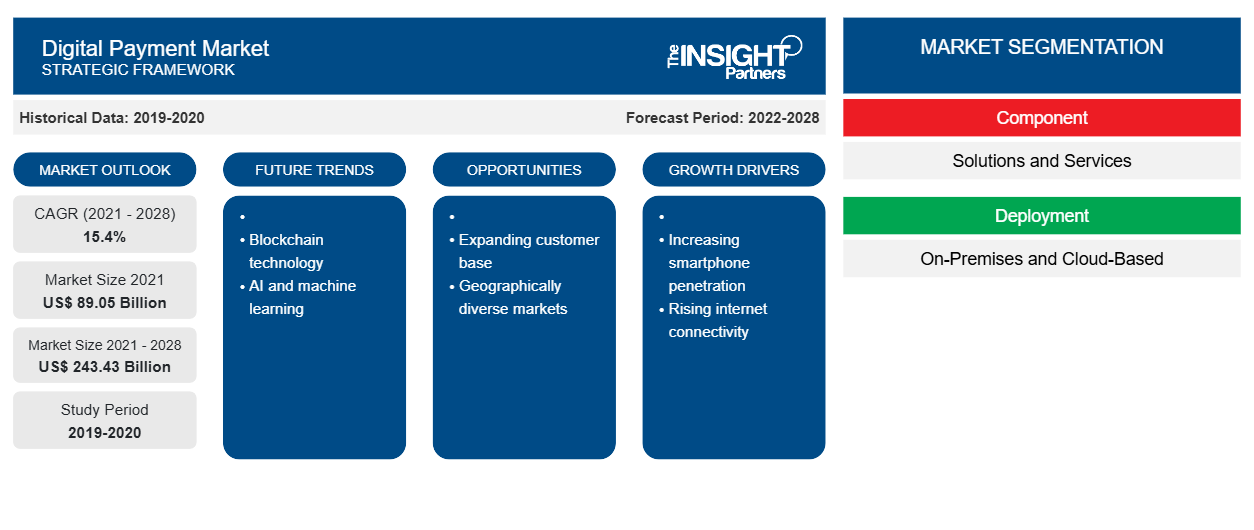

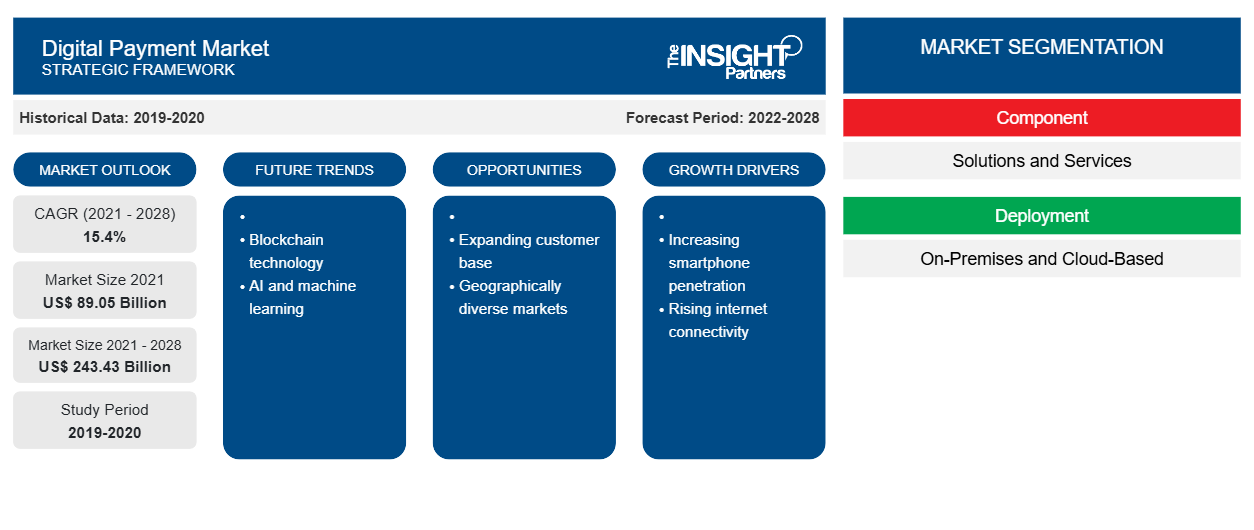

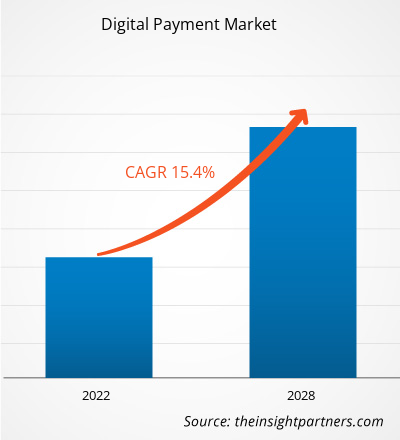

The digital payment market is expected to grow from US$ 89,045.67 million in 2021 to US$ 243,426.71 million by 2028; it is estimated to grow at a CAGR of 15.4% from 2021 to 2028.

The global digital payment market is expected to grow during the forecast period due to the increasing prevalence of smartphones enabling the expansion of mCommerce. The way people access the internet has a direct impact on the growth of mobile commerce. Users prefer smartphones over PCs for internet surfing as smartphones are more affordable, and high-speed internet is no longer a premium infrastructure in many countries. Retailers develop shopping applications that have easy-to-browse catalogs and a simple checkout experience. The fact that customers are intrinsically tied to their mobile phones is not missed by bankers and payment service providers. Banks provide banking apps that allow transactions to be completed on a mobile device's screen. Mobile commerce has also shifted the way brick-and-mortar businesses work, particularly in terms of accepting cashless payments. Furthermore, difference between physical and digital commerce is dissolving, and channels are converging increasingly. The in-store purchase experience has shifted significantly closer to the online one due to the strong emphasis on contactless payments during the COVID-19 pandemic. Also, before the pandemic, contactless payments were already well-established in a few regions. Touchless payments and/or biometric identification are prevalent in the online purchase experience. The contactless card is the most prevalent kind of touch-free payment. Mobile payments, on the other hand, are gaining popularity due to easy use and the growing popularity of original equipment manufacturer (OEM) Pay solutions as a retail payment method. In a few countries, retailers and governments proactively request the customers to increase contactless payments and encourage retailers to make this possible. Many banks have increased their contactless payment limits to reduce the need for a touchpad or cash at the point of sale. All these factors drive the growth of the digital payment market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Digital Payment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Digital Payment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Digital Payment Market

The COVID-19 pandemic has benefited the digital payment market. Businesses are facing new challenges due to the pandemic and the development of remote work environments. At least 58 governments in developing countries have adopted digital payments to give COVID-19 help, according to a World Bank survey of policy responses to the pandemic. At least 36 countries received the funds in fully functional accounts that may be used for saving or