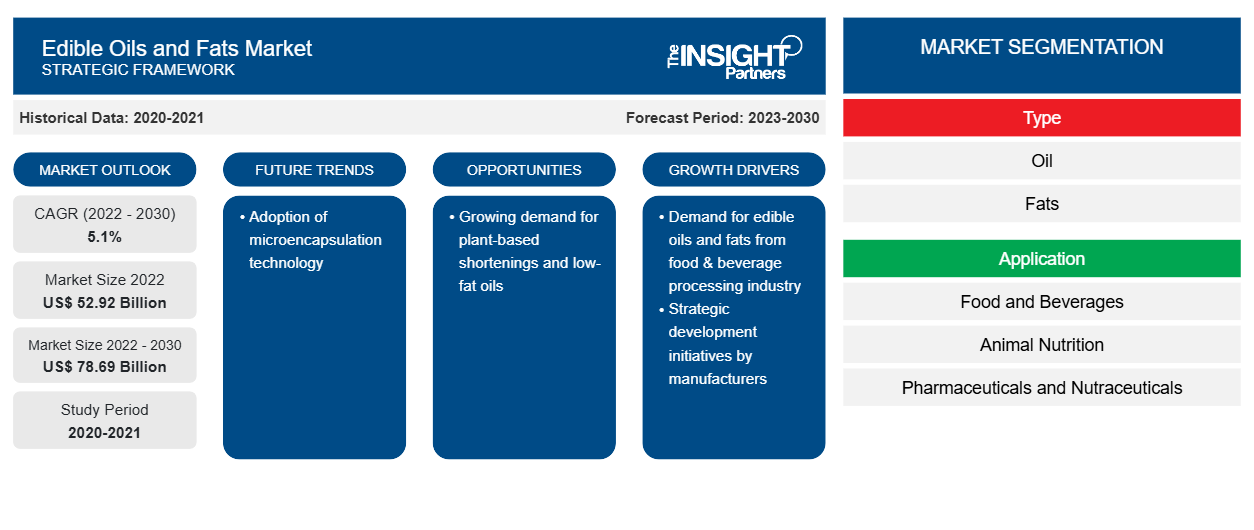

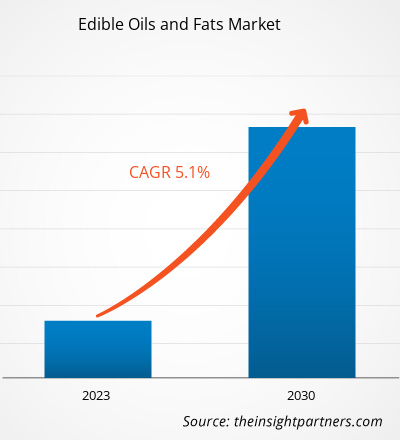

[Research Report] The Edible Oils and Fats market is expected to grow from US$ 52,920.00 million in 2022 to US$ 78,686.61 million by 2030; it is expected to record a CAGR of 5.1% from 2023 to 2030.

Market Insights and Analyst View:

Edible fats are obtained through animal-origin raw materials such as pork fat (lard) and tallow or from plant origin. Meat processors are the raw material suppliers for manufacturers of edible animal-derived fats. Manufacturers have long-term agreements with the meat processing industries for an uninterrupted supply of raw materials. The fatty tissues of pork or beef are chopped into small pieces and boiled in steam digesters, where the fat is released in water. The fat floats over the water surface and is collected by skimming. The membranous matter of animal tissues is pressed in a hydraulic press where additional fat is obtained. Fat is separated from the liquid phase in a desludging centrifuge.

Vegetable fat such as margarine is obtained by the hydrogenation of soybean oil, corn oil, or safflower oil. The oil is first bleached with bleaching earth or charcoal to remove the undesirable odor and color. It is then passed through hydrogen gas under high pressure, which solidifies the oil to obtain margarine. There are various processes to manufacture vegetable oils and fats.

The refined edible oils and fats are packaged in containers and sent to end users such as food & beverage, animal nutrition, and pharmaceuticals & nutraceuticals industries through distributors and suppliers. Cargill Incorporated, Bunge Limited, ADM, Fuji Oil Co Ltd, and Kao Corporation are among the key manufacturers of edible oils and fats across the world.

Growth Drivers and Challenges:

According to the United States Department of Agriculture (USDA), soy oil is the second largest consumed vegetable oil. It is extensively utilized for frying, cooking, shortening, and margarine. According to the Organization for Economic Co-operation and Development (OECD), in 2022, the consumption of vegetable oil reached 249 million metric tons, with the food sector accounting for the major share. Moreover, the confectionery industry significantly utilizes butter as a primary ingredient, followed by margarine. The high-quality edible oils and fats are used in bakery and confectionery, dairy and frozen desserts, snacks, Ready-to-Eat (RTE) and Ready-to-Cook (RTC) meals, and other food and beverage items. Refined oils and fats are a rich source of lipids. Thus, their use is increasing due to rising application and growing global population.

