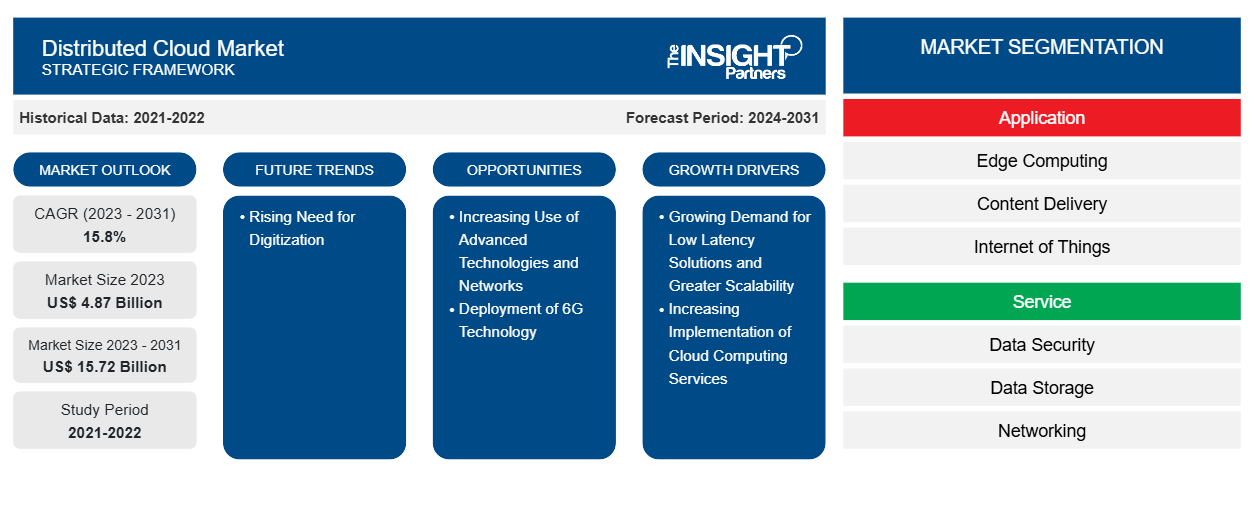

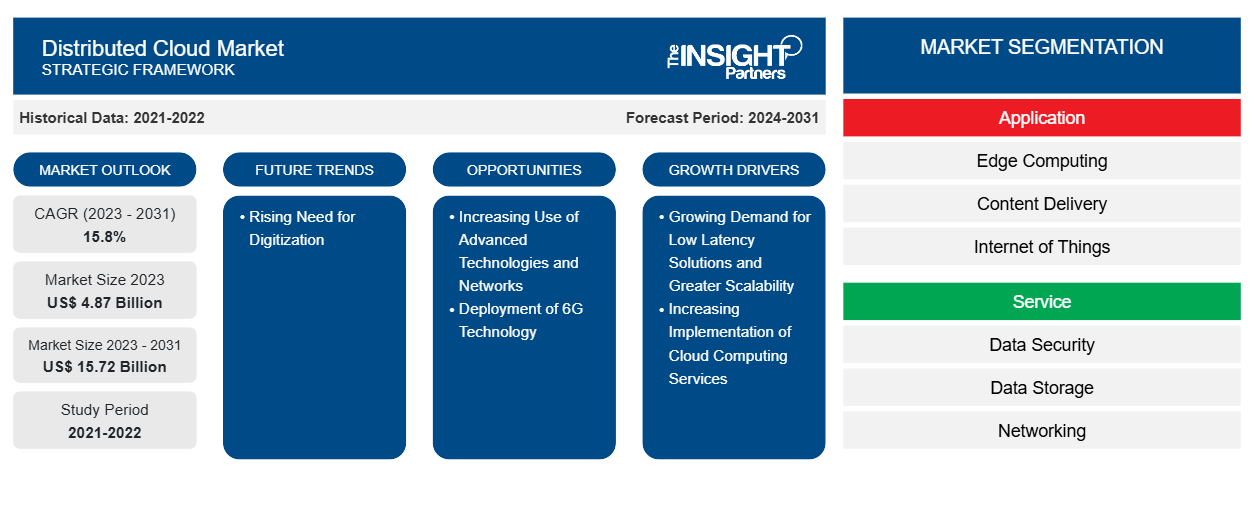

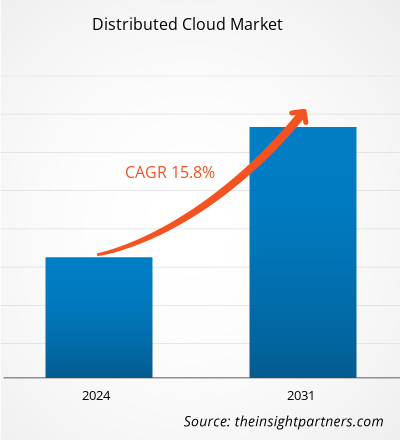

The distributed cloud market size is projected to reach US$ 15.72 billion by 2031 from US$ 4.87 billion in 2023. The market is expected to register a CAGR of 15.8% during 2023–2031. The rising need for digitization is likely to bring in new trends in the market.

Distributed Cloud Market Analysis

The distributed cloud market growth is attributed to the increasing demand for low-latency solutions and greater scalability. Distributed cloud computing also increases the responsiveness of services by relocating the processing tasks closer to the end user. In addition, the growing implementation of cloud computing services in several industries, such as automobile, education, financial, retail, real estate, agriculture, media, and entertainment, drives the market. Moreover, the rising requirement for digitization and deployment of 6G technology is anticipated to fuel the distributed cloud market in the coming years. In Asia Pacific, there is a notable rise in cloud computing growth and investment, with expected growth in public cloud service revenue. China is recognized as the largest public cloud market in the region. Top infrastructure-as-a-service (IaaS) companies such as Alibaba Cloud and Huawei are based in China. Additionally, governments in Asia Pacific are increasingly showing interest in sovereign cloud solutions because of geopolitical disruptions, rising cyber threats, changing data protection laws, and shifts in digital trade policies.

Distributed Cloud Market Overview

