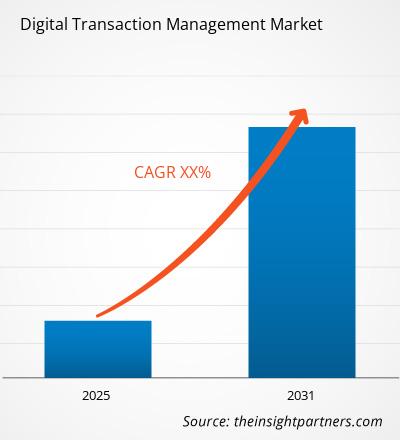

The digital transaction management market size is expected to grow at a CAGR of 26.3% from 2025 to 2031. The augmented usage of digital transformation technologies is the principal driver of market expansion. Digital transaction management is a component of cloud services that is precisely designed to manage digital document-based transactions. Organizations benefit from digital transaction management in numerous ways, such as collaborative document management and enhancing document-based processes for an improved customer experience.

Digital Transaction Management Market Analysis

Increasing organizational efficiency through the use of digital technologies to handle all business activities with little or no human participation is known as business automation. Robotic Process Automation (RPA) and low-code automation are examples of technological developments that are opening the door to more secure transaction management systems. Throughout the projected period, the digital transaction market—especially for cloud-based services—is anticipated to grow at a faster rate due to the growing usage of technology in financial transactions and the expansion of e-commerce platforms.

Digital Transaction Management Market Overview

- The digital transaction market growth can be attributed to the model shift toward process and workflow automation across various industry verticals such as BFSI, retail, government, real estate, and healthcare, among others. Enterprises worldwide are looking forward to executing seamless and efficient business procedures, which can be implemented regardless of the location. As such, digital transaction management solutions can help organizations refine customer experiences while reducing transaction periods, thereby generating opportunities for the growth of the market.

REGIONAL FRAMEWORK

Digital Transaction Management Market Driver and Opportunities

Increasing Adoption in BFSI Industry to Drive the Digital Transaction Management Market

- The transaction workflow of financial institutions and banks often tends to be agile. Thus, officials of the BFSI industry are aggressively implementing cloud-based digital transaction management solutions to enhance their transaction management processes for greater flexibility. Various challenges from the demanding customers, increasing competition, and a developing regulatory environment are predominantly encouraging financial institutions and banks to choose digital business transformation. Thus, the increasing adoption of digital transaction management solutions in the BFSI industry is expected to drive market growth during the forecast period.

Increasing Adoption of Cloud-based Solutions to Create Lucrative Market Opportunities

- The increasing adoption of cloud-based services worldwide is projected to create lucrative growth opportunities for the market during the forecast period. Cloud-based solutions speed up signing business contracts and agreements by digitalizing the business process accurately.

- Cloud-based competencies of digital transaction management solutions can predominantly allow operators to manage their business procedures efficiently. A consistent approach toward cloud-based filing management and storage can significantly help businesses with paperless documentation.

Digital Transaction Management Market Report Segmentation Analysis

The key segments that contributed to the derivation of the digital transaction management market analysis are component, solution, end user, and vertical.

- Based on component, the market is divided into hardware, software, and services. The hardware held the principal market share in 2023. The swelling demand for Point of Sale (POS) machines from companies across numerous industry verticals, such as hospitality, retail, and healthcare, is principally boosting the growth of the hardware segment.

- By Solution, the market is divided into electronic signatures, workflow automation, authentication, document archival, and others. The electronic signature segment is expected to hold a prominent share in 2023. This growth can be attributed to the improved efficiency and speed of transactions offered by electronic signatures.

- By End-user, the market is bifurcated into large enterprises and SMEs. The large enterprises segment is expected to hold the majority share in 2023.

- By Vertical, the market is segmented into retail, BFSI, healthcare, IT & Telecom, government, real estate, utilities, and others.

Digital Transaction Management Market Share Analysis By Geography

- The scope of the Digital Transaction Management market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific region is expected to grow at the fastest CAGR during the forecast period.

- The increasing adoption of digital solutions for transaction management in emerging countries, such as India, is projected to boost the regional market growth. In India, constant digitization initiatives, such as Digital India, being pursued by government bodies are anticipated to propel market growth. Further, the growing number of small and medium enterprises (SMEs) in the Asia Pacific region is also projected to create lucrative growth opportunities for the market growth during the forecast period.

MARKET PLAYERS

Digital Transaction Management Market Report Scope

Digital Transaction Management Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the digital transaction management market. Some of the recent key market developments are listed below:

- December 2022 – Skyslope collaborated with Weichert, Realtors for its innovative digital transaction management to Weichert's over 7,000 corporate associates. This partnership enlarges Skyslope's capability by adding several thousands of agents to the present members in Canada and the USA. In addition to the central transaction platform, Skyslope provides a projecting digital signature solution to send real estate documents out for e-signature. [Source: Skylope, Company Website]

Digital Transaction Management Market Report Coverage & Deliverables

The Digital Transaction Management market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Digital Transaction Management Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Digital Transaction Management Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | XX% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Solution

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global digital transaction management market was estimated to grow at a CAGR of 26.3% during 2023 - 2031.

The growing adoption of cloud-based solutions is the major factors that propel the global digital transaction management market.

The increasing adoption of digital technologies in the BFSI industry is anticipated to play a significant role in the global digital transaction management market in the coming years.

The major players holding majority shares are BlackRock, Inc., The Vanguard Group, Inc., Charles Schwab & Co., Inc., JPMorgan Chase & Co., and FMR LLC.

Asia Pacific is anticipated to grow with a high growth rate during the forecast period.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

1.Adobe Systems Incorporated

2.AssureSign LLC

3.DocuSign Inc.

4.eOriginal, Inc.

5.HELLOSIGN

6.Kofax, Inc.

7.Namirial SPA

8.Nintex Global Ltd.

9.ThinkSmart LLC

10.ZorroSign, Inc.

Get Free Sample For

Get Free Sample For