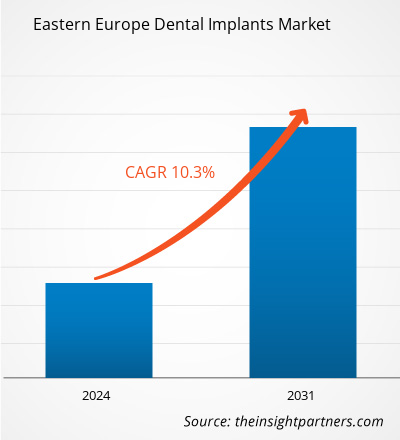

The Eastern Europe dental implants market size is projected to reach US$ 452.14 million by 2031 from US$ 208.74 million in 2023. The market is expected to register a CAGR of 10.3% during 2023–2031. Increasing adoption of mini-dental implants is likely to remain a key trend in the market.

Eastern Europe Dental Implants Market Analysis

Dental implants are surgical devices implanted into the jaw to restore a person's ability to chew and their appearance. They provide support for artificial teeth, such as crowns, bridges, or dentures. Unlike regular teeth that support bridgework, the materials in implants cannot decay. The titanium in the implants fuses with the jawbone, and the implants do not slip, make noise, or cause bone damage. The growing medical tourism in Eastern European countries and technological advancements in dental implants are the key factors driving the market.

Eastern Europe Dental Implants Market Overview

In recent years, medical tourism has gained considerable popularity for dental implant treatments due to the availability of services at substantially lower costs. Most Americans seek dental treatments in Eastern European countries, such as Hungary, Poland, and Turkey. Dental tourism is an increasingly important part of medical tourism. The dental tourism industry in Hungary has experienced significant growth in recent years, making it a popular choice among those seeking dental care and cosmetic procedures. The country is known for its high-quality dental services, skilled professionals, and competitive pricing, attracting many medical tourists. According to the Dental Tourism Association, more than 40% of European dental tourists opt for Hungary as their treatment destination. The number of dental tourists visiting the country has been steadily increasing year by year. In 2021, Hungary welcomed over 50,000 dental tourists, treating more than 100,000 cases. The majority of these tourists (around 70%) come from Western Europe, with a growing number also traveling from the UK, North America, and other regions.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Eastern Europe Dental Implants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Eastern Europe Dental Implants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Eastern Europe Dental Implants Market Drivers and Opportunities

Rising Technological Advancements in Dental Implants Favors Market Growth

The field of dental implants has experienced several advancements due to groundbreaking innovations and technologies. 3D printing, nanotechnology, smart implants, regenerative dentistry, immediate loading, and laser-guided procedures have made implants more effective, efficient, and patient-friendly. These advancements promise greater comfort, reliability, and longevity, making dental implants the preferred solution for restoring smiles and improving overall oral health. 3D printing technology has revolutionized the customization of dental implants. This advancement allows for tailoring implants as per the unique anatomy of each patient's jawbone. Eastern European dental clinics are increasingly adopting this technology, recognizing its potential to improve surgical outcomes and patient satisfaction. The precision of 3D-printed implants ensures a better fit and reduces the risk of complications.

Consolidation of Dental Practices and Rising Dental Service Organization Activities to Create Significant Opportunities

A report by McCleskey in March 2024 highlighted that the dental industry is approximately 35% consolidated, signaling that it is about halfway through the ongoing consolidation wave. Consolidation is projected to reach 60–70% within the next 5–7 years, indicating a significant shift in the industry's investment dynamics. With more practices becoming part of private-equity-backed Dental Service Organization (DSOs), the flow of investor capital is expected to slow down, fundamentally altering the ownership landscape of dental practices. The dental industry consolidation presents an opportunity for the growth of the dental implants market.

Eastern Europe Dental Implants Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Eastern Europe dental implants market analysis are product, material, and end user.

- By material, the market is categorized into titanium implants, zirconium implants, and others. The titanium implants segment held the largest share of the Eastern Europe dental implants market in 2023.

- By product, the market is segmented into dental bridges, dental crowns, dentures, abutments, and others. The dental bridges segment held the largest share of the market in 2023.

- Based on end user, the Eastern Europe dental implants market is divided into hospitals and clinics, dental laboratories, and others. The hospitals segment held the largest market share in 2023.

Eastern Europe Dental Implants Market Share Analysis by Country

The scope of the Eastern Europe dental implants market report is mainly divided into Russia, Poland, Austria, Czech Republic, Hungary, Belarus, Slovakia, Romania, and Turkey. In terms of revenue, Poland held the largest the Eastern Europe dental implants market share in 2023. According to the Ministry of Health, 98% of the Polish population is affected by tooth decay, and around 9 million people use dental prostheses. The use of dental implants is thus increasing, with an estimated 100,000 implants being inserted annually.

