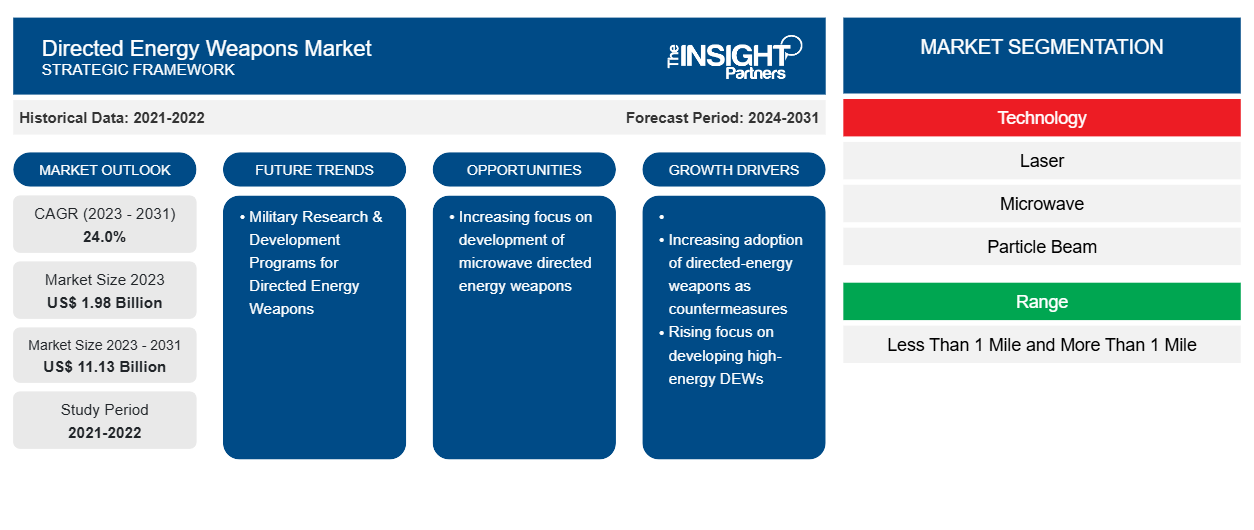

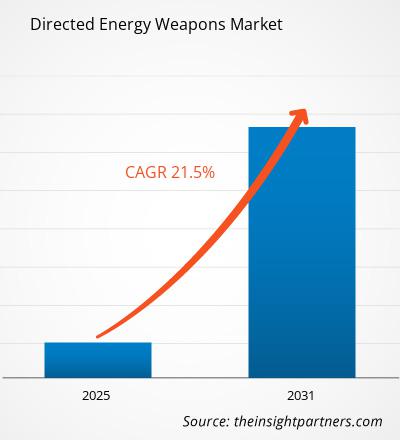

The directed energy weapons market size is projected to reach US$ 10.27 billion by 2031 from US$ 2.62 billion in 2024. The market is expected to register a CAGR of 21.50% during 2025-2031. Increasing focus on development of microwave directed energy weapons is likely to remain a key trend in the market.

Directed Energy Weapons Market Analysis

The key stakeholders in the directed-energy weapons market include component manufacturers, DEWs manufacturers, technology providers, and end users. The directed energy weapons system market ecosystem comprises the following stakeholders- component manufacturers, DEW manufacturers, and defense forces. The directed-energy weapon system manufacturing market players procure components such as sensors, tracking mount, beam detectors, and other spare parts from various suppliers across the globe. Some of the component manufacturers are Lockheed Martin Corporation, Raytheon Technologies, Northrop Grumman Corporation, and Boeing Company, among others. These suppliers continuously optimize their production lines and lead times to enhance their respective supply chains. The directed-energy weapon system manufacturers are witnessing significant demand for their products owing to the rising threat of UAVs over the past few years. The DEW supplier works in sync with the procurer of the directed-energy weapon system to understand the demand of the procurer or end users. This helps the DEW manufacturers to suitably meet the needs of their respective customers. The defense forces are the end users, which continue to seek high-energy, high-precise, and long-range laser weapon systems for their defense fleet. Several defense forces work closely with the DEW manufacturers such as Raytheon Technologies, Lockheed Martin Corporation, and others to incorporate the best possible system into the defense fleet. This factor also propels the directed-energy weapons market.

