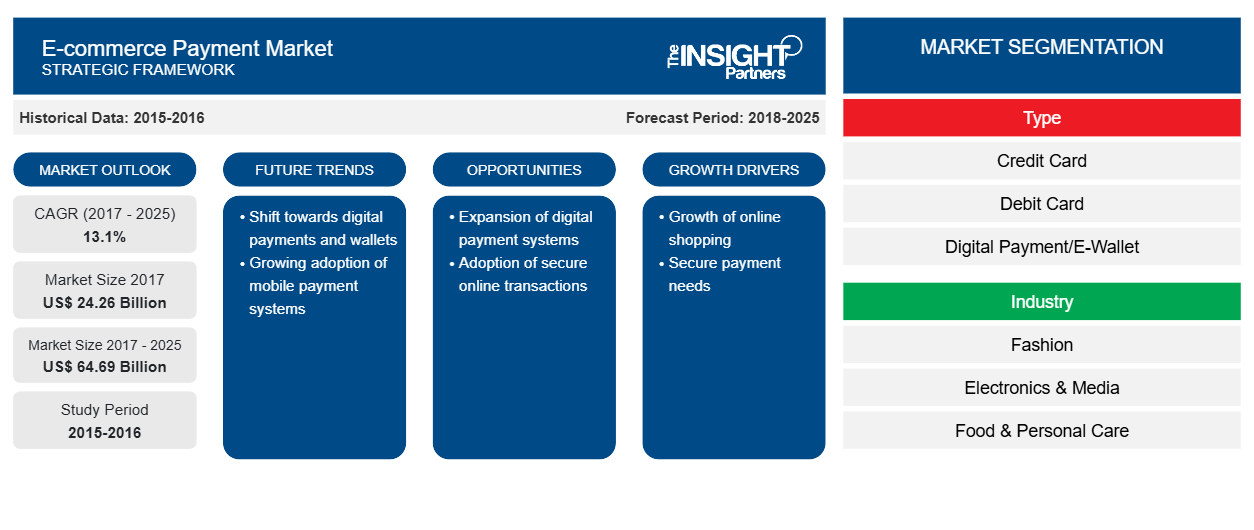

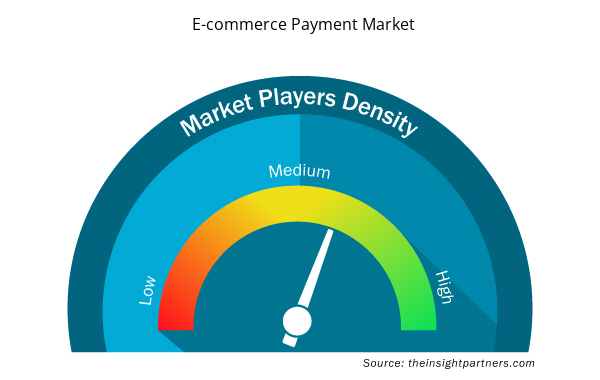

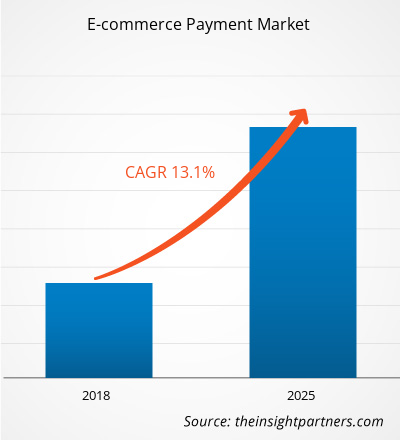

The Global e-commerce payment market is expected to grow from US$ 24.26 Bn in 2017 to US$ 64.69 Bn by 2025 at a CAGR of 13.1% between 2018 and 2025.

E-commerce payment market is experiencing growth all across the globe, with the rising preference for making online payments due to the availability of several payment methods. Furthermore, the rising adoption of smartphones and availability of internet is also propelling the e-commerce payment market growth. Moreover, the increasing number of banking population and digitalization, the e-commerce payment market is anticipated to flourish during the forecast period. The report focuses on an in-depth segmentation of E-Commerce Payment market based by type, industry vertical and geography.

Market Insights

APAC is recognized as the leading region throughout the forecast period

The Asia Pacific region comprises of several developing countries such as South Korea, India, Indonesia, and Malaysia among others. These countries are witnessing a high growth in their population, resulting in growth of e-commerce payment market. The e-commerce industry of the region is blooming with increasing penetration of internet as well as high adoption of smartphones and tablets. Also, the governments of emerging economies are taking initiatives for improving the banking population thus, providing better platform to online payment industry. Recently, a shift has been noticed wherein, consumers across APAC are preferring to pay online via alternative payment methods such as e-wallets, bank transfers and credit & debit cards. The increasing use of these payment methods is expected to significantly contribute towards the growth of payment gateways in e-commerce industry during the forecast period. These factors are anticipated to further propel the demand for e-commerce payment market in APAC region.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

E-commerce Payment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

E-commerce Payment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Business Model in Retail remains untapped in Middle East region thus offering huge potential for industry players

Digital payments in the Middle East are at a breaking point as regulations, culture and technology witness paradigm shifts, opening the door for innovative companies to disrupt the oldest payment ecosystems. More than 80% of brick-and-mortar retail payments and 65% of e-commerce payments are still made in cash, and smartphone adoption exceeds 100% in several countries. Mobile penetration in the MEA region is on the verge of a new era that is driven by evolving consumer behavior, rapid industrialization, government ambitions, and changing economic condition. The opportunities have been identified in the growth in data access and revenues, which are becoming substantial and growing strongly; and also in digital payment services. This is being validated by the fact that the smartphone penetration in the region is greater than 65%. In addition, more than two-thirds of the population use the Internet, with penetration in the U.A.E. and Qatar exceeding 90%. The region has a substantial population of wealthy individuals with an appetite for luxury goods.Market initiative was observed as the most adopted strategy in global E-Commerce Payment market. Few of the recent strategies by some of the players in E-Commerce Payment market landscape are listed below-

2018:PayPal announced the extension of its partnership agreement with eBay. Through this agreement eBay continue to promote and accept PayPal Credit through marketplace platform.

2018:Alipay announced the launch itself in 20 European countries at the end of this year. The company signed contracts with over 40 digital wallets companies and 100 banks across Europe.

2018:Visa, Inc. announced the extension of its partnership with PayPal to Canada, for accelerating the implementation of reliable, secure, and appropriate mobile and digital payments for merchants and consumers.

E-commerce Payment Market Regional Insights

E-commerce Payment Market Regional Insights

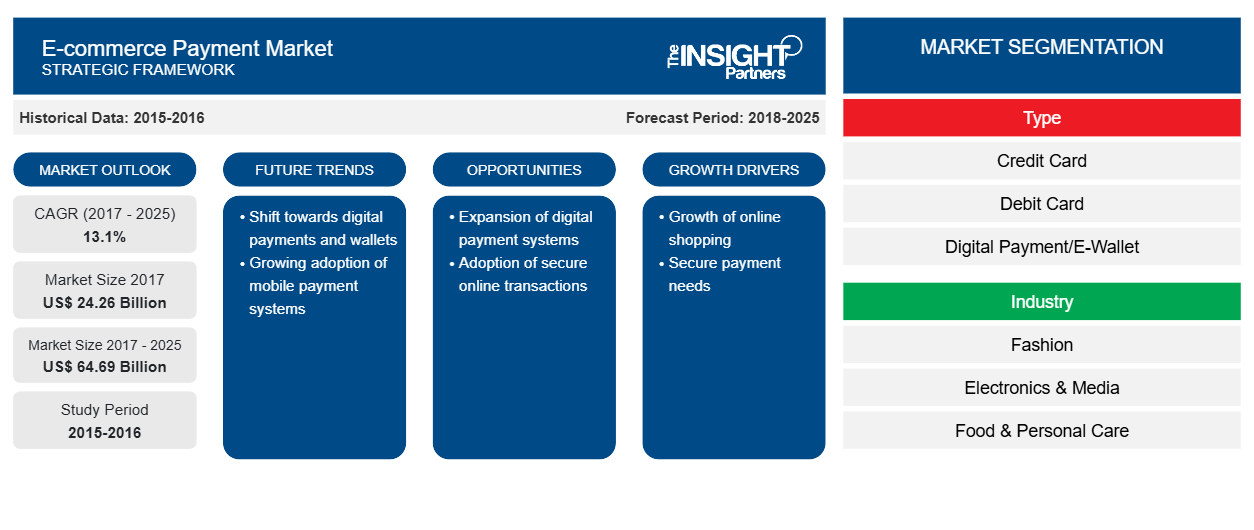

The regional trends and factors influencing the E-commerce Payment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses E-commerce Payment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for E-commerce Payment Market

E-commerce Payment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2017 | US$ 24.26 Billion |

| Market Size by 2025 | US$ 64.69 Billion |

| Global CAGR (2017 - 2025) | 13.1% |

| Historical Data | 2015-2016 |

| Forecast period | 2018-2025 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

E-commerce Payment Market Players Density: Understanding Its Impact on Business Dynamics

The E-commerce Payment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the E-commerce Payment Market are:

- PayPal Holdings, Inc.

- Amazon Payments, Inc.

- CCBill, LLC

- WePay Inc.

- Alipay

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the E-commerce Payment Market top key players overview

Global E-Commerce Payment Market Segmentation

By Type

- Credit Card

- Debit Card

- Digital Payment/ E-Wallet

- Net Banking

- Gift Cards

- Others

By Industry

- Fashion

- Electronics & Media

- Food & Personal Care

- Furniture and Appliances

- Service Industry

- Others

By Geography

North America

- U.S.

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- Spain

- UK

- Rest of Europe

Asia Pacific (APAC)

- Australia

- China

- India

- Japan

- Rest of APAC

Middle East and Africa (MEA)

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

South America (SAM)

- Brazil

- Rest of SAM

Company Profiles

- PayPal Holdings, Inc.

- Amazon Payments, Inc.

- CCBill, LLC

- WePay Inc.

- Alipay

- Visa, Inc.

- MasterCard Incorporated

- Stripe Inc.

- American Express Company

- UnionPay International Co., Ltd.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Asset Integrity Management Market

- Oxy-fuel Combustion Technology Market

- Online Recruitment Market

- Environmental Consulting Service Market

- Identity Verification Market

- Mice Model Market

- Ceramic Injection Molding Market

- Surgical Gowns Market

- Terahertz Technology Market

- Battery Testing Equipment Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type ; and Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

1. PayPal Holdings, Inc.

2. Amazon Payments, Inc.

3. CCBill, LLC

4. WePay Inc.

5. Alipay

6. Visa, Inc.

7. MasterCard Incorporated

8. Stripe Inc.

9. American Express Company

10. UnionPay International Co., Ltd.

Get Free Sample For

Get Free Sample For