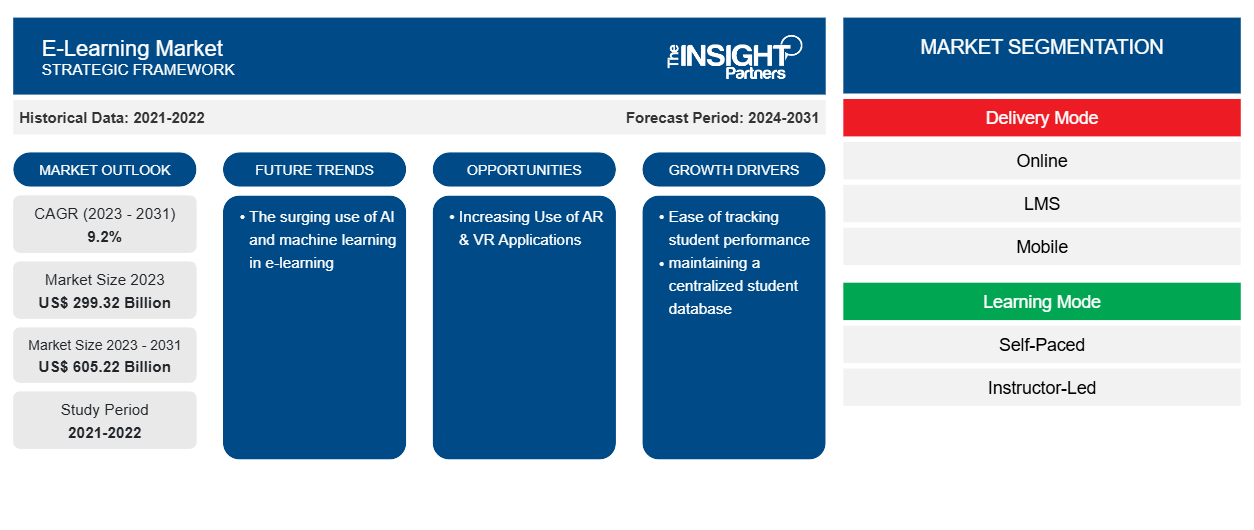

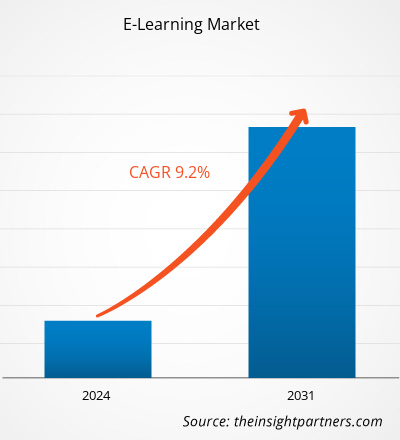

The E-Learning market size is projected to reach US$ 605.22 billion by 2031 from US$ 299.32 billion in 2023. The market is expected to register a CAGR of 9.2% during 2023–2031. The surging use of AI and machine learning in e-learning is likely to remain a key trend in the market.

E-Learning Market Analysis

Online and technology-driven education has surpassed classroom-based education in terms of cost, accessibility, time, and convenience. Students can enhance their skills by enrolling in courses provided by top experts and universities worldwide. Aside from students, working professionals are another important target segment for digital learning organizations. Online certifications have become increasingly popular in today's competitive corporate climate. Continuous skill upgrading is expected in various industries, including IT, BPOs, KPOs, and start-ups. Corporate personnel are increasingly taking online courses to remain ahead of the curve, while most professionals demand certificates for their jobs.

E-Learning Market Overview

The digital learning market is rapidly expanding in developing countries, with a high number of start-ups joining the sector. The digital learning sector is driven by factors such as increased internet usage, time constraints, geographical obstacles, and reduced costs for online training. These drivers promote self-paced learning and expand its scope. As the demand for quality certification grows, more people are turning to online learning programs.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

E-Learning Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

E-Learning Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

E-Learning Market Drivers and Opportunities

Rising Number of Connected Devices and Growing Internet Penetration to Favor the Market

The demand for connected devices, such as tablets, laptops, and smartphones, is increasing globally. The demand is further catalyzed due to learn-from-home and work-from-home scenarios. As students could not attend school or tuition classes due to the lockdown and social distancing measures due to the COVID-19 pandemic, their education was conducted online, eventually propelling the demand for smartphones and laptops. Moreover, the development of telecommunication services globally has led to a rise in internet penetration, even in the remote areas of the world, this is supplementing the global e-learning market.

Increasing Use of AR & VR Applications

In recent years, Augmented Reality (AR) and Virtual Reality (VR) technologies have gained appeal in the education and training industries as excellent methods for improving the learning experience. AR and VR can provide remote and flexible learning, allowing students to access training materials and simulations from anywhere in the world. This can be especially useful when students are unable to attend in-person training sessions.

E-Learning Market Report Segmentation Analysis

Key segments that contributed to the derivation of the E-Learning market analysis are delivery mode, learning mode, and end user.

- Based on delivery mode, the E-Learning market is divided into online, LMS, mobile, and others. The online segment held a larger market share in 2023.

- By learning mode, the market is segmented into self-paced and instructor-led.

- By end user, the market is segmented into academic and corporate. K-12 and higher institutions are the prominent sub-segments of the end user segment.

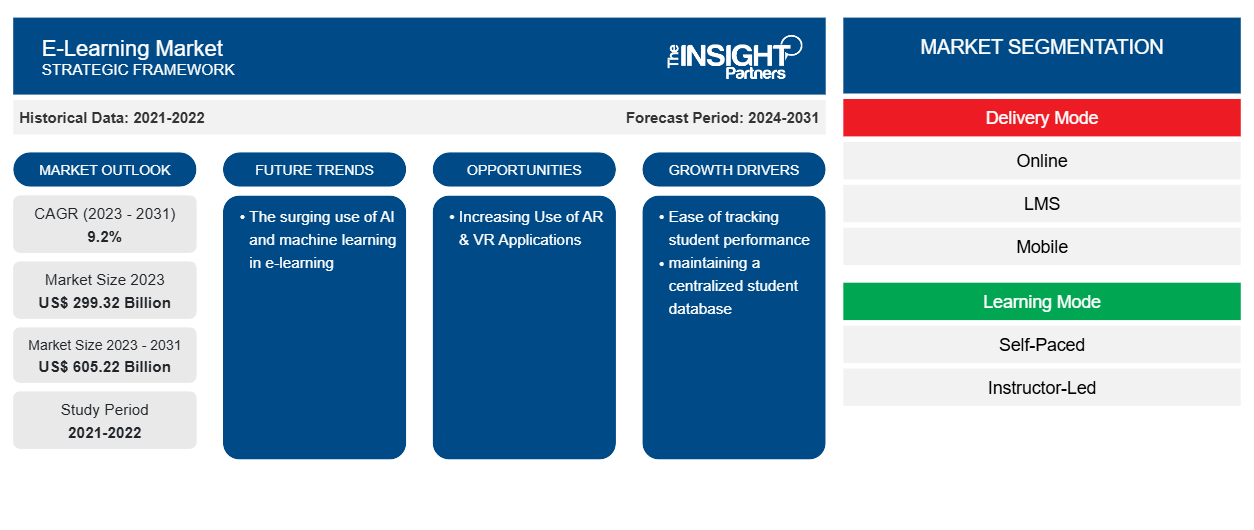

E-Learning Market Share Analysis by Geography

The geographic scope of the E-Learning market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America dominated the E-Learning market share in 2023. As per the HurixDigital 2023 report, the US is one of the world's leading countries in terms of successful eLearning implementation in education.

E-Learning Market Regional Insights

The regional trends and factors influencing the E-Learning Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses E-Learning Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for E-Learning Market

E-Learning Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 299.32 Billion |

| Market Size by 2031 | US$ 605.22 Billion |

| Global CAGR (2023 - 2031) | 9.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Delivery Mode

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

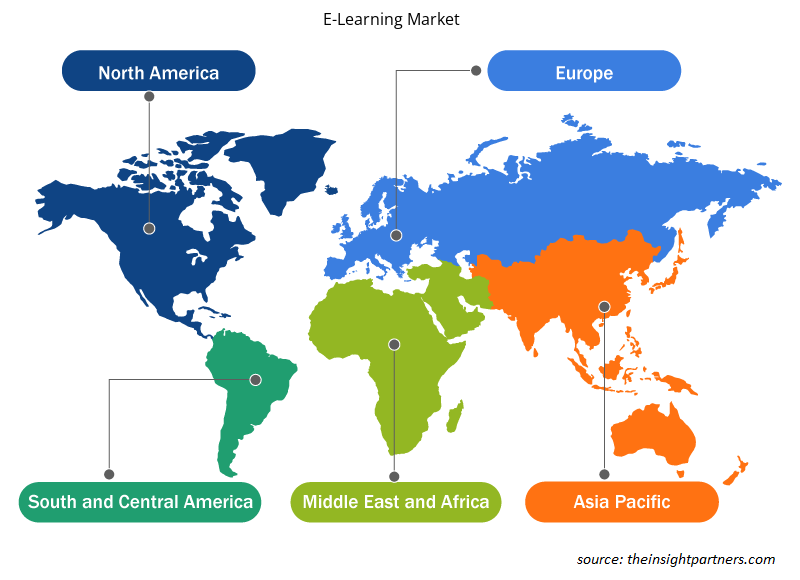

E-Learning Market Players Density: Understanding Its Impact on Business Dynamics

The E-Learning Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the E-Learning Market are:

- Coursera

- edX

- LinkedIn Learning

- Skillshare

- Skillsoft

- Udacity

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the E-Learning Market top key players overview

E-Learning Market News and Recent Developments

The E-Learning market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the E-Learning market are listed below:

- William Woods University WWU) today officially announced an agreement with Coursera, a global online learning platform, that will significantly expand access to digital content that is relevant to today’s workplace, offering skills training and industry-recognized certifications of in-demand job skills to WWU students, staff, alumni and university partners. The new partnership will allow William Woods to learn from over 325 top universities and companies on Coursera, with online courses and credentials in a variety of disciplines and thread it into the university’s curriculum, further enhancing the academic experience and employment marketability of every WWU student. (Source: William Woods University, Press Release, February 2024)

- edX and Degreed announced an expanded strategic partnership to provide organizations with premier educational content and platform solutions that drive skills-based learning. Now, edX For Business – a best-in-class content solution for organizations looking to drive more impactful learning and development programs – is available to organizations and their employees directly within the Degreed platform, reflecting a concerted effort to redefine how companies train, upskill, and retain talent across every level of their workforce. (Source: edX, Press Release, December 2023)

E-Learning Market Report Coverage and Deliverables

The “E-Learning Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- E-Learning market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- E-learning market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- E-learning market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the E-Learning market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Space Situational Awareness (SSA) Market

- Collagen Peptides Market

- High Speed Cable Market

- Animal Genetics Market

- Formwork System Market

- Airport Runway FOD Detection Systems Market

- Human Microbiome Market

- Data Annotation Tools Market

- Green Hydrogen Market

- Excimer & Femtosecond Ophthalmic Lasers Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Delivery Mode, Learning Mode, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, New Zealand, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America dominated the E-Learning market in 2023.

Ease of tracking student performance and maintaining a centralized student database are expected to drive the E-Learning market.

The surging use of AI and machine learning in e-learning is likely to remain a key trends in the market.

Coursera, edX, LinkedIn Learning, Skillshare, Skillsoft, Udacity, Khan Academy, Learning Pool, Pluralsight, Blackboard, Adobe Inc, Aptara, AllenComm, Plato eLearning, LLC, FutureLearn, Infopro Learning, Instructure, iSpring Solutions, Absorb, Allen Interactions Inc, Cisco Systems Inc are among the leading payers operating in the E-Learning market.

The E-Learning market size is projected to reach US$ 605.22 billion by 2031

The E-Learning market is expected to register a CAGR of 9.2% during 2023–2031

Get Free Sample For

Get Free Sample For