Directed Energy Weapons Market Overview

Over the past decade, the defense forces have been seeking the directed energy weapon system. The microwave-based DEW systems have attracted several defense forces across the globe. However, the DEW systems are still in the development/prototyping phase in many countries. The existence of substitute technology is a key parameter for the directed energy weapons manufacturers to emphasize. Directed energy weapon is one of the key products of security and safety and many more among the defense forces. Thus, a complete substitute is not available in the market in the current scenario.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Directed Energy Weapons Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Directed Energy Weapons Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Directed Energy Weapons Market Drivers and Opportunities

Continuous Rise in Demand from Different Defense Force

The directed energy weapon market across the globe comprises different manufacturers. The end-users of directed energy weapons include defense aircraft manufacturers, naval ships, defense ground vehicle manufacturers, and defense forces. Since directed energy weapons are among the emerging technology in the defense industry, the demand for the same is high. Pertaining to the higher demand, several well-known defense contractors have ventured into the market. The presence of many suppliers of directed energy weapons has been raising the bargaining power of buyers. Over the years, as the number of end users rises, the bargaining power of buyers is anticipated to rise.

Military Research & Development Programs for Directed Energy Weapons

Improved system dependability is a key consideration when choosing a directed energy weapon. The use of cutting-edge technology with the integration of hardware components disseminates across a range of military assets, such as combat vehicles, unidentified objects, drones, and UAVs. Modern directed-energy weapons with exceptional precision have made it necessary for nations with border disputes and regional threats to rely on such cutting-edge weapons for their border safety. For instance, Missile Defense Agency’s (MDA) directed energy demonstrator development program targets technical risk reduction and maturation for high-powered strategic lasers, beam control, lethality, and associated technologies. Future DEW systems are most certainly to be developed more powerful than current systems using realistic klystron amplifier technology, as reported by the Chinese researchers. For instance, in Shanghai, researchers are developing a DEW system to enable a firing range of 100-petawatt laser shots by 2023. Such factors are likely to provide new opportunities for market vendors in the coming years.

Directed Energy Weapons Market Report Segmentation Analysis

Key segments that contributed to the derivation of the directed energy weapons market analysis are technology, application, range, and platform.

- Based on technology, the directed energy weapons market is divided into laser, microwave, particle beam, and others. The laser segment held a larger market share in 2023.

- Based on application, the directed energy weapons market is segmented into ground, naval, and airborne. The ground segment held a larger market share in 2023.

- By range, the market is segmented into less than 1 mile and more than 1 mile. The XX segment held the largest share of the market in 2023.

- In terms of platform, the market is segmented into armored vehicles, unmanned systems, handheld systems, aircraft systems, ships and submarines, and others. The armored vehicles segment held a significant share of the market in 2023.

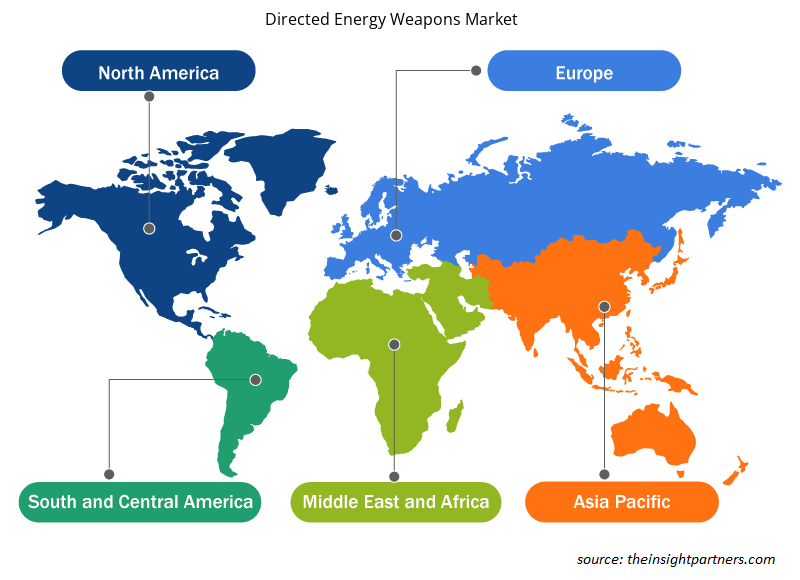

Directed Energy Weapons Market Share Analysis by Geography

The geographic scope of the directed energy weapons market report is mainly divided into five regions: North America, Europe, Asia Pacific, and Rest of the World.

