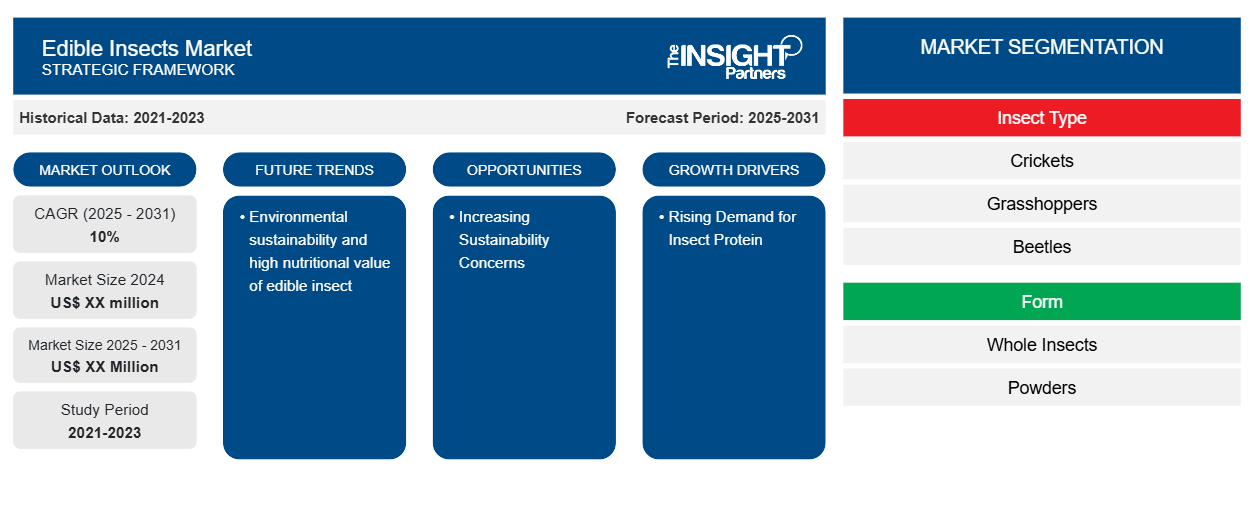

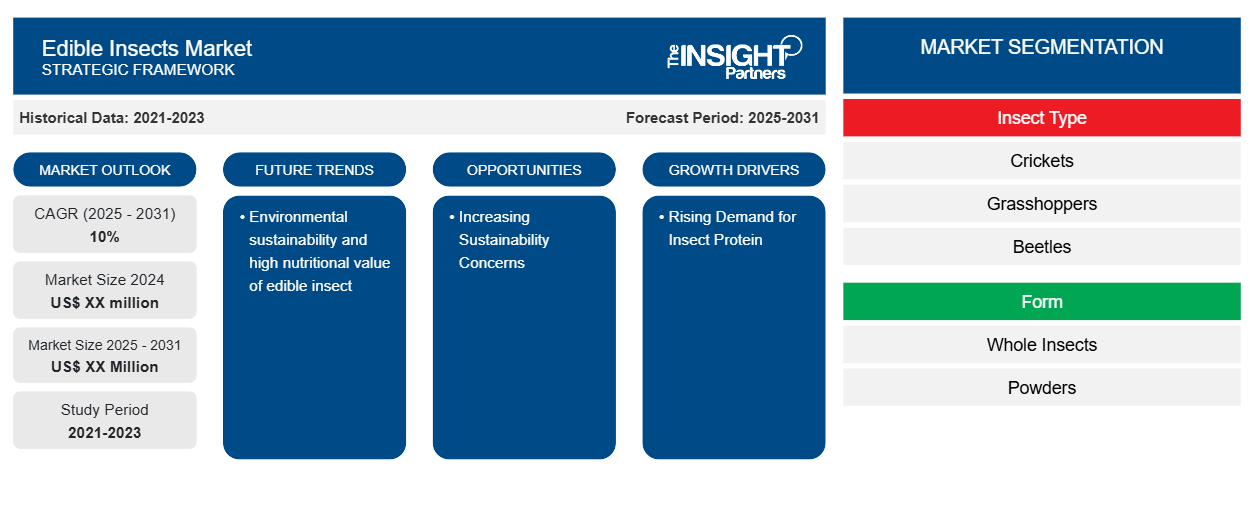

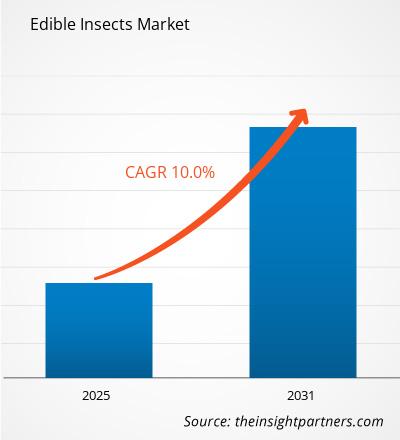

The edible insects market is expected to register a CAGR of 10% during 2023–2031. Sustainability concerns and rising inclination towards alternative protein sources are likely to remain key market trend.

