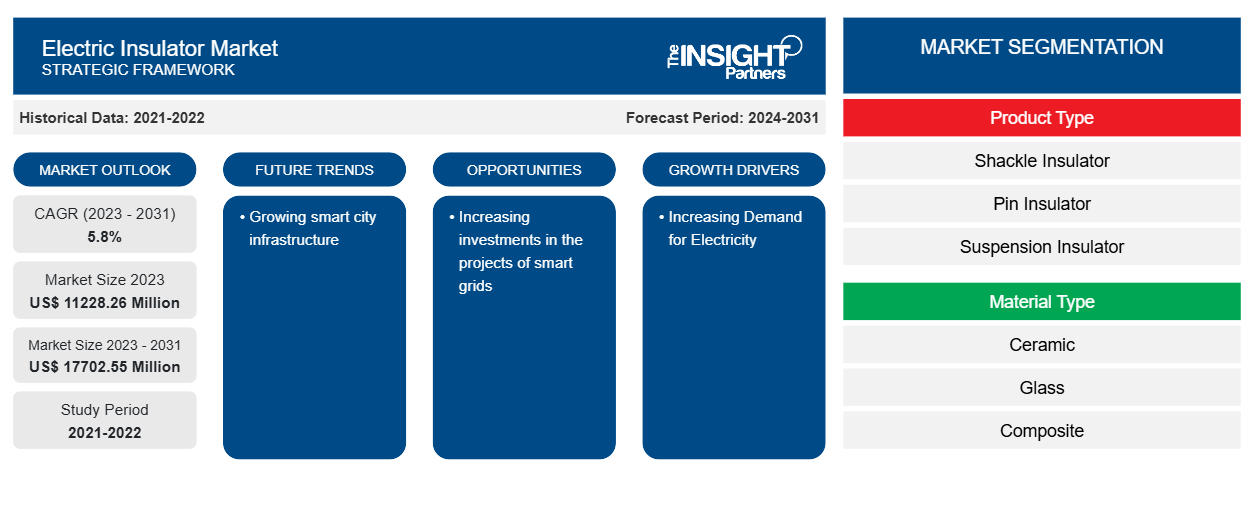

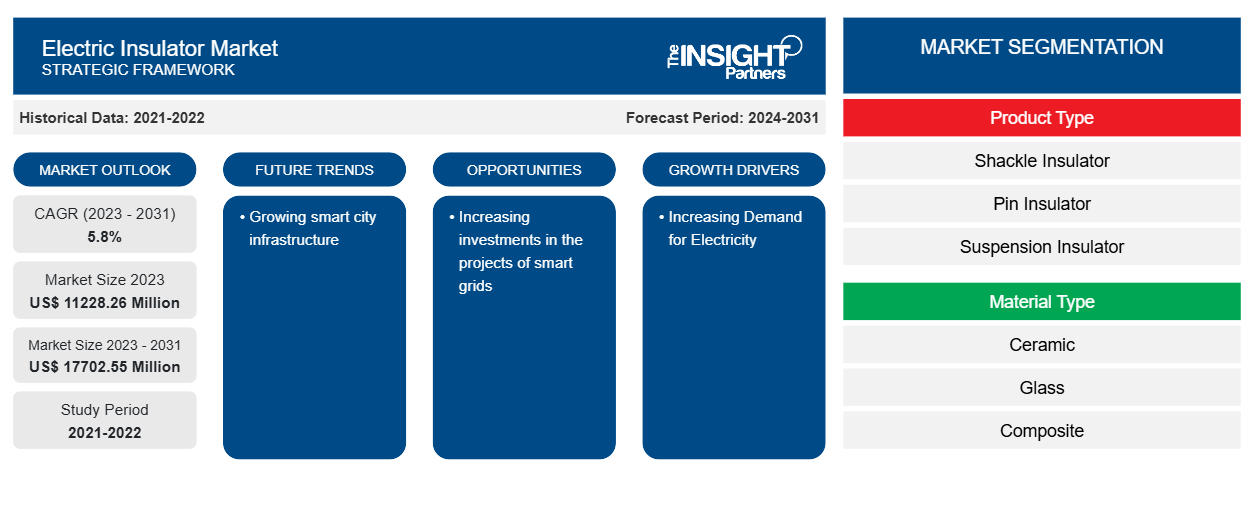

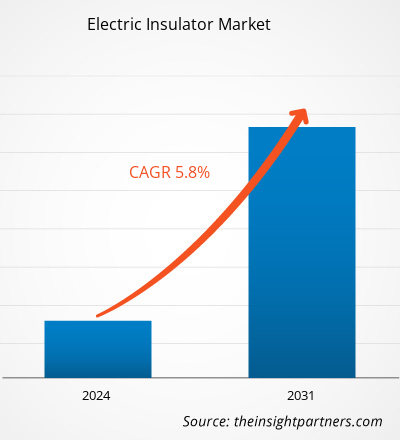

The electric insulator market size is projected to reach US$ 17702.55 million by 2031 from US$ 11228.26 million in 2023. The market is expected to register a CAGR of 5.8% during 2023–2031. Growing smart city infrastructure is likely to remain a key trend in the market.

Electric Insulator Market Analysis

Many developing nations, including Brazil, Vietnam, Saudi Arabia, India, and others, are concentrating on increasing their industrialization. As part of the "Make in India" initiative, the Indian government is concentrating on growing industries. It is a significant national initiative of the Indian government that aims to improve talent development, encourage innovation, protect intellectual property, make investment easier, and create the nation's best manufacturing infrastructure. Cars, auto components, aviation, biotechnology, chemicals, construction, defense manufacturing, electrical machinery, electronic systems, food processing, IT & BPM, leather, media and entertainment, mining, oil and gas, pharmaceuticals, ports and shipping, railways, renewable energy, roads and highways, space, textile and garments, thermal power, tourism and hospitality, and wellness are among the 25 industries that are the focus of the Made in India program.

Electric Insulator Market Overview

Electrical conductors and electrical insulators are not the same thing. Materials that facilitate the easy flow of electricity through them are known as electrical conductors. Charges can pass through them with ease. Conversely, materials that act as insulators prevent the free passage of electric charges through them. The capacity of conductors to conduct electricity is determined by a property known as conductivity. How much resistance an insulator offers to the flow of electricity determines how effective they are. Resistivity is the name given to this characteristic as opposed to conductivity. Insulators are primarily utilized in situations where it is necessary to stop the flow of electric charges. Because these materials don't have the moveable electric charges needed to spread electric current, they function as efficient non-conductors. The majority of applications for electrical insulators are in electrical equipment. For instance, insulating material is placed over electrical lines that carry power through homes to guard against any potential safety risks.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electric Insulator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electric Insulator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Electric Insulator Market Drivers and Opportunities

