Electro-Optics in Naval Market Segments and Growth by 2031

Electro-Optics in Naval Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Camera, Sensor, and Laser Range Finder), Application (Target Detection, Identification, and Tracking; Surveillance; Fire Control; and Others), End Use (Defense and Commercial), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2023-2031- Report Date : Mar 2026

- Report Code : TIPRE00029823

- Category : Aerospace and Defense

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

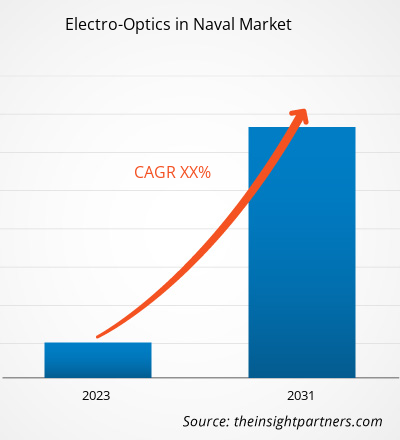

The electro-optics in naval market size is projected to reach US$ 12,980.06 million by 2031 from US$ 9,268.34 million in 2023. Electro-optic has enabled successful mission execution, possessing unique features and capabilities best suited for naval targeting, surveillance, and situational awareness. Companies in the market are designing an electro-optic solution to provide superior operation and surveillance in a lightweight and lower-cost package that effectively supports multiple mission requirements for full-spectrum surface detection, identification, surveillance, and target assessment.

Electro-Optics in Naval Market Analysis

With the naval expansion, there is an increase, and national security concerns continue to rise across commercial maritime activity regarding shipbuilding and investment in port infrastructure. Additionally, heavy investments in modernizing and upgrading electro-optic technology, an increase in the need for ISR capabilities, and adoption of unmanned surface vehicles (USVs) are among the major factors fuelling the electro-optic in the naval market growth. For instance, in September 2022, L3Harris Technologies Inc received a contract from the U.S. Navy worth US$ 8.9 million to supply electro-optics sensors for fire control applications across warship deck guns. However, the stagnant lifecycle of naval electro optic systems that reduces the product demand for retrofit installations is one of the major factors limiting the market growth. On the contrary, increase in sea-based situational awareness, a rise in the need for better sensor systems that are highly reliable and accurate for maritime patrol, and rapid developments and R&D investments are anticipated to create lucrative growth opportunities for the market in the coming years.

Electro-Optics in Naval Market Overview

The naval electro-optics systems consist of multi-sensor imaging modules catering to the needs for surveillance, monitoring, fire control, and panoramic search-and-track. In addition, the electro-optic enables the detection of all airborne and surface threats, both symmetrical and asymmetrical, regardless of the time of the day and weather conditions. Moreover, for high sea and coastal security operations, electro-optic systems provide surveillance, fire control, and air defense systems for several surface vessels, including aircraft carriers, frigates, corvettes, ocean and coastal patrol boats, and high-speed craft. Moreover, electro optic sensors are operational in various airborne, ground, and naval applications, providing position and orientation data required for operation and target acquisition. Also, the sensors provide early-warning, abnormal activity monitoring, incident management, and comprehensive observation and reaction capabilities.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONElectro-Optics in Naval Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Electro-Optics in Naval Market Drivers and Opportunities

Continuous Growth of Global Defense Sector

The change in the modern warfare system has been urging governments across the world to allocate high funds toward respective military forces. The military budget allocation enables military forces to procure advanced technologies and equipment from domestic or international manufacturers. Solider and military vehicle modernization practices are also on the rise across numerous countries. To strengthen military forces with advanced technologies, armaments, artilleries, combat aircraft, naval vessels, and armoured vehicles, defense forces across the world are investing substantial amounts in the aforementioned products. The continuous urge for new technologies for combat and noncombat operations by the defense forces is boosting defense spending across the world.

Increasing Number of Disputes and Threats to Naval Vessels

Due to the growth in maritime disputes and threats to naval vessel forces, countries are investing in advanced electro-optical systems for maritime applications such as threat detection, