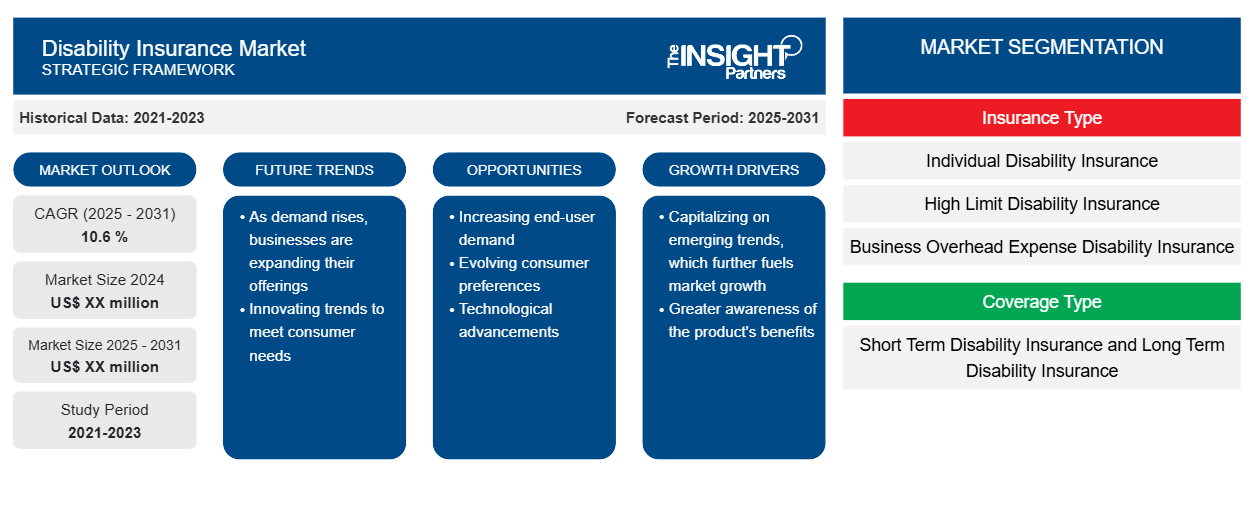

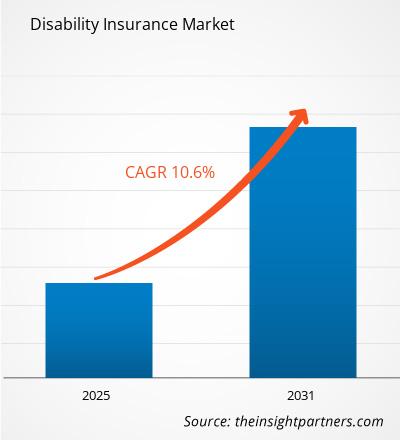

The disability insurance market size is anticipated to expand at a CAGR of 10.6 % from 2025 to 2031.Rising awareness of disability insurance and tax benefits will drive disability insurance market growth. The market includes growth prospects owing to the current disability insurance market trends and their foreseeable impact during the forecast period.

Disability Insurance Market Analysis

The disability insurance market has experienced significant growth over the past few decades, driven by various factors such as changing demographics, increased awareness about the importance of income protection, advancements in medical technology, and shifts in the labor market landscape. Disability insurance provides financial protection to individuals who are unable to work due to illness or injury, replacing a portion of their lost income.

Disability Insurance

Industry Overview

- One of the key drivers of the disability insurance market growth is the aging population. As populations in many countries age, the likelihood of individuals experiencing disabilities increases. According to the World Health Organization, the global population aged 60 years and older is expected to double by 2050, with a corresponding increase in age-related disabilities. This demographic trend has led to greater demand for disability insurance products among older individuals looking to protect their income in case of disability.

- Also, the rise of awareness of disability insurance is driving the market.

- Furthermore, advancements in medical technology and healthcare have improved the survival rates of individuals with severe illnesses or injuries. While this is undoubtedly positive, it also means that more people are living with disabilities that may prevent them from working. Disability insurance provides these individuals with financial security, allowing them to maintain their standard of living despite their inability to earn income from work.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Disability Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Disability Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Disability Insurance Market Drivers and Opportunities

Rising Awareness about Benefits of Disability Insurance Policies to Drive the Disability Insurance Market

- The disability insurance sector is expanding as more people become aware of the advantages of having a policy. This is explained by increased information transparency, which encourages clients to take a more active role in the disability insurance purchase process.

- Furthermore, because disability insurance takes a long time to process claims, the market for quicker claim processing is growing due in large part to the introduction of automated claim technologies.

- In addition, lowering operating costs and improving overall client experiences are both having a beneficial effect on the expansion of the disability insurance market. In addition, the industry is expanding due to consumer preferences for technology and the value of understanding user needs and accessible insurance products.

- In a market where competition is fierce, brokers must take the time to get to know their clients personally and understand their true needs. It leads to the right fit being found, which significantly boosts market growth. These are the elements propelling the market's expansion.

Disability Insurance Market Report Segmentation Analysis

- Based on insurance type, the disability insurance market is segmented into individual disability insurance, high-limit disability insurance, business overhead expense disability insurance, employer-supplied disability insurance, and others.

- The employer-supplied disability insurance segment is expected to hold a substantial microfinance market share in 2023. Because it offers skilled workers protection from harm and a competitive advantage over rivals, as it shields the business from bankruptcy or losses during the employer's disability term, the business overhead expense disability insurance segment is anticipated to increase at the fastest rate over the projected year.