The food & beverages industry in various regions such as North America and Asia Pacific is continuously growing owing to an upsurging inclination toward sustainability, preference for convenience and ready-to-eat products, and rising adoption of organic and plant-based products. The industry is witnessing substantial motion with innovation in processes, products, and services to cater to rapidly changing consumer preferences. According to the United States Census Bureau, the US had 39,646 food and beverage manufacturing plants in 2020. Of which California, Texas, and New York had 6,116, 2,625, and 2,600 respectively. Similarly, the food & beverage industry is one of the significant contributors to the European Economy. Thus, the growing food & beverages industry across the globe propels the demand for edible oils and fats.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Edible Oils and Fats Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Edible Oils and Fats Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

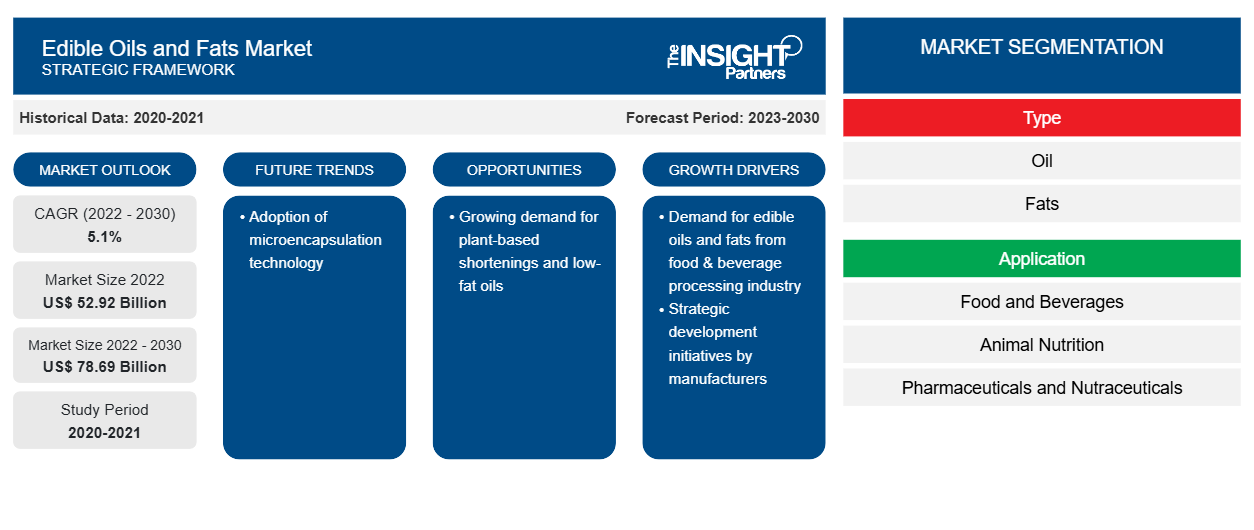

The "Global Edible Oils and Fats Market" is segmented on the basis of type, application, and geography. Based on type, the market is bifurcated into oil and fats. Based on application, the global edible oils and fats devided into food and beverages, animal nutrition, and pharmaceuticals and nutraceuticals. The oil segment held a larger share of the global

edible oils and fats market

in 2022. Based on geography, the edible oils and fats market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Chile, and the Rest of South & Central America).Segmental Analysis:

Based on type, the edible oil and fats market is bifurcated into oil and fats. The oil segment held a larger share of the edible oils and fats market in 2022 and is expected to register a higher CAGR during the forecast period. Vegetable oils can be derived from seeds, cereal grains, nuts, and fruits. Olive, sunflower, palm, canola, coconut, safflower, corn, peanut, cottonseed, palm kernel, and soybean oils are among the most consumed oils. Generally, vegetable oils are used in food preparation, and crude oil is added for flavor. Vegetable oil is also used in the production of animal feed. Palm oils are easy to stabilize, and they maintain flavor quality and consistency in processed foods. Therefore, they are frequently favored by food manufacturers. Indonesia, Malaysia, Thailand, and Nigeria are among the biggest palm oil producers and exporters. Rising awareness related to health concerns associated with trans fats in hydrogenated vegetable oils propels the use of palm oil in the food industry. The agri-food industry is a significant consumer of palm oil, as it is used majorly in industrial baked goods, chocolate products, confectionery, ice creams, and even diet meal substitutes. Palm oil is a rich source of tocopherols and carotenoids, which confer natural stability against oxidative deterioration. Thus, the benefits and applications of palm oils in various end-use industries drive their demand across the world.

