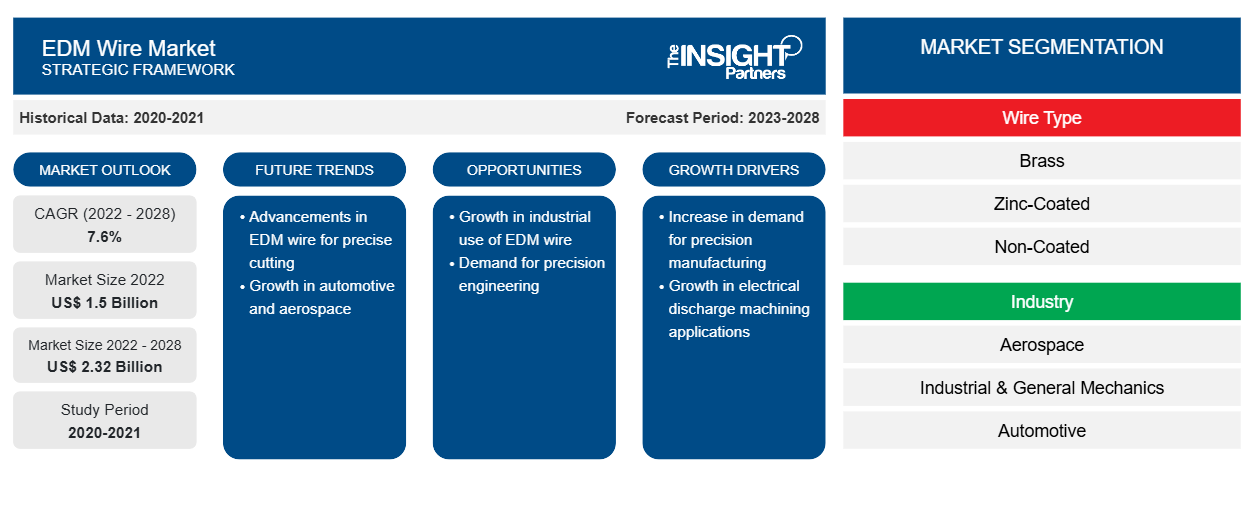

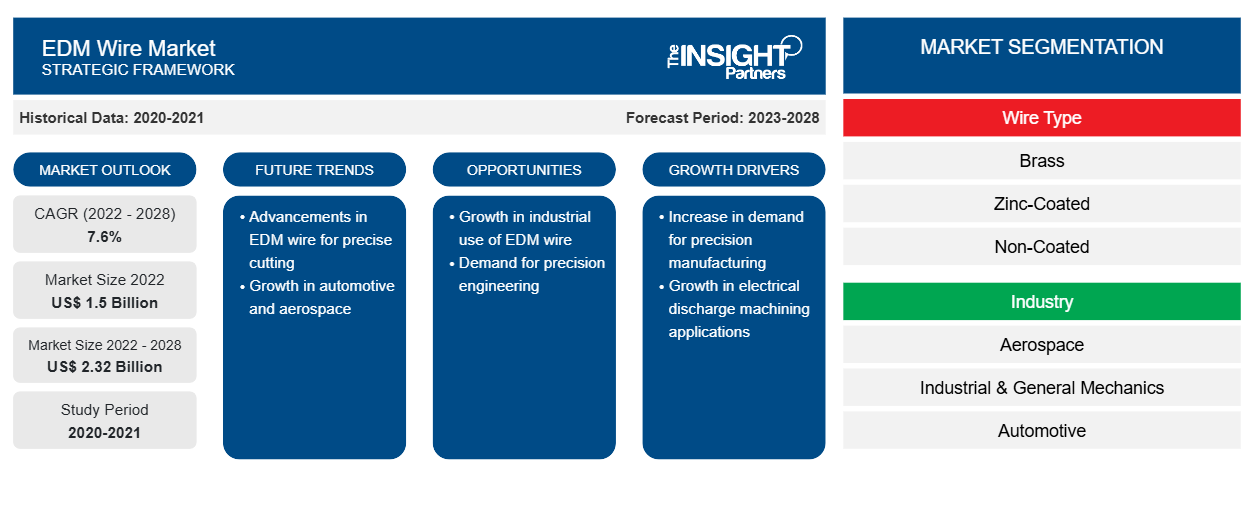

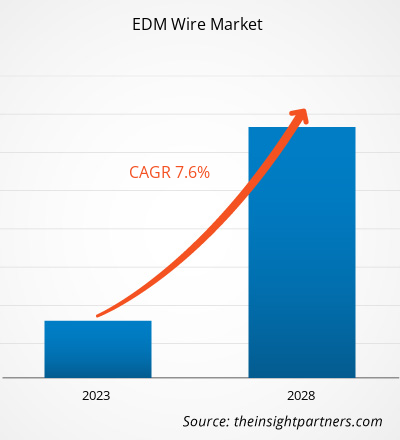

The EDM wire market size is expected to grow from US$ 1,497.50 million in 2022, it is estimated to grow at a CAGR of 7.6% from 2022 to 2028.