transactions in addition to withdrawing cash. Financial inclusion necessitates such extensive capability. Further, the emergence of the pandemic in 2020 has prompted a slew of challenges for global market operations. Healthcare infrastructures of developed economies have collapsed due to the rising number of COVID-19 cases. As a result, the public healthcare emergency will require the governments and market players to intervene and assist in the revival of market operations and revenue through collaborative efforts of research and development initiatives to recover the losses during the forecast period. In addition, the increased investments bode well for the digital payment market in the following years.

Digital Payment Market Insights

Growing Adoption of Open-Banking APIs

Financial services companies are recognizing the importance of open banking initiatives and application programming interfaces. Traditional banks understand that they must improve their digital capabilities to compete in the sector and avoid being disintermediated by new entrants with superior offers and services. For instance, numerous financial services companies such as PayPal, Wells Fargo, and Visa are supporting Open Banking projects. Also, in Europe, Open Banking initiatives are progressively becoming the norm because banks are legally required to make account information accessible via APIs under the Revised Payment Services Directive (PSD2), effective from 2018. Open Banking APIs boost a bank's attractiveness and enable it to meet the changing expectations of existing clients and attract new ones. The APIs may also be used as a one-of-a-kind solution to boost customer interaction and respond to consumer requirements in a safe, agile, and future-proof way. Open Banking APIs are significant assets for financial services organizations because they allow them to expand service offerings, boost client interaction, and create new digital income channels, which would offer a significant opportunity for the digital payment market to expand during the forecasted period

Deployment Segment Insights

Based on deployment, the digital payment market is bifurcated into on-premise and cloud-based. The cloud-based segment led the market in 2020. Cloud-based deployment provides built-in data security, on-demand scalability, and the capacity to quickly perform intensive computing activities. The cloud is a significant enabler of digital wallets. As digital wallets become popular, these benefits might greatly improve existing functionality and even lead to new innovations. The use of remote virtual storage eliminates the need for physical servers, reducing the risk of outage and disaster. Clouds also provide robust cybersecurity protections and can meet critical regulatory standards, such as the Payment Card Industry Data Security Standard (PCI DSS), which is particularly relevant in the financial services industry.

