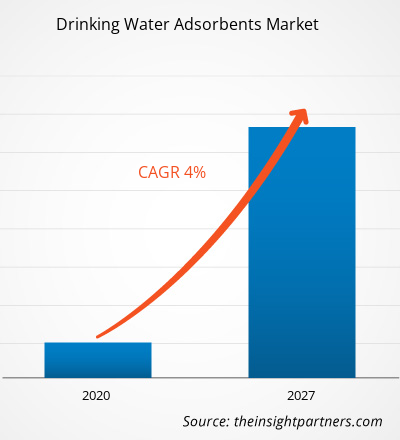

The drinking water adsorbents market was valued at US$ 511.81 million in 2019 and is projected to reach US$ 698.17 million by 2027; it is expected to grow at a CAGR of 4.0% from 2020 to 2027.

Adsorbent materials possess the capability to absorb another substance. Adsorbents are extensively used to treat and remove impurities from drinking water, and they help in enhancing the overall water quality. The stringent regulations pertaining to water quality backed by initiatives taken by government to invest in water treatment industries promote the demand for drinking water adsorbents. Further, rapid urbanization coupled with economic growth and rising demand for bio-adsorbents are driving the growth of the drinking water adsorbents market

In 2019, North America contributed to the largest share in the global drinking water adsorbents market. The market growth in this region is primarily attributed to the presence of strong industrial base along with prominent manufactures significantly contributing to market growth, rapid urbanization, and surge in demand for fresh and portable water. The easy accessibility and availability of raw materials are yet another factors that bolster the market growth in the region.

The COVID-19 outbreak pandemic is adversely affecting economies and industries in various countries due to government-imposed lockdowns and travel bans, and business shutdowns. The chemical & materials is one of the major industries suffering serious disruptions such as supply chain breaks, technology events cancellations, and office shutdowns. The shutdown of various plants and factories in North America, Europe, Asia Pacific, South America, and the Middle East and Africa has restricted the global supply chain and negatively impacted the manufacturing activities, delivery schedules, and product sales. Furthermore, various companies have already predicted possible delays in product deliveries and slump in future sales of their products. The travel bans imposed by countries in Europe, Asia, and North America are hindering the business collaborations and partnerships opportunities. All these factors are hampering activities in the chemical & materials industry, which are restraining the growth of various markets related to this industry.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Drinking Water Adsorbents Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Drinking Water Adsorbents Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Growing Demand for Activated Carbon

Activated carbon can remove natural organic matter (NOM) from drinking water and can be used as an integral component for water filtration system. Activated carbon has swept across the industrial world and has become an essential component to purify water. Activated carbon is used by both large- and small-scale enterprises. It helps in eliminating impurities from large-scale, community-wide water supplies as well as residential products on a smaller scale. Moreover, due to its exceptionally rare physical properties such as excellent pore properties including high surface area and wide pore size distribution, activated carbon is preferably be used as drinking water adsorbents. Further, it can eliminate dissolved pollutants and harmful organisms. In addition, with the inclusion of carbon and hydrogen in their composition, activated carbon acts as an effective product for removing organic pollutants. Increasing demand for activated carbon for the removal of turbidity and naturally occurring organic matter is expected to propel the growth of the drinking water adsorbents market during the forecast period.

Product Insights

The global drinking water adsorbents market, by product, is segmented into zeolite, clay, activated alumina, activated carbon, manganese oxide, cellulose, and others. The activated carbon segment led the drinking water adsorbents market with the largest share in 2019. Activated carbon is also known as activated coal, activated charcoal, or active carbon, and it is an extremely effective adsorbent. It can be used to purify, dechlorinate, deodorize, and decolorize both liquid and vapor applications due to its large surface area, pore structure (micro, meso, and macro), and a high degree of surface reactivity. The raw material used for activated carbons is a coconut shell, coal, and wood. Further, activated carbons are cost-effective adsorbents for a variety of industries, such as water purification, food-grade products, cosmetology, automotive applications, industrial gas purification, petroleum, and others. Activated carbon filtration is a popular technology that works by adsorbing pollutants onto the surface of a filter. This method is effective for eliminating organics such as unwanted tastes and odors, and micropollutants; chlorine; fluorine; or radon from drinking water or wastewater. Due to the inclusion of carbon and hydrogen in their composition, activated carbon is the most effective commodity for the removal of organic pollutants, which propels its demand in the market.

