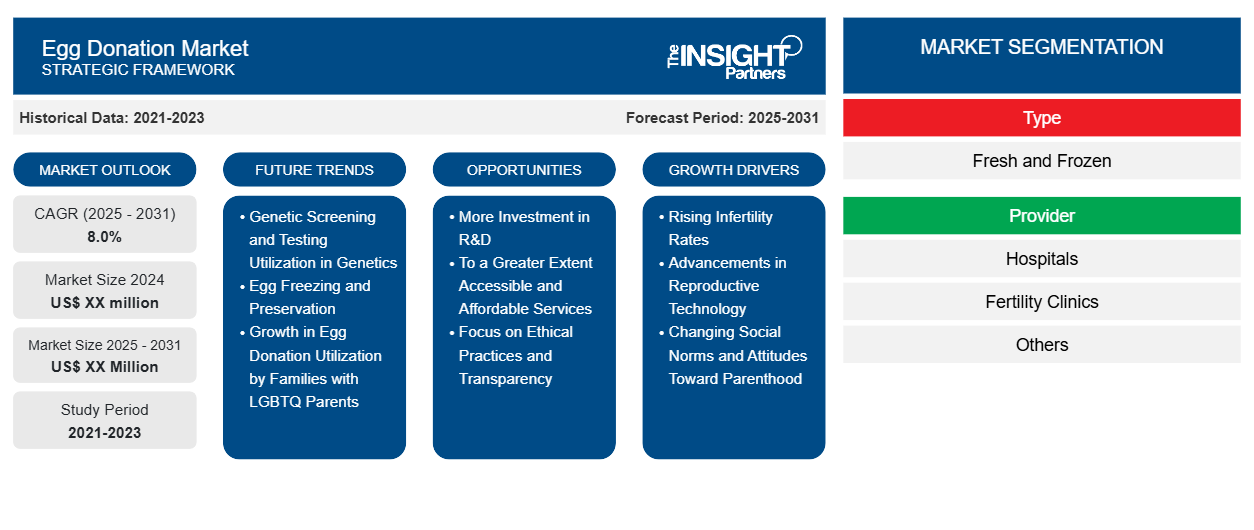

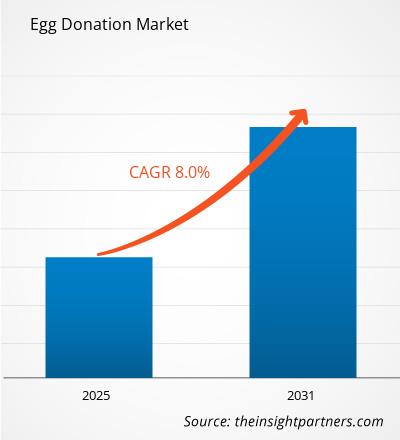

The Egg Donation Market is expected to register a CAGR of 8.0% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Type (Fresh and Frozen). The report further presents analysis based on the Indication Provider (Hospitals, Fertility Clinics, and Others). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Egg Donation Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Egg Donation Market Segmentation

Type

- Fresh and Frozen

Provider

- Hospitals

- Fertility Clinics

- Others

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Egg Donation Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Egg Donation Market Growth Drivers

- Rising Infertility Rates: One of the key factors responsible for the increasing egg donation market is the rise in global infertility rates. Among various causes are delayed childbearing, lifestyle, medical and environmental factors. Many women postpone childbearing for managerial or educational purposes or finances only to encounter challenges conceiving later in life such as bad quality eggs and quantity. The research studies show that it is an effective remedy for overcoming infertility and thus the demand for egg donors.

- Advancements in Reproductive Technology: Technological advancements in ART, such as in vitro fertilization (IVF), have opened the doors to egg donation for all women who are having trouble conceiving. Advances in egg preservation, embryo freezing, and genetic screening have made fertility treatment much more successful. With improved results and access to egg donation, it is now a valid option for all intended parents and women who would consider donating their eggs.

- Changing Social Norms and Attitudes Toward Parenthood: More people than ever are being accepted in nontraditional family forms, such as single women and same-sex couples as well as older parenting aspirants. All of this has contributed to demand for egg donation services as people require reproductive assistance to fulfill their parental aspirations.

Egg Donation Market Future Trends

- Genetic Screening and Testing Utilization in Genetics: Genetic screening is a rampant trend in the market for egg donation. Clinics and fertility centers undertake genetic testing to improve the health as well as the quality of the eggs to be donated. Genetic disorders-also known as chromosomal abnormalities-are screened to suppress inherited conditions, thus yielding better outcomes for their recipients. The trend is in line with increased demand for healthy children; hence, it has given rise to "genetic testing" or "genetic screening" egg donors, who involve more picky clients.

- Egg Freezing and Preservation: Young women's lifestyles often take priority over their personal lives. They freeze their eggs in order to continue having children in the future. This has paved the way for a secondary market for the donation of eggs as frozen eggs are also available to women who cannot bear children for some reasons. They can go on to start families themselves, forgetting they had some fertility issues related to age. Egg freezing is in an ever-increasing trajectory, and as these technologies become more affordable, the growth will be bound to increase with more opportunities for women wanting to donate eggs, as well as those interested in using them.

