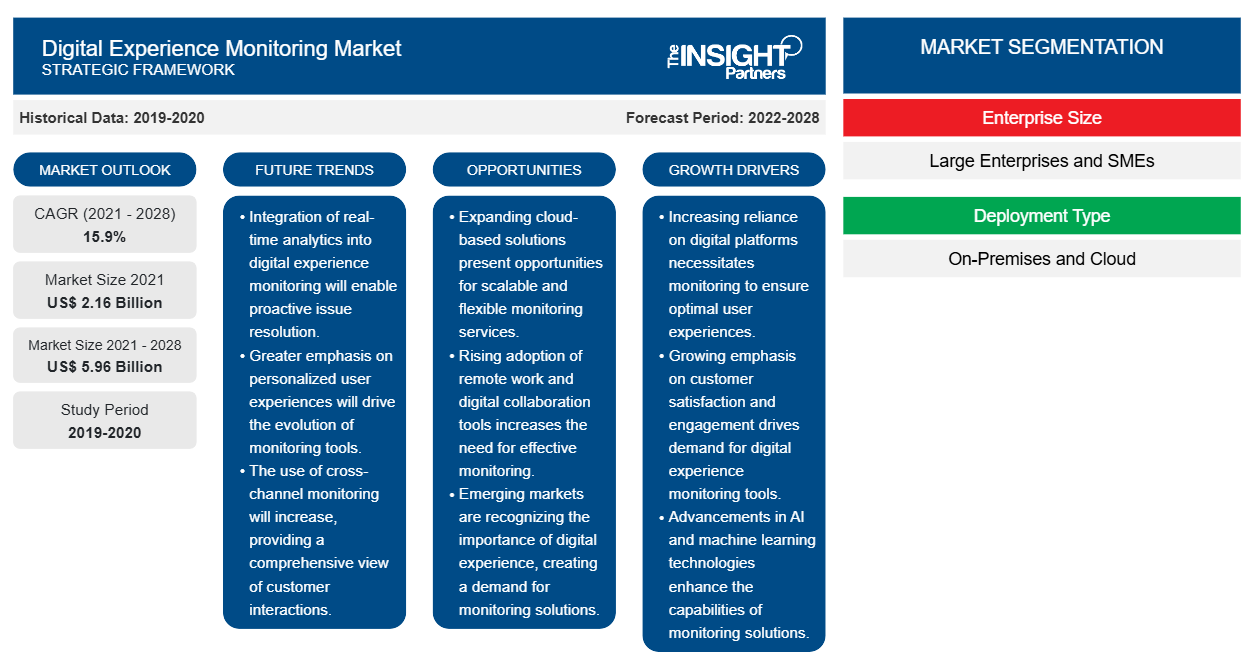

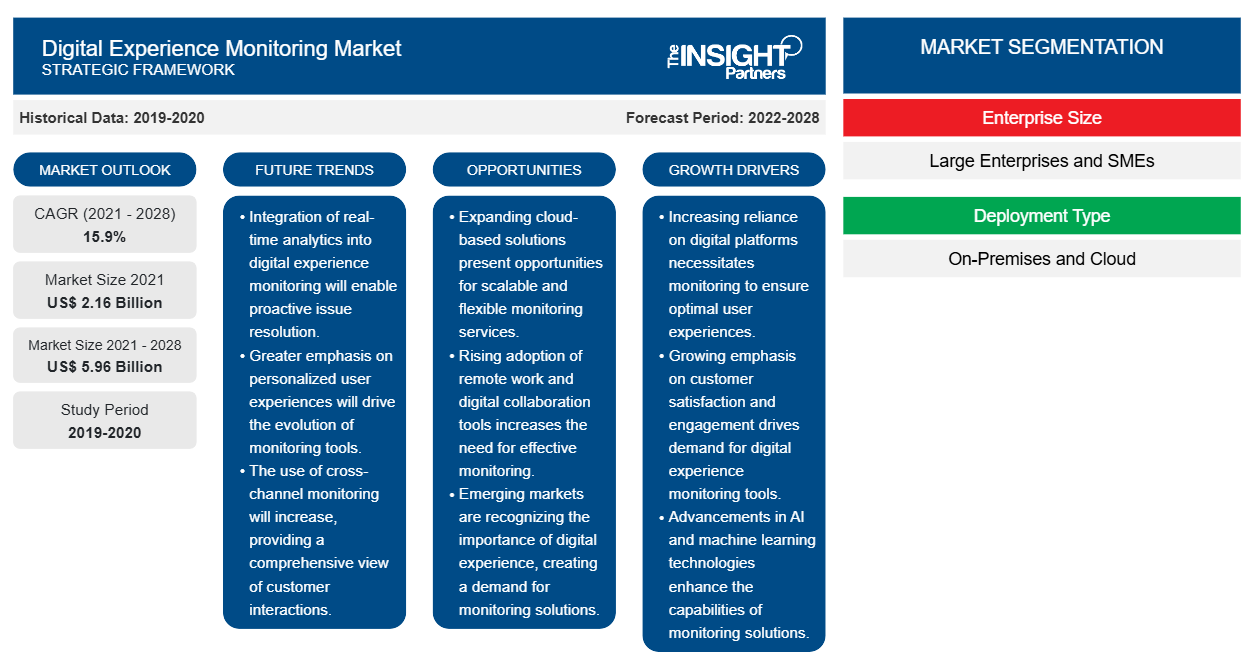

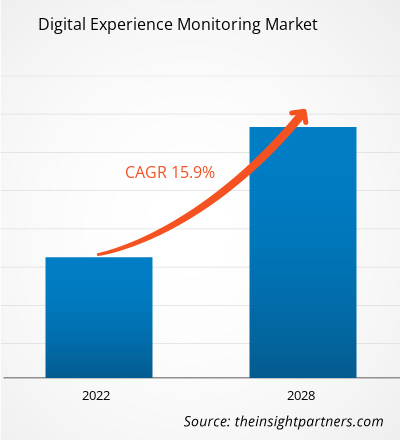

The digital experience monitoring market size is expected to grow from US$ 2,156.71 million in 2021 to US$ 5,960.87 million by 2028. Digital experience monitoring market size is estimated to grow at a CAGR of 15.9% from 2022 to 2028.

Digital experience monitoring (DEM) is a new technology that enterprises are looking at as a method to simplify user performance concerns while gaining insight into a range of networking technologies with a single solution. The progression of application performance monitoring (APM) and end-user experience monitoring (EUEM) into a holistic solution that assesses the efficacy of an enterprise's applications and services is DEM. DEM is a real-time monitoring solution that assists IT operations teams in promptly resolving user concerns while ensuring the network is not disturbed. Existing application performance monitoring (APM) and network performance monitoring and diagnostics (NPMD) technologies can be supplemented with DEM solutions. When used together, they give an end-to-end view, with DEM providing insight into the user experience. Those are the experiences that have the most direct impact on company outcomes. DEM is a real-time monitoring tool that helps your company's "machine" function smoothly by discovering vulnerabilities that cause downtime or disturbances to the user experience, such as poor page load times, and determining the underlying cause of performance. The DEM software monitors user behavior, traffic, and additional factors to help businesses understand product usability and performance. DEM products integrate active or simulated traffic and real-user monitoring to analyze theoretical performance and real-user experience. These tools provide analytical tools for examining and improving application and site performance. They also help businesses understand how visitors navigate through their site and discover where end-user experience appears to suffer.