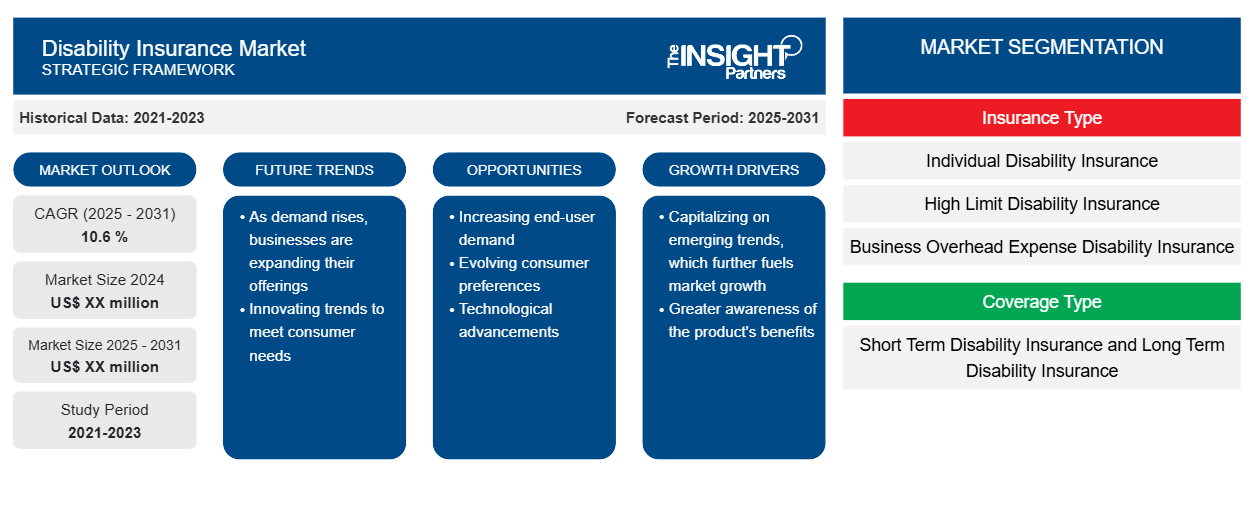

Disability Insurance Market Share Analysis by Geography

The scope of the disability insurance market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant disability insurance market share. The region's significant economic development, growing population, and increasing focus on financial inclusion across diverse economies have contributed to this growth. North America's emerging markets, characterized by a large unbanked population and a growing entrepreneurial culture, have presented substantial opportunities for disability insurance to expand their services and reach previously underserved communities.

Disability Insurance Market Regional Insights

Disability Insurance Market Regional Insights

The regional trends and factors influencing the Disability Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Disability Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Disability Insurance Market

Disability Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX million |

| Global CAGR (2025 - 2031) | 10.6 % |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Insurance Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Disability Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Disability Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Disability Insurance Market are:

- The Guardian Life Insurance Company of America

- ASSICURAZIONI GENERALI S.P.A.

- Mutual of Omaha

- Petersen International Underwriters

- Assurity Group, Inc

- Nippon life insurance

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Disability Insurance Market top key players overview

The " Disability Insurance Market Analysis" was carried out based on insurance type, coverage type, end-user, and geography. In terms of insurance type, the market is segmented into individual disability insurance, high-limit disability insurance, business overhead expense disability insurance, employer-supplied disability insurance, and others. Based on coverage type, the market is segmented into short-term disability insurance and long-term disability insurance. Based on end-user, the disability insurance market is segmented into government, enterprise, and individual. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Disability Insurance

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the disability insurance market. A few recent key market developments are listed below:

- In May 2023, Ameritas announced the launch of DInamic Cornerstone Income ProtectionSM, a new disability income insurance product that includes greater strength and flexibility for policyholders. DInamic Cornerstone offers three new riders: Lump Sum Savings, Enhanced Plus Residual, and Benefit Increase.

[Source: Ameritas, company website]

- In September 2023, Prudential Financial, Inc. made a new strategic partnership with EvolutionIQ, a technology company with an artificial intelligence-driven platform that will enhance Prudential’s disability claims ecosystem. With AI playing an increasingly crucial role in businesses today, the integration of this platform into Prudential’s claims process augments the important work of the company’s disability claims examiners. EvolutionIQ uses proprietary, next-generation machine learning to provide specialized insights that will help Prudential streamline the disability claims process.

[Source: Prudential Financial, Inc., company website]

Disability Insurance

Market Report Coverage & Deliverables

The disability insurance market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report on “Disability Insurance Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Latent TB Detection Market

- Medical Second Opinion Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Bioremediation Technology and Services Market

- Europe Surety Market

- Third Party Logistics Market

- Online Exam Proctoring Market

- Travel Vaccines Market

- Formwork System Market

- Skin Tightening Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Rising awareness of disability insurance is the major factor that propels the global disability insurance market.

The global disability insurance market is expected to grow at a CAGR of 10.6% during the period 2023 - 2031.

Rising labor costs and declining economic output are anticipated to play a significant role in the global disability insurance market in the coming years.

The key players holding majority shares in the global disability insurance market are The Guardian Life Insurance Company of America; ASSICURAZIONI GENERALI S.P.A.; Mutual of Omaha; Assurity Group, Inc; Nippon Life Insurance.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- The Guardian Life Insurance Company of America

- ASSICURAZIONI GENERALI S.P.A.

- Mutual of Omaha

- Petersen International Underwriters

- Assurity Group, Inc

- Nippon life insurance

- Ping An Insurance

- MetLife Services and Solutions, LLC.

- Illinois Mutual

- Mercer Belong, Inc.

Get Free Sample For

Get Free Sample For