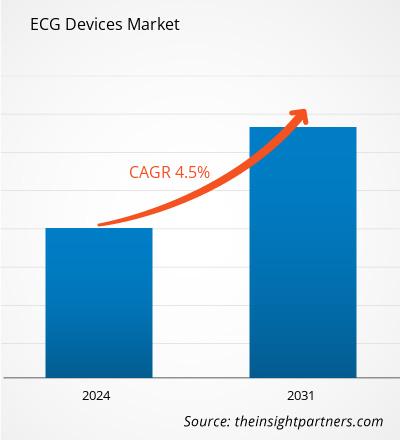

The ECG devices market size is projected to reach US$ 4,509.53 million by 2031 from US$ 3,310.87 million in 2024. The market is expected to register a CAGR of 4.5% during 2024-2031. Technological advancements and developments of smart wearables are likely to bring new trends in the ECG devices market in the coming years.

ECG Devices Market Analysis

The factors driving the ECG devices market include the increasing prevalence of cardiovascular disorders and a surge in government initiatives and healthcare investment. Additionally, increasing awareness about cardiovascular conditions and development of new technologies are expected to contribute to the market growth. Moreover, the strategic initiatives by market players are expected to create ample opportunities in the coming years.

ECG Devices Market Overview

North America is expected to dominate the ECG devices market, and Asia Pacific is expected to register a significant growth rate owing to the rapidly aging demographic, implementation of several initiatives by the government, and technological advancements in medical equipment across the region. Further, in APAC, China accounts for the major market share, and India registers a significant growth rate in the region. Increasing aging population, rising incidence of cardiovascular diseases (CVDs), and technological advancements in medical equipment are among the crucial factors bolstering the market growth for ECG devices. CVD is the country’s leading cause of healthcare burden, and its prevalence is rising continuously. As per the research article titled “Cardiovascular Disease Mortality and Potential Risk Factor in China: A Multi-Dimensional Assessment by a Grey Relational Approach,” published in April 2022, CVD is one of the major healthcare burdens in the country. In addition, 290 million people are suffering from cardiac disorders, stroke (13 million), coronary heart disease (11 million), rheumatic heart disease (2.5 million), heart failure (4.5 million), congenital heart disease (2 million), and pulmonary heart disease (5 million) in the country.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

ECG Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

ECG Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

ECG Devices Market Drivers and Opportunities

Increasing Incidences of Cardiovascular Diseases Favors Market Growth

According to the World Health Organization (WHO), cardiovascular diseases (CVDs) are among the leading causes of death worldwide. According to the American Heart Association, CVDs account for 19.91 million global deaths in 2021. According to the Centers for Disease Control and Prevention (CDC), 702,880 deaths are reported due to heart disease every year and 805,000 people suffered from a heart attack in the US in 2022. According to the American Heart Association, more than 130 million people in the US suffer from a type of CVD and ~45.1% of the population in the country is likely to suffer from a type of CVD by 2035. According to reports by the European Society of Cardiology, more than 10.2 million people are affected by CVD every year and more than 3 million CVD-related deaths are reported in Europe every year. The prevalence of cardiovascular risk factors in Central and Western Europe can be attributed to smoking habits and heavy drinking among men. According to the World Heart Federation, CVDs accounted for more than a third of all deaths, i.e., 1.4 million people in the Middle East and North Africa. Further, CVD deaths have increased by 48% over the past 30 years, accounting for 40% and 10% of deaths in Oman and Somalia, respectively. According to the American College of Cardiology Foundation report, in 2021, CVD mortality rates in the Middle East and North Africa were from 134.2 to 600.2 per 100,000 people. As ECG devices help in effectively diagnosing irregular heartbeats due to blocked or narrowed heart arteries, the high prevalence of cardiovascular diseases promotes the use of these devices, thereby bolstering its market growth.