As per Switzerland Global Enterprise, in 2019, there were ~36,000 practicing dentists in Poland. About 4,000 practices have annual contracts with the National Health Fund, decreasing an average of around 100 per year. However, private dental services are growing, and practice chains such as Medicover Stomatologia, Luxmed Stomatologia, or Dent a Medical are emerging and offering comprehensive treatments. Furthermore, rising medical tourism, including dental treatments, and significant developments in dental bridges, dental crowns, dentures, abutments, and other dental implants are contributing to the market growth.

Eastern Europe Dental Implants Market News and Recent Developments

The Eastern Europe dental implants market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- Neoss Group, a leading innovator in dental implant solutions, introduced the new Multi-Unit Abutment for its Neoss4+ Treatment Solution. This cutting-edge abutment revolutionized the approach of dental professionals toward full arch restorations. With the launch of Neoss4+ and its innovative Multi-Unit Abutment, Neoss reaffirms its dedication to advancing patient care and dental implant technology. (Source: Neoss Group, Press Release, September 2023)

- Neobiotech introduced the "Tick-Tock Implant (YK Link System)," a next-generation prosthesis system that allows for easy attachment and detachment of the prosthesis without screws. This implant is aesthetically pleasing and reduces surgery time while preventing inflammation around the dental implant. It overcomes the shortcomings of existing implants, providing convenience for both patients and dentists. (Source: Neobiotech, Press Release, August 2023)

Eastern Europe Dental Implants Market Regional Insights

The regional trends and factors influencing the Eastern Europe Dental Implants Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Eastern Europe Dental Implants Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Eastern Europe Dental Implants Market

Eastern Europe Dental Implants Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 208.74 Million |

| Market Size by 2031 | US$ 452.14 Million |

| Global CAGR (2023 - 2031) | 10.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Eastern Europe

|

| Market leaders and key company profiles |

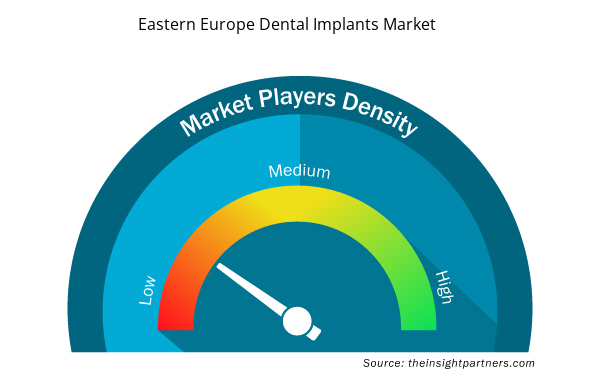

Eastern Europe Dental Implants Market Players Density: Understanding Its Impact on Business Dynamics

The Eastern Europe Dental Implants Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Eastern Europe Dental Implants Market are:

- NEOBIOTECH

- Henry Schein, Inc.

- Envista Holdings Corporation (Danaher)

- Bicon

- Sweden & Martina

- Neoss Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Eastern Europe Dental Implants Market top key players overview

Eastern Europe Dental Implants Market Report Coverage and Deliverables

The “Eastern Europe Dental Implants Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Eastern Europe dental implants market size and forecast at country levels for all the key market segments covered under the scope

- Eastern Europe dental implants market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Eastern Europe dental implants market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Eastern Europe dental implants market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Dental implants are artificial tooth roots used to replace missing teeth and have become a popular choice for dental restoration due to their durability and natural appearance.

The Eastern Europe Dental Implants market was valued at US$ 208.74 million in 2023.

The Eastern Europe Dental Implants market majorly consists of the players, including ZimVie Inc, BEGO GmbH & Co. KG, Dentsply Sirona Inc, Institut Straumann AG, BioHorizons Inc, Nobel Biocare Services AG, Nobel Biocare Services AG, 3M Co, MEGA’GEN IMPLANT CO. LTD, DIF Dental Implants, Thommen Medical AG, and Alpha Dent Implants GmbH.

The Eastern Europe Dental Implants market is expected to be valued at US$ 452.14 million in 2031.

Based on product, the Eastern Europe dental implants market is segmented into dental bridges, dental crowns, dentures, abutments, and others. The dental bridges segment held the largest share of the market in 2023.

By material, the market is categorized into titanium implants, zirconium implants, and others. The titanium implants segment held the largest Eastern Europe dental implants market share in 2023.

Factors such as the growing medical tourism in Eastern European countries and technological advancements in dental implants.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Eastern Europe Dental Implants Market

- NEOBIOTECH

- Henry Schein, Inc.

- Envista Holdings Corporation (Danaher)

- Bicon

- Sweden & Martina

- Neoss Limited

- OSSTEM IMPLANT CO., LTD.

- Cortex

- LEADER ITALIA SRL

- T-Plus Implant Tech. Co.

Get Free Sample For

Get Free Sample For