Examining performance data across devices, apps, infrastructure, and services to understand how end users' interactions with technology influence the quality of their digital experience is known as DEM. IT may track and assess various parameters that affect users, including CPU, memory, hardware utilization, latency, software performance, and more, using digital experience monitoring. These measurements, which are collected constantly from the endpoint and paired with cognitive analysis and automation, may assist IT in promptly diagnosing, remediating, and even predicting problems without the user's knowledge. Feedback and opinion can also indicate elements, which endpoint statistics can't capture. Digital experience monitoring solutions go beyond typical network and application performance monitoring to uncover network issues, which may affect cloud-based service performance. This factor is influencing the digital experience monitoring market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Digital Experience Monitoring Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Digital Experience Monitoring Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Digital Experience Monitoring Market

With the emergence of the COVID-19 pandemic, the entire aviation industry came to an unscheduled halt. Turkey, Iran, South Africa, Iraq, Israel, Saudi Arabia, and the UAE reported a large number of COVID-19 confirmed cases and deaths. The digital experience monitoring market comprises major economies, such as the UAE and Saudi Arabia, which are prospective providers in the digital experience monitoring industry due to the huge presence of a diverse customer base. Before the pandemic, Gulf countries were on the verge of adopting transformative digital technologies in various verticals to improve the socio-economic conditions of the countries. However, due to the COVID-19 outbreak, the implementation of stringent measures such as factory lockdowns, business shutdowns, and travel restrictions aggravated the economic problems of the countries, such as the MEA. Hence, the MEA’s economic condition and the impact of the COVID-19 pandemic on the growth of various industries in the region slightly influenced the digital experience monitoring market growth in 2020.

Digital Experience Monitoring Market Insights

The customer feedback system critical to any functional and profitable digital experience monitoring industry has been enhanced thanks to technology improvements in the digital experience monitoring market. For example, companies are implementing an online feedback system using a cutting-edge Customer Relationship Management (CRM). As a result, client input directly aids in making real-time modifications and updating the company’s software to conduct a real-time assessment of the quality and adjust or change as needed. Any company experiencing a digital transition must implement experience monitoring systems. Streamlining the digital procedures involved in running a company lays a strong basis for future system changes or ongoing innovation. This is driving the digital experience monitoring market.

Enterprise Size-Based Market Insights

Digital experience monitoring market analysis by enterprise size, the market is segmented into large enterprises and SMEs. In 2021, the large enterprises segment accounted for a larger digital experience monitoring market share.

Deployment Type-Based Market Insights

Digital experience monitoring market analysis by deployment type, the market is segmented into on-premises and cloud. In 2021, the cloud segment accounted for a larger digital experience monitoring market share.

Players adopt strategies, such as mergers, acquisitions, and market initiatives, to maintain their positions in the market. A few developments by key players in the market are listed below:

- In 2022, BMC announced new capabilities and integrations across its BMC AMI (automated mainframe intelligence) and BMC Compuware portfolios. The innovations help customers improve service quality and accelerate software delivery by providing greater data visibility and context-based insights across their IT environments.

- In 2021, Broadcom Inc. acquired AppNeta to bolster network performance monitoring across the internet and hybrid cloud-based applications. By combining AppNeta's end-to-end visibility with Broadcom's award-winning and proven Infrastructure and AIOps capabilities, the world's largest enterprises running the most complex networks will now have access to a single source of truth to support their cloud journey.

