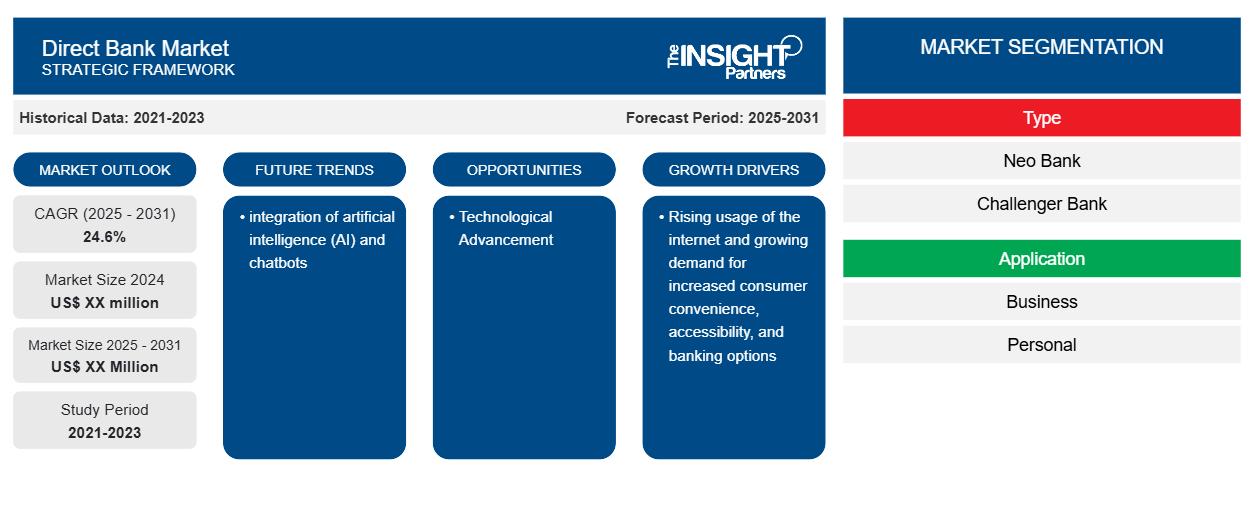

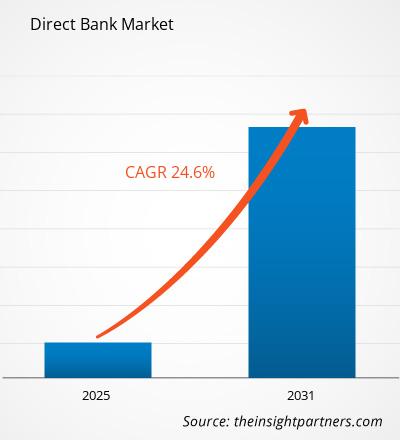

The direct bank market size is expected to register a CAGR of 24.6% during 2023–2031. integration of artificial intelligence (AI) and chatbots is likely to remain a key trend in the market.

Direct Bank Market Analysis

The direct bank market includes growth prospects owing to the current market trends and their foreseeable impact during the forecast period. The direct bank market is growing due to the rising usage of the Internet and growing demand for increased consumer convenience, accessibility, and banking options. Technological integration provides lucrative opportunities for direct bank market growth.

Direct Bank Market Overview

A direct bank is a financial institution that solely provides its services online through mobile apps, email, and other electronic channels. These channels frequently include phone calls, online chat, and mobile check deposits. It is sometimes referred to as a branchless or virtual bank. Direct banks don't have tellers or branch offices. Direct banks are typically able to provide more affordable banking products because they operate in a manner that significantly lowers operational expenses.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Direct Bank Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Direct Bank Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Direct Bank Market Drivers and Opportunities

Growing Demand For Increased Consumer Convenience, Accessibility, And Banking Options to Favor Market

Consumers are becoming more and more aware nowadays, due to which there is a growing demand for greater accessibility and convenience in banking options. Customers nowadays expect convenience to avail banking services at any time, from any location. Financial institutions can meet these needs with the help of direct banks. Using services provided by direct banks will allow customers to receive a more convenient and customized service. For example, mobile banking apps can provide users with personalized product recommendations, rewards for their loyalty, and guidance on creating a budget. Banks may save expenses, increase customer happiness and loyalty, foster long-term partnerships, and increase profitability by implementing digital channels. Thus, growing demand for increased consumer convenience, accessibility, and banking options will drive the market growth.

Technological Advancement

Virtual banking or direct banking is gaining traction nowadays. Customers are already switching to direct banking in increasing numbers. As banks adopt more technology, two trends in bank technology adoption include reduced paper usage and wireless transaction processing. The regular banking procedure now includes processing online applications for account opening and other services, transferring money without the need for checks, and seeing online account statements. The digitization of all client data and transactions allows banks to increase efficiency, save expenses, and offer faster, higher-quality customer service. In response to client demands for "anytime and anywhere" access to their funds and financial data, banks are forced to adopt wireless solutions that work across devices and networks.

Direct Bank Market Report Segmentation Analysis

Key segments that contributed to the derivation of the direct bank market analysis are type and application.

