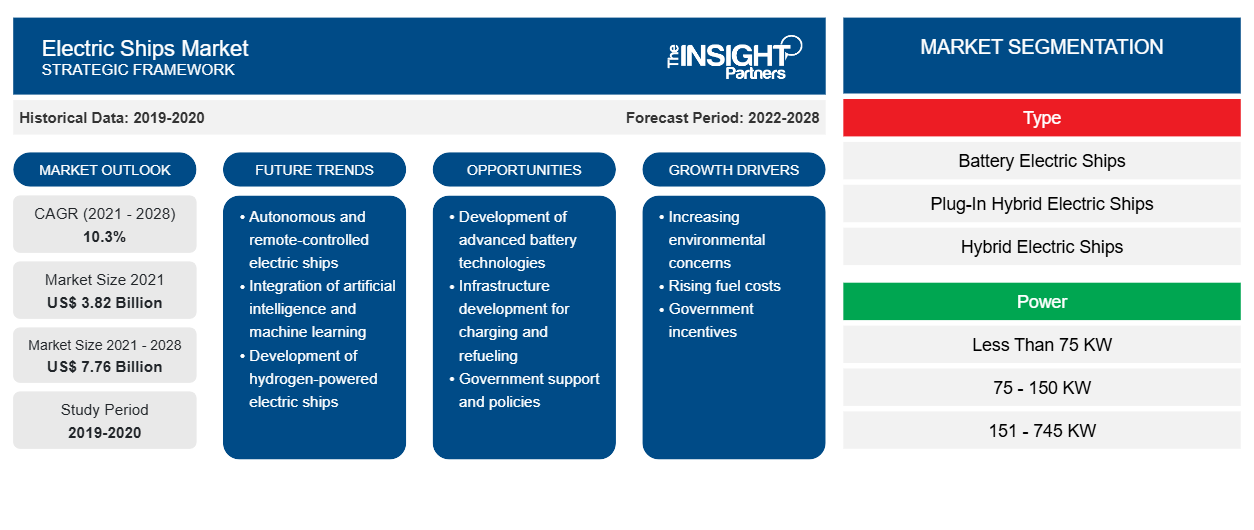

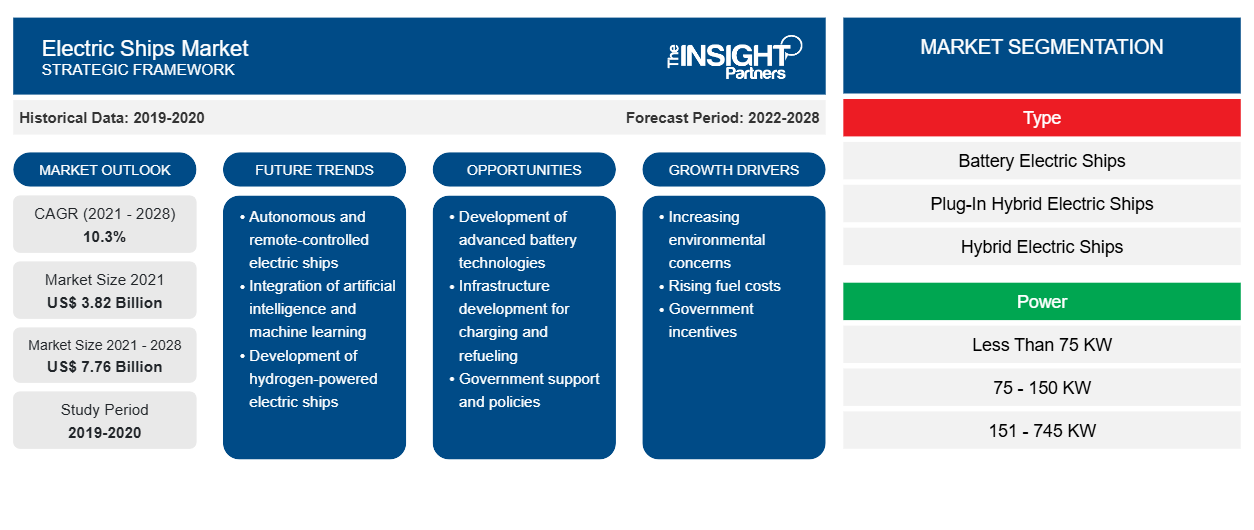

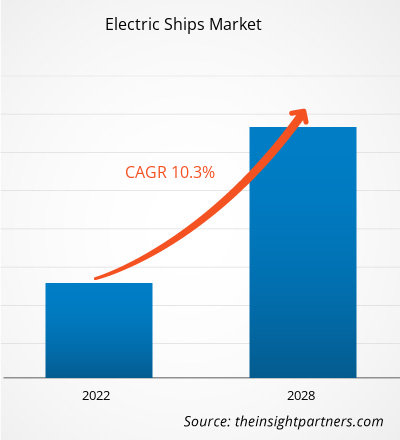

The electric ships market was valued US$ 3.82 billion in 2021, it is estimated to grow at a CAGR of 10.3% from 2021 to 2028.

An electric boat is any boat or ship whose primary propulsion technology is an electric drive system. It can be a full-battery electric, hydrogen fuel cell electric, electric hybrid boat or ship, from tugboats, ferries, cargo ships, and barges to tour boats, fishing trawlers, cruising yachts, and unmanned underwater vehicles (UUVs). Electric ships are driven electrically, unlike conventional diesel engine ships. These ships use a battery storage device as their power source to drive electric motors. Numerous types of batteries can be used in an electric ship, including lithium-ion batteries, lead-acid batteries, and fuel cells. Electric ships are mainly ferries and small passenger ships on inland waterways that sail entirely with electricity. They travel only short distances with ~80 km in a single charge. Further, solar-powered ships are also used in lightweight ships that require low power output. However, the power requirements of cargo ships cannot be fulfilled by a fully electric system due to heavyweight; hence cargo ships are utilizing a hybrid diesel-electric system.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electric Ships Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electric Ships Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Electric Ships Market

The COVID-19 pandemic adversely affected the electric ships market. The pandemic led to unparalleled global impacts on human mobility. In the ocean, ship-based activities are affected due to severe restrictions on human movements and changes in consumption of goods. A few countries have closed their cruise industry due to the COVID-19 pandemic. However, some cruise lines are trying to resume their activities