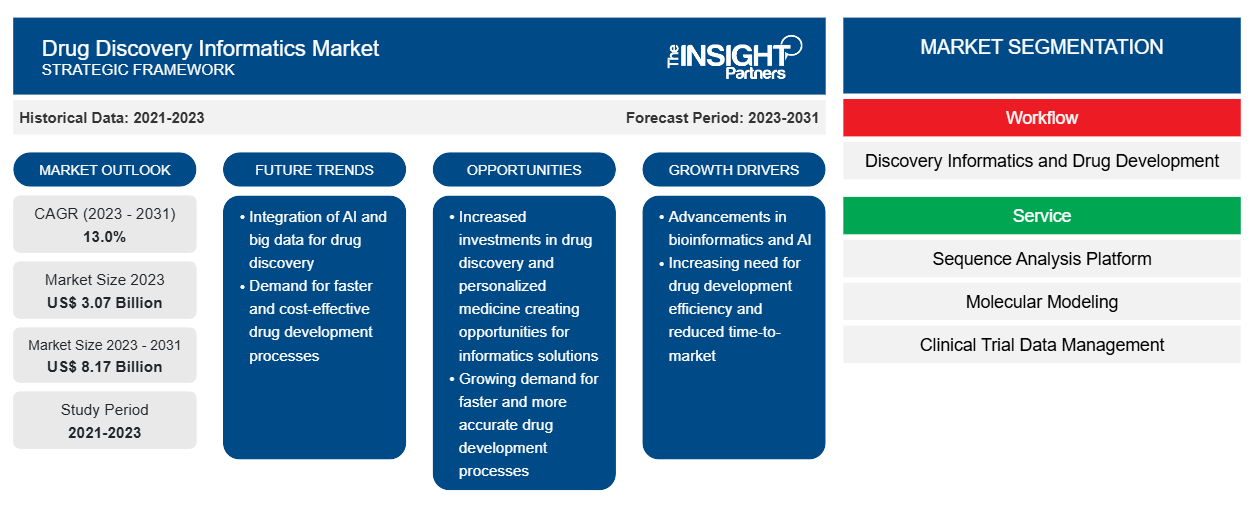

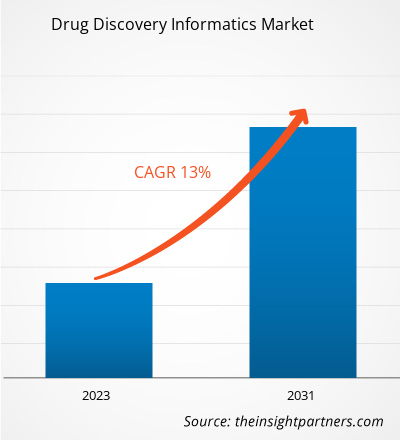

[Research Report] The drug discovery informatics market was valued at US$ 3.07 billion in 2023 and is expected to reach US$ 8.17 billion by 2031; it is estimated to record a CAGR of 13.0% during 2023–2031.

Market Insights and Analyst View:

The drug discovery informatics market forecast is derived on the basis of findings from various secondary and primary research sources.

Drug discovery informatics is a field that integrates computational and information sciences with chemistry and biology. It uses various computational tools, algorithms, and databases to study and interpret vast volumes of biological and chemical data. By utilizing the power of informatics, researchers can speed up the drug discovery process, resulting in the identification of potential drug candidates more efficiently and cost-effectively. Thus, the adoption of informatics tools is contributing to the growing drug discovery informatics market size.

Drivers Affecting Drug Discovery Informatics Market Growth

Pharmaceutical and biopharmaceutical industries invest heavily in R&D to develop new products and expand product pipelines in areas such as immunology, cancer, and infectious diseases. For instance, many innovative pharmaceutical companies are now investing in genomics to re-energize drug discovery. According to the article published by the Journal of Precision Medicine in March 2021, AstraZeneca launched a project to sequence 2 million genomes—a massive initiative aimed at collecting genome sequences and health records over the next decade. The same source further stated that GlaxoSmithKline invested £40 (UD$ 42.48) million to expand its partnership with the UK Biobank. This investment supports the sequencing of 500,000 individuals, generating a uniquely rich data resource that is both anonymized and secure. Instead of sourcing data, the leading pharmaceutical companies are tapping into population data sets that are rich in genomic, phenotypic, and clinical data. Therefore, the increasing investments in activities focused on drug discovery are driving the drug discovery informatics market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Drug Discovery Informatics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Drug Discovery Informatics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