- Based on type, the direct bank market is divided into neo-bank and challenger banks. The neo-bank segment held a larger market share in 2023.

- By application, the market is segmented into business and personal. The personal segment held a larger market share in 2023.

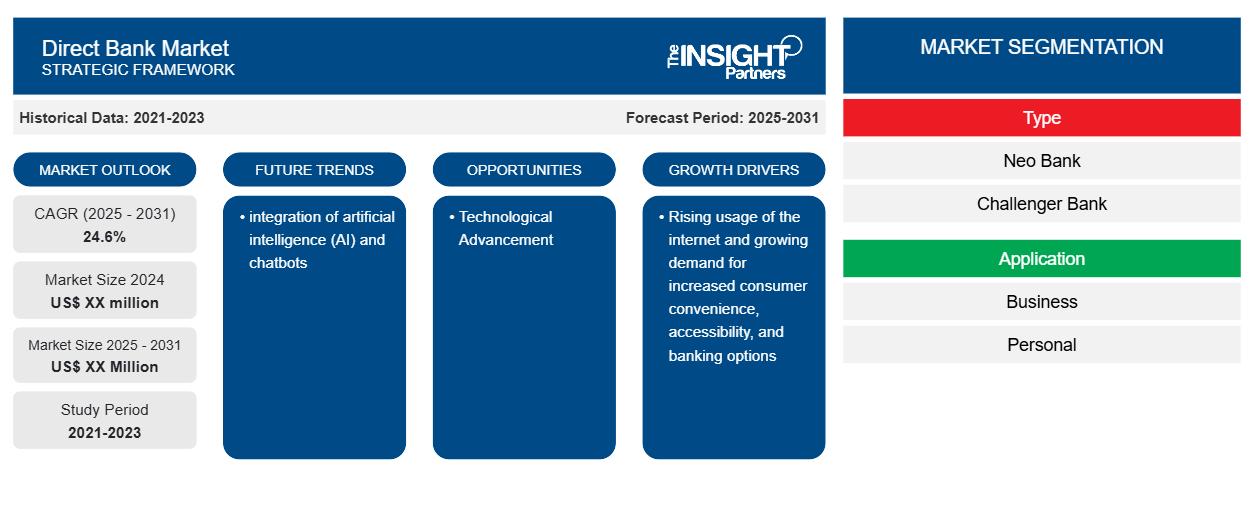

Direct Bank Market Share Analysis by Geography

The geographic scope of the direct bank market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North American direct bank market is a rapidly growing sector that is driven by technological advancements and the increasing demand for personalized and efficient customer experiences. North America, which includes countries such as the United States and Canada, is known for its strong technological infrastructure and high adoption rates of digital solutions. With the widespread adoption of smartphones and advanced banking infrastructure, consumers are increasingly turning to direct banking solutions.

Direct Bank Market Regional Insights

The regional trends and factors influencing the Direct Bank Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Direct Bank Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Direct Bank Market

Direct Bank Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 24.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Direct Bank Market Players Density: Understanding Its Impact on Business Dynamics

The Direct Bank Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Direct Bank Market are:

- Atom Bank

- Movencorp

- Fiserv

- Fidor Group

- N26

- Pockit

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Direct Bank Market top key players overview

Direct Bank Market News and Recent Developments

The direct bank market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the direct bank market are listed below:

- CIT Bank, a division of First Citizens Bank, today announced the launch of a redesigned mobile app and the addition of new features for desktop online banking that provide an improved customer experience that delivers seamless and convenient digitally integrated banking. (Source: CIT Bank, Press Release, December 2023)

- California-based Banking-as-a-Service (BaaS) fintech, Treasury Prime, has announced a strategic reorientation, emphasizing the direct sale of its embedded banking technology to banks. To align with the new strategy, Treasury Prime is launching a Bank-Direct product, designed to empower banks in supporting the entire lifecycle of direct relationships with fintech customers. (Source: Treasury Prime, Press Release, March 2024)

Direct Bank Market Report Coverage and Deliverables

The “Direct Bank Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Direct bank market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Direct bank market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Direct bank market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the direct bank market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Rugged Servers Market

- Data Center Cooling Market

- Electronic Health Record Market

- Sandwich Panel Market

- Emergency Department Information System (EDIS) Market

- Point of Care Diagnostics Market

- Skin Tightening Market

- Mobile Phone Insurance Market

- Health Economics and Outcome Research (HEOR) Services Market

- Military Rubber Tracks Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

The leading players operating in the direct bank market are Atom Bank, Movencorp, Fiserv, Fidor Group, N26, Pockit, Ubank, Monzo Bank, MyBank, Holvi Bank, WeBank, Hello Bank, Koho Bank, Rocket Bank, Soon Banque, Digibank, Timo, Jibun, Starling Bank, and Tandem Bank

The integration of artificial intelligence (AI) and chatbots is anticipated to play a significant role in the global direct bank market in the coming years.

The global direct bank market is expected to grow at a CAGR of 24.6% during the forecast period 2024 - 2031.

The major factors driving the direct bank market are the rising usage of the internet and growing demand for increased consumer convenience, accessibility, and banking options.

Get Free Sample For

Get Free Sample For