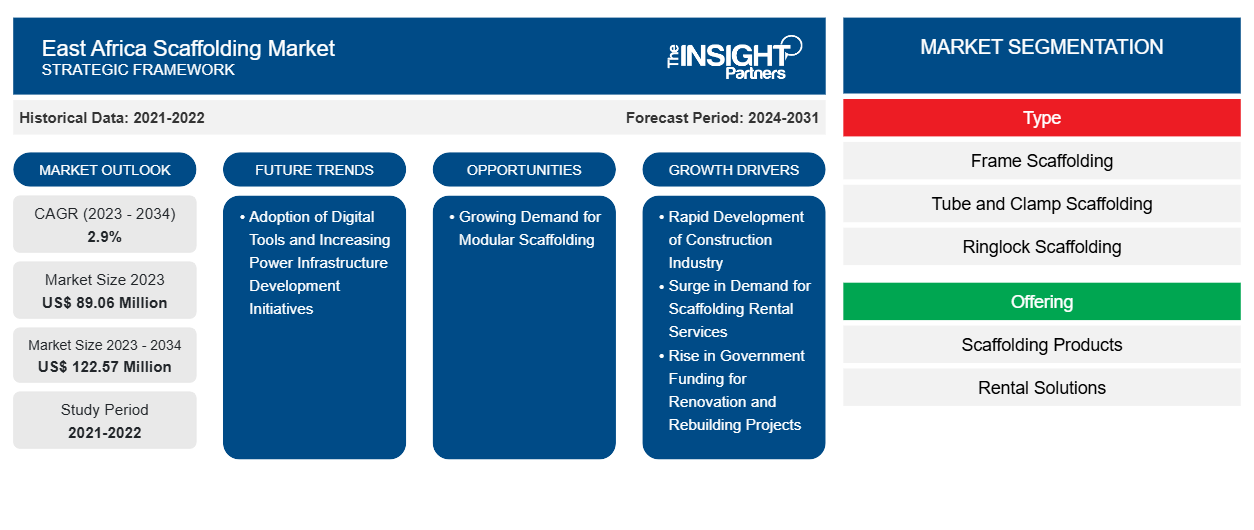

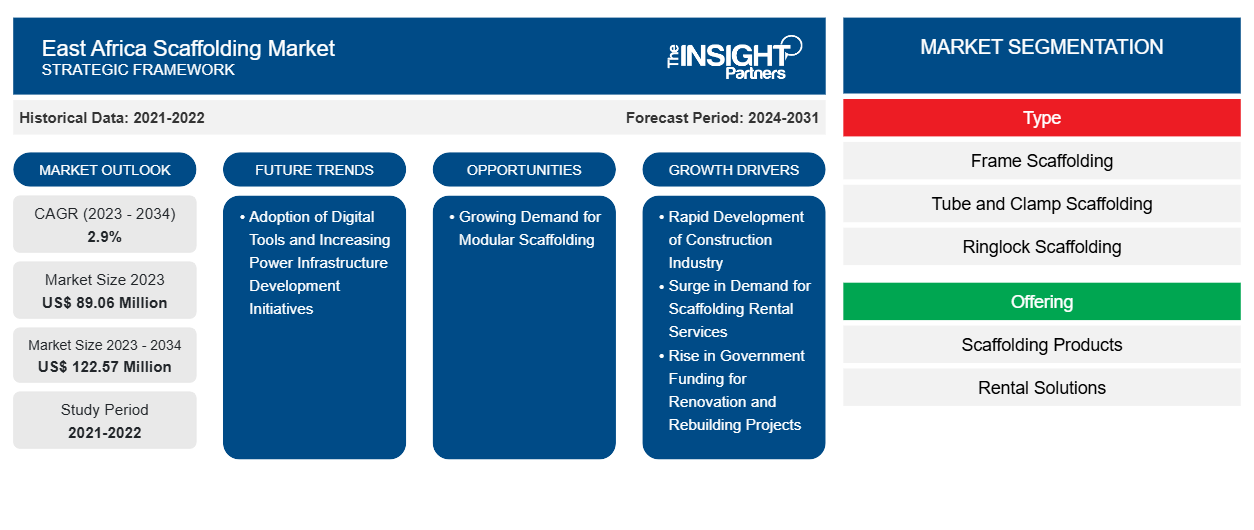

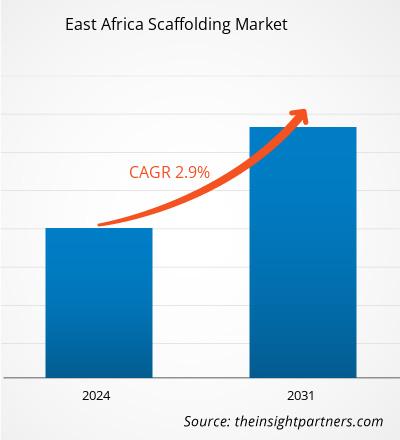

The scaffolding market size is projected to reach US$ 122.57 million by 2034 from US$ 89.06 million in 2023. The market is expected to register a CAGR of 2.9% during 2023–2034. Growing demand for modular scaffolding is likely to bring new key trends in the market in the coming years.

Scaffolding Market Analysis

Key factors fueling the East Africa scaffolding market include the rapid growth of the construction industry, surge in demand for scaffolding rental services, and rise in government funding for renovation and rebuilding projects. However, high initial investment and the presence of alternatives hamper the East Africa scaffolding market growth. Moreover, the adoption of digital tools and the rise in energy infrastructure development projects are projected to create opportunities for the key companies operating in the East Africa scaffolding market during the forecast period. Further, the growing demand for modular scaffolding is expected to be the key trend in the East Africa scaffolding market from 2023 to 2034.

The increasing need for residential and commercial construction and rising spending on renovation and retrofitting activities are positively impacting the growth of the East Africa scaffolding market. The restoration of historic buildings requires delicate work to preserve their original features. Scaffolding offers a safe and minimally intrusive method for restoration and maintenance without compromising the building's integrity. Governments of various countries in East Africa are actively promoting real estate by launching initiatives such as offering tax incentives, facilitating property registration, and prioritizing affordable housing. These measures aim to boost both local and foreign direct investment in the construction sector.

Scaffolding Market Overview

The East Africa scaffolding market is segmented into Tanzania, Uganda, Rwanda, Kenya, and the Rest of East Africa. The East Africa scaffolding market is expected to record a CAGR of 2.9% during the forecast period owing to the rise in demand for scaffolding products and rental services from residential, commercial, industrial, and other sectors. Many countries in East Africa are aiming to develop their land and economy by building infrastructure and residential areas. The construction industry in East Africa has been growing in recent years, driven by rapid urbanization, infrastructure development, and strategic investments. The construction industry is among the major end users of scaffolding in the region. These construction projects involving scaffolding include road construction, airport upgradation, rehabilitation of port facilities, oil and gas pipeline infrastructure, upstream refinery construction, and renewable energy projects, among others.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

East Africa Scaffolding Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

East Africa Scaffolding Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Scaffolding Market Drivers and Opportunities

Rapid Development of Construction Industry

Increased demand for residential and commercial complexes, a rise in government initiatives, and increased high-rise constructions in residential, commercial, and industrial settings are a few factors contributing to the growth of the construction industry. A few construction projects include residential buildings, commercial complexes, infrastructure development, and industrial facilities. As per the report by the African Development Bank, East Africa is anticipated to achieve an average real GDP growth of 5% in 2023, exceeding estimates for the entire Africa. The total population of East Africa is currently 480 million and is expected to more than double by 2050.

Uganda records the highest urbanization growth rate worldwide, i.e., ~5.7%, according to UN-Habitat. As a result, there is a high demand for apartment complexes and gated communities that support government affordable housing initiatives. The commercial, retail, and industrial sectors are also experiencing significant growth, which is driven by a growing middle class and increasing consumer spending. To meet the increasing consumer demand for various goods and tourism sector, there is a rise in the construction of shopping centers, office buildings, hotels, and restaurants. Ethiopia, Tanzania, and Kenya are among the top countries focused on the development of the construction sector. As per the Kenya National Bureau of Statistics, the value of construction production in the country increased by 4.1% to US$ 17.29 billion in 2022, and the sector contributed 7.1% to gross domestic product (GDP). Thus, the rapid development of the construction industry drives the growth of the East Africa scaffolding market.

Adoption of Digital Tools

Digitalization is growing notably across industries, especially in the construction industry. Digital tools such as Building Information Modelling (BIM) are widely used in this industry. BIM enables the user to create a virtual 3D model of the construction as well as scaffoldings. 3D modeling of the construction and scaffolding enables contractors and construction companies to plan required materials and types of scaffolding accurately, which helps reduce errors in the designs. This leads to effective and efficient usage of resources, which ultimately reduces the operation costs.

Digital tools provide data analytics and insights that help scaffold providers to optimize inventory management, resource allocation, and project scheduling. By leveraging digital tools and automation, scaffold manufacturers and providers can offer advanced solutions that streamline operations, enhance safety, and improve overall project efficiency. Thus, the rising adoption of digital tools by scaffolding manufacturers and construction companies is anticipated to create lucrative opportunities for the key players operating in the East Africa scaffolding market growth during the forecast period.

Scaffolding Market Report Segmentation Analysis

Key segments that contributed to the derivation of the East Africa scaffolding market analysis are type, offering, and application.

- In terms of offering, the East Africa scaffolding market is bifurcated into scaffolding products (sale) and rental solutions. The rental solutions segment held a larger share of the market in 2023.

- Based on type, the East Africa scaffolding market is segmented into frame scaffolding, tube and clamp scaffolding, ring lock scaffolding, cup lock scaffolding, and other conventional scaffolding. The tube and clamp scaffolding segment dominated the market in 2023.

- In terms of application, the East Africa scaffolding market is categorized into residential buildings, commercial buildings, industrial, oil and gas, and events. The commercial building segment held the largest share of the market in 2023.

East Africa Scaffolding Market Regional Insights

The regional trends and factors influencing the East Africa Scaffolding Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses East Africa Scaffolding Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for East Africa Scaffolding Market

East Africa Scaffolding Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 89.06 Million |

| Market Size by 2034 | US$ 122.57 Million |

| Global CAGR (2023 - 2034) | 2.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | East Africa

|

| Market leaders and key company profiles |

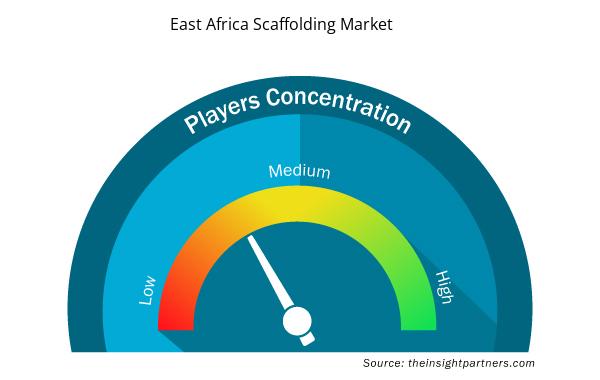

East Africa Scaffolding Market Players Density: Understanding Its Impact on Business Dynamics

The East Africa Scaffolding Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the East Africa Scaffolding Market are:

- HUGO Scaffolds Limited

- Wapo Scaffolding (T) Limited

- Southey Contracting

- Liberty Events and Contracts Scaffolding Ltd.

- Form-Scaff (Parent - WACO International)

- SA Scaffold Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the East Africa Scaffolding Market top key players overview

Scaffolding Market Share Analysis

The geographic scope of the scaffolding market report offers a detailed country analysis. Tanzania, Uganda, and Kenya are major countries witnessing significant growth in the scaffolding market. Tanzania dominated the scaffolding market in 2023 with a share of 22.9%; it is likely to continue to dominate the scaffolding market during the forecast period. Kenya is the second-largest contributor to the scaffolding market, followed by Uganda. The rise in demand for scaffolding from residential, commercial, and industrial construction projects drives the demand for scaffolding in Tanzania. According to the project registration data from the Tanzania Investment Center (TIC), from July 2022 to June 2023, TIC registered 369 projects worth US$ 5.4 billion.

The rise in government initiatives and investment in the development of infrastructure projects in various sectors, including transportation, manufacturing, construction, and energy and power, is expected to fuel the market growth in the coming years. The most valuable construction project in East Africa is the Likong’o–Mchinga LNG project in Tanzania. The project is expected to be worth US$ 30 billion, and it is the most expensive LNG plant in the country. The construction is likely to be completed by 2028. The Bagamoyo Mega Port is another project in Tanzania valued at US$ 10 billion; it is expected to be the largest port in East Central Africa.

Scaffolding Market Report Coverage and Deliverables

The "Scaffolding Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Scaffolding market size and forecast at country levels for all the key market segments covered under the scope

- Scaffolding market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Scaffolding market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the scaffolding market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The Tanzania dominated the East Africa scaffolding market in 2023.

Growing demand for modular scaffolding is the key future trend of the East Africa scaffolding market.

Rapid development of construction industry, surge in demand for scaffolding rental services, and rise in government funding for renovation and rebuilding projects are the driving factors in the market.

The estimated value of the East Africa scaffolding market by 2034 is US$ 122.57 million.

HUGO Scaffolds Limited, Wapo Scaffolding (T) Limited, Southey Contracting, Liberty Events and Contracts Scaffolding Ltd., Form-Scaff (Parent - WACO International), SA Scaffold Group, Kasthew Construction Uganda, Neetoo Industries & Co. Ltd., Afix Scaff (Mauritius) Ltd, and ACE SCAFFOLDINGS Co Limited are the leading players operating in the East Africa scaffolding market.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - East Africa Scaffolding Market

- HUGO Scaffolds Limited

- Wapo Scaffolding (T) Limited

- Southey Contracting

- Liberty Events and Contracts Scaffolding Ltd.

- Form-Scaff (Parent - WACO International)

- SA Scaffold Group

- Kasthew Construction Uganda

- Neetoo Industries & Co. Ltd.

- Afix Scaff (Mauritius) Ltd

- ACE SCAFFOLDINGS Co Limited

Get Free Sample For

Get Free Sample For