Increasing Demand for Electricity

Total U.S. electricity consumption in 2022 was about 4.07 trillion kWh, according to the U.S. Energy Information Administration. The growing population demands more electricity. With the increase in the electricity demand across commercial, residential, and industrial applications, more transmission and distribution networks are needed to provide electricity across the world, also, according to the data of the Ministry of Power Govt. In India, the electricity generation target (including RE) for the year 2023-24 has been reduced to 1750 Billion Units (BU). i.e., growth of around 7.2% over an actual generation of 1624.158 BU for the previous year (2022-23). The generation during 2022-23 was 1624.158 BU, compared to 1491.859 BU generated during 2021-22, resulting in a growth of approximately 8.87%. Therefore, the increasing demand for electricity and the increasing investments in transmission and distribution networks are boosting the need for electric insulators.

Increasing investments in the projects of smart grids

In order to satisfy the various energy needs of end users, a smart grid is an electricity network that makes use of digital and other cutting-edge technology to monitor and control the transportation of electricity from all generation sources. The government of various regions is investing in smart grid projects significantly. For instance, in October 2023, The US Department of Energy (DOE) earmarked $3.46 billion for 58 smart power grid projects spanning 44 states aimed at fortifying the resilience and reliability of the nation's electric grid. The initiatives, underpinned by the Bipartisan Infrastructure Law, will leverage a total investment of over $8 billion from both federal and private sources. Thus, increasing investments in smart power grids is creating opportunities for the market.

Electric Insulator Market Report Segmentation Analysis

Key segments that contributed to the derivation of the electric insulator market analysis are Product type, material type, application, and end user.

- Based on the Product type, the electric insulator market is divided into shackle insulators, pin insulators, suspension insulators, and other product types. The pin insulators segment held a larger market share in 2023.

- By material type, the market is segmented into ceramic, glass, and composite. The ceramic segment held a larger market share in 2023.

