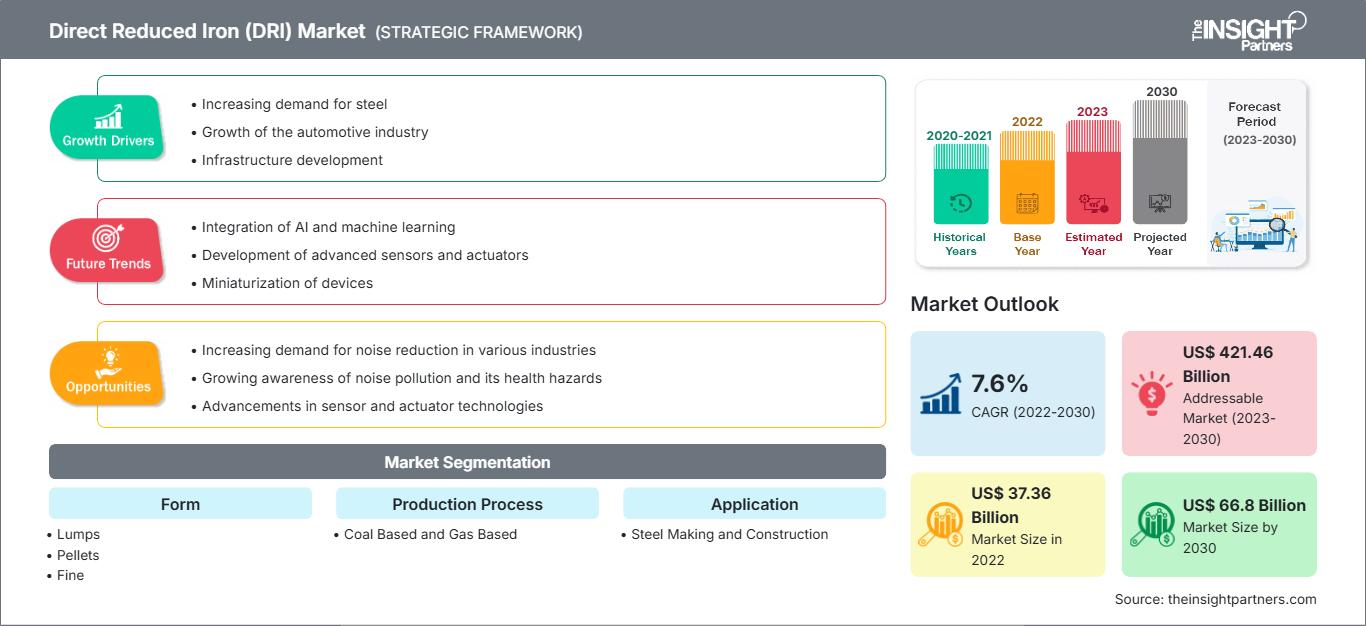

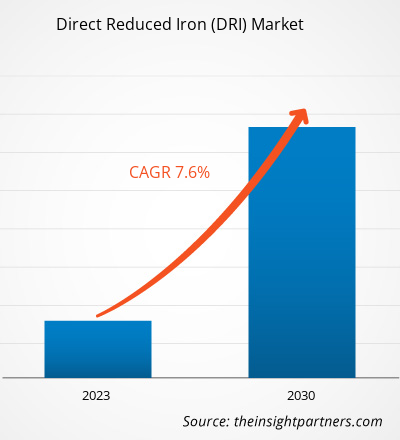

[Research Report] The direct reduced iron (DRI) market size is expected to grow from US$ 37,361.73 million in 2022 to US$ 66,803.85 million by 2030; it is estimated to register a CAGR of 7.6% from 2023 to 2030.

