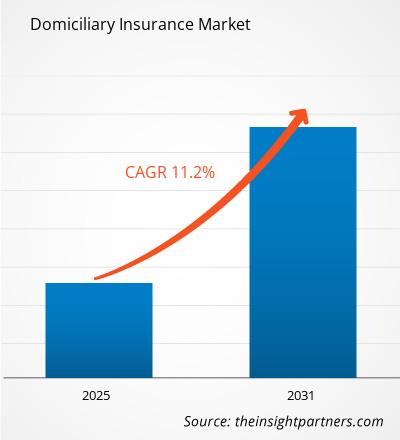

The domiciliary insurance market is anticipated to expand at a CAGR of 11.2% from 2025 to 2031.

The rising aging population and rising healthcare expenditure drive the domiciliary insurance market growth.

Domiciliary Insurance Market Analysis

The domiciliary insurance market has experienced significant growth in recent years, driven by various factors, including changing demographics, rising healthcare costs, and evolving consumer preferences. Domiciliary health insurance, also known as home health insurance, provides coverage for medical services and treatments delivered at home, offering convenience and flexibility for patients while potentially reducing healthcare expenses.

Domiciliary Insurance

Industry Overview

- When a policyholder has domiciliary insurance, they are still treated as though they are in a hospital, even though they are receiving care at home. Health insurance also pays for in-home therapies for illnesses, injuries, and cures; policyholders receive reimbursement for these services.

- As populations age worldwide, there is a growing demand for healthcare services that can be provided in the comfort of one's home. Domiciliary health insurance caters to the needs of elderly individuals who prefer to receive medical care at home rather than in institutional settings.

- The prevalence of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders is increasing globally. Domiciliary health insurance plans often cover services like remote monitoring, medication management, and home visits by healthcare professionals, which are essential for managing chronic conditions effectively.

- Advances in telemedicine, wearable devices, and remote monitoring technology have facilitated the delivery of healthcare services outside traditional clinical settings. Domiciliary health insurance providers leverage these technologies to offer virtual consultations, real-time health monitoring, and personalized care plans tailored to individual patient needs.

Domiciliary Insurance Market Drivers and Opportunities

Rising Aging Population to Drive the Domiciliary Insurance Market

- One of the key drivers of the domiciliary market growth is the rising aging population. The world's population is aging, with the 65+ age group experiencing the fastest rate of growth. For example, the World Health Organization estimates that approximately 1 billion people worldwide are 60 years of age or older. By 2031, there will be 1.4 billion, and by 2045, there will be 2.1 billion.

- The aging population is becoming more and more dependent on home health services since they have more health issues that need to be managed constantly and a limited amount of mobility.

Domiciliary Insurance Market Report Segmentation Analysis

- Based on coverage, the domiciliary insurance market is segmented into lifetime coverage and term coverage.

- The lifetime coverage segment is expected to hold a substantial domiciliary insurance market share in 2023.

- The worldwide domiciliary insurance industry is seeing a notable upswing in demand for the lifetime coverage sector. Customers' growing awareness of the lifetime coverage plans' long-term benefits and security is the reason for this increased interest.

- Whole-life insurance policies are becoming more and more popular as the number of older people increases and more people look for long-term financial security.

- In order to meet this demand, the lifetime coverage market offers policies that not only take care of urgent medical needs but also give a feeling of stability and security, especially in the event that age-related health issues arise. The worldwide domiciliary insurance industry is seeing a notable upswing in demand for the lifetime coverage sector.

Domiciliary Insurance

Market Share Analysis By Geography

The scope of the domiciliary insurance market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant domiciliary insurance market share. The region's significant economic development, growing population, and increasing focus on financial inclusion across diverse economies have contributed to this growth. There are several reasons for the increase in demand, including the region's increased interest in home-based healthcare coverage. The aging population in North America is a major factor since many people are looking for insurance plans that support their desire to get medical treatment in the convenience of their own homes.

Domiciliary Insurance Market Report Scope

The "Domiciliary Insurance Market Analysis" was carried out based on coverage, service provider, and geography. In terms of coverage, the market is segmented into lifetime coverage and term coverage. Based on the service provider, the domiciliary insurance market is segmented into public and private. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Domiciliary Insurance Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the domiciliary insurance market. A few recent key market developments are listed below:

- In December 2023, Universal Sompo General Insurance introduced “Muskaan," an innovative health insurance policy carefully designed to create a positive social impact and uplift domestic workers and staff. Recognizing the significant contributions of domestic workers to society and understanding their unique needs, the insurance company has developed a tailored product to cater to their specific requirements.

[Source: Universal Sompo General Insurance, company website]

- In January 2024, Narayana Health received approval from the Insurance Regulatory and Development Authority of India (Irdai) to launch a health insurance business in India.

[Source: Narayana Health, company website]

Domiciliary Insurance

Market Report Coverage & Deliverables

The market report “Domiciliary Insurance Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Domiciliary Insurance Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX million |

| Global CAGR (2025 - 2031) | 11.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Coverage

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Trade Promotion Management Software Market

- E-Bike Market

- Digital Language Learning Market

- Small Internal Combustion Engine Market

- Aircraft Wire and Cable Market

- Nitrogenous Fertilizer Market

- Portable Power Station Market

- Data Annotation Tools Market

- Extracellular Matrix Market

- Medical and Research Grade Collagen Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global domiciliary insurance market is expected to grow at a CAGR of 11.2% during the period 2023 - 2031.

The rising aging population and rising healthcare expenditure are the major factors that propel the global domiciliary insurance market growth.

Telehealth integration and customized policies are anticipated to play a significant role in the global domiciliary insurance market in the coming years.

The key players holding majority shares in the global domiciliary insurance market are Allianz; Cigna Group; AIA Group Limited; AXA; Aviva.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Allianz

- Cigna Group

- AIA Group Limited

- AXA

- Aviva

- Aetna Inc.

- HDFC ERGO General Insurance Company Limited

- Munich Re

- ICICI Lombard General Insurance Company Ltd.

- Ethos Technologies Inc.

Get Free Sample For

Get Free Sample For