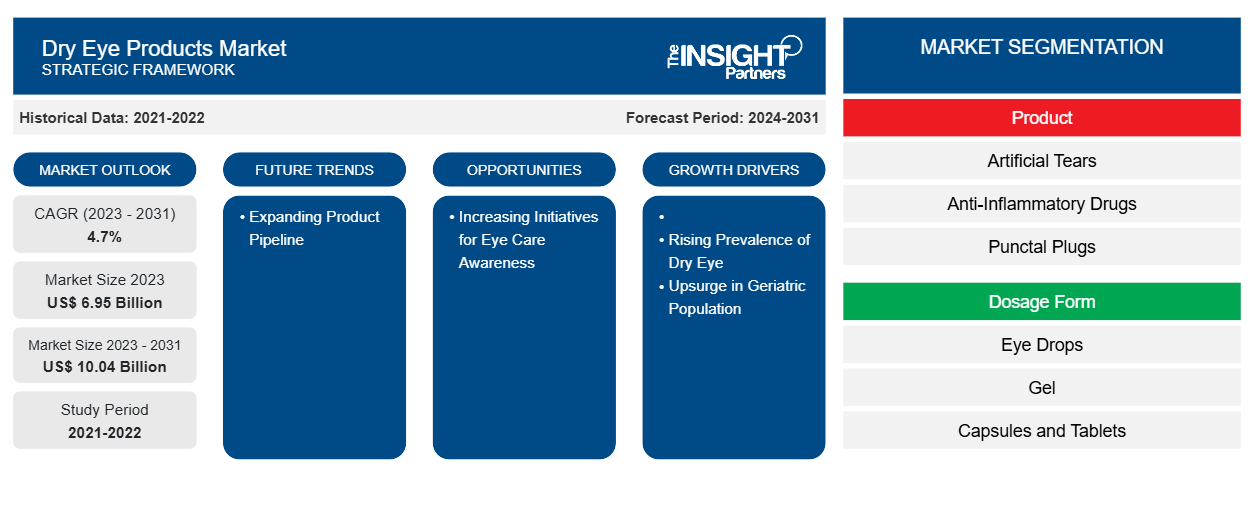

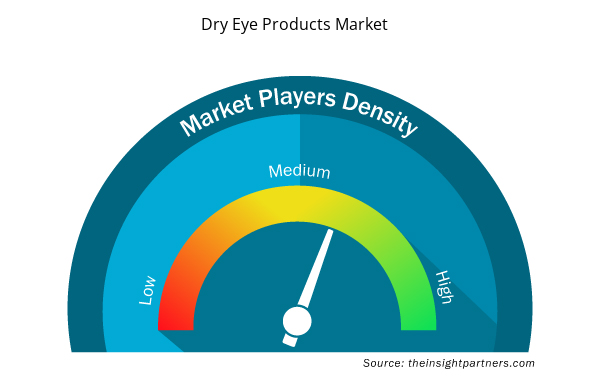

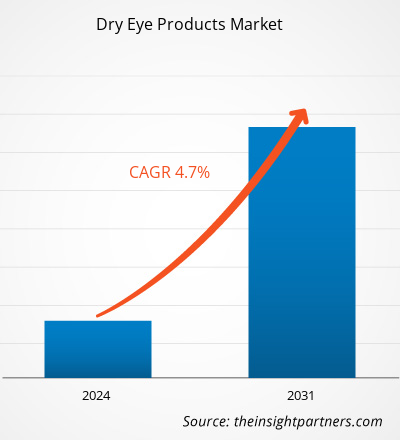

The dry eye products market size is projected to grow from US$ 6.95 billion in 2023 to US$ 10.04 billion by 2031, recording a CAGR of 4.7% during 2023–2031.

The report includes growth prospects owing to the current dry eye products market trends and their foreseeable impact during the forecast period. Dry eye is a condition characterized by the lack of adequate quality of tears to lubricate and nourish the eye or by a quick evaporation of tears. With hormonal changes, as people get older, the tendency to produce tears decreases. Dry eye is common in both males and females. However, more cases are recorded in women, mainly those who have gone through menopause. Dry eye is a chronic condition that doesn’t have a specific cure, but treatments can help manage the symptoms. Developing countries are expected to offer significant growth opportunities to the dry eye products market in the coming years.

Growth Drivers:

Upsurge in Geriatric Population Drives Dry Eye Products Market Growth

Dry eye syndrome is a common eye disorder affecting a substantial share of the population, especially those older than 50. Middle-aged and older adults are more common targets of this syndrome, which can be associated with the usage of contact lenses, the prevalence of autoimmune diseases, systemic drug effects, and refractive surgeries. The burden of dry eye syndrome would continue to surge due to increased life expectancy, along with the rising cases among the elderly population. According to the World Health Organization (WHO), the population aged 60 and above would increase from 1 billion in 2020 to 1.4 billion by 2030; the number is further likely to double and reach ~2 billion by 2050. The number of individuals aged 80 and above is expected to triple from 2020 to 2050 to reach 426 million. According to an article published by the American Academy of Ophthalmology, the risk of DED increases with age. The prevalence of DED ranges from 2.7% in individuals aged 18–34 to 18.6% in those aged 75 and above. The Centers for Disease Control and Prevention (CDC) states that in the US the prevalence of diabetic retinopathy was lowest among people younger than 25 years (13.0%) and highest among people from the age group of 65–79 (28.4%). Thus, the demand for dry eye products such as artificial tears is increasing with the growing geriatric population worldwide.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Dry Eye Products Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Dry Eye Products Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The dry eye products market analysis is performed by considering the following segments: product, dosage form, type, and distribution channel.

Segmental Analysis:

By product, the dry eye products market is segmented into artificial tears, anti-inflammatory drugs, punctal plugs, secretagogues, oral omega supplements, and others. The artificial tears segment held the largest dry eye products market share in 2023. The anti-inflammatory drugs segment is anticipated to register the highest CAGR of 5.7% during 2023–2031. Anti-inflammatory drugs are further categorized into cyclosporine, corticosteroid, and others. The dryness of eyes is a result of the low level of tear production or the lack of the right-quality tear film in the eye. The lack of lubrication of eyes, mostly due to the insufficiency of tears, leads to the dryness of eyes. Artificial tears help maintain good moisture content on the outer surface of eyes, subsequently lubricating them. They are generally available as over-the-counter products. Artificial tears, or eye drops, are available in two forms: with preservatives and without preservatives. These are recommended based on the frequency of use. Artificial tears are also available in gel and gel insert forms. These products may have side effects such as blurred vision.

By dosage form, the dry eye products market is categorized into eye drops, gels, capsules and tablets, and others. The eye drops segment held the largest market share in 2023. The gels segment is anticipated to register the highest CAGR of 5.2% during 2023–2031.

By type, the dry eye products market is bifurcated into OTC and prescription. The OTC segment held a larger market share in 2023, and it is anticipated to register a higher CAGR of 5.1% during 2023–2031. The prescription eye drops are used to treat disorders such as DED and the lowering of intraocular pressure (IOP) in glaucoma patients.

The dry eye products market, by distribution channel, is segmented into retail pharmacy, hospital pharmacy, and online pharmacy. The retail pharmacy segment held the largest market share in 2023. The online pharmacy is anticipated to register the highest CAGR of 5.7% during the forecast period.

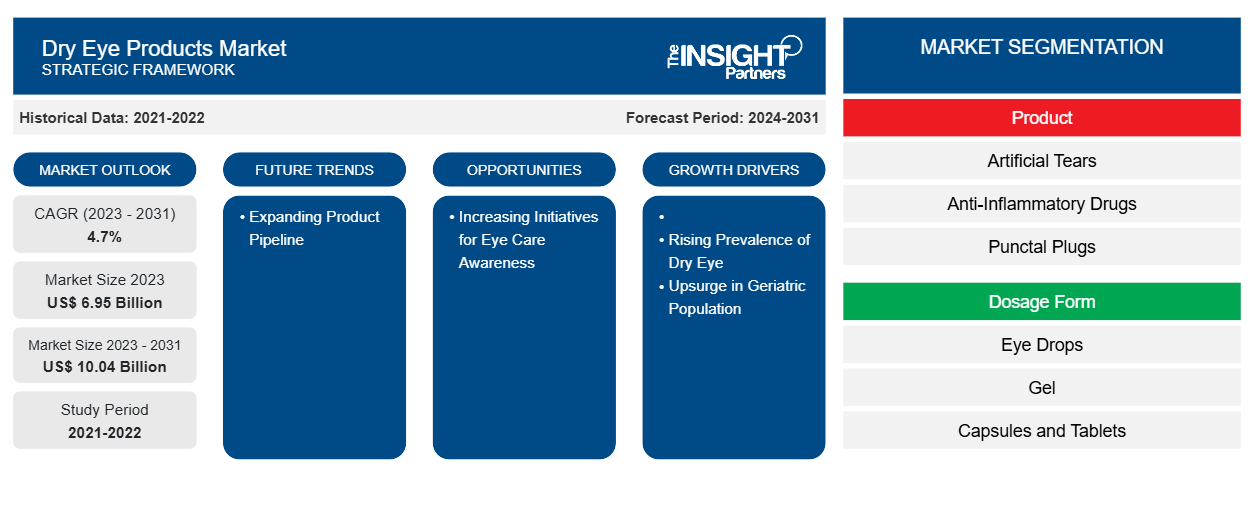

Regional Analysis:

The scope of the dry eye products market report includes North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In 2023, North America accounted for the largest dry eye products market share. The market growth in this region is driven by increasing awareness of dry eyes disease, a growing aging population, technological advancements, and rising eye disease cases. Moreover, the easy availability of various drugs due to frequent launches of new drugs is one of the key factors propelling the market growth in the region.

Europe occupies a significant position in the global dry eye products market, and it is expected to record a strong growth rate during the forecast period. The dry eye products market growth in the region is mainly attributed to rising incidences of glaucoma (leading to the growing cases of dry eye disease), availability of new products, the surging aging population, and rising awareness about DED. Germany is a country with a large number of patients suffering from eye disorders. Due to the widespread occurrence of ophthalmic conditions such as glaucoma, cataracts, and retinal detachments, eye drops have become increasingly important in the country. According to the "Incidence of Retinal Detachment in Germany: Results from the Gutenberg Health Study," published in Ophthalmologica in May 2021, the incidence of retinal detachment disease in Germany was 42 per 100,000 people per year in the age group of 35–74. Compared to estimates from other European nations, Germany has a high incidence of retinal detachment in people from this age group. Thus, the demand for eye drops increases with population aging in Germany.

Dry Eye Products Market Regional Insights

Dry Eye Products Market Regional Insights

The regional trends and factors influencing the Dry Eye Products Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Dry Eye Products Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Dry Eye Products Market

Dry Eye Products Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.95 Billion |

| Market Size by 2031 | US$ 10.04 Billion |

| Global CAGR (2023 - 2031) | 4.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Dry Eye Products Market Players Density: Understanding Its Impact on Business Dynamics

The Dry Eye Products Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Dry Eye Products Market are:

- Santen Pharmaceutical Co., Ltd.,

- Johnson & Johnson,

- OASIS Medical,

- URSAPHARM Arzneimittel GmbH,

- Rohto Pharmaceutical Co Ltd,

- OCuSOFT Inc.,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Dry Eye Products Market top key players overview

Competitive Landscape and Key Companies:

The dry eye products market forecast can help stakeholders in this marketplace plan their growth strategies. Santen Pharmaceutical Co Ltd, Johnson & Johnson, OASIS Medical, URSAPHARM Arzneimittel GmbH, Rohto Pharmaceutical Co Ltd, OCuSOFT Inc, Bausch Health Companies Inc, AbbVie Inc, Prestige Consumer Healthcare Inc, Farmigea SpA, and Alcon AG are among the prominent companies profiled in the dry eye products market report. These companies focus on developing new technologies, upgrading existing products, and expanding their geographic presence to meet the growing consumer demand worldwide. As per company press releases, the following are a few recent developments by major companies in the market:

- In September 2023, Bausch + Lomb Corporation (Bausch + Lomb), a subsidiary of Bausch Health Companies Inc, completed its acquisition of XIIDRA (lifitegrast ophthalmic solution) 5%, a non-steroid eye drop specifically approved to treat the signs and symptoms of dry eye disease. The product specifically focuses on inflammation associated with dry eye and certain other ophthalmology assets.

- In November 2022, Santen Pharmaceutical Co Ltd launched DIQUAS LX Ophthalmic Solution 3% (diquafosol sodium) in Japan. The DIQUAS LX solution is a formulation that requires the administration of one drop three times daily to treat dry eye disease.