The architecture of a distributed cloud involves multiple clouds that help meet compliance requirements and performance needs, as well as support edge computing while being centrally managed by a public cloud provider. The growth of the Internet of Things (IoT) and edge computing have been a major driver for distributed cloud deployments. Artificial intelligence (AI) applications that move large amounts of data from edge locations to the cloud require cloud services to be as close as possible to edge locations; also, moving cloud resources to the edge location itself can significantly increase performance for these applications.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Distributed Cloud Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Distributed Cloud Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Distributed Cloud Market Drivers and Opportunities

Growing Demand for Low Latency Solutions and Greater Scalability to Favor Market

Low latency is a computer network that is improved to process a high volume of data messages with the least delay time. These networks are intended to support functions that require near real-time access to rapidly changing data. Distributed cloud computing decreases latency and increases the responsiveness of services by relocating the processing tasks closer to the end user. Data is then managed locally instead of at a centralized server, developing a superior user experience. Further, various companies offered distributed cloud offerings to meet low latency needs. For instance, in September 2023, Oracle expanded its distributed cloud offerings to cater to organizations’ diverse needs and the growing global demand for Oracle Cloud Infrastructure (OCI) services. Oracle Database Azure and MySQL HeatWave Lakehouse on AWS are the new additions to OCI’s distributed cloud. As a result, enterprises gain increased flexibility to deploy cloud services anywhere while addressing numerous data privacy, data sovereignty, and low latency requirements, allowing access to over 100 services designed to run any workload.