MARKET ANALYSIS

Direct Reduced Iron, also known as sponge iron, is obtained by the direct reduction of iron ore in the solid state either by hydrogen or carbon monoxide derived from natural gas or coal. It is produced by three processes including gas-based shaft furnace process, gas-based fluidized bed process, and coal based rotary kiln furnaces. Iron ore, coal, and natural gas are significant raw materials required, which are procured for all three processes. Steel making through direct reduced iron is considered as the sustainable route for steel production. It is commercially available in the form of lumps, pellets and fine. The product is gaining popularity worldwide as it is considered as valuable source of virgin iron for the electric steelmaking process.

GROWTH DRIVERS AND CHALLENGES

The rise in steel production and infrastructural activities across the globe has aided the direct reduced iron market growth in the past few years. Direct reduced iron has a high degree of iron content. It exhibits a consistent quality, and low sulfur and phosphorus content, along with insignificant impurities. Therefore, it is widely used as a substitute for scrap in steel production. In mini steel plants, sponge iron can be directly dissolved in an electric arc furnace instead of melting the steel scraps. Thus, the use of direct reduced iron in steel manufacturing is increasing with a continuous rise in the demand for steel. Steel is a vital alloy to modern economies as it plays a major role in manufacturing industries. It is the world’s most important engineering and construction material. The construction of homes, schools, hospitals, bridges, and automotive vehicles, among others, relies heavily on steel. Besides, increase in worldwide infrastructure activities along with rise in preference of green steel production using direct reduced iron as raw material in steel plants has created lucrative opportunities for industry expansion. However, shortage of high-quality iron ore creates a significant hurdle for steelmakers who are trying to reduce their carbon emissions. Hence, the lack of availability of high-quality raw materials of restrains the growth of the direct reduced iron market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Direct Reduced Iron (DRI) Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Direct Reduced Iron Market Analysis to 2030" is a specialized and in-depth study with a major focus on the global direct reduced iron market trends and growth opportunities. The report aims to provide an overview of the global direct reduced iron market with detailed market segmentation by form, production process, application, and geography. The global direct reduced iron market has been witnessing high growth over the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of direct reduced iron worldwide along with their demand in major regions and countries. In addition, the report provides the qualitative assessment of various factors affecting the direct reduced iron market performance in major regions and countries. The report also includes a comprehensive analysis of the leading players in the direct reduced iron market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative direct reduced iron market opportunities that would, in turn, aid in identifying the major revenue pockets.

Further, ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global direct reduced iron market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global direct reduced iron market is segmented on the basis of form, production process, and application. Based on form, the direct reduced iron market is segmented as, lumps, pellets, and fine. On the basis of production process, the market is classified as, coal based and gas based. The direct reduced iron market is categorized on the basis of application into, steel making and construction.

Based on form, the pellet form accounted for a significant direct reduced iron market share which can be attributed to its popularity across the globe and wide availability. Pellets are more resistant to disintegration than iron ore lumps. The high metallization rate, effectiveness and availability of uniform sizes of pellets of direct reduced iron in EAF steelmaking route is driving the segment’s growth Lump form segment has been growing in popularity owing to better reducibility properties compared to pellets. The iron rich lumps are used for manufacturing various steel products, including fine wire, forging bars, plates, and seamless tubes. Based on production process, gas based accounted for a major market share owing to rise in transition from coal fired to gas fired plants to reduce carbon emissions. For instance, in 2017, the Indian government announced to increase the share of natural gas in its energy mix to 15 percent by 2030. Natural gas is a cleaner fossil fuel compared to coal. Based on application, steel making held major market share, as it is considered to be most viable source of virgin iron feed material in steel production. Construction application segment will grow at a significant pace owing to increasing renovation activities and government investment in infrastructure projects across the globe. Sponge iron is used to produce steel rebars and ingots. Besides, the construction industry has undergone massive changes relating to the use of environment-friendly materials in infrastructure projects. This will further attract new growth opportunities for the overall industry growth.