North America has dominated the market in 2023 and it is expected to retain its dominance during the forecast period as well. Europe is likely to retain its second largest position in the market during the forecast period followed by the Asia Pacific region. In North America, the US is the most developed country. As the country is an early adopter of technologies, the adoption of directed energy weapon is high in the North American region. More advancement of directed energy weapons is witnessed in the US comparing to other countries of the global market. Increasing collaboration and partnership of the US government with leading companies such as Lockheed Martin Corporation, Raytheon Technologies Corporation, and Boeing, among others, is accelerating the country’s growth. Acceptance of advanced weapon systems by the US government encourages laser weapon systems manufacturers to provide more innovative laser solutions for the US. The North American region is estimated to surge at the prime rate over the years till 2031 due to the strong presence of directed energy weapons manufacturers and significantly higher military spending year on year. These parameters continuously boost the directed energy weapons market to surge in the forecasted period.

Directed Energy Weapons Market Regional Insights

The regional trends and factors influencing the Directed Energy Weapons Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Directed Energy Weapons Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Directed Energy Weapons Market

Directed Energy Weapons Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 2.62 Billion |

| Market Size by 2031 | US$ 10.27 Billion |

| Global CAGR (2025 - 2031) | 21.50% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

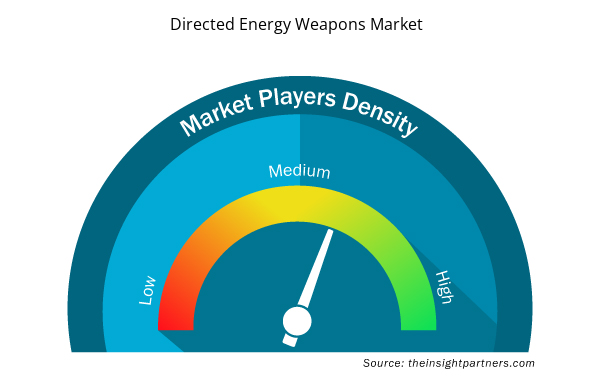

Directed Energy Weapons Market Players Density: Understanding Its Impact on Business Dynamics

The Directed Energy Weapons Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Directed Energy Weapons Market are:

- Lockheed Martin Corporation

- Thales Group

- L3Harris Technologies, Inc.

- Elbit Systems Ltd.

- Raytheon Technologies Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Directed Energy Weapons Market top key players overview

Directed Energy Weapons Market News and Recent Developments

The directed energy weapons market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the directed energy weapons market are listed below:

- Lockheed Martin (NYSE: LMT) was awarded a contract to develop and deliver up to four 300 kW-class laser weapon systems to the U.S. Army’s Indirect Fire Protection Capability-High Energy Laser (IFPC-HEL) prototype program. The IFPC-HEL system complements other layered defense components to protect soldiers from stressing threats, unmanned aerial systems, rocket, artillery and mortars, along with rotary and fixed-wing aircraft. (Source: Lockheed Martin Corporation, Press Release, Oct 2023)

Raytheon UK is set to receive its first high-energy laser weapon system to be tested and integrated in the United Kingdom, marking a significant advancement in the understanding of how such systems can be fielded. (Source: Raytheon Technologies, Press Release, Sep 2023)

Directed Energy Weapons Market Report Coverage and Deliverables

The “Directed Energy Weapons Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Directed energy weapons market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Directed energy weapons market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed porter’s five forces analysis

- Directed energy weapons market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the directed energy weapons market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology, Range, Application, and Platform

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Canada, China, France, Germany, India, Israel, Italy, Japan, Mexico, RoW, Russian Federation, South Korea, Turkey, United Kingdom, United States

Frequently Asked Questions

North America region dominated the directed energy weapons market in 2023.

Increasing focus on development of microwave directed energy weapons is one of the major trends of the market.

Increasing adoption of directed-energy weapons as countermeasures and rising focus on developing high-energy DEWs are some of the factors driving the growth for directed energy weapons market.

The estimated value of the directed energy weapons market by 2031 would be around US$ 10.27 billion.

Lockheed Martin Corporation, Thales Group, L3Harris Technologies, Elbit Systems, Raytheon Technologies Inc, BAE Systems Plc, Moog Inc, Honeywell Aerospace Inc, Boeing, and Rheinmetall AG are some of the key players profiled under the report.

The directed energy weapons market is likely to register of 21.50% during 2023-2031.

Get Free Sample For

Get Free Sample For