Organization Size Segment Insights

Based on organization size, the digital payment market is bifurcated into large enterprises and SMEs. The large enterprises segment led the market in 2020 and is expected to dominate the market during the forecast period. Even when it comes to payment systems, technological adoption is critical for reducing redundancies. For larger organizations, however, a one-size-fits-all solution will not work. The emergence of central bank digital currencies (CBDCs) and increase in the widespread adoption of cryptocurrencies on traditional payment systems would force many large enterprises to include digital currencies into their apps in the coming years. These companies will utilize digital currencies primarily for payment, as a store of value, and to leverage high-yield investments offered in decentralized finance (DeFi) apps. For instance, PayG provides tailored payment solutions for major businesses and assists them in improving their collection methods. It allows large enterprises to keep track of their cash inflows and outflows and enables them to scale when they need to, without introducing any processes, which is driving the growth of the digital payment market

Component Type Segment Insights

Based on application, the digital payment market is bifurcated into solution and service. The solution segment led the market in 2020. Banks, processors, telecom carriers, and merchants can use digital payment systems to make digital payments smoothly and in conformity with international payment standards. The solution includes a platform that controls the life cycle of digital cards. It oversees the whole enrollment process, as well as the provisioning and securing administration of credentials. Issuers and service providers can use the platform to deliver their services in their own wallets or third-party wallets, which fuels the growth of the market. The global digital payment market for the solution segment is segmented into payment gateway, payment processing, payment security and fraud management, and others.

The digital payment market players focus on new product innovations and developments by integrating advanced technologies and features to compete. For instance, in January 2021, Okay and FSS Technologies (Financial Software and Systems), a worldwide payments technology firm, announced their alliance to deliver focused authentication security to consumer payments, particularly transaction validation and authentication on mobile. With its next-generation products, technology, and solution offerings, FSS is already expanding its commercial potential in Europe. In May 2020, Fiserv, Inc. purchased Inlet, LLC (“Inlet”), a supplier of secure digital delivery solutions for invoices and statements for enterprise and middle-market billers. The Payments sector includes Inlet, which advances the company’s digital bill payment strategy.

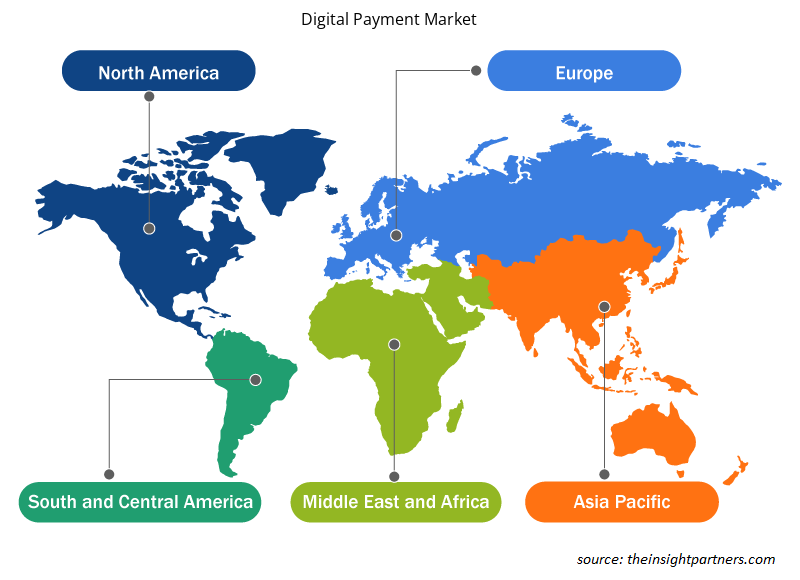

Digital Payment Market Regional Insights

The regional trends and factors influencing the Digital Payment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Digital Payment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Digital Payment Market

Digital Payment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 89.05 Billion |

| Market Size by 2028 | US$ 243.43 Billion |

| Global CAGR (2021 - 2028) | 15.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

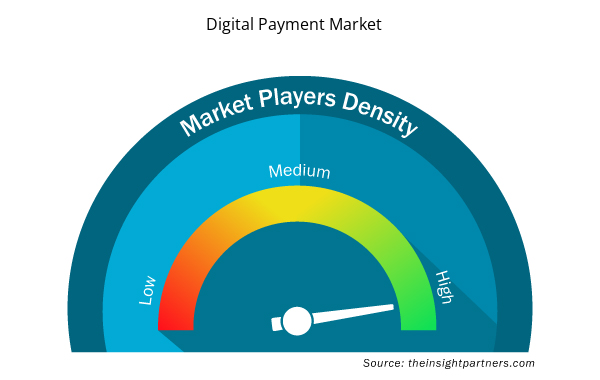

Digital Payment Market Players Density: Understanding Its Impact on Business Dynamics

The Digital Payment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Digital Payment Market are:

- ACI WORLDWIDE, INC

- ADYEN

- FINANCIAL SOFTWARE & SYSTEMS PVT. LTD.

- FISERV, INC.

- GLOBAL PAYMENTS INC.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Digital Payment Market top key players overview

Digital Payment Market – Company Profiles

- ACI WORLDWIDE, INC

- Adyen

- Financial Software & Systems Pvt. Ltd.

- Fiserv, Inc.

- Global Payments Inc.

- Novatti Group Ltd

- PayPal Holdings, Inc.

- Paysafe Limited

- Block, Inc.

- PayU

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Deployment, Organization Size, and Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Increasing Prevalence of Smartphones Enabling Expansion of mCommerce

Rising Adoption of Contactless Payments

Financial services companies are recognizing the importance of open banking initiatives and application programming interfaces. Traditional banks understand that they must improve their digital capabilities to compete in the sector and avoid being disintermediated by new entrants with superior offers and services. For instance, numerous financial services companies such as PayPal, Wells Fargo, and Visa are supporting Open Banking projects. Also, in Europe, Open Banking initiatives are progressively becoming the norm because banks are legally required to make account information accessible via APIs under the Revised Payment Services Directive (PSD2), effective from 2018.

Open Banking APIs boost a bank's attractiveness and enable it to meet the changing expectations of existing clients and attract new ones. The APIs may also be used as a one-of-a-kind solution to boost customer interaction and respond to consumer requirements in a safe, agile, and future-proof way. Open Banking APIs are significant assets for financial services organizations because they allow them to expand service offerings, boost client interaction, and create new digital income channels, which would offer a significant opportunity for the digital payment market to expand during the forecasted period.

The rising demand of the diverse demands of customers, retailers, banks, telecom providers, and gadget suppliers is the primary reason for emerging digital payment model's success. It enables them to go to various locations, such as concerts, trade exhibits, and food trucks, where they may receive money from clients. This is accomplished by properly implementing mPOS in the industry. Retailers may use mPOS and associated software systems to improve and enhance consumer interaction, resulting in higher conversion rates and sales. Mobile point-of-sale (mPOS) refers to specific integrated devices that may operate as electronic point-of-sale terminals, such as smartphones and tablets. Mobile POS deployments allow brick-and-mortar retailers to use pricing, product information, and inventory data, enabling for omnichannel engagement, which, in turn, is likely to gain momentum for the digital payment market during the forecasted period.

Key companies in the digital payment market include ACI Worldwide, Inc; Adyen; Financial Software & Systems Pvt. Ltd.; Fiserv, Inc.; Global Payments Inc.; Novatti Group Ltd; and Paypal Holdings, Inc.

The global digital payment market is bifurcated on basis of organization type as small and medium enterprises (SMEs), and large enterprises. The global digital market is dominated by large enterprises segment in 2020, which accounted for ~ 68.4%.

North America held the largest market share in year 2020, along with the notable revenue generation opportunities in Europe and APAC.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of companies - Digital Payment Market

- ACI WORLDWIDE, INC

- ADYEN

- FINANCIAL SOFTWARE & SYSTEMS PVT. LTD.

- FISERV, INC.

- GLOBAL PAYMENTS INC.

- NOVATTI GROUP LTD

- PAYPAL HOLDINGS, INC.

- PAYSAFE LIMITED

- BLOCK, INC.

- PAYU

Get Free Sample For

Get Free Sample For