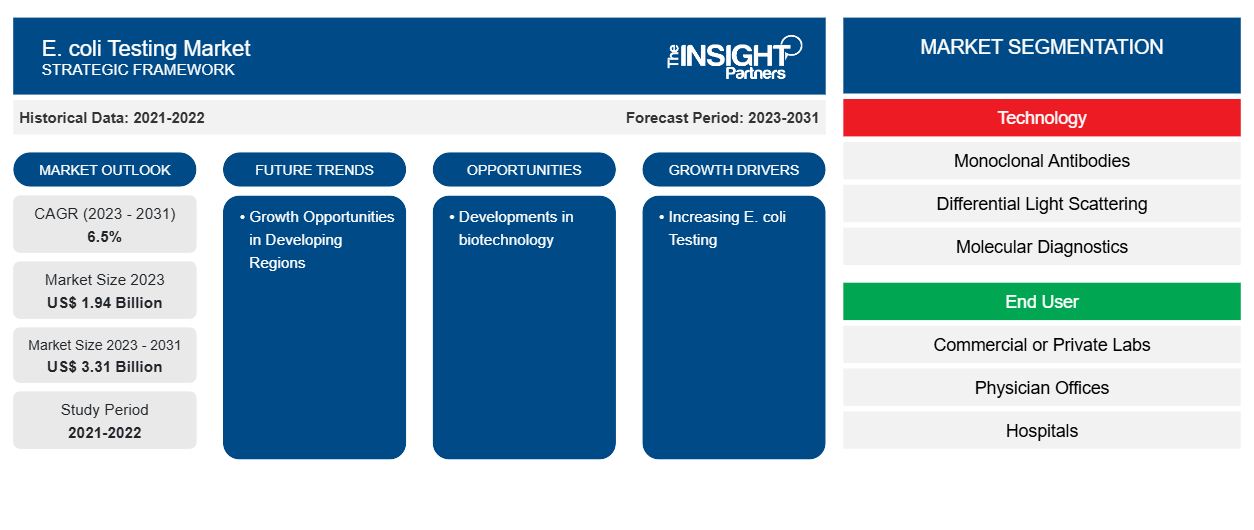

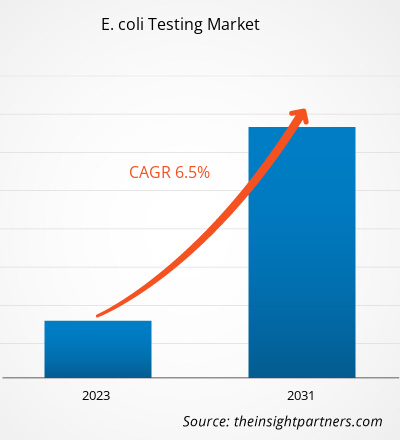

The E. coli testing market was valued at US$ 1.94 billion in 2023 and is expected to reach US$ 3.31 billion by 2031. The market is expected to register a CAGR of 6.5% in 2023–2031. Developments in biotechnology will likely remain a key E. coli testing market trend.

E. coli Testing Market Analysis

Escherichia coli (E. coli) are rod-shaped gram-negative bacteria generally available in warm-blooded animals' food, environment, and intestines. The majority of the E. coli strains are typically harmless to humans. Still, some strains are recognized as the reason for serious medical complications, such as gastrointestinal tract infections, cholecystitis, cholangitis, neonatal meningitis, bacteremia, pneumonia, urinary tract infection (UTI), and regularly spread via polluted food or water. Key factors driving the market, such as increasing E. coli testing, growing product innovation, and rising research activities, are expected to propel the market's growth. However, testing challenges is the major factor hindering the market growth

E. coli Testing Market Overview

Awareness regarding hygiene, stringent government regulations, and the presence of all key regional players are the major driving factors for this market. In addition, high R&D spending to develop new diagnostic products and sophisticated infrastructure are prominent factors propelling the market growth. Furthermore, increased government funding for healthcare infrastructure and technological advancements in E. coli diagnostic procedures, major market players in the U.S., and awareness regarding hygiene drive the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

E. coli Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

E. coli Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

E. coli Testing Market Drivers and Opportunities

Increasing E. coli Testing

Escherichia coli is a large group of foodborne bacteria found in food, the environment, and the intestines of animals and humans. Although most types of E coli are harmless and help keep the digestive tract healthy, a few strains can cause tract infections, respiratory illness, and pneumonia, among others. Most instances of food poisoning and infectious diseases is caused due to E. coli. Therefore, detecting the concentration E. coli in various products is essential. Apart from industrial sectors such as pharmaceutical, biotechnology, and environmental, the food & beverages sector is at a higher risk of E coli contamination. Food & beverage companies must detect and monitor the presence of the bacteria before starting production, during the production process, and in the final products.

Growth Opportunities in Developing Regions– An Opportunity in E. coli Testing Market

Regions such as Asia Pacific, the Middle East, Africa, and Latin America are developing their healthcare sector faster. The countries are exploring new techniques by collaborating with well-established biotechnology organizations in the developed regions. Countries such as India, Brazil, the UAE, Saudi Arabia, and South Korea have increased their investments for the development biotechnology sector. For instance, the UAE government launched a project called DuBiotech, or Dubai Biotechnology and Research Park in 2005.

The government has invested US$ 35.4 million (AED 130 million) in infrastructure and US$ 163.4 million (AED 600 million) in laboratories and headquarters buildings. Likewise, the Department of Biotechnology in India is expected to make the Indian Biotechnology industry worth US$ 100 billion by 2025. Thus, rising investments in the biotechnology sector are expected to drive growth opportunities for E. coli testing services and facilities in developing regions. In addition, the regions have rising numbers of biotechnology start-ups contributing to developing the biotechnology sector. Various start-ups have launched their innovative products and services in the biotechnology field, which is expected to influence the market growth during the forecast period.

E. coli Testing Market Report Segmentation Analysis

Key segments that contributed to the derivation of the E. coli testing market analysis are disorder and service providers.

- Based on test technology, the E. coli testing market is segmented into monoclonal antibodies, differential light scattering, molecular diagnostics, immunoassays, chromatography, flow cytometry, gel microdroplets, and diagnostic imaging. The monoclonal antibodies segment held a larger market share in 2023.

- By end users, the E. coli testing market is segmented into commercial or private labs, physician offices, hospitals, public health labs, academic research institutes. The public health labs segment held the largest share of the market in 2023.

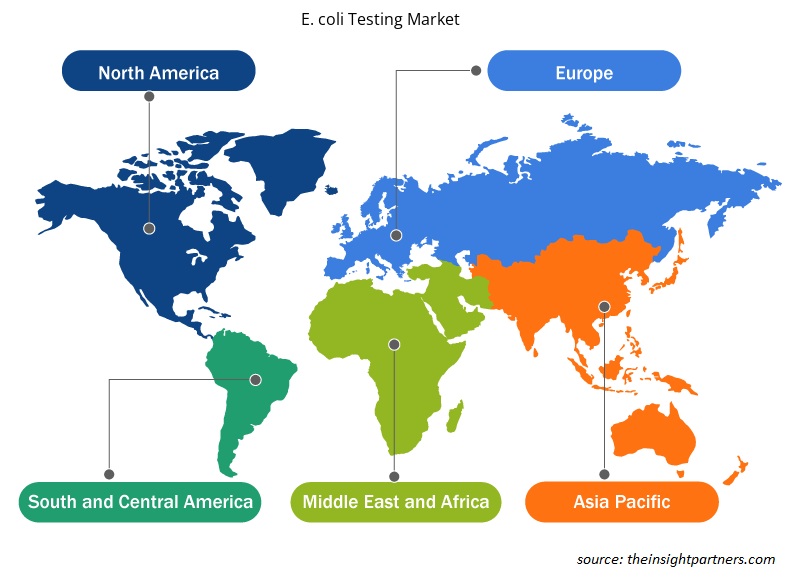

E. coli Testing Market Share Analysis by Geography

The geographic scope of the E. coli testing market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

In North America, the U.S. is the largest market for E. coli testing. The growth of this market is primarily driven by increased government funding for healthcare infrastructure and technological advancement in E. coli diagnostic procedures; the presence of major market players in the U.S. and awareness regarding hygiene will accelerate the growth of this market in this country.

E. coli O157:H7 is one of the strains and produces a toxin known as Shiga. It is one of the most powerful toxins, and it can cause an intestinal infection. According to the North Carolina Department of Health and Human Services, some 265,000 Shiga toxin-producing E. coli (STEC) infections occur yearly in the United States (U.S.). Around 36 percent of these are probably caused by E. coli O157:H7. Moreover, UTIs result in approximately 8 million physician visits and over 100,000 hospitalizations in the United States, with an associated annual cost of $1.6 billion.

E. coli Testing Market Regional Insights

E. coli Testing Market Regional Insights

The regional trends and factors influencing the E. coli Testing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses E. coli Testing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for E. coli Testing Market

E. coli Testing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.94 Billion |

| Market Size by 2031 | US$ 3.31 Billion |

| Global CAGR (2023 - 2031) | 6.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

E. coli Testing Market Players Density: Understanding Its Impact on Business Dynamics

The E. coli Testing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the E. coli Testing Market are:

- BIO-RAD LABORATORIES INC.

- Pro Lab Diagnostics Inc.

- Abbott

- IDEXX LABORATORIES, INC

- MERIDIAN BIOSCIENCE, INC

- THERMO FISHER SCIENTIFIC INC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the E. coli Testing Market top key players overview

E. coli Testing Market News and Recent Developments

The E. coli testing market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for E. coli testing:

- The E. Coli water testing kit, based on an enzyme-substrate medium, was created by researchers at the Indian Institute of Technology (IIT) Kanpur. It can identify whether or not E. Coli is present in drinking water. (Source: Research Article, 2022).

- In order to better understand the diversity and effects of the same bacteria, researchers at Michigan State University experimented with Escherichia coli. According to the researchers, this experiment demonstrates that the advantages of early variety were quickly lost throughout succeeding generations, indicating that random mutations serve as the primary catalyst for E. coli evolution. (Source: Michigan State University, Press Release, 2022).

E. coli Testing Market Report Coverage and Deliverables

The “E. coli Testing Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology ; End User ; and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For