- Growth in Egg Donation Utilization by Families with LGBTQ Parents: Egg donation services have witnessed increased social acceptability for LGBTQ couples wanting to have kids through them. This trend is likely to increase even further among same-sex male couples and single men because of greater demand for egg donation in conjunction with surrogacy. Most gay couples turn to egg donation and surrogacy services to get kids biologically related to at least one of the parents. This trend has opened up the market for egg donations into much more because of the need by fertility clinics to cater for the reproductive needs of the LGBTQ community.

Egg Donation Market Opportunities

- More Investment in R&D: Egg donation market-the demand makes it an attractive area of investment in research and development especially in genetic testing, preservation for eggs, and fertility treatment. Companies and research institutions that develop better ways on improving egg quality, increasing the efficiency of IVF procedures, and reducing risk complications have the potential to completely transform fertility. Invest in the latest technologies and innovations to secure egg donation services' future development in line with what consumers need.

- To a Greater Extent Accessible and Affordable Services: Egg donation treatments are expensive; hence, this opens up so much space for these services to be within reach by many more customers. Demand by the varied populations, including single women and LGBTQ couples, opens affordability and accessibility as the top two things that can assure the market's continued growth. Cheap models like packaged deals and government-assisted fertility programs can increase the access of egg donation to the whole lot of people.

- Focus on Ethical Practices and Transparency: This is a different angle that businesses can adopt to differentiate their offering. With increasing awareness among the public about the ethical implications of egg donation, clinics will likely attract more customers by making the donation process clearer and more transparent in terms of compensation and rights of both the donor and the recipient. This would give the patented market a better ethical focus, as this would become a strong differentiator in a highly competitive and build trust with customers.

Egg Donation Market Regional Insights

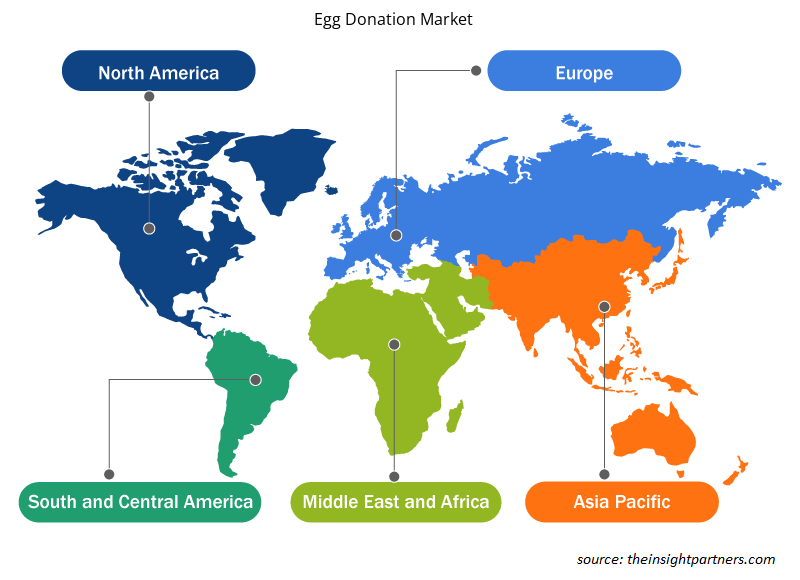

The regional trends and factors influencing the Egg Donation Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Egg Donation Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Egg Donation Market

Egg Donation Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 8.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

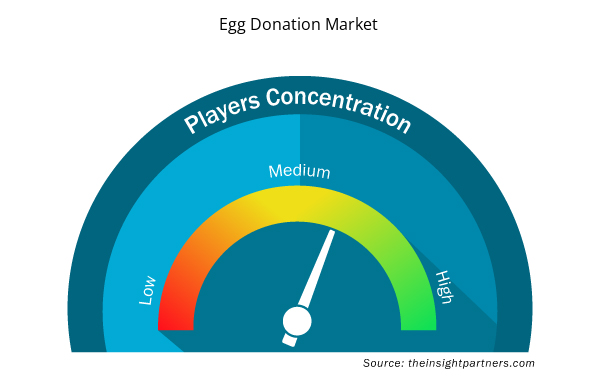

Egg Donation Market Players Density: Understanding Its Impact on Business Dynamics

The Egg Donation Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Egg Donation Market are:

- Medvisit Global

- Copenhagen Fertility Center

- Fertility Associates

- Cryos International

- ivfspain

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Egg Donation Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Egg Donation Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Egg Donation Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Batter and Breader Premixes Market

- Antibiotics Market

- Unit Heater Market

- UV Curing System Market

- Adaptive Traffic Control System Market

- Electronic Signature Software Market

- Vision Guided Robotics Software Market

- Lyophilization Services for Biopharmaceuticals Market

- Legal Case Management Software Market

- Portable Power Station Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Service Provider, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Frozen segment, by type, dominated the market in 2023.

North America region dominated the Egg Donation market in 2023.

More Investment in R&D act as a opportunity for growth of the market in forecast period.

The Egg Donation Market is estimated to witness a CAGR of 8.0% from 2023 to 2031

The major factors driving the Egg Donation market are:

1. Rising Infertility Rates

2. Advancements in Reproductive Technology

Players operating in the market are Medvisit Global, Copenhagen Fertility Center, Fertility Associates, Cryos International, ivfspain, Sanatorium Helios, Dünya IVF, Virtus Health, Boston IVF

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Medvisit Global

- Copenhagen Fertility Center

- Fertility Associates

- Cryos International

- ivfspain

- Sanatorium Helios

- Dünya IVF

- Virtus Health

- Boston IVF

- Bourn Hall International

Get Free Sample For

Get Free Sample For