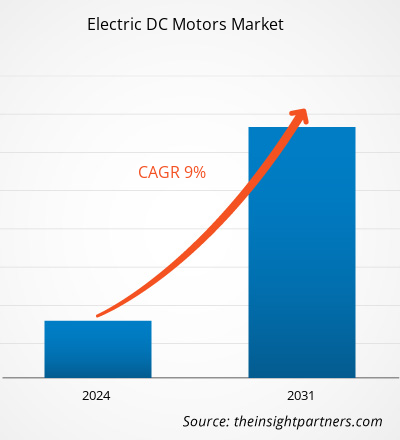

The electric DC motors market size is projected to reach US$ 29811.77 million by 2031 from US$ 14965.81 million in 2023. The market is expected to register a CAGR of 9% during 2023–2031. Increasing adoption of automated lighting systems is likely to remain a key trend in the market.

Electric DC Motors Market Analysis

Heating, ventilation, and air conditioning (HVAC) systems maintain air quality and provide thermal comfort. The US Department of Energy estimates that the demand for HVAC equipment was 10% higher in 2021 than in 2020. HVAC systems are a crucial component of modern infrastructure, particularly in large office buildings and commercial malls. Electric DC motors are often employed in HVAC systems to increase their lifespan, power, and airflow efficiency. Expansions of commercial spaces; construction of new corporate hubs, office buildings, organized retail stores, and residential complexes; and rising income levels in Southeast Middle Eastern and Asian countries have made HVAC equipment highly accessible to consumers.

Electric DC Motors Market Overview

One kind of electric machine that transforms electrical energy into mechanical energy is a direct current (DC) motor. DC motors use direct current electricity to generate mechanical spin from the energy they receive. DC motors employ magnetic fields created by the electrical currents flowing through them to drive a rotor that is fixed inside the output shaft. The electrical input and the motor's design both affect the torque and speed of the output. A stator and an armature are the two main parts of a DC motor. In a motor, the armature rotates while the stator remains motionless. The armature of a DC motor rotates because of the magnetic field generated by the stator. An electromagnetic field that is aligned with the coil's center is produced by a simple DC motor using a coil of wire that is current-driven and a set of stationary magnets in the stator.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electric DC Motors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electric DC Motors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Electric DC Motors Market Drivers and Opportunities

Increasing adoption of brushless DC motors

The adoption of brushless DC motors is increasing as various companies are launching these motors. For instance, in January 2021, Portescap added the 16ECS high-speed brushless motor to its Ultra EC™ mini brushless DC motor platform. These compact 16-millimeter motors are available in 36- and 52-mm lengths and provide high power while running at speeds of 75,000 rpm. Similarly, in February 2023, Johnson Electric announced the launch of our ECI-043 brushless DC motor platform. Thus, with the introduction of brushless DC motors, the market is growing.

Increasing Adoption Of EVs

Some of the world’s largest automotive OEMs, manufacturing plants established in the various American regions that manufacture passenger cars, trucks, buses, and other off-highway vehicles, have undertaken various electrification initiatives. For instance, in July 2021, Stellantis had planned to invest around US$35.5 billion in vehicle electrification through 2025. Furthermore, Stellantis joins automakers such as General Motors, Volkswagen, and Ford Motor in announcing investments of tens of billions of dollars in EVs. California state in the US, one of the world's largest automotive manufacturing hubs, has started providing incentives and mandates to automotive OEMs for zero-emission vehicles. For instance, in August 2022, The California Air Resources Board approved the trailblazing Advanced Clean Cars II regulation to accelerate 100% new zero-emission vehicle sales by 2035. Thus, the increasing adoption of EVs is creating more opportunities for the market.

Electric DC Motors Market Report Segmentation Analysis

Key segments that contributed to the derivation of the electric DC motors market analysis are type, speed, and application.

- Based on the type, the electric DC motors market is divided into Brushed DC Motors and Brushless DC Motors. The Brushless DC Motors segment held a larger market share in 2023.

- By speed, the market is segmented into low, medium, and high.

- By application, the market is segmented into industrial machinery, automotive and transportation, HVAC equipment, aerospace & defense, household appliances, and others.

Electric DC Motors Market Share Analysis by Geography

The geographic scope of the electric DC motors market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

APAC dominates the electric DC motors market. The electric DC motors market in this region is growing due to various factors, such as increasing government initiatives to improve the visibility of tunnel lighting and the presence of a well-established transportation industry.

Electric DC Motors Market Regional Insights

The regional trends and factors influencing the Electric DC Motors Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electric DC Motors Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electric DC Motors Market

Electric DC Motors Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 14965.81 Million |

| Market Size by 2031 | US$ 29811.77 Million |

| Global CAGR (2023 - 2031) | 9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

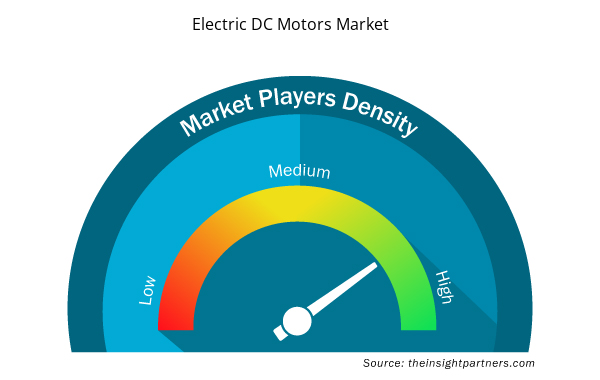

Electric DC Motors Market Players Density: Understanding Its Impact on Business Dynamics

The Electric DC Motors Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electric DC Motors Market are:

- ABB

- Allied Motion Inc.

- Ametek Inc

- Yaskawa Electric Corp

- Minebeamitsumi Inc.

- Johnson Electric Holdings Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electric DC Motors Market top key players overview

Electric DC Motors Market News and Recent Developments

The electric DC motors market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the electric DC motors market are listed below:

- Johnson Electric announced the launch of our ECI-040 brushless DC motor platform. This new generation is designed to simplify integration by accepting direct mains AC power through the controller as input. Customers can replace AC motors directly and can also eliminate the need for expensive and large AC-to-DC transformers. (Source: Johnson Electric, Press Release, August 2021)

- Nidec Corporation announced that it has developed a single-phase, low-vibration, and low-cost brushless DC motor that can be installed in an electric fan. Most electric fans used around the world employ low-cost AC (capacitor) motors, which, as a solution for the global increase in energy consumption, should be replaced by high-efficiency brushless DC motors. While three-phase brushless DC motors are excellent in durability, noise level, and controllability, their prices, higher than those of AC motors, have made products that are equipped with the motors expensive, posing an impediment to the ACDC motor replacement. (Source: Nidec Corporation, Press Release, September 2022)

Electric DC Motors Market Report Coverage and Deliverables

The “Electric DC Motors Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Electric DC motors market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Electric DC motors market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- electric DC motors market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the electric DC motors market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Europe dominates the electric DC motors market.

Increasing adoption of brushless DC motors and increasing adoption of EVs are the major factors that propel the global electric DC motors market.

Increasing adoption of automated lighting systems is anticipated to play a significant role in the global electric DC motors market in the coming years.

The key players holding majority shares in the global electric DC motors market are ABB, Allied Motion Inc., Ametek Inc., Yaskawa Electric Corp, Minebeamitsumi Inc., Johnson Electric Holdings Limited, Maxon Motor AG, NIDEC Corporation, Regal Rexnord Corporation, and Siemens AG.

The global electric DC motors market is expected to reach US$ 29811.77 million by 2031.

The expected CAGR of the global electric DC motors market is 9%.

Get Free Sample For

Get Free Sample For