Deployment of 6G Technology

6G is accepted to offer latency in the microsecond range. This allows distributed cloud services to perform real-time processing tasks such as augmented reality (AR), virtual reality (VR), and autonomous driving with unprecedented efficiency. Various companies offer 6G distributed cloud and communications systems. For example, Next G Alliance (NGA) offers a distributed cloud and communications system. NGA developed this system for the North American 6G vision. It intends to make 6G systems a wide-area cloud with abundant computing and workload distribution across devices, data centers, and network nodes. The 6G distributed cloud and communications system is a step toward joined communication and computing system capabilities that have not been achieved in 4G and 5G on network cloudification and edge computing. Thus, the deployment of 6G technology is anticipated to hold several opportunities for the distributed cloud market growth during the forecast period.

Distributed Cloud Market Report Segmentation Analysis

Key segments that contributed to the derivation of the distributed cloud market analysis are application, service, enterprise, size, and industry vertical.

- Based on application, the distributed cloud market is divided into edge computing, content delivery, Internet of Things, and others. The edge computing segment held the largest market share in 2023. Edge computing is a distributed computing outline that brings enterprise applications closer to data sources, such as local edge servers or IoT devices. This results in improved response times, faster insights, and better bandwidth availability.

- By service, the market is segmented into data security, data storage, networking, and others. The data storage segment held the largest share of the market in 2023. Data storage services involve the implementation of measures to securely store and manage data across diverse cloud environments. This encompasses addressing concerns such as ensuring data availability, loss of control over data, and the need for robust data backup and recovery strategies.

- In terms of enterprise size, the market is bifurcated into large enterprises and SMEs. The large enterprises segment held a significant share of the market in 2023. Major corporations utilize the distributed computing model to effectively distribute various stages of their business processes across a computer network, typically structured into presentation, application, and data layers. Large enterprises are increasingly adopting multi-cloud strategies, distributing their computing needs across multiple cloud providers to avoid being locked into a single vendor and bolster their resilience.

- Based on industry vertical, the distributed cloud market is divided into BFSI, healthcare, retail & e-commerce, manufacturing, IT & telecom, energy & utilities, media & entertainment, government & defense, and others. The BFSI industry is increasingly capitalizing on the potential of distributed cloud technology to tackle crucial challenges and foster innovation. This industry consistently confronts the forthcoming threat of cyberattacks, the requirement to streamline customer data collection while upholding data integrity, and the pressing requirement to adhere to stringent security standards and regulations.

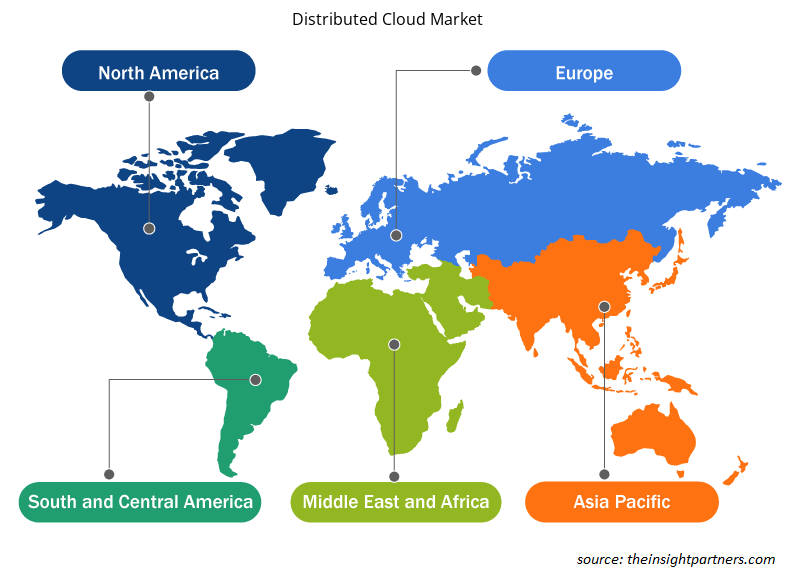

Distributed Cloud Market Share Analysis by Geography

The geographic scope of the distributed cloud market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

In North America, significant growth is anticipated in the distributed cloud market due to increased cloud enablement activities and trends within the cloud market. The distributed cloud allows businesses to transfer data of any size without extra charges and can ensure data sovereignty while complying with the General Data Protection Regulation (GDPR). It provides a data lake powered by AI that centralizes data to enhance predictive analytics quality. It can be used in different scenarios, such as manufacturing, IoT, machine learning, and imaging.