during the pandemic. Human activities in the ocean have been radically changed by the COVID-19 pandemic, with reports of port restrictions and shifts in consumption patterns impacting multiple maritime sectors, fisheries, passenger ferries, and cruise ships. However, in some regions, the shipping of goods was declared essential during the lockdown, which created a lucrative opportunity for the electric ships market.

Electric Ships Market Insights

Rise in Adoption of Hybrid and Electric Propulsion Systems for Retrofitting Ships

Retrofitting ships is gaining interest and attracting shipowners/shipbuilders to extend the lifetime of their existing ships. Such a process provides a chance to reduce fuel consumption and stay updated with the latest eco-friendly solutions as a cost-effective procedure. Retrofitting is becoming a common practice in the maritime industry. Shipbuilders are moving toward automation, integrating newly built ships, and retrofitting existing ships with hybrid and electric propulsion systems. This system is a convenient choice for retrofitting outdated ships with enormous retrofit potential, including ferries, container vessels, cruise ships, tugboats, and general cargo ships. Shipbuilders choose to retrofit ships with a hybrid-electric propulsion system or a fully electric propulsion system as it is a relatively cheaper option than purchasing a new ship. Further, several European shipbuilders are actively retrofitting their current ship fleet with hybrid and electric propulsion systems. For instance, according to the article published by the Riviera Maritime Media Ltd, in March 2020, the offshore supply vessel (OSV) owners invested in retrofitting diesel-electric/LNG-powered fleets with battery-hybrid propulsion in a move that is paying off for the charterer, owner, and the environmental issues in Norway. These factors have resulted in the adoption of hybrid and electric propulsion systems for retrofitting ships.

