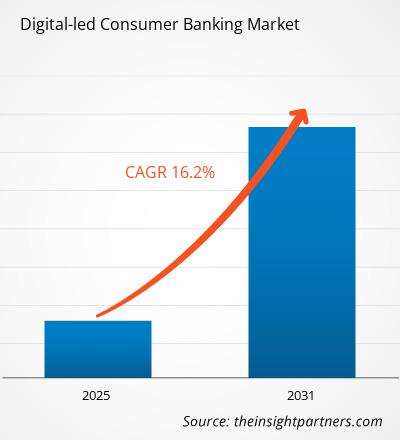

The digital-led consumer banking market size is expected to register a CAGR of 16.2% during 2023–2031. Integration of artificial intelligence (AI) and chatbots is likely to remain a key trend in the market.

Digital-led Consumer Banking Market Analysis

The digital-led consumer banking market includes growth prospects owing to the current market trends and their foreseeable impact during the forecast period. The digital-led consumer banking market is growing due to the rising penetration of smartphones and growing demand for increased consumer convenience, accessibility, and banking options. Technological integration and increasing demand for digital payments provide lucrative opportunities for the digital-led consumer banking market growth.

Digital-led Consumer Banking Market Overview

Digital-led consumer banking refers to the automation of traditional banking services through digital and online platforms. With digital-led consumer banking, customers can manage their accounts without having to visit a physical bank branch. This covers a broad variety of online and mobile application-based tasks like money transfers, check deposits, bill payments, investment management, and loan access. Digital led consumer banking offers convenience, speed, and availability, typically offering services 24/7.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Digital-led Consumer Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Digital-led Consumer Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Digital-led Consumer Banking Market Drivers and Opportunities

Growing Demand For Increased Consumer Convenience, Accessibility, And Banking Options to Favor Market

Alternative delivery channels are becoming more and more crucial in today's banking industry due to the growing demand from consumers for greater accessibility, convenience, and banking options. Customers nowadays expect convenience in checking their bank accounts and conducting financial activities at any time, from any location. Financial institutions can meet these needs through three main alternative delivery channels: online, mobile, and UPI banking. Using digital-led consumer banking methods allows customers to receive a more convenient and customized service. For example, mobile banking apps can provide users with personalized product recommendations, rewards for their loyalty, and guidance on creating a budget. Banks may save expenses, increase customer happiness and loyalty, foster long-term partnerships, and increase profitability by implementing digital channels. Thus, growing demand for increased consumer convenience, accessibility, and banking options will drive the market growth.

Increasing Demand For Digital Payments

As more consumers and businesses embrace online shopping, mobile payments, and contactless transactions, the need for secure and convenient banking solutions increases significantly. Moreover, the growing preference for cashless transactions, especially due to the COVID-19 pandemic, has accelerated the adoption of digital payment technologies. Furthermore, the widespread availability of mobile internet connections allows businesses to recognize the importance of offering digital-led consumer banking solutions to cater to diverse customer preferences and increase sales opportunities.

Digital-led Consumer Banking Market Report Segmentation Analysis

Key segments that contributed to the derivation of the digital-led consumer banking market analysis are components and application.

- Based on component, the digital-led consumer banking market is divided into software and services. The software segment held a larger market share in 2023.

- By application, the market is segmented into transactional accounts, savings accounts, debit cards, credit cards, loans, and others. The transactional accounts segment held the largest market share in 2023.

Digital-led Consumer Banking Market Share Analysis by Geography

The geographic scope of the digital-led consumer banking market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North American digital-led consumer banking market is a rapidly growing sector that is driven by technological advancements and the increasing demand for personalized and efficient customer experiences. North America, which includes countries such as the United States and Canada, is known for its strong technological infrastructure and high adoption rates of digital solutions. With the widespread adoption of smartphones and advanced banking infrastructure, consumers are increasingly turning to digital-led consumer banking solutions.

Digital-led Consumer Banking Market Regional Insights

The regional trends and factors influencing the Digital-led Consumer Banking Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Digital-led Consumer Banking Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Digital-led Consumer Banking Market

Digital-led Consumer Banking Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 16.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

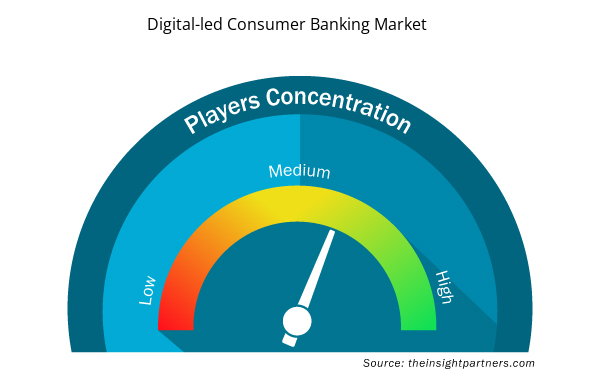

Digital-led Consumer Banking Market Players Density: Understanding Its Impact on Business Dynamics

The Digital-led Consumer Banking Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Digital-led Consumer Banking Market are:

- Atom Bank

- Babb

- Ffrees

- I&M Bank Limited

- MonzoE

- N26

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Digital-led Consumer Banking Market top key players overview

Digital-led Consumer Banking Market News and Recent Developments

The digital-led consumer banking market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the digital-led consumer banking market are listed below:

- Nubank marks 100 million-plus digital banking customers. The company announced that it was the first digital banking platform to mark this milestone outside of Asia. (Source: Nubank, Press Release, May 2024)

- NCR Voyix Corporation, a leading global platform and provider of digital commerce solutions for the retail, restaurant, and banking industries, announced that the $8.5 billion-asset Nicolet National Bank (Nicolet Bank) has selected NCR Voyix to enhance and improve its customer experience for digital banking. (Source: NCR Voyix Corporation, Press Release, March 2024)

Digital-led Consumer Banking Market Report Coverage and Deliverables

The “Digital-led Consumer Banking Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Digital-led consumer banking market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- led consumer banking market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- led consumer banking market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the digital-led consumer banking market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Some of the customization options available based on the request are additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The leading players operating in the digital-led consumer banking market are Atom Bank, Babb, Ffrees, I&M Bank Limited, Monzo, N26, Revolut, Starling Bank, Tandem, Bank of America Corporation, Citigroup Inc., HSBC Holdings plc, BNP Paribas, Wells Fargo & Company, Capital One Financial Corporation, Zopa, Finserv Inc, JPMorgan Chase, Finacle, and Temenos.

The integration of artificial intelligence (AI) and chatbots is anticipated to play a significant role in the global digital-led consumer banking market in the coming years.

The global digital-led consumer banking market is expected to grow at a CAGR of 16.2% during the forecast period 2024 - 2031.

The major factors driving the digital-led consumer banking market are the rising penetration of smartphones and the growing demand for increased consumer convenience, accessibility, and banking options.

Get Free Sample For

Get Free Sample For