REGIONAL ANALYSIS

The report provides a detailed overview of the global direct reduced iron market with respect to five major regions, namely; North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South & Central America. Middle East & Africa accounted for a significant share of the market and valued at more than US$ 15 billion in 2022 and estimated to reach approximately US$ 24 billion in 2028. Steady growth of the construction industry along with the abundance availability of DR-grade iron have positively contributed to the market growth in Middle East & Africa. Asia Pacific is also expected to witness considerable growth valued at over US$ 14 billion in 2022, attributed to increasing industrialization and urbanization projects driving product demand in steelmaking and construction applications. Asia contributes to large percentage of the world’s production of steel. China, India, Japan, and South Korea made the top 10 list of steel producers globally. North America is also expected to witness considerable growth valued at over US$ 3 billion in 2022, attributed to the expansion of electric arc furnace-based steel production, and increasing construction activities.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Partnership, acquisitions and new product launches were found to be the major strategies adopted by the players operating in the global direct reduced iron market.

In April, 2022, ArcelorMittal acquired 80% shareholding in Voestalpine’s world-class Hot Briquetted Iron (‘HBI’) plant in Corpus Christi, Texas. The voestalpine will reserve the remaining 20% share.

In November, 2020, Tenova signed a contract with the HBIS Group for implementing the Paradigm Project, a High-Tech hydrogen energy development and utilization plant. The project includes a 600,000 Kilotons Per Year energiron DRI plant.

Direct Reduced Iron

Direct Reduced Iron (DRI) Market Regional InsightsThe regional trends and factors influencing the Direct Reduced Iron (DRI) Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Direct Reduced Iron (DRI) Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Direct Reduced Iron (DRI) Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 37.36 Billion |

| Market Size by 2030 | US$ 66.8 Billion |

| Global CAGR (2022 - 2030) | 7.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Form

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Direct Reduced Iron (DRI) Market Players Density: Understanding Its Impact on Business Dynamics

The Direct Reduced Iron (DRI) Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Direct Reduced Iron (DRI) Market top key players overview

IMPACT OF COVID/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

The COVID-19 pandemic led to a decline in the progress of many industries across the globe. Shutdown of manufacturing plants and restricted trade across the globe led to supply chain constraints for the manufacturers across the globe. Industries such as steel and construction have been the major contributors to the demand for direct reduced iron. In 2020, these industries had to slow down their operations due to disruptions in the value chain caused by the shutdown of national and international boundaries. The COVID-19 pandemic led to a shortage of manpower, which interrupted direct reduced iron production and distribution operations. Disruptions in global supply chain and shutdown of industrial material production facilities led to a severe spike in the prices of direct reduced iron. Lockdowns imposed by governments of different countries in 2020 hampered the ability of industries to maintain inventory levels. However, in 2021, the global marketplace began recovering from the losses incurred in 2020 as governments of various countries announced relaxation in social restrictions. Manufacturers were permitted to operate at full capacities, which helped them overcome the demand–supply gap. Therefore, the direct reduced iron market has recovered quite well from the aftermath of the pandemic and is expected to grow over the coming years.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Some of the key players operating in the direct reduced iron market include, Nucor Corp, Cleveland-Cliffs Inc., Kobe Steel Ltd, Voestalpine AG, Ternium SA, SMS Group GmbH, JSW Steel Ltd, Tenova SpA, Liberty Steel Group Holdings UK Ltd, Bharat Engineering Works Pvt Ltd., Mobarakeh Steel Company, Khouzestan Steel Company, Tosyali Algerie, Emirates Steel Arkan, Tata Steel Ltd., Briquetera del Orinoco and OMK among others.

Frequently Asked Questions

Based on form, which segment is leading the global direct reduced iron (DRI) market during the forecast period?

Can you list some of the major players operating in the global direct reduced iron (DRI) market?

Which region held the largest share of the global direct reduced iron (DRI) market?

Based on application, which segment is leading the global direct reduced iron (DRI) market?

Which region held the fastest CAGR in the global direct reduced iron (DRI) market?

Based on production process, which segment is leading the global direct reduced iron (DRI) market during the forecast period?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For