Regional Analysis:

The edible oil and fats market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The global edible oils and fats market was dominated by South & Central America and was estimated to be ~US$ 4,500 billion in 2022. The edible oils and fats market in South & Central America is segmented into Brazil, Argentina, and the Rest of South & Central America. The snack food sector in the region is expanding owing to the rising consumer preference for different snacking options such as frozen snacks, savory snacks, fruit snacks, confectionery snacks, and bakery snacks. Edible oils and fats play an integral role, as they provide distinctive flavors to food and provide unique and desirable functions in manufacturing snacks. For example, oils are the frying media for deep-fried food, and in pastries, vegetable oil-based shortenings are added to prevent the flour and other ingredients from clumping. Hence, the rising demand for different snacks and the benefits associated with the edible oils and fats propel the demand for edible oils and fats in the snacking sector in South & Central America.

Furthermore, the demand for edible oils and fats in end-use industries such as animal nutrition has seen a rise in the South & Central America. According to the Oil World, in 2022, China purchased around 70% of the Brazilian soybean oil, mainly for animal protein consumption. Moreover, expanding animal nutrition, pharmaceuticals, and nutraceutical industries drive the demand for specialized edible oils and fats. These industries require specific types of oils for various applications, such as in animal feed formulations and pharmaceutical formulations. As these sectors grow and diversify, the demand for their unique requirements increases, fuelling the edible oils and fats market growth in South & Central America.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the global edible oils and fats market are listed below:

- In October 2021, ADM, one of the prominent edible fat and oil manufacturers in the US, announced its plans to build the first-ever dedicated soybean crushing plant and refinery in North Dakota to cater to the fast-growing demand for soybean oil from the food and animal feed industries.

- In December 2021, ITOCHU Corporation, headquartered in Japan, announced their agreement through ITOCHU International Inc., headquartered in New York, US, for the establishment of Fuji Oil International Inc. in the US. With this agreement, the firm plans to strengthen the oil and fat business in North America.

Edible Oils and Fats Market Regional Insights

Edible Oils and Fats Market Regional Insights

The regional trends and factors influencing the Edible Oils and Fats Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Edible Oils and Fats Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Edible Oils and Fats Market

Edible Oils and Fats Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 52.92 Billion |

| Market Size by 2030 | US$ 78.69 Billion |

| Global CAGR (2022 - 2030) | 5.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

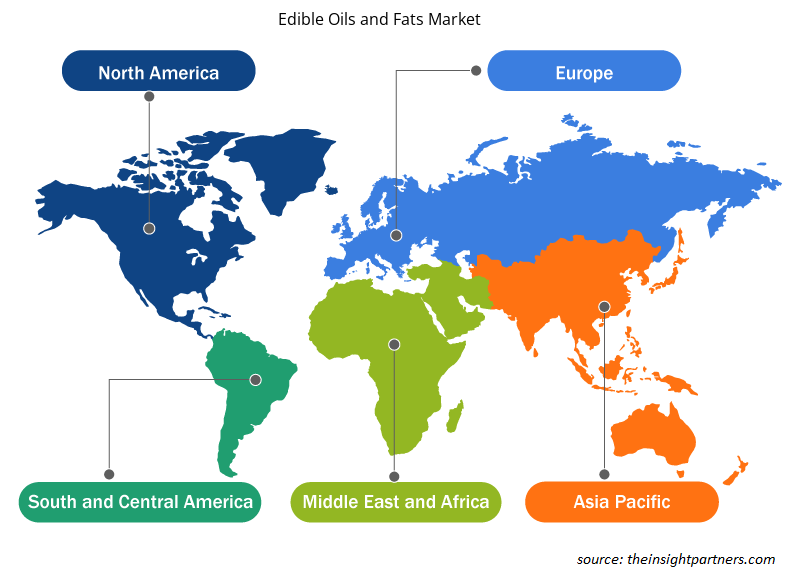

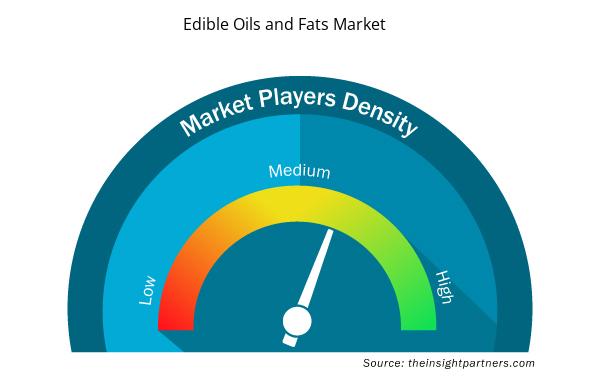

Edible Oils and Fats Market Players Density: Understanding Its Impact on Business Dynamics

The Edible Oils and Fats Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Edible Oils and Fats Market are:

- Bunge Ltd

- Archer-Daniels-Midland Co

- Fuji Oil Co Ltd

- Kao Corp

- AAK AB

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Edible Oils and Fats Market top key players overview

COVID-19 Pandemic Impact:

The COVID-19 pandemic affected economies and industries in various countries. Lockdowns, travel bans, and business shutdowns in leading countries in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) negatively affected the growth of various industries, including the food & beverage industry. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and sales of various essential and non-essential products. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. In addition, the bans imposed by various governments in Europe, Asia, and North America on international travel forced the companies to put their collaboration and partnership plans on a temporary hold. All these factors hampered the food & beverages industry in 2020 and early 2021, thereby restraining the growth of the edible oils and fats market.

