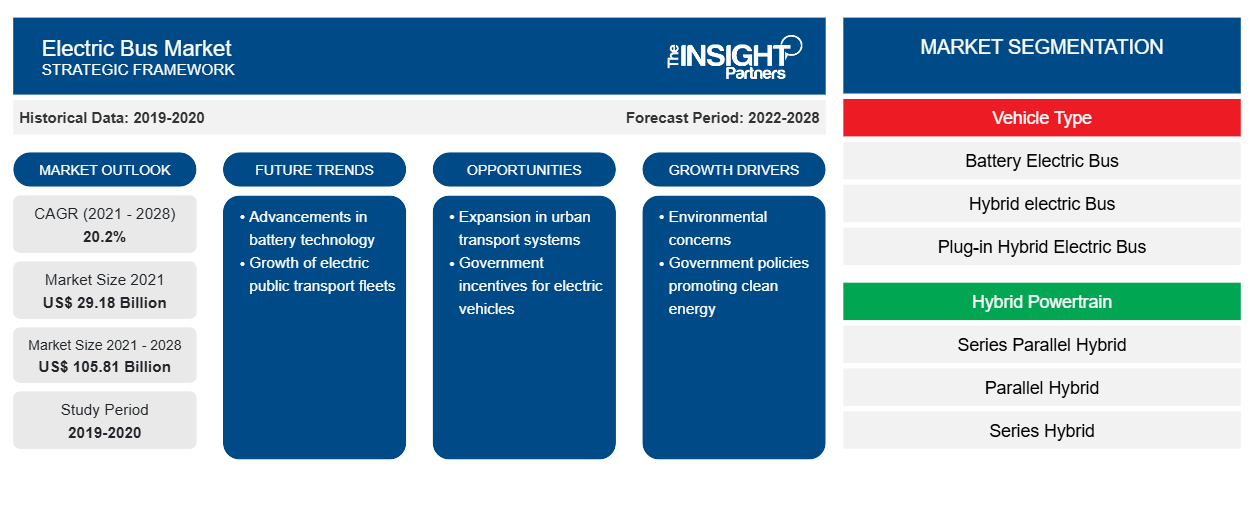

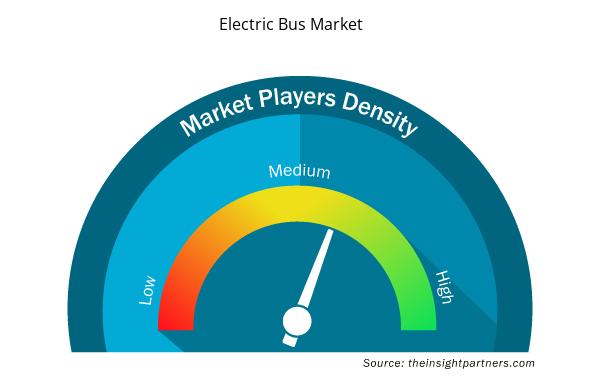

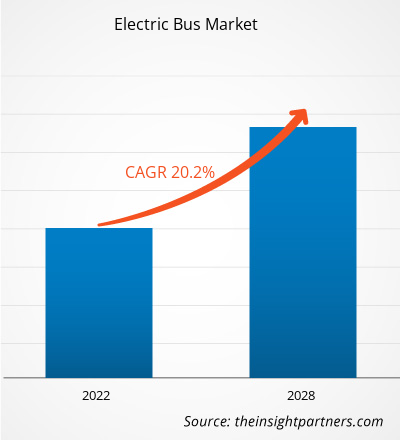

[Research Report] The electric bus market was valued at US$ 29,179.51 million in 2021 and is expected to reach US$ 105,808.15 million by 2028; it is estimated to register a CAGR of 20.2% from 2021-2028.

Analyst Perspective:

The electric bus market has experienced significant growth and transformation in recent years. With the increasing concern for environmental sustainability and the need to reduce carbon emissions, electric buses have emerged as a promising solution for public transportation. Electric buses are powered by electricity instead of traditional fossil fuels, offering numerous advantages such as zero tailpipe emissions, reduced noise pollution, and improved energy efficiency. These factors have driven the adoption of electric buses across the globe. Governments and transit agencies in many countries have been actively promoting the deployment of electric buses as part of their sustainable transportation initiatives. They have implemented various incentives, subsidies, and regulations to encourage the adoption of electric buses and accelerate the transition towards greener public transportation. Key market players in the electric bus sector have been investing heavily in research and development to enhance battery technology, improve charging infrastructure, and increase the range and efficiency of electric buses. As a result, the performance and reliability of electric buses have improved significantly over time, making them a viable alternative to conventional buses.

China has emerged as the largest market for electric buses, accounting for a significant share of global sales. The Chinese government's strong support and favorable policies, along with the country's ambitious targets to reduce pollution, have propelled the rapid growth of the electric bus market in China. However, electric buses are not limited to China alone. Several other countries, including the United States, European nations, and India, have also witnessed a surge in electric bus adoption. In Europe, countries like the Netherlands, Germany, and the United Kingdom have been at the forefront of electric bus deployment, driven by stringent emissions regulations and sustainable transport goals. The market for electric buses is also witnessing technological advancements, such as the development of autonomous electric buses. These self-driving buses have the potential to revolutionize public transportation by providing efficient and convenient mobility solutions.

Market Overview:

A bus that is entirely electric and does not use a conventional internal combustion engine (ICE) for propulsion is known as an electric bus or e-bus. A set of batteries or on-board batteries power an on-board electric motor that propels an e-bus. Because they don't emit any pollutants and are more cost-effective than conventional gasoline/diesel buses, electric buses are regarded as being environmentally friendly.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electric Bus Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electric Bus Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Successful Deployments of Electric Buses in Various Cities and Regions to Drive Growth of Electric Bus Market

The successful deployments of electric buses in various cities and regions play a vital role in driving the development of the electric bus market. When cities and transit agencies successfully implement electric bus fleets and demonstrate their effectiveness, it creates a positive impact that ripples through the market in several ways. Firstly, successful deployments act as proof of concept, showcasing the viability and benefits of electric buses to other cities and regions. When one city demonstrates the positive outcomes of electric bus adoption, it inspires and motivates others to follow suit. Transit agencies and municipalities observe the operational performance, environmental impact, and public reception of electric buses in action, leading to increased confidence in their potential as a sustainable transportation solution.

Secondly, successful deployments create a domino effect, fostering a sense of competition among cities and regions. When a neighboring city or region implements electric buses and witnesses positive results, it prompts nearby jurisdictions to consider adopting them to maintain competitiveness. This creates healthy market competition, driving the growth of the electric bus market as more cities join the transition towards cleaner and greener public transportation. Furthermore, successful deployments act as learning opportunities. Cities and transit agencies can learn from the experiences of early adopters, including best practices, challenges faced, and strategies for overcoming barriers. This knowledge-sharing enables smoother and more efficient implementations in subsequent deployments, accelerating the overall growth of the electric bus market. Successful deployments also attract media attention and public interest, generating positive publicity for electric buses. Media coverage of cities achieving environmental milestones and improving air quality through electric buses raises public awareness. It supports the public perception of electric buses as a viable and sustainable alternative to conventional buses. This increased visibility contributes to positive market sentiment, encouraging more cities, transit agencies, and stakeholders to embrace electric buses. This, in turn, makes electric buses more affordable and attractive to a wider range of cities and regions, fueling market growth.

Segmental Analysis:

Based on vehicle type, the market is segmented into battery electric bus, hybrid electric bus, and plug-in hybrid electric bus. The battery electric bus segment held the largest share of the market in 2020 and is anticipated to register the highest CAGR in the market during the forecast period. Battery electric buses have become the dominant technology in the electric bus market, capturing the largest market share. This is primarily due to their environmental sustainability, as they produce zero tailpipe emissions, aligning with global efforts to reduce carbon emissions. Advancements in battery technology, including increased energy density and improved range, have enhanced the performance and feasibility of battery electric buses. The presence of a growing charging infrastructure network further supports their practicality. Favorable government policies and incentives, along with the active involvement of major bus manufacturers, have contributed to the widespread adoption of battery electric buses. With these factors driving market growth, battery electric buses are expected to maintain their leading position in the industry.

Regional Analysis:

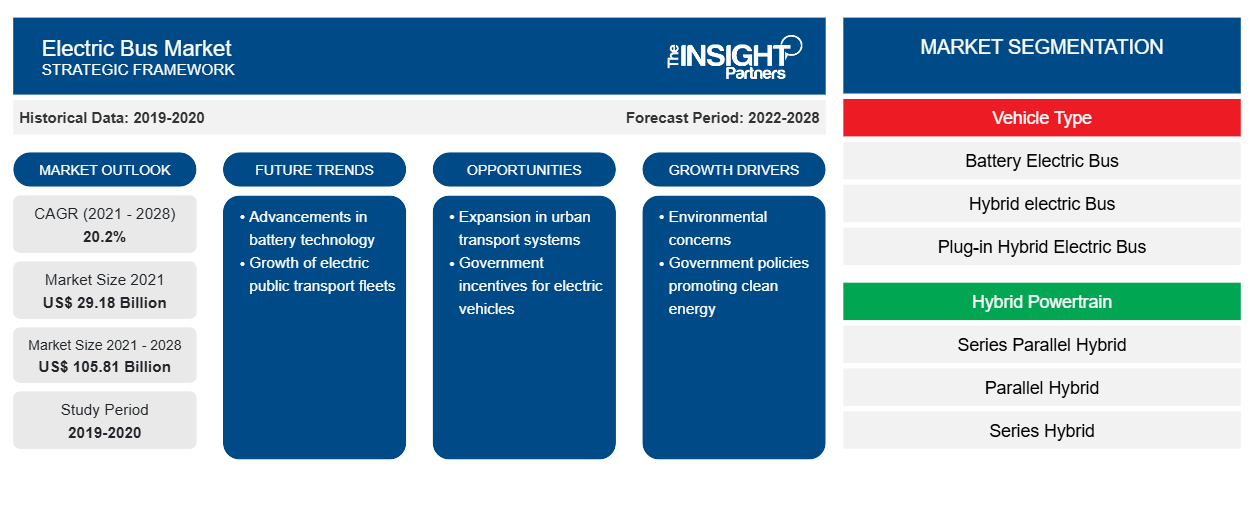

The Asia Pacific electric bus market was valued at US$ 26,375.34 million in 2021 and is projected to reach US$ 15,386.11 million by 2028; it is expected to grow at a CAGR of 20.2% during the forecast period. The Asia Pacific region has appeared as the dominant market for electric buses, exhibiting significant growth and capturing a substantial market share. There are several key factors contributing to this regional dominance. Firstly, the Asia Pacific region, particularly China, has been at the forefront of electric bus adoption. China has implemented ambitious policies and targets to address air pollution and reduce greenhouse gas emissions.

The Chinese government has provided strong support and incentives, including subsidies and grants, to accelerate the deployment of electric buses. This proactive approach has propelled China to become the largest market for electric buses globally, driving the overall dominance of the Asia Pacific region. Moreover, the Asia Pacific region's large population and urban centers have created a pressing need for sustainable and efficient public transportation solutions. Rapid urbanization and growing concerns over air pollution and traffic congestion have prompted governments and transit agencies in countries such as India, Japan, and South Korea to prioritize adopting electric buses. The dense urban environments and heavy traffic volumes make electric buses an attractive option for reducing emissions and improving air quality.

Additionally, a robust manufacturing ecosystem in the Asia Pacific region has played a significant role in its dominance. Asian countries, particularly China, possess a strong manufacturing infrastructure and expertise in producing electric vehicles, including buses. Local manufacturers have invested heavily in research and development, driving advancements in battery technology and cost-effective production methods. This has led to a competitive market landscape and the availability of a wide range of electric bus models at varying price points, further fueling the market dominance. Furthermore, supportive government policies and initiatives have accelerated the development of the electric bus market in the Asia Pacific region. Governments have implemented regulations, emissions standards, and financial incentives to encourage the adoption of electric buses. These policies have created a favorable business environment and provided the impetus for transit agencies to invest in electric bus fleets.

Key Player Analysis:

The electric bus market analysis consists of the players such as King Long United Automotive Industry Co. Ltd; AB Volvo; Shenzhen Wuzhoulong Motors Co., Ltd; BYD Company Limited; Daimler; AGAlexander Dennis Limited; EBUSCO; Proterra Solaris Bus & Coach S.A; and NFI Group Inc. Among the players in the electric bus AB Volvo and EBUSCO are the top two players owing to the diversified product portfolio offered.

Electric Bus Market Regional Insights

The regional trends and factors influencing the Electric Bus Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electric Bus Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electric Bus Market

Electric Bus Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 29.18 Billion |

| Market Size by 2028 | US$ 105.81 Billion |

| Global CAGR (2021 - 2028) | 20.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

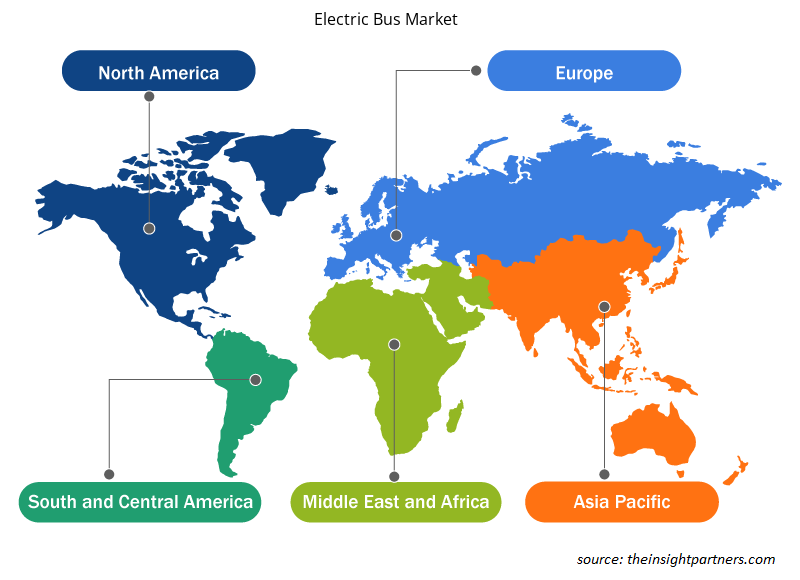

Electric Bus Market Players Density: Understanding Its Impact on Business Dynamics

The Electric Bus Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electric Bus Market are:

- AB Volvo

- King Long United Automotive Industry Co., Ltd

- Shenzhen Wuzhoulong Motors Co., Ltd

- BYD Company Ltd

- Daimler AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electric Bus Market top key players overview

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the electric bus market. A few recent key market developments are listed below:

- In March 2022: Proterra Inc announced a strategic, multi-year supply agreement with The Shyft Group to power their Blue Arc purpose-built electric delivery van and EV chassis.

- In July 2020, AB Volvo entered into a partnership with the Public Transport Authority of Western Australia (PTA) to bring Volvo’s first ever Electric Buses to Australia. These provisions for the introduction of alternatively powered vehicles into the public transport bus network when the technology became available in Volvo’s Australian product line.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Sexual Wellness Market

- Authentication and Brand Protection Market

- Power Bank Market

- Aircraft Wire and Cable Market

- Identity Verification Market

- Medical Devices Market

- Mail Order Pharmacy Market

- Environmental Consulting Service Market

- Vertical Farming Crops Market

- Nuclear Decommissioning Services Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Vehicle Type, End User and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Asia Pacific dominated the electric bus market in 2020 with a share of 90.4% and is expected to continue its dominance by 2028. Europe is the second-largest contributor to the global electric bus market in 2020, followed by North America.

The major companies in electric bus market are AB Volvo; King Long United Automotive Industry Co., Ltd; Shenzhen Wuzhoulong Motors Co., Ltd; BYD Company Ltd; Daimler AG; Ebusco; CAF Group (Solaris Bus & Coach); Proterra Inc; NFI Group; and Van Hool NV.

Based on vehicle type, the global electric bus market is segmented into battery electric bus, hybrid electric bus, and plug-in hybrid electric bus. The electric bus market was dominated by the battery electric bus segment in 2020.

The major end user in electric bus market includes public, and private. In terms of market share, the market was dominated by the public segment in 2020.

An electric powertrain is combined with fuel cell systems, controlled technology, and batteries to power hydrogen fuel cell buses. These buses are considered next-generation green transportation because their lifespan is far longer than a typical electric bus. The hydrogen fuel cell bus can refuel quickly and has many routes. With such benefits, the demand for hydrogen fuel cell buses is skyrocketing. For instance, over a thousand hydrogen buses will be launched throughout Europe during the next few years. China has been at the forefront of this technology, moving the battery-electric-driven business forward. In the United States, the deployment of hydrogen-fueled buses has been slow, with hydrogen buses accounting for only 3.1% of total zero-emission buses (deployed or planned) across the country. The deployment will likely grow significantly over the next decade, with the scalability factor outweighing the high procurement costs. For instance, within the scope of three initiatives in Cwmbran, Warwickshire, and Ballymena, the UK Business Secretary announced a GBP 54 million fund to create the next generation of electric trucks and hydrogen-powered buses. The initiatives are expected to create around 10,000 employment and reduce 45 million tonnes of carbon emissions across the UK. Thus, increasing demand for hydrogen fuel bus will drive the electric bus market.

Electric buses employ a variety of batteries. Low-cost lithium ion-phosphate batteries are becoming increasingly used in electric buses. Batteries made of lithium-ion phosphate are both cost-effective and robust. The average price of these batteries is a significant benefit for automakers. Due to its speed, safety, and excellent thermal stability, lithium-ion phosphate batteries have seen a phenomenal increase in sales in recent years. To accommodate the growing need for longer driving ranges, market participants are implementing technical improvements to improve the operational efficiency of the batteries. This will increase electric bus sales. Electric bus manufacturers are always trying to improve efficiency and increase the range of their vehicles. Furthermore, the production of high-density Nickel, Manganese, and Cobalt (NMC) batteries are subject to significant intellectual property rights, primarily from Japanese and Korean battery manufacturers, and the use of LFP batteries avoids any risk of litigation while simultaneously promoting domestic battery suppliers over foreign competitors such as LG Chem and Samsung. For instance, CATL and BYD sold 78 percent of electric bus lithium-ion batteries in China in 2018, and both companies chose LFP batteries for electric buses. Thus, rising production of low-cost lithium ion-phosphate batteries will drive the demand for electric bus market.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies - Electric Bus Market

- AB Volvo

- King Long United Automotive Industry Co., Ltd

- Shenzhen Wuzhoulong Motors Co., Ltd

- BYD Company Ltd

- Daimler AG

- Ebusco

- CAF Group (Solaris Bus & Coach)

- Proterra Inc

- NFI Group

- Van Hool NV

Get Free Sample For

Get Free Sample For