A varied mix of technologies and regulations defines Europe's distributed cloud computing sector. Cloud technologies are expanding, resulting in a varied adoption of cloud technologies across EU countries. The EU is making notable efforts to enable the transition to the edge and create compatible cloud and edge services to back the establishment of unified European data spaces. Furthermore, there is an emphasis on guaranteeing data residency, controlling operational staffing, and minimizing the effects of jurisdictional challenges, especially in regulated sectors, by means such as the European Cybersecurity Certification Scheme (EUCS) for cloud services.

Distributed Cloud Market Regional Insights

The regional trends and factors influencing the Distributed Cloud Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Distributed Cloud Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Distributed Cloud Market

Distributed Cloud Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.87 Billion |

| Market Size by 2031 | US$ 15.72 Billion |

| Global CAGR (2023 - 2031) | 15.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

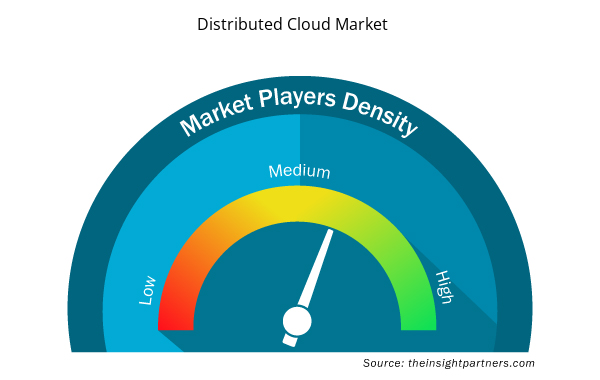

Distributed Cloud Market Players Density: Understanding Its Impact on Business Dynamics

The Distributed Cloud Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Distributed Cloud Market are:

- Alibaba Cloud

- Amazon Web Services, Inc.

- IBM

- Oracle

- Microsoft

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Distributed Cloud Market top key players overview

Distributed Cloud Market News and Recent Developments

The distributed cloud market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the distributed cloud market are listed below:

- Cloud Software Group Inc. and Microsoft Corp. announced they are deepening their collaboration through an eight-year strategic partnership agreement. The agreement will strengthen the go-to-market collaboration for the Citrix® virtual application and desktop platform and support the development of new cloud and AI solutions with an integrated product roadmap. Additionally, Cloud Software Group will make a $1.65 billion commitment to the Microsoft cloud and its generative AI capabilities.

(Source: Microsoft, Company Website, April 2024)

- Oracle, Microsoft, and OpenAl are partnering to extend the Microsoft Azure Al platform to Oracle Cloud Infrastructure (OCI) to provide additional capacity for OpenAl. OCI's purpose-built AI capabilities enable startups and enterprises to build and train models faster and more reliably anywhere in Oracle's distributed cloud.

(Source: Oracle, Company Website, June 2024)

Distributed Cloud Market Report Coverage and Deliverables

The “Distributed Cloud Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Distributed cloud market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Distributed cloud market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Distributed cloud market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the distributed cloud market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application, Service, Enterprise Size, and Industry Vertical

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Rising need for digitization is expected to present new trends in the market during the forecast period.

The market is anticipated to expand at a CAGR of 15.8% during 2023–2031.

Oracle, Amazon Web Services, Inc., IBM, Broadcom, and Google are major players in the market.

The market is projected to reach US$ 15.72 billion by 2031.

North America dominated the distributed cloud market in 2023.

Increasing demand for low latency solutions and greater scalability and increasing implementation of cloud computing services in several industries are driving the market growth.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Distributed Cloud Market

- Alibaba Cloud

- Amazon Web Services, Inc.

- IBM

- Oracle

- Microsoft

- RACKSPACE TECHNOLOGY

- Broadcom

- Databricks

- Salesforce, Inc.

Get Free Sample For

Get Free Sample For