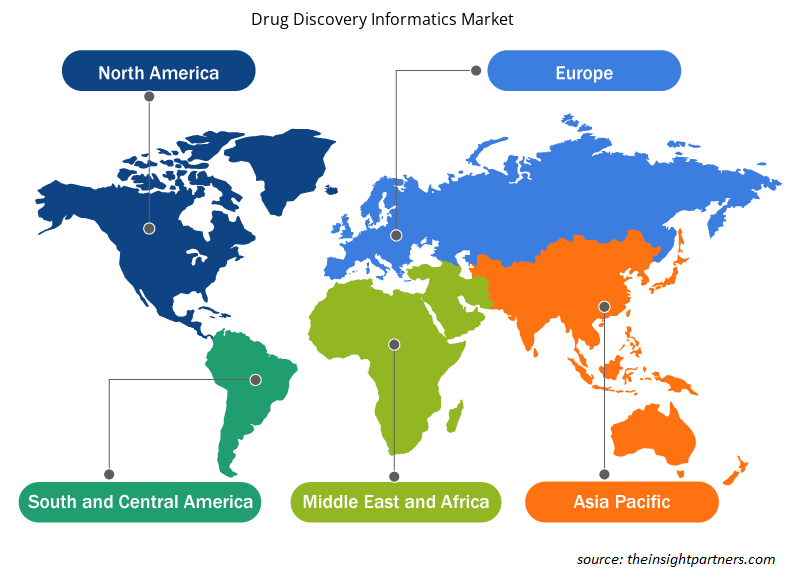

The "Global Drug Discovery Informatics Market Analysis to 2031" is a specialized and in-depth study focusing on the global market dynamics to help identify the key driving factors, future trends, and lucrative opportunities that would, in turn, aid in identifying major revenue pockets. The report aims to provide an overview of the market with detailed market segmentation by workflow, services, solutions, and end user. The scope of the drug discovery informatics market report entails North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

By workflow, the market is bifurcated into discovery informatics and drug development. The discovery informatics segment held a larger market share in 2023. The drug development segment is projected to register a higher CAGR from 2023 to 2031.

The market, by service, is segmented into sequence analysis platforms, molecular modeling, clinical trial data management, docking, and others. The sequence analysis platform segment is anticipated to hold the largest drug discovery informatics market share in 2023. The molecular modeling segment is projected to register the highest CAGR from 2023 to 2031.

By solution, the drug discovery informatics market is segmented into software and services. The services segment held a larger market share in 2023, and the same segment is projected to register a higher CAGR from 2023 to 2031.

Based on end user, the market is segmented into pharmaceutical and biotechnology companies, contract research organizations, and others. The pharmaceutical and biotechnology companies segment held the largest share of the market in 2023. The contract research organizations segment is expected to register the highest CAGR from 2023 to 2031.

Regional Outlook:

North America held the largest drug discovery informatics market share in 2023. The US held the largest share of the market in 2023, followed by Canada. This is attributed to factors such as the presence of major players, including Charles River Laboratories, Certara, and Curia, the high incidence of infectious diseases, and the rapid adoption of new and advanced R&D tools by leading pharmaceutical companies and Contract Research Organizations (CROs) for drug discovery and development. These companies are increasingly focusing on joint ventures and research collaborations, which are further expected to boost market growth in the region. For instance, in August 2022, Atomwise entered into a strategic multi-target research collaboration with Sanofi for AI-powered drug discovery. The collaboration will focus on leveraging the company's AtomNet platform for up to five drug targets as part of their computational discovery and research efforts.