Type-Based Market Insights

Based on type, the electric ships market is segmented into battery electric ships, plug-in hybrid electric ships, and hybrid electric ships. The hybrid electric ships segment led the market in 2020. The reliability offered by hybrid electric ships supports its demand owing to the use of supplementary propulsion systems and higher speed, which can reduce the risk of failure and cover greater distances in less time. Besides, hybrid electric vessel propulsion can be propelled in two ways—electrical (via diesel-electric or battery power-driven) or mechanical (direct diesel drove). Furthermore, ship owners or shipping and logistic companies across the globe prefer hybrid electric ships as they enable lower fuel consumption and help reduce operational costs. The use of diesel-electric propulsion at low power and direct diesel-driven propulsion in need of high power that is inland water sailing with different speed conditions enables a reduction in operational cost in the electric ship. This is a smarter way to use available energy and save on fuel costs by using hybrid electric ship propulsion.

Players operating in the electric ships market adopt strategies, such as mergers, acquisitions, and market initiatives, to maintain their positions in the market. A few developments by key players are listed below.

- In November 2021, BAE Systems launched a next-generation power and propulsion system to help marine operators reach zero emissions. It provides a flexible solution improving electrical efficiency and vessel range, increasing propulsion power, and simplifying installation.

- In September 2020, Kolumbus (a mobility company) and Fjellstrand (shipbuilder) signed a contract to deliver the world’s first fully electrical fast ferry. This project had received funding from the European Union’s Horizon 2020 research and innovation program.

Based on type, the electric ships market is segmented into battery electric ships, plug-in hybrid electric ships, and hybrid electric ships. Based on the power, the electric ships market is segmented into less than 75 kW, 75-150 kW, 151-745 kW, 746-7560 kW, and more than 7560 kW. Based on range, the electric ships market is categorized into less than 50 km, 50-100 km, 101-1000 km, and more than 1000 km. Based on ships type, the electric ships market is segmented into cruise ship, ferries, tankers, bulk carriers, fishing vessels, destroyers, aircraft carriers, and others. By geography, the electric ships market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America (SAM).

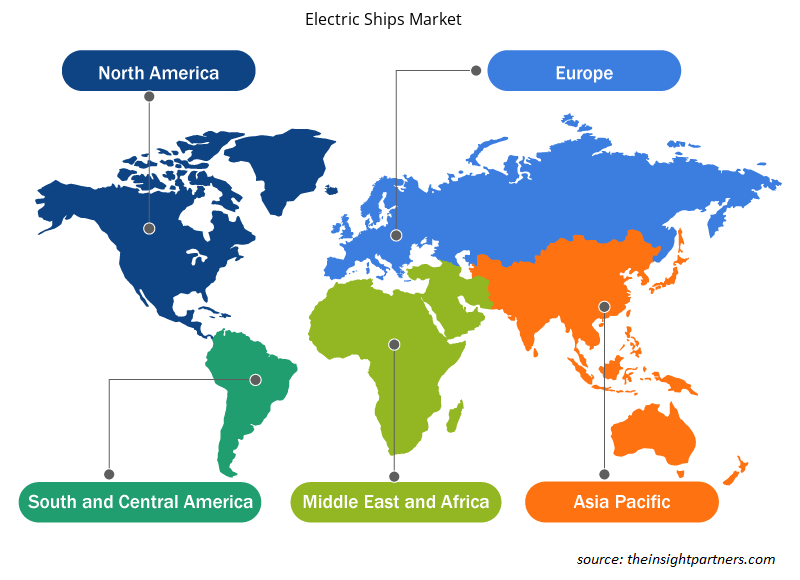

Electric Ships Market Regional Insights

Electric Ships Market Regional Insights

The regional trends and factors influencing the Electric Ships Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electric Ships Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electric Ships Market

Electric Ships Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3.82 Billion |

| Market Size by 2028 | US$ 7.76 Billion |

| Global CAGR (2021 - 2028) | 10.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Electric Ships Market Players Density: Understanding Its Impact on Business Dynamics

The Electric Ships Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electric Ships Market are:

- BAE Systems

- Duffy Electric Boat Company

- Fjellstrand AS

- X Shore

- General Dynamic Electric Boat

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electric Ships Market top key players overview

Company Profiles

- BAE Systems

- Duffy Electric Boat Company

- Fjellstrand AS

- X Shore

- General Dynamic Electric Boat

- Hurtigruten

- MAN Energy Solutions

- PortLiner

- Siemens Energy

- VARD AS

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Medical Devices Market

- Architecture Software Market

- Tortilla Market

- Clear Aligners Market

- Saudi Arabia Drywall Panels Market

- Railway Braking System Market

- Airport Runway FOD Detection Systems Market

- Space Situational Awareness (SSA) Market

- Helicopters Market

- Social Employee Recognition System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Power, Range, and Ship Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Canada, China, France, Germany, Italy, Japan, Middle East and Africa, South America, South Korea, United Kingdom, United States

Frequently Asked Questions

The idea of retrofitting ships is gaining interest and is attracting shipowners/shipbuilders to extend the lifetime of their existing ships. Such a process provides a chance to reduce fuel consumption and stay up to date with the latest eco-friendly solutions as a cost-effective procedure. Retrofitting is becoming a common practice in the maritime industry. Shipbuilders are moving toward automation, integrating new build ships, and retrofitting existing ships with hybrid and electric propulsion systems. A hybrid-electric propulsion system is a convenient choice for retrofitting outdated ships. Ships have a large retrofit potential, including ferries, container vessels, cruise ships, tugboats, and general cargo ships. Shipbuilders choose to retrofit ships with a hybrid-electric propulsion system or a fully electric propulsion system as it is a relatively cheaper option than purchasing a new ship. These factors mentioned above have resulted in the adoption of hybrid and electric propulsion systems for retrofitting ships.

Nowadays, hybrid propulsion technology is commonly used for small vessels such as ferries. For instance, according to the article published by the Institution of Engineering and Technology, in January 2019, the UK shipbuilder Ferguson Marine had built Catriona, a £12.3 million (US$ 15.82 million) diesel-electric-battery-power hybrid ferry for CalMac to use on its Clyde and Hebridean routes. However, with the development of marine electric propulsion technology and alternative fuels such as fuel cells, there is a massive opportunity for manufacturers to work on hybrid-electric propulsion systems for larger ships. The stricter emissions targets have encouraged shipbuilders to install a hybrid propulsion system on existing or new vessels. The research & development (R&D) department for ABB marine activities in Norway stated that the hybrid propulsion systems significantly reduce both fuel consumption and emissions, according to the article published by the Institution of Engineering and Technology in January 2019. Therefore, with the growing emission control norms, the adoption of hybrid-electric propulsion systems is increasing among larger ships, creating a massive opportunity for manufacturing larger ships using hybrid-electric propulsion systems.

Europe dominated the Electric Ships market in 2020 with a share of 48.6% and is expected to continue its dominance by 2028. North America is the second-largest contributor to the global Electric Ships market in 2020, followed by Asia Pacific.

The major companies in Electric Ships market are BAE Systems, Duffy Electric Boat Company, Fjellstrand AS, X Shore, General Dynamic Electric Boat, Hurtigruten, MAN Energy Solutions, PortLiner, Siemens Energy, and VARD AS

The major Application in Electric Ships includes cruise ship, ferries, tankers, bulk carriers, fishing vessels, destroyers, aircraft carriers, and others. In terms of market share, the electric ships market was dominated by the ferries segment in 2020.

The electric ships market, by type is segmented into battery electric ships, plug-in hybrid electric ships, and hybrid electric ships. The Electric Ships market was dominated by the hybrid electric ships segment in 2020.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies - Electric Ships Market

- BAE Systems

- Duffy Electric Boat Company

- Fjellstrand AS

- X Shore

- General Dynamic Electric Boat

- Hurtigruten

- MAN Energy Solutions

- PortLiner

- Siemens Energy

- VARD AS

Get Free Sample For

Get Free Sample For