Key players operating in the global drinking water adsorbents market are GEH Wasserchemie; DuPont de Nemours, Inc.; Cyclopure; Lenntech; and BASF SE. Major players in the market are focused on strategies such as mergers and acquisitions, and product launches to increase their geographical presence and consumer base globally. For instance, in 2019, Hyosung Corporation and Saudi Aramco announced to develop a drinking water adsorbents manufacturing plants in South Korea and Saudi Arabia.

Drinking Water Adsorbents Market Regional Insights

The regional trends and factors influencing the Drinking Water Adsorbents Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Drinking Water Adsorbents Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Drinking Water Adsorbents Market

Drinking Water Adsorbents Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 511.81 Million |

| Market Size by 2027 | US$ 698.17 Million |

| Global CAGR (2019 - 2027) | 4.0% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Drinking Water Adsorbents Market Players Density: Understanding Its Impact on Business Dynamics

The Drinking Water Adsorbents Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Drinking Water Adsorbents Market are:

- BASF SE

- CycloPure Inc.

- Dupont

- Evoqua Water Technologies LLC

- GEH Wasserchemie

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Drinking Water Adsorbents Market top key players overview

Report Spotlights

- Progressive industry trends in the global drinking water adsorbents market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the market from 2017 to 2027

- Estimation of the demand for drinking water adsorbents across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the competitive market scenario and the demand for drinking water adsorbents

- Market trends and outlook coupled with factors driving and restraining the growth of the drinking water adsorbents market

- Decision-making process by understanding strategies that underpin commercial interest with regard to global drinking water adsorbents market growth

- Drinking water adsorbents market size at various nodes of market

- Detailed overview and segmentation of the global drinking water adsorbents market as well as its dynamics in the industry

- Drinking water adsorbents market size in various regions with promising growth opportunities

Drinking water adsorbents Market, by Product

- Zeolite

- Clay

- Activated Alumina

- Activated Carbon

- Manganese Oxide

- Cellulose

- Others

Company Profiles

- BASF SE

- CYCLOPURE INC

- DuPont de Nemours, Inc

- Geh Wasserchemie

- Kuraray Co. Ltd

- Evoqua Water Technologies LLC

- KMI Zeolite

- Lenntech B.V

- Purolite

- Tigg LLC

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Activated carbon segment held the largest share in the global drinking water adsorbents market in 2019. The dominance of the segment is attributable to rising adoption of these material in removal of organic contaminants. Activated carbon is composed of a family of substances along with several types of carbonaceous materials which possesses adsorptive properties. These materials exhibit rare physical properties, which helps to minimize dissolved contaminants along with the taste and odor, color and toxic impurities. Strict government regulations along with significant focus on research and development activities is expected to promote the demand for activated carbon in global market

The major players operating in the global drinking water adsorbents market are BASF SE, CYCLOPURE INC., DuPont de Nemours, Inc., Geh Wasserchemie, Kuraray Co. Ltd, Evoqua Water Technologies LLC, KMI Zeolite, Lenntech B.V., Purolite, Tigg LLC among many others.

In 2019, North America contributed to the largest share in the global drinking water adsorbents market. The dominance of the drinking water adsorbents market in this region is primarily attributable to the presence of strong industrial base along with prominent manufactures significantly contributing to market growth. Further, rapid urbanization along with rising demand for fresh and portable water is also favor the market growth in the region. The easy accessibility and availability of raw materials are yet another factor that bode well the market demand in the region.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Drinking Water Adsorbents Market

- BASF SE

- CycloPure Inc.

- Dupont

- Evoqua Water Technologies LLC

- GEH Wasserchemie

- KMI Zeolite

- Kuraray Co. Ltd

- Lenntech B.V.

- Purolite

- TIGG LLC

Get Free Sample For

Get Free Sample For