Drug Discovery Informatics Market Regional Insights

Drug Discovery Informatics Market Regional Insights

The regional trends and factors influencing the Drug Discovery Informatics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Drug Discovery Informatics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Drug Discovery Informatics Market

Drug Discovery Informatics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.07 Billion |

| Market Size by 2031 | US$ 8.17 Billion |

| Global CAGR (2023 - 2031) | 13.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Workflow

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

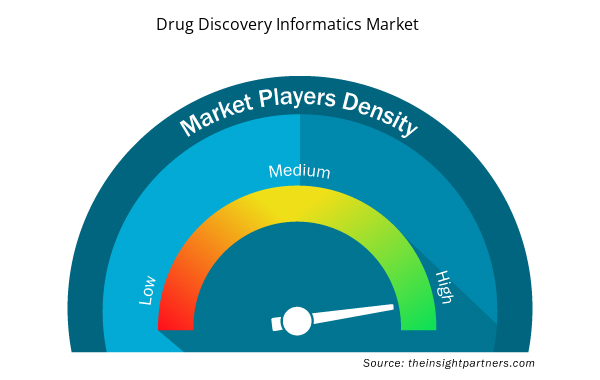

Drug Discovery Informatics Market Players Density: Understanding Its Impact on Business Dynamics

The Drug Discovery Informatics Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Drug Discovery Informatics Market are:

- Certara

- Infosys Ltd.

- Collaborative Drug Discovery, Inc.

- Jubliant Biosys

- Curia Global, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Drug Discovery Informatics Market top key players overview

Industry Developments and Future Opportunities:

As per company press releases, a few initiatives taken by key players operating in the global drug discovery informatics market are listed below:

- In January 2024, Evotec partnered with the Crohn's & Colitis Foundation to develop new treatments for inflammatory bowel disease (IBD). Under this partnership, both companies will use Evotec's comprehensive R&D platform to advance drug discovery for two innovative drug targets that address fibrosis and impaired intestinal barrier function.

- In November 2023, Certara introduced Simcyp Biopharmaceutics software, which aims to increase the efficiency of formulation development for new and generic drugs. The Simcyp Biopharmaceutics software is designed to assist biopharmaceutics, formulation, and scientists in quickly and cost-effectively formulating complex, novel, and generic small molecule medicines.

- In June 2022, Chemical.AI and Chemaxon announced a collaboration to integrate their scientific informatics software. Chemical.AI, a renowned Artificial Intelligence (AI) firm, announced a strategic partnership with Chemaxon, a leading chemical and biological software development company. The collaboration allows end users to access Chemaxon's Design Hub and Chemical.AI's ChemAIRS as an option.

- In April 2022, Certara, Inc. and Chemaxon entered a strategic partnership to modernize pharmaceutical research. The partnership provides interconnectivity between their scientific informatics workflows. Certara's Scientific Informatics software will seamlessly connect with Chemaxon's Design Hub, providing users with analytics and compound design. This co-development builds on integrations between Certara and Chemaxon products, such as the JChem chemistry cartridge, MarvinSketch, and JChem for Office.

Competitive Landscape and Key Companies:

Certara; Infosys Ltd.; Collaborative Drug Discovery, Inc.; Jubliant Biosys; Curia Global, Inc.; Chemaxon Ltd; Charles River Laboratories; Agilent Technologies, Inc.; Illumina, Inc; Boehringer Ingelheim International GmbH; and Evotec are among the prominent companies profiled in drug discovery informatics market report. These companies focus on new technologies, existing product advancements, and geographic expansions to meet the growing consumer demand worldwide.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Workflow, Service, Solution, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Drug discovery informatics is a field that integrates computational and information sciences with chemistry and biology. It uses various computational tools, algorithms, and databases to study and interpret vast volumes of biological and chemical data.

The drug discovery informatics majorly consists of the players, including Certara; Infosys Ltd.; Collaborative Drug Discovery, Inc.; Jubliant Biosys; Curia Global, Inc.; Chemaxon Ltd; Charles River Laboratories; Agilent Technologies, Inc.; Illumina, Inc; Boehringer Ingelheim International GmbH; and Evotec.

Key factors driving the drug discovery informatics growth are the increasing investments in the R&D of new drug molecules by pharmaceutical companies and the growing adoption of computational and information tools for drug discovery and development.

The drug discovery informatics market, by workflow, is bifurcated into discovery informatics and drug development. The discovery informatics segment held a larger market share in 2023.

The drug discovery informatics was valued at US$ 3.073billion in 2023.

The drug discovery informatics is expected to be valued at US$ 8.17 billion in 2031.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Drug Discovery Informatics Market

- Certara

- Infosys Ltd.

- Collaborative Drug Discovery, Inc.

- Jubliant Biosys

- Curia Global, Inc.

- Chemaxon Ltd

- Charles River Laboratories

- Agilent Technologies, Inc.

- Illumina, Inc

- Boehringer Ingelheim International GmbH

Get Free Sample For

Get Free Sample For