Competitive Landscape and Key Companies:

Bunge Ltd, Archer-Daniels-Midland Co., Fuji Oil Co Ltd, Kao Corp, AAK AB, J-Oil Mills Inc, Cargill Inc, Olam Group Ltd, ConnOils LLC, and Louis Dreyfus Co BV. are among the prominent players operating in the global edible oils and fats market. These edible oils and fats manufacturers offer cutting-edge extract solutions with innovative features to deliver a superior experience to consumers.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Electronic Data Interchange Market

- Trade Promotion Management Software Market

- Malaria Treatment Market

- Adaptive Traffic Control System Market

- Personality Assessment Solution Market

- Vaginal Specula Market

- Visualization and 3D Rendering Software Market

- Sandwich Panel Market

- Industrial Inkjet Printers Market

- Portable Power Station Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Manufacturers of edible fats and oils invest significantly in the expansion of business and production capacity to serve their customer base better and meet their consumer requirements. In December 2021, ITOCHU Corporation, headquartered in Japan, announced their agreement through ITOCHU International Inc., headquartered in New York, US, for the establishment of Fuji Oil International Inc. in the US. With this agreement, the firm plans to strengthen the oil and fat business in North America.

Based on type, oil segment mainly has the largest revenue share. Vegetable oils can be derived from seeds, cereal grains, nuts, and fruits. The most consumed oils are olive, sunflower, palm, canola, coconut, safflower, corn, peanut, cottonseed, palm kernel, and soybean. Generally, vegetable oils are used in food preparation, and crude oil is added for flavor. Vegetable oil is also used in the production of animal feed.

The major players operating in the global edible oils and fats market are are Bunge Ltd, Archer-Daniels-Midland Co, Fuji Oil Co Ltd, Kao Corp, AAK AB, J-Oil Mills Inc, Cargill Inc, Olam Group Ltd, ConnOils LLC, and Louis Dreyfus Co BV.

Consumers consider plant-based products healthier than conventional products. Rising health consciousness among consumers propels the demand for plant-based and low-fat products. Thus, manufacturers develop plant-based shortenings and low-fat oils to cater to the rising demand. Plant-based shortenings are non-hydrogenated and do not contain cholesterol and trans-fat. Thus, it is considered a healthier alternative to conventional shortenings. Moreover, the increasing prevalence of cardiovascular diseases, obesity, and diabetes over the years is expected to boost the demand for low-fat products such as low-fat oils among various industries, including bakery & confectioneries, dairy & frozen desserts, and snacking.

Asia Pacific accounted for the largest share of the global edible oils and fats market. The market growth is attributed to increasing demand for bakery products, especially breads, cakes, pastries, and muffins, coupled with the growing influence of Western culture on the millennial and Gen-z population in the region. The bakery sector in China witnessed tremendous growth, with retail sales of bakery products accounting for US$ 34 billion in 2020, according to the United States Department of Agriculture (USDA). Moreover, manufacturers of edible oils and fats actively operate across the region and offer edible oils and fats made with fine-quality oil or its fractions. Distinct melting profiles of butter and margarines, packaging types, and the expansion of antifoaming or antioxidant agents of edible oils and fats are available across the region and widely applicable in many end-use industries such as confectionery, bakery, dairy, and infant nutrition.

Based on the application, food and beverages segment is hold a significant share in the market. The demand for edible oils and fats, such as shortenings, is gradually increasing in bakery and confectionery segment as they lubricate the structure of bakery products and shorten or tender flour proteins. Fats and oils in the mixture hold many air cells incorporated during creaming, making the products smooth and creamy. Fats act as enriching agents, add calorie value to baked foods, and develop flakiness in products. The rising demand for baked products, including cakes, breads, cookies, and biscuits, significantly drives edible oils and fats utilization.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Edible Oils and Fats Market

- Bunge Ltd

- Archer-Daniels-Midland Co

- Fuji Oil Co Ltd

- Kao Corp

- AAK AB

- J-Oil Mills Inc

- Cargill Inc

- Olam Group Ltd

- ConnOils LLC

- Louis Dreyfus Co BV

Get Free Sample For

Get Free Sample For