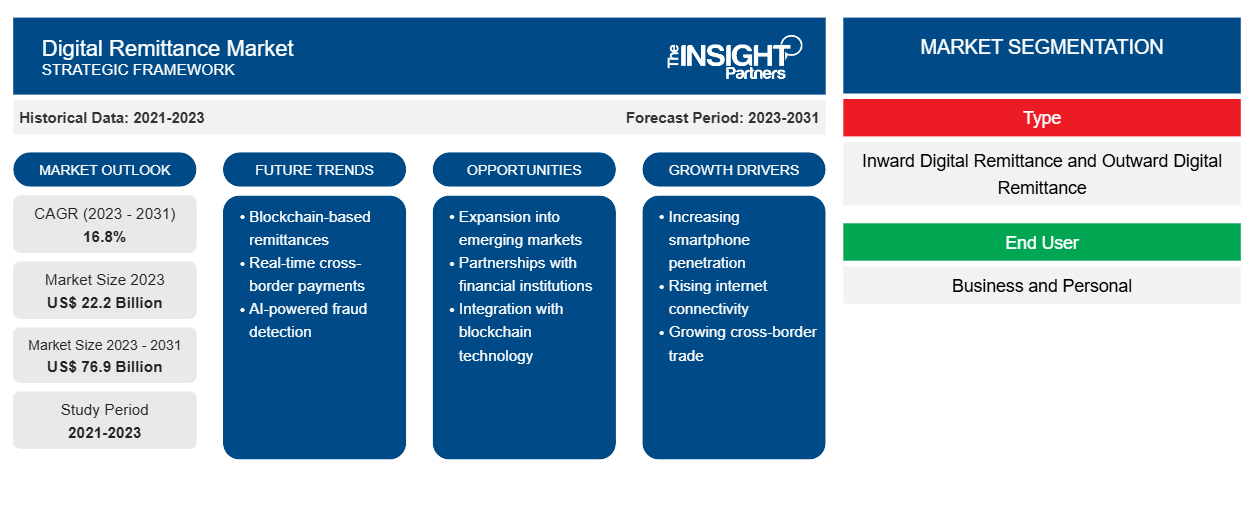

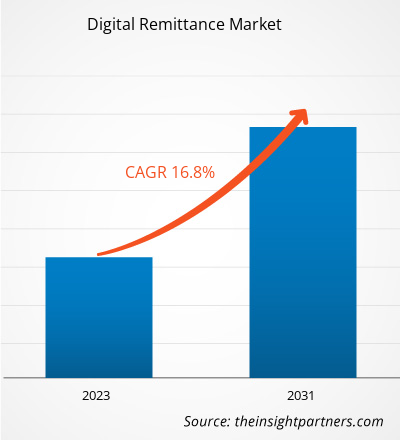

The digital remittance market size is expected to grow from US$ 22.2 billion in 2023 to US$ 76.9 billion by 2031; it is anticipated to expand at a CAGR of 16.8% from 2023 to 2031. The growth in cross-border transactions and mobile-based payment channels, along with reduced transfer time and remittance costs, are expected to boost the digital remittance market growth.

Digital Remittance Market Analysis

The digital remittance market is also witnessing significant growth due to the rising number of migrants across the world and the acceleration of digital channels for remittance transfers, especially in the wake of the COVID-19 pandemic. The market is subject to various regulations and compliance requirements, including anti-money laundering (AML) and know-your-customer (KYC) regulations, which can pose barriers for smaller players entering the market.

Digital Remittance Market

Overview

- Digital remittance refers to the electronic transfer of funds from one party to another, typically across international borders. This method of payment is commonly used for international money transfers, enabling individuals or businesses to send funds to recipients in foreign countries through electronic transfer or wire submission.

- Digital remittance transactions are often executed almost immediately and are frequently utilized to provide financial support to individuals in their home countries. The global rise in cross-border business activities has triggered a significant demand for digital remittance payments worldwide, with the market representing a substantial and growing sector of the global economy.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Digital Remittance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Digital Remittance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Digital Remittance Market Drivers and Opportunities

Increasing Adoption of Smartphones and Internet Connectivity to Drive the Digital Remittance Market Growth

- The increasing adoption of smartphones and internet connectivity has significantly propelled the digital remittance market's expansion. As more individuals worldwide embrace smartphones and gain access to internet connectivity, the accessibility of digital remittance services has substantially improved. This trend has simplified cross-border money transfers, contributing to the market's growth by making remittance transactions more convenient and efficient.

- Moreover, the widespread adoption of smartphones and internet connectivity has facilitated the development and utilization of user-friendly online platforms and mobile wallets, empowering users to initiate cross-border fund transfers effortlessly.

- The growing availability of digital payment solutions, coupled with the rising number of migrants globally, has further amplified the demand for fast, secure, and cost-effective cross-border payment solutions, driving the digital remittance market's positive trajectory.

Digital Remittance Market Report Segmentation Analysis

- Based on type, the market is segmented into inward digital remittance and outward digital remittance. The inward digital remittance segment is expected to hold a substantial digital remittance market share in 2023.