- By application, the market is segmented into transformer, busbar, cable, switchgear, surge protection devices, and other applications.

By end user, the market is segmented into utilities, industries, and other end users.

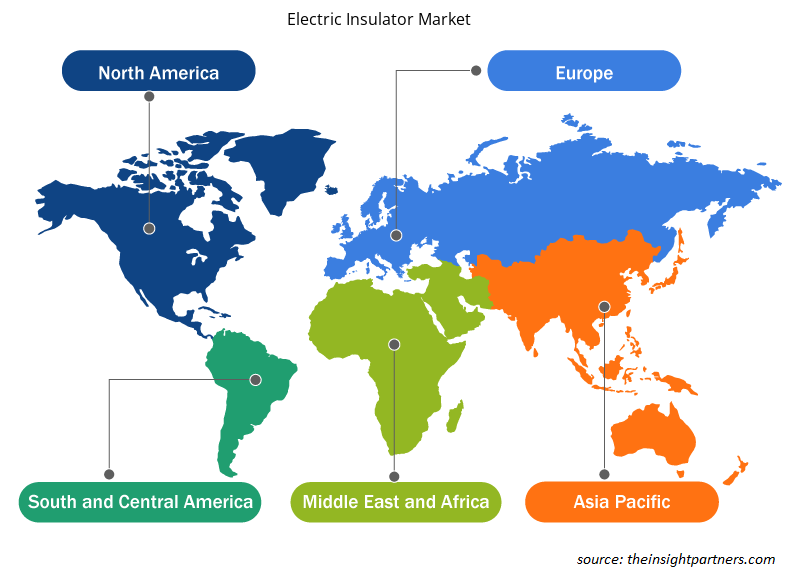

Electric Insulator Market Share Analysis by Geography

The geographic scope of the electric insulator market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. APAC dominates the electric insulator market. The electric insulator market in this region is growing due to various factors, such as increasing government initiatives for the electric grid infrastructure and the growing population as well as the economy.

Electric Insulator Market Regional Insights

The regional trends and factors influencing the Electric Insulator Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electric Insulator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electric Insulator Market

Electric Insulator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 11228.26 Million |

| Market Size by 2031 | US$ 17702.55 Million |

| Global CAGR (2023 - 2031) | 5.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Electric Insulator Market Players Density: Understanding Its Impact on Business Dynamics

The Electric Insulator Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electric Insulator Market are:

- Hitachi ABB Power Grids Group

- Aditya Birla Insulators

- General Electric Company

- Hubbell Incorporated

- MacLean-Fogg Company

- NGK Insulators

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electric Insulator Market top key players overview

Electric Insulator Market News and Recent Developments

The electric insulator market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the electric insulator market are listed below:

- Avery Dennison Performance Tapes announced the launch of the newly developed Volt Tough™ portfolio of electrical insulation tape solutions. This advanced offering of electrically insulative, single-sided film tapes is engineered to address the challenges of insufficient electrical insulation in EV battery packs. (Source: Signify, Press Release, September 2023)

- China Machinery Industry Federation organized 12 new types of 1000 kV AC, ±800 kV, and ±500 kV DC rod suspension composite insulators independently developed by Nanjing Electric Insulator Co., Ltd. in Nanjing. National product appraisal meeting. Appraisal by experts, the comprehensive technical performance of the product has reached the international advanced level of similar products. (Source: Nanjing Electric Insulator Co., Ltd, Press Release, March 2020)

Electric Insulator Market Report Coverage and Deliverables

The “Electric Insulator Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Electric insulator market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Electric insulator market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- electric insulator market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the electric insulator market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type , Material Type , Application , and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The expected CAGR of the global electric insulator market is 5.8%.

The global electric insulator market is expected to reach US$ 17702.55 million by 2031.

Growing smart city infrastructure is anticipated to play a significant role in the global electric insulator market in the coming years.

The key players holding majority shares in the global electric insulator market are Hitachi ABB Power Grids Group, Aditya Birla Insulators, General Electric Company, Hubbell Incorporated, MacLean-Fogg Company, NGK Insulators, Ltd., PFISTERER Holding AG, SEVES Group, Siemens AG, and TE Connectivity Ltd.

Increasing demand for electricity and Increasing investments in the projects of smart grids are the major factors that propel the global electric insulator market.

APAC dominates the electric insulator market.

Get Free Sample For

Get Free Sample For