Edible Insects Market Analysis:

- The edible insect market is growing fast. Interest in exotic and novel food experiences is a major driving factor. Another driver is the environmental benefits of edible insect food: they emit less greenhouse gases, create less water pollution and use much less land than traditional livestock farming.

- The potential of the edible insect market in the Western world is only just emerging. Two billion people already consume insects worldwide, but edible insects are not yet widely consumed in the West.

- in April 2023, Nutrition Technologies Group, an American startup active in the insect-based food sector, signed a trade deal of up to USD 100 million with the Japanese Sumitomo Corporation Group to expand distribution of its pet food and aquafeed products in Japan. Such commercial agreements are a way to capitalize on the rising demand for protein alternatives and create new markets.

Edible Insects Market Overview

- The market demand for edible insects is projected to grow at a rapid rate in the next decade due to reasons such as the increasing demand for insect protein in the animal feed industry, the benefits to the environment, and the low risk of spreading zoonotic diseases.

- Besides, insect farming and cultivated practices are helping make the intensifying production efforts to keep up with the demand.

- Demand for edible insects is emerging, but there are some barriers to overcome, including ethical issues from tradition and culture, the lack of awareness, and regulations.

- Nevertheless, the environmental costs of traditional livestock farming are becoming increasingly evident, and consumers are turning to edible insects as an alternative source of protein with a much smaller environmental footprint.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Edible Insects Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Edible Insects Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Edible Insects Market Drivers and Opportunities

Rising Demand for Insect Protein

- Insect protein offers several benefits as an alternative source to traditional protein. Insects are high in proteins, vitamins, minerals and essential amino acids. They are a good source of protein with similar content to conventional animal products. Insects also contain high amounts of micronutrients and antioxidants, making them a nutritious choice.

- Insect farming needs less land, water and feed than the traditional livestock; insects have less food conversion inputs and have lower greenhouse gas emissions when compared to livestock – more sustainable source of proteins.

- Replacing traditional protein sources such as fish meal in animal feed with alternative protein source provided by insects support sustainable aquaculture.

- Thus, rising demand for edible insect an alternative protein source is driving the market growth.

Opportunities

Increasing Sustainability Concerns

- Insects for food are a good solution as they are much more sustainable than more traditional protein sources that currently come from animals, reducing pressure on the environment and the need to feed more people on a global scale.

- Increasingly, consumers are taking environmental factors into consideration and trying to eat foods with a smaller footprint. Edible insects use less land, water and feed than traditional livestock products; they also produce fewer greenhouse gases and have a higher food conversion efficiency.

- Moreover, the nutritional value of insects as protein contributes to the demand. Edible insects are an excellent source of proteins, vitamins, minerals, essential amino acids. They could be an excellent supplement for a human diet, thanks to their fairly high levels of protein, vitamins, minerals and essential amino acids.

- Thus, increasing sustainability concerns and nutrition benefits of insects are expected to open new opportunities in the market in the coming years.

Edible Insects Market Segmentation

The scope of the global edible insects market has been segmented on the based-on insect type, form, and distribution channel.

- Based on insect type, the edible insects market is divided into crickets, grasshoppers, beetles, caterpillars, and others.

- On the basis of form, the market is divided into whole insects, powders, and others.

- Based on distribution channel, the market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others.