- Inward digital remittance refers to the electronic transfer of funds from overseas to the recipient's home country. This segment of the market is witnessing significant growth, driven by the increasing adoption of mobile payment technology for money transfers among migrants.

Digital Remittance Market Share Analysis by Geography

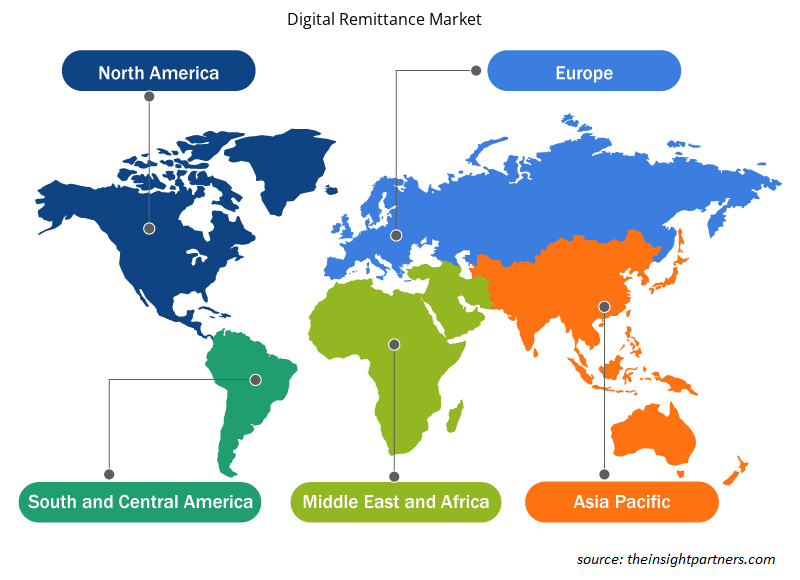

The scope of the digital remittance market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant digital remittance market share. The North American market is driven by migration for job opportunities, education, and business purposes. Key drivers of market growth in North America include the increasing adoption of digital payment solutions, growth in cross-border transactions, and reduced transfer time and remittance costs.

Digital Remittance Market Regional Insights

Digital Remittance Market Regional Insights

The regional trends and factors influencing the Digital Remittance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Digital Remittance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Digital Remittance Market

Digital Remittance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 22.2 Billion |

| Market Size by 2031 | US$ 76.9 Billion |

| Global CAGR (2023 - 2031) | 16.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

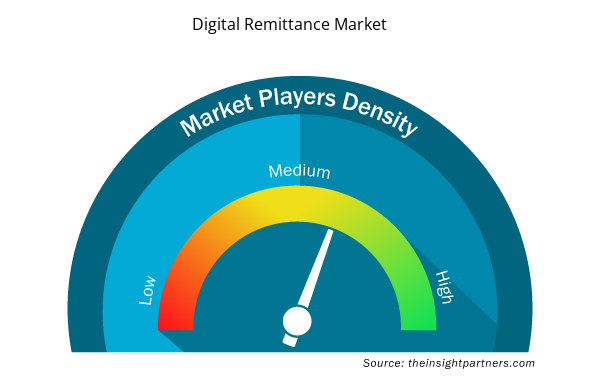

Digital Remittance Market Players Density: Understanding Its Impact on Business Dynamics

The Digital Remittance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Digital Remittance Market are:

- The List of Companies

- Azimo Limited

- Digital Wallet Corporation

- InstaReM Pvt. Ltd.

- MoneyGram

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Digital Remittance Market top key players overview

The "Digital Remittance Market Analysis" was carried out based on type, end user, channel, and geography. In terms of type, the market is segmented into inward digital remittance and outward digital remittance. Based on end user, the market is segmented into business and personal. Based on channel, the market is segmented into banks, money transfer operators, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Digital Remittance Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the market. The digital remittance market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. A few recent key market developments are listed below:

- In February 2024, TerraPay, a global leader in cross-border payments, announced a strategic partnership with Banco G&T Continental, a distinguished financial institution in Guatemala. This collaboration marks TerraPay’s first direct partnership in Central America. It is a significant advancement in the cross-border remittance sector, aimed at providing seamless and innovative solutions for Guatemalans abroad to send money to their families back home securely.

[Source: TerraPay Holdings Limited, Company Website]

Digital Remittance Market Report Coverage & Deliverables

The market report “Digital Remittance Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, End User, Channel, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is expected to reach US$ 76.9 billion by 2031.

The increasing adoption of smartphones & internet connectivity and growth in cross-border transactions are the major factors that propel the market.

The market was estimated to be US$ 22.2 billion in 2023 and is expected to grow at a CAGR of 16.8% during the forecast period 2023 - 2031.

The key players holding majority shares in the market are Azimo Limited; Digital Wallet Corporation; InstaReM Pvt. Ltd.; MoneyGram; PayPal Holdings, Inc.

Technological advancements in digital remittance are anticipated to play a significant role in the market in the coming years.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

- Azimo Limited

- Digital Wallet Corporation

- InstaReM Pvt. Ltd.

- MoneyGram

- PayPal Holdings, Inc.

- Ria Financial Services Ltd.

- TransferGo Ltd.

- Western Union Holdings, Inc.

- Wise Payments Limited

- WorldRemit Ltd.

Get Free Sample For

Get Free Sample For