- In August 2022, Alcon and Aerie Pharmaceuticals Inc. entered into a definitive merger agreement. As a part of this deal, Alcon acquired Aerie. This transaction helps bolster Alcon’s presence in the ophthalmic pharmaceutical space with its growing portfolio of commercial products and development pipeline.

- In July 2021, TheraTears was acquired by Prestige Consumer Healthcare Inc. The acquisition of TheraTears added to Prestige's leading eye care portfolio and provided the company with new long-term growth prospects.

- In February 2021, Allergan launched Refresh Digital, a new lubricant eye drop designed to specifically relieve dryness and irritation caused by prolonged screen time.

- In June 2020, OCuSOFT Inc. and EKKDA Research LLC entered into a sales-distribution agreement. This partnership helps the partners to establish and develop in the ophthalmology and optometry-related business. EKKDA’s research LLC's projects are focused fundamentally on eye care.

- In May 2020, AbbVie Inc acquired Allergan plc as a part of the company's inorganic business strategy. The acquisition has provided the company access to and expanded its business portfolio in the eye care associated markets.

- In January 2020, Santen Pharmaceutical Co Ltd as a part of its business expansion in China constructed its second plant for its Chinese subsidiary "Santen Pharmaceutical (China) Co Ltd." to support the growing demand for products in China.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Dosage Form, Type, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The dry eye products market majorly consists of the players such as Santen Pharmaceutical Co Ltd, Johnson & Johnson, OASIS Medical, URSAPHARM Arzneimittel GmbH, Rohto Pharmaceutical Co Ltd, OCuSOFT Inc, Bausch Health Companies Inc, AbbVie Inc, Prestige Consumer Healthcare Inc, Farmigea SpA and Alcon AG.

US holds the largest market share in dry eye products market. DED is a common but underdiagnosed condition in the US, and an increase in the population age can be associated with the surging prevalence of this disease. According to the Centers for Disease Control and Prevention (CDC), age-related eye diseases such as cataract, macular degeneration, diabetic retinopathy, and glaucoma are the primary causes of blindness and impaired vision in the US. Other common eye disorders include amblyopia and strabismus. Dry eye disease is expected to affect as many as 2.79 million US men by 2030.

The dry eye products market, based on product, is segmented into artificial tears, anti-inflammatory drugs, punctal plugs, secretagogues, oral omega supplements, and others. The artificial tears segment held the largest dry eye products market share in 2023. The anti-inflammatory drugs segment is anticipated to register the highest CAGR during 2023–2031.

The dry eye products market by dosage form is bifurcated into OTC and prescription. The OTC segment held a larger share of the market in 2023, and it is anticipated to register a higher CAGR of 5.1% during 2023–2031.

The factors that are driving growth of the market are the rising prevalence of dry eye and upsurge in geriatric population.

Dry eye is a condition characterized by the lack of adequate quality of tears to lubricate and nourish the eye or by a quick evaporation of tears. With hormonal changes, as people get older, the tendency to produce tears decreases. Dry eye is common in both males and females. However, more cases are recorded in women, mainly those who have gone through menopause. Dry eye is a chronic condition that doesn’t have a specific cure, but treatments can help manage the symptoms.

The dry eye products market by distribution channel, is categorized into retail pharmacies, hospital pharmacies, and online pharmacies. The retail pharmacies segment held the largest dry eye products market share in 2023. The online pharmacies segment is anticipated to register the highest CAGR of 5.7%.

Asia Pacific is expected to be the fastest growing region in the dry eye products market. The dry eye products market in Asia Pacific is expected to register the highest CAGR during the forecast period. According to NIH, in China, ~20–30% of people are diagnosed with dry eye conditions every year. The dry eye products market in China is quite competitive, with the presence of both domestic and international pharmaceutical companies. Novaliq has established a strategic cooperation with Jiangsu Hengrui Pharmaceuticals to manufacture, develop, and commercialize NOV03 for the treatment of dry eye disease.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Dry Eye Products Market

- Santen Pharmaceutical Co., Ltd.

- Johnson & Johnson

- OASIS Medical

- URSAPHARM Arzneimittel GmbH

- Rohto Pharmaceutical Co Ltd

- OCuSOFT Inc.

- Bausch Health Companies Inc

- AbbVie Inc

- Prestige Consumer Healthcare Inc.

- Farmigea SpA

- Alcon AG

Get Free Sample For

Get Free Sample For