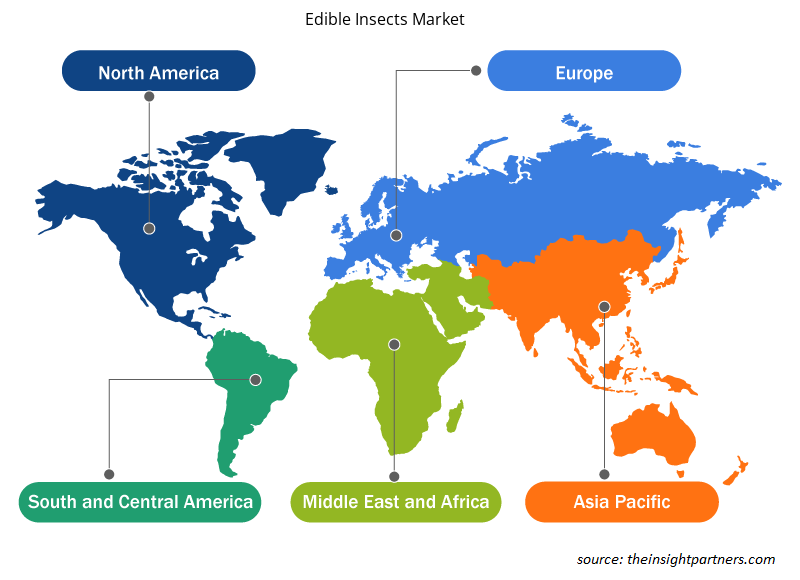

Edible Insects Market Share Analysis by Geography

- Edible Insects Market Report comprises a detailed analysis of five major geographic regions, which includes current and historical market size and forecasts for 2021 to 2031, covering North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and South & Central America.

- Each region is further sub-segmented into respective countries. This report provides analysis and forecasts of 18+ countries, covering edible insects market dynamics such as drivers, trends, and opportunities that are impacting the markets at the regional level.

- Also, the report covers Porter’s Five Forces analysis, which involves the study of major factors that influence the edible insects market in these regions.

Edible Insects Market Regional Insights

The regional trends and factors influencing the Edible Insects Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Edible Insects Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Edible Insects Market

Edible Insects Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 10% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Insect Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Edible Insects Market Players Density: Understanding Its Impact on Business Dynamics

The Edible Insects Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Edible Insects Market are:

- All Things Bugs LLC

- Aspire Food Group

- Bitty Foods

- Bugsolutely Ltd

- Entomofarms

- Circle Harvest

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Edible Insects Market top key players overview

Edible Insects Market News and Recent Developments:

The edible insects market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- Tyson Foods, Inc. (NYSE: TSN), one of the world’s largest food companies, has reached an agreement for a two-fold investment with Protix, the leading global insect ingredients company. The strategic investment will support the growth of the emerging insect ingredient industry and expand the use of insect ingredient solutions to create more efficient sustainable proteins and lipids for use in the global food system. The agreement combines Tyson Foods’ global scale, experience and network with Protix’s technology and market leadership to meet current market demand and scale production of insect ingredients. (Source – Tyson Foods, Press Release, Oct 2023)

- Vietnamese edible insect startup Cricket One has opened what it claims is Asia’s largest cricket processing facility and closed a series A round for an undisclosed “seven-figure” sum. The round was led by Singapore-based investor Robert Alexander Stone and supported by Cub Capital along with a Singapore-based family office. The new facility, in Binh Phuoc, north of Saigon, will initially process 1,000 metric tons a year, increasing to 10,000 tons over the next five years. (Source – Cricket One, Newsletter, Sept 2023)

Edible Insects Market Report Coverage and Deliverables

The “Edible Insects Market Size and Forecast (2021 – 2031)” provides a detailed analysis of the market covering below areas:

- Edible Insects market size and forecast at global, regional and country levels for all the key market segments covered under the scope.

- Edible Insects market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Edible Insects market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the edible insects market.

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Joint Pain Injection Market

- Environmental Consulting Service Market

- GMP Cytokines Market

- Pharmacovigilance and Drug Safety Software Market

- Procedure Trays Market

- Enzymatic DNA Synthesis Market

- Biopharmaceutical Contract Manufacturing Market

- Explosion-Proof Equipment Market

- Dairy Flavors Market

- Rugged Servers Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The report can be delivered in PDF/Word format, we can also share excel data sheet based on request.

All Things Bugs LLC, Aspire Food Group, Bitty Foods, Bugsolutely Ltd, Entomofarms, Circle Harvest, Wurmfarm, Kreca Ento-Food BV, Protifarm Holding NV, and Eat Criche are among the leading players operating in the edible insects market.

Rising demand for insect protein is driving the edible insects market growth.

Environmental sustainability and high nutritional value of edible insect are likely to remain the key trends in the market.

The global edible insects market is estimated to grow above 10% during the forecast period 2023-2031.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies

1. All Things Bugs, LLC

2. Aspire Food Group

3. Bitty Foods

4. Bugsolutely Ltd

5. Cricke

6. Cricket Lab

7. EntomoFarms

8. Exo Inc.

9. Kreca Ento-Food BV

10. Protifarm Holding NV

Get Free Sample For

Get Free Sample For