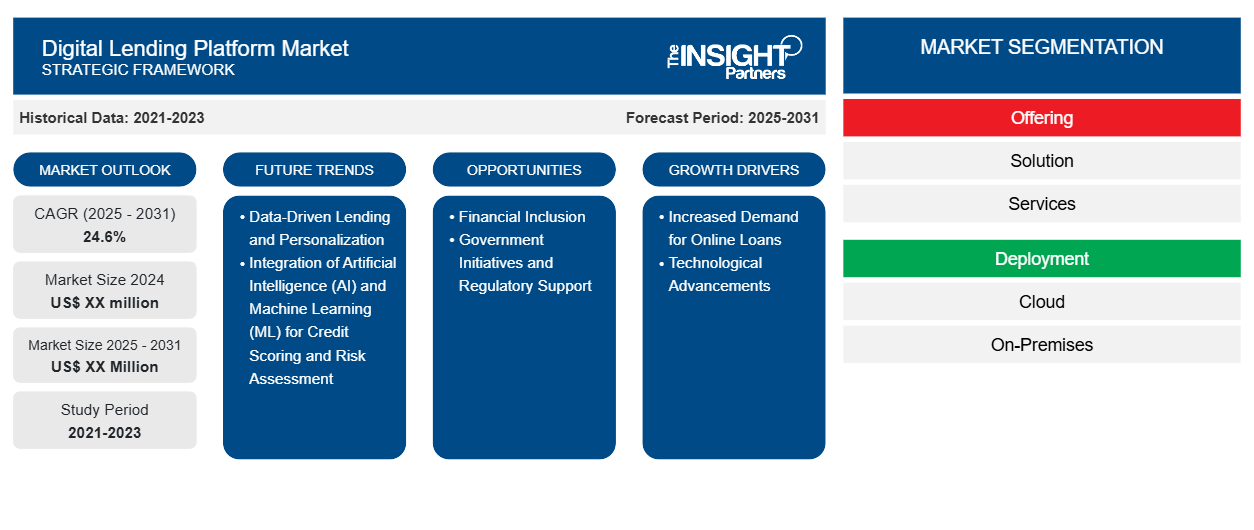

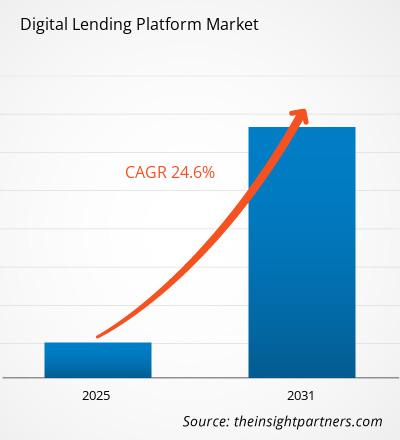

The Digital Lending Platform Market is expected to register a CAGR of 24.6% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Offering (Solution, Services); End-User (BFSI, Credit Unions, P2P Lenders, Others); Deployment (Cloud, On-Premises). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Digital Lending Platform Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Digital Lending Platform Market Segmentation

Offering

- Solution

- Services

Deployment

- Cloud

- On-Premises

End-User

- BFSI

- Credit Unions

- P2P Lenders

- Others

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Digital Lending Platform Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Digital Lending Platform Market Growth Drivers

- Increased Demand for Online Loans: One of the significant pushes for the expansion of digital lending platforms is the demand from consumers for the rapid and effortless access of loans. Consumers increasingly demand better-efficient ways of accessing financial assistance, especially in providing personal, business, or school loans. Traditional lending outfits are typically time-consuming to get into, especially when considering paper handling and approval; digital lending platforms can produce a loan almost instantly, with minimal or no paperwork at all. This development has deeply influenced consumer behavior, as people prefer this convenience of application online from the comfort of their home mainly due to advancement towards digitalization.

- Technological Advancements: Technological innovation in artificial intelligence, machine learning, and blockchain is dramatically improving both the efficiency and security of lending, according to Ryazanov. The algorithms used in AI and ML help assess creditworthiness in real-time, thereby reducing the risks of defaults while improving user experience simultaneously. On the other hand, blockchain technology helps to secure transactions and increase transparency in lending. For this reason, it appears attractive to both borrowers and lenders. Advances in such technologies continue to open opportunities for new players in the market as well as the existing platforms to innovate even further.

Digital Lending Platform Market Future Trends

- Data-Driven Lending and Personalization: Another significant opportunity for digital platforms in lending is the ability to work on vast volumes of data and tailor lending experiences. By getting customer information from social media, online behaviour, transaction history, amongst other digital footprints, lenders are capable of establishing very personalized loan products that best fit the borrowers' needs and profiles. Personalization results not only in higher customer satisfaction but also reduces risk by ensuring that the loan products will be appropriate with the capability and financial needs of the borrowers.

- Integration of Artificial Intelligence (AI) and Machine Learning (ML) for Credit Scoring and Risk Assessment: One of the most significant trends in the digital lending platform market is the integration of AI and machine learning for improving the credit scoring and risk assessment process. Traditional lending models are often reliant on credit scores, which may exclude certain individuals or groups who do not have a credit history. Digital lending platforms are using AI/ML algorithms to evaluate a broader set of data points—such as transaction history, mobile phone usage, social behavior, and more—to determine a borrower’s creditworthiness. This shift to more inclusive and data-driven lending processes is transforming the way credit risk is assessed and reducing the barriers to accessing credit.

Digital Lending Platform Market Opportunities

- Financial Inclusion: Digital lending platforms have turned out to be a real game-changer in furthering the cause of financial inclusion, and especially in underdeveloped regions. Millions of customers, mainly from emerging economies, do not have the option of accessing traditional banking as there is paucity of infrastructure or credit history. Digital lending, however can be used to lend to customers who would otherwise have been excluded from mainstream banking. This therefore constitutes a very large market of untapped customers and offers an opportunity for growth in areas with limited alternative access to financial banks.

- Government Initiatives and Regulatory Support: This aspect contributes to the flourishing growth of digital lending platforms as part of the general efforts those governments throughout the world make into encouraging financial inclusion and economic growth. Many countries are introducing highly considered regulatory frameworks to be conducive to the spread of fintech solutions, such as digital lending. In this regard, some offer tax exemptions and streamlined licensing processes. Furthermore, there are fintech company-based regulatory sandboxes to scale businesses for digital lending platforms.

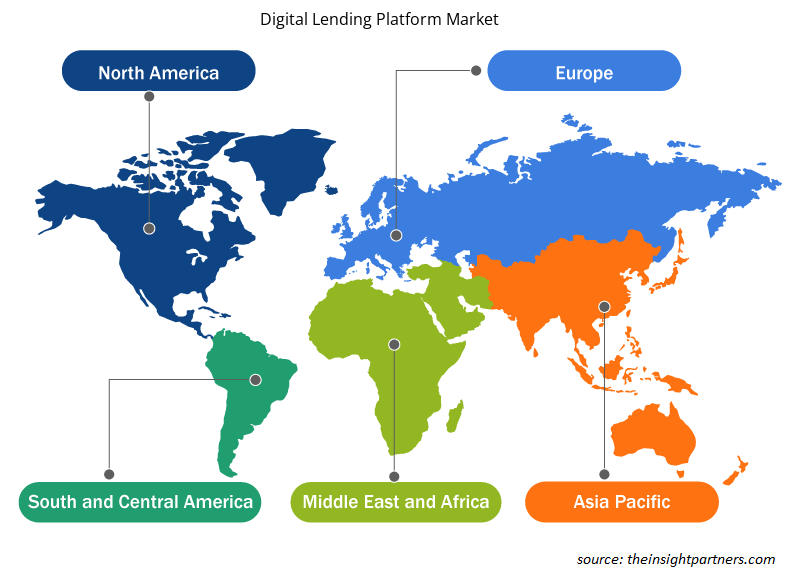

Digital Lending Platform Market Regional Insights

The regional trends and factors influencing the Digital Lending Platform Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Digital Lending Platform Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Digital Lending Platform Market

Digital Lending Platform Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 24.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

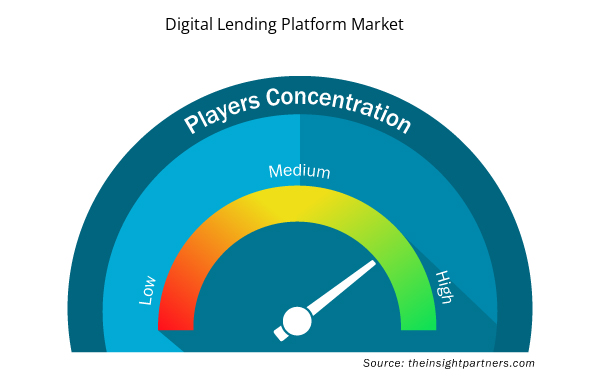

Digital Lending Platform Market Players Density: Understanding Its Impact on Business Dynamics

The Digital Lending Platform Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Digital Lending Platform Market are:

- Docutech, LLC

- ICE Mortgage Technology, Inc.

- FIS

- Finastra International Limited.

- Fiserv, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Digital Lending Platform Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Digital Lending Platform Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Digital Lending Platform Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are an additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation as our team would review the same and check the feasibility

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request

The major factors driving the digital lending platform market are:

1. Increased Demand for Online Loans

2. Technological Advancements

Data-Driven Lending and Personalization is anticipated to play a significant role in the global digital lending platform market in the coming years

The Digital Lending Platform Market is estimated to witness a CAGR of 24.6% from 2023 to 2031

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

1. Docutech, LLC

2. ICE Mortgage Technology, Inc.

3. FIS

4. Finastra International Limited.

5. Fiserv, Inc.

6. HES FinTech

7. Novopay Solutions Pvt Ltd.

8. Nucleus Software Exports Ltd.

9. Pegasystems Inc.

10. Tavant

Get Free Sample For

Get Free Sample For