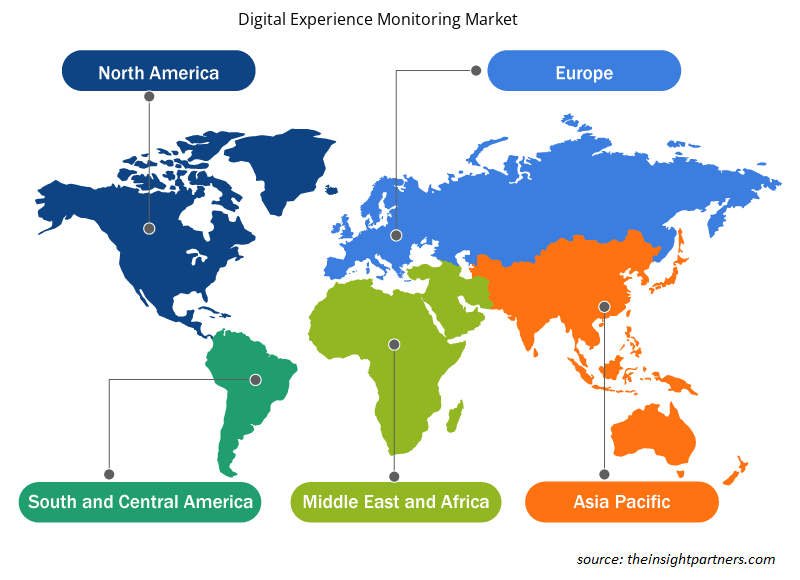

Digital Experience Monitoring Market Regional Insights

Digital Experience Monitoring Market Regional Insights

The regional trends and factors influencing the Digital Experience Monitoring Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Digital Experience Monitoring Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Digital Experience Monitoring Market

Digital Experience Monitoring Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2.16 Billion |

| Market Size by 2028 | US$ 5.96 Billion |

| Global CAGR (2021 - 2028) | 15.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Enterprise Size

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Digital Experience Monitoring Market Players Density: Understanding Its Impact on Business Dynamics

The Digital Experience Monitoring Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Digital Experience Monitoring Market are:

- AppDynamics LLC

- BMC Software, Inc.

- Broadcom Inc.

- Catchpoint Systems, inc.

- Dynatrace LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Digital Experience Monitoring Market top key players overview

Company Profiles in the Digital Experience Monitoring Market Report

- BMC Software, Inc.

- Broadcom Inc.

- ControlUp Technologies LTD

- Lakeside Software, LLC

- Aternity LLC

- Nexthink SA

- AppDynamics LLC

- Catchpoint Systems, inc.

- Dynatrace LLC

- IBM Corporation

- Micro Focus

- Oracle Corporation

- Riverbed Technology, Inc.

- SAP SE

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Enterprise Size, Deployment Type, and End-User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The major five companies in the digital experience monitoring market include BMC Software, Inc.; Broadcom Inc.; AppDynamics LLC; Dynatrace LLC; and IBM Corporation.

On the basis of end user, the digital experience monitoring market is segmented into BFSI, IT and telecommunications, retail and consumer goods, healthcare and life sciences and life sciences, and others. In 2021, the BFSI segment led the digital experience monitoring market, accounting for the largest share in the market.

In 2021, North America led the market with a substantial revenue share, followed by Europe and APAC. North America is a prospective market for digital experience monitoring developers.

Based on enterprise size, the digital experience monitoring market is bifurcated into large enterprises and SMEs. In 2021, the large enterprises segment led the digital experience monitoring market, accounting for the largest share in the market. Further, small and medium enterprises (SMEs) are companies with revenues, assets, or personnel that fall below a particular threshold. A small and medium enterprises (SME) is defined differently in each country. Small and medium enterprises (SMEs) play a vital role in the economy, despite their small size. They outnumber major corporations by a substantial margin, employ a huge workforce, and are entrepreneurial in nature, contributing to the shaping of innovation.

Demand for better end-user experience and adoption of cutting-edge technologies are driving the growth of the digital experience monitoring market.

The market opportunity lies in developing countries. Developing countries have become a hub of opportunity for various markets, including the digital experience monitoring market. Further, adoption of AI & IoT in fintech business is presenting significant potential for the future growth of the digital experience monitoring market players.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Digital Experience Monitoring Market

- AppDynamics LLC

- BMC Software, Inc.

- Broadcom Inc.

- Catchpoint Systems, inc.

- Dynatrace LLC

- IBM Corporation

- Micro Focus

- Oracle Corporation

- Riverbed Technology, Inc.

- SAP SE

- ControlUp Technologies LTD

- Lakeside Software, LLC

- Aternity LLC

- Nexthink SA

Get Free Sample For

Get Free Sample For