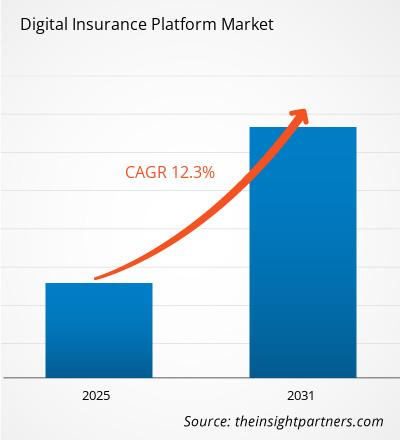

The market size is expected to grow from US$ 136.59 billion in 2023 to US$ 346.49 billion by 2031; it is anticipated to expand at a CAGR of 12.3% from 2025 to 2031.

Digital Insurance Platform Market Analysis

The digital insurance platform market forecast is estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. Insurance technology companies are changing the dynamics of the insurance industry by developing digital platforms and collaborating with insurance suppliers & companies. The paradigm change from a product-centric model in conventional insurance companies to a principally client-centric model has been enabled by digital insurance platforms with the help of technologies such as big data analytics, the Internet of Things (IoT), cloud computing, and artificial intelligence (AI).

Digital Insurance Platform

Industry Overview

- Digital insurance platform enables insurers to move from complex core systems to superior technical flexibility and agility, digital fluency, and modernization in the existing business model. Moreover, it helps a company to manage, create, control, and monitor the digital insurance ecosystem. The digital insurance platform includes numerous technologies such as artificial intelligence, APIs, machine learning, cloud-native computing, and other insurance-specific content and capabilities.

- The digital insurance platform enables the customization of insurance products, thereby allowing underwriters to price and underwrite policies more precisely for individual clientele. Furthermore, it enables more enhanced customer engagement via numerous channels & allows the delivery of personalized services to the customers, which is driving the digital insurance platform market growth.

REGIONAL FRAMEWORK

Digital insurance platform Market Driver

Increasing Technological Advancement in Digital Insurance Platforms to Drive Digital Insurance Platform Market Growth

- The increasing need for improved fraud detection and risk management capabilities is driving the demand for digital insurance platforms. Insurance companies are searching for Artificial Intelligence (AI) and advanced analytics solutions to analyze data and identify fraud in real time owing to the increasing volume of data. AI and Advanced analytics capabilities built into digital insurance systems allow insurers to analyze data from numerous sources, recognize risks, and discover fraud.

- Insurance providers are using digital technologies to offer dedicated insurance products and services to their clientele in response to the growing complexity of risks and changing customer demands. The necessity for digital insurance systems that let insurers deliver real-time quotations and customized customer care is driving the digital insurance platform market.

Digital insurance platform

Market Report Segmentation Analysis

- Based on Deployment, the market is segmented into on-premise and cloud. The cloud segment held a significant digital insurance platform market share in 2023.

- Cloud-based insurance solutions can deliver higher conversion rates from the opportunity to sale through targeted campaign management and lead engagement models. This results in cross-sell, higher upsell, and retention rates. Cloud can also improve the claims experience by providing enhanced service and improved communication with end clientele. This ability of the cloud-based digital insurance platform is supplementing the growth of the segment.

Digital Insurance Platform

Market Regional Analysis

The scope of the Digital insurance platform market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is observing rapid growth and is expected to hold a noteworthy digital insurance platform market share in 2023. Asia Pacific region is anticipated to grow at a substantial CAGR during the forecast period. The insurance distribution business landscape is progressively evolving. In China, digital channels are becoming more protuberant. In many Asia Pacific jurisdictions, customers are open to having insurers provide digital services. These digital insurance ecosystems are interconnected companies creating sets of services and products that allow users to fulfill a variety of requirements in one shared involvement. This is anticipated to augment the demand for a digital insurance platform.

Digital insurance platform

Market Report Scope

The "Digital insurance platform Market Analysis" was carried out based on card type and geography. In terms of type, the market is segmented into public cloud, private cloud, and hybrid cloud. By component, the market is segmented into services and platforms. By organization size, the market is divided into small and medium enterprises and large enterprises. By application, the market is segmented into government, healthcare, banking & financial services, media & entertainment, retail & e-commerce, transportation & logistics, travel, manufacturing, IT & Telecom, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Digital Insurance Platform

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the Digital insurance platform market. A few recent key market developments are listed below:

- April 2022 - Mindtree, a provider of technology services, has teamed up with Sapiens International Corporation to assist insurance businesses with their digital transformation. This company develops software solutions for the insurance and banking sectors. With this collaboration, these companies will provide a cloud-native core suite of banking and insurance applications.

MARKET PLAYERS

Digital Insurance Platform

Market Report Coverage & Deliverables

The market report "Digital Insurance Platform Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Digital Insurance Platform Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 153.39 billion |

| Market Size by 2031 | US$ 346.49 billion |

| Global CAGR (2025 - 2031) | 12.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Deployment

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Grant Management Software Market

- Travel Vaccines Market

- Pharmacovigilance and Drug Safety Software Market

- Tortilla Market

- Nurse Call Systems Market

- Saudi Arabia Drywall Panels Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Aircraft Wire and Cable Market

- Hummus Market

- Ceramic Injection Molding Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Digital advancements in the digital insurance platform market to play a significant role in the global digital insurance platform market in the coming years.

The key players holding majority shares in the global digital insurance platform market are IBM Corporation, Microsoft Corporation, Oracle Corporation, Pegasystems Inc., and Appian Corporation.

The global digital insurance platform market is expected to reach US$ 346.49 billion by 2031.

Increasing demand for cloud-based digital insurance platforms and growing initiatives by market players towards technological advancement are the major factors that propel the global digital insurance platform market.

The global digital insurance platform market was estimated to be US$ 136.59 billion in 2023 and is expected to grow at a CAGR of 12.3% during 2023–2031.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- IBM Corporation

- The Linux Foundation

- Digital Asset Holdings, LLC

- Microsoft Corporation

- Digital insurance platform Tech LTD

- Ripple Chain

- Deloitte Touche Tohmatsu Limited

- Circle Internet Financial, LLC

- Global Arena Holding, Inc. (GAHC)

- Monax Labs

Get Free Sample For

Get Free Sample For