Strategic Initiatives by Market Players Create Ample Opportunities for Market Growth

Companies operating in the ECG devices market constantly focus on strategic developments such as product approvals, collaborations, funding, agreements, and new product launches to improve their sales, increase their geographic reach, and reinforce their capacities to cater to a large customer base. A few strategic initiatives by key players operating in the ECG devices market are mentioned below.

- In June 2024, Clario was granted US Food and Drug Administration (FDA) 510(k) clearance for its SpiroSphere with the wireless COR-12 Electrocardiogram (ECG) device. This technological advancement enables the simultaneous collection of spirometry and ECG data during a single site visit through Clario’s SpiroSphere platform, consolidating all data into a single, unified database.

- In June 2024, AliveCor received US Food and Drug Administration (FDA) 510(k) approval for the Kardia 12L ECG System, a portable AI-powered ECG device. The device consists of an inbuilt software that can help in the analysis of ECGs to detect up to 35 conditions, including arrhythmias, heart attacks, and other diseases.

- In May 2024, OMRON Healthcare India collaborated with AliveCor India to provide AI-based handheld ECG technology. This collaboration brings forth devices such as the first home BPM+ECG Monitoring FDA-cleared device (blood pressure monitor with AliveCor ECG capability in a single device) for early CVD detection and management.

- In January 2022, Philips launched its first at-home, 12-lead ECG integrated solution for decentralized clinical trials; this is the most advanced patient-centric ECG solution within the company's cardiac monitoring portfolio, combining data readings similar to clinical, site-based ECGs with Philips cloud-based data collection and analysis services.

Therefore, ongoing product launches, approvals, and collaborations are expected to create ample opportunities for the ECG devices market in the coming years.

ECG Devices Market Report Segmentation Analysis

Key segments that contributed to the derivation of the ECG devices market analysis are product, lead type, technology, and end user.

- Based on product, the ECG devices market is bifurcated into resting ECG and stress ECG. The resting ECG segment held a larger share of the market in 2023 and is expected to register a higher CAGR in the market during 2024-2031.

- By lead type, the ECG devices market is segmented into 12-lead ECG, 3–6 lead ECG, and single lead ECG. The 12-lead ECG segment held the largest share of the market in 2023, and the single lead ECG segment is expected to register the highest CAGR in the market during 2024-2031.

- By technology, the ECG devices market is bifurcated into portable (wired) ECG system and wireless ECG systems. The wireless ECG system segment held a larger share of the market in 2023 however, and is expected to register a higher CAGR in the market during 2024-2031.

- In terms of end user, the ECG devices market is segmented into hospitals and clinics, ambulatory surgical centers, cardiac centers, and others. The hospitals and clinics segment dominated the market in 2023 and is anticipated to register the highest CAGR during 2024-2031.

ECG Devices Market Share Analysis by Geography

The geographical scope of the ECG devices market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America held a significant share of the market in 2023. The increasing incidence of cardiovascular disease, an increased focus on preventive healthcare, and the presence of well-developed healthcare infrastructure in the region are among the major factors propelling the market growth. Government support, aging population, and growing awareness of heart-related diseases are further accelerating the expansion of the ECG devices market in the region. Technological advancements have also played a crucial role. Innovations in digital ECG devices have enhanced accuracy, portability, and user-friendliness, making them more accessible and effective for both healthcare providers and patients. The US is expected to account for the largest market share owing to the rising geriatric population, growing prevalence and awareness of cardiovascular diseases, increasing focus on preventive healthcare, technological advancements in monitoring vital cardiac indicators, and the push for remote monitoring.

ECG Devices Market Regional Insights

ECG Devices Market Regional Insights

The regional trends and factors influencing the ECG Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses ECG Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for ECG Devices Market

ECG Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3,310.87 Million |

| Market Size by 2031 | US$ 4,509.53 Million |

| Global CAGR (2024 - 2031) | 4.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

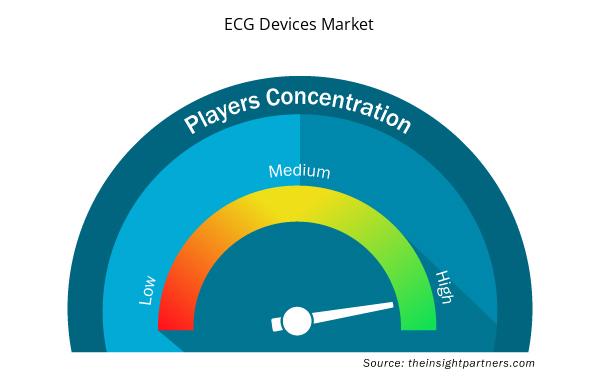

ECG Devices Market Players Density: Understanding Its Impact on Business Dynamics

The ECG Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the ECG Devices Market are:

- GE Healthcare

- Spacelabs Healthcare (OSI Systems, Inc.)

- Nihon Kohden Corporation

- SCHILLER AG

- Hill-Rom Holdings, Inc

- BPL Medical Technologies

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the ECG Devices Market top key players overview

ECG Devices Market News and Recent Developments

The ECG devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the ECG devices market are listed below:

- Norav Medical introduced its latest innovation, the Chest Strap ECG, a revolutionary device that transforms long-term cardiac monitoring by providing unparalleled comfort, accuracy, and efficiency for patients and healthcare providers. The Chest Strap ECG replaces traditional adhesive electrodes with a sticker-free, allergy-free solution in single-channel mode, making it an ideal choice for patients with sensitive skin. It supports 1–3 channel ECG monitoring, offering flexibility with single-channel use when using the strap alone, or multi-channel configurations with an extender. (Source: Norav Medical, Company Website, January 2025)

- AliveCor and Anumana, an AI-driven health technology company, entered a partnership to integrate Anumana’s advanced AI algorithms for early cardiac disease detection into AliveCor’s Kardia electrocardiogram (ECG) devices. The collaboration will begin with the deployment of Anumana’s FDA-cleared ECG-AI LEF algorithm. (Source: AliveCor, Inc, Company Website, January 2025)

- AliveCor received the US Food and Drug Administration (FDA) clearance and commercially launched its KAI 12L AI technology and the Kardia 12L ECG System. This is the world’s first AI that can detect life-threatening cardiac conditions, including heart attacks,. The Kardia 12L ECG System is a groundbreaking innovation, combining patented technology with AI to create the world’s first handheld 12-lead ECG system, featuring a distinctive single-cable design. (Source: AliveCor, Inc, Company Website, June 2024)

ECG Devices Market Report Coverage and Deliverables

The “ECG Devices Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- ECG devices market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- ECG devices market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- ECG devices market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the ECG devices market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

North America dominated the ECG devices market in 2023.

GE Healthcare; Spacelabs Healthcare (OSI Systems, Inc.); Nihon Kohden Corporation; SCHILLER AG; Hill-Rom Holdings, Inc.; BPL Medical Technologies; Koninklijke Philips N.V.; AliveCor Inc; Fukuda Denshi Co., Ltd; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; CompuMed, Inc.; Norav Medical; and custo med GmbH are among the key players operating in the ECG devices market.

The increasing prevalence of cardiovascular disorders and a surge in government initiatives and healthcare investment are the most influential factors responsible for the market growth.

The global ECG devices market is estimated to register a CAGR of 4.5% during the forecast period.

The estimated value of the ECG devices market can reach US$ 4,509.53 million by 2031.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - ECG Devices Market

- GE Healthcare

- Spacelabs Healthcare (OSI Systems, Inc.)

- Nihon Kohden Corporation

- SCHILLER AG

- Hill-Rom Holdings, Inc.

- BPL Medical Technologies

- Koninklijke Philips N.V.

- AliveCor Inc

- Fukuda Denshi Co., Ltd

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- CompuMed, Inc.

- Norav Medical

- custo med GmbH

Get Free Sample For

Get Free Sample For