The automotive industry is steadily growing in North America, and it has an immense impact on the domestic economy. This industry accounts for ~3% of the national GDP in the US. Such a well-positioned industry is continuously in the need of supplies and components for cars’ engines, chassis, and other metal fixtures, which indicates the high demand for machine tool makers. EDM wires are used for various metal mold applications, such as molding steel headlights, in this industry. Manufacturers prefer employing EDM procedures for the molding and drilling of large automotive parts. Further, government initiatives to encourage investments in the automotive industry are expected to raise the demand for EDM wires in the coming years. According to The Frontier Hub, foreign direct investment (FDI) in the US automotive industry reached US$ 114.6 billion in 2018. Also, in August 2021, the US government signed an executive order that sets a new target of 50% Electric Vehicle Sales Share by 2030. The government has also allotted US$3 billion to bolster the domestic electric vehicle industry. In line with this plan, GM announced an investment of US$ 35 billion and Ford of US$ 30 billion in 2025 to boost the automotive sector. In addition, a rise in the demand for furnishing; household appliances; and consumer electronics, including smart and efficient kitchen appliances, with many people moving to developing and evolving suburbs, fuels the EDM wire market growth in the region.

Various military and commercial aircraft manufacturers have a significant presence in North America, which makes it the world’s largest aerospace market. According to Aerospace Industries Association (AIA), the aerospace industry represented 1.8% of the total US GDP, contributing US$ 382 billion to the GDP. The aerospace industry in North America has flourished on the back of the positive outlook toward adopting new technologies, the presence of a skilled workforce, and favorable economic policies and high GDP per capita in major economies in the region. In April 2021, the US Space and Missile Systems Center announced the investments of US$ 191 million, US$ 240 million, and US$ 253 million in Boeing, Lockheed Martin Corporation, and Northrop Grumman Corporation, respectively, for designing prototype payloads for the Protected Tactical Satcom program of the US Space Force. Thus, the growing aerospace industry has the potential to drive EDM wire market in North America in the coming years.

EDM wires are used in manufacturing consumer electronic devices, automotive, medical devices, and various other applications. The US automotive sector is growing rapidly due to growing automotive sales, increasing capital growth, and higher exports. Therefore, the demand for EDM wires is very high in the market. Carmakers have taken a significant market initiative, boosting the growth of the EDM wire market in the country. Major automakers announced multibillion-dollar investments in EVs and AVs. The presence of manufacturers, including Oki Electric Cable Co., Ltd. and Hitachi Metals America, Ltd., further augments the growth of EDM wire market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

EDM Wire Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

EDM Wire Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on North America EDM Wire Market Growth

The US was the most affected country in North America due to the COVID-19 pandemic. Amid the strict regulations imposed by the US government during Q2 of 2020, the supply chain and import & export were disrupted. As a result, most manufacturing facilities were temporarily shut down or operating with minimum staff. Automotive, manufacturing, and many other industries were negatively affected in 2020. However, as soon as global supply chain resumed, the EDM wire market started to rise. The US automotive industry is one of the largest industries globally. In Q1 of 2022, the factories started to increase their production due to increased demand for products, which propelled the need for EDM wires.

Market Insights – EDM Wire Market

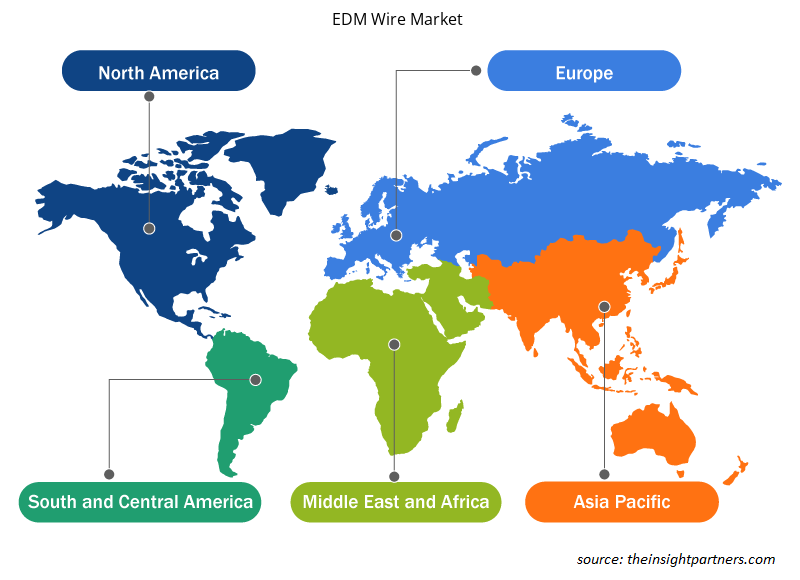

Based on geography, the EDM wire market size is primarily segmented into North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America (SAM). Asia Pacific held the largest market share in 2021 and would retain its dominance during the forecast period. Also, the region is expected to register the highest CAGR in the global EDM wire market during the forecast period. The APAC EDM wire market players are witnessing high growth in the demand for EDM wires.

Asia-Pacific is dominating the EDM wire market in 2021, wherein China is expected to dominate in terms of market share. The electronics industry accounts for 20–50% of Asia's total value of exports. China is the world's largest maker of electronic appliances, including TVs, DVDs, and cell phones. According to Nikkei Inc., the Chinese government will be working on various plans with an investment of US$ 327 billion till 2023 to expand the country's domestic electronic market. Indian government is also working on the expansion of the electronics industry in the country. According to the Ministry of Electronics & IT, the domestic production of electronic goods in India reached the revenue value of US$ 74.7 billion in 2020, a CAGR of 17.9%, owing to the initiatives taken by the government and the efforts of the industry. A few of the government policies related to electronics manufacturing include the Production Linked Incentive (PLI) Schemes, Scheme for Promotion of Electronic Components and Semiconductors Promotion and Modified Electronics Manufacturing Cluster (EMC 2.0) Scheme.

EDM Wire Market Regional Insights

EDM Wire Market Regional Insights

The regional trends and factors influencing the EDM Wire Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses EDM Wire Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for EDM Wire Market

EDM Wire Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.5 Billion |

| Market Size by 2028 | US$ 2.32 Billion |

| Global CAGR (2022 - 2028) | 7.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Wire Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

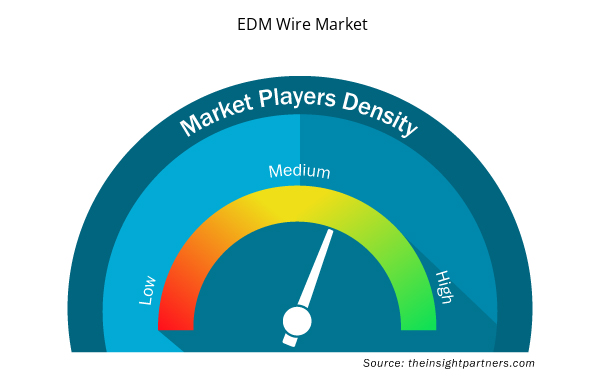

EDM Wire Market Players Density: Understanding Its Impact on Business Dynamics

The EDM Wire Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the EDM Wire Market are:

- Berkenhoff GmbH

- Hitachi Metals Ltd.

- Sumitomo Electric Industries, Ltd.

- Novotec

- Opecmade, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the EDM Wire Market top key players overview

Wire Type-Based Insights – EDM Wire Market

Based on wire type, the EDM wire market is segmented into brass, zinc-coated, and non-coated. The brass segment accounted for the largest share in the market in 2021. The wire provides good machining speed and high accuracy in cutting the metal. Also, the excellent straightness of the wire offers improved automatic threading capability, which propels the demand for brass EDM wire in the market.

EDM wire market players are mainly focused on the development of advanced and efficient systems. For instance;

- In 2020, Makino launched the U6 H.E.A.T. Extreme, a new wire EDM machine. It is manufactured to take machining speeds to the next levels of performance as well as efficiency. At the core of these solutions is the use of a large wire with diameter —0.016” (0.4mm). It is elevating the U6 H.E.A.T. Extreme as the one of the fastest wires EDM machine.

- In 2020, OKI launched new series of EDM wires, electrode wires for wire-cut electrical discharge machines (WEDMs) that feature roundness of 0.25 microns for all its products. It is used in die machining and other processes.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Wire Type, and Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global EDM wire market is expected to be valued at US$ 1,497.50 million in 2022.

The increasing adoption of miniature pneumatics in electronics is anticipated to propel the demand for EDM wire with small diameters. This factor will help in promoting the growth of EDM wire market.

Increase in the production components & parts and rising government support for the manufacturing sector are some of the major driving factors contributing towards the growth of EDM wire market.

Oki Electric Cable; Sumitomo Electric; Hitachi Metals; Berkenhoff GmbH (Bedra); and Novotec BV are the five key market players operating in the global EDM wire market.

China holds the major market share of EDM wire market in 2021. China is the world’s largest manufacturing hub, it produces around 36% of the world’s electronics which includes smartphones, computers, cloud servers, and telecom infrastructure

Automotive segment held the largest share EDM wire market in 2021. The automobile manufacturers highly prefer EDM wire technology as it ensures the accuracy in molding and drilling of the largest automotive part.

The US, China, Germany, Italy, Saudi Arabia, and Brazil held the largest market share in 2021.

By 2028, the global market size of EDM wire market will be US$ 2,323.98 million.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - EDM wire Market

- Berkenhoff GmbH

- Hitachi Metals Ltd.

- Sumitomo Electric Industries, Ltd.

- Novotec

- Opecmade, Inc.

- Oki Electric Cable Co., Ltd.

- Thermo Compact

- Yuang Hsian Metal Industrial Corporation

- Ningbo Kangqiang Micro-Electronics Technology Co., Ltd

- JIA BAO Metal Co., Ltd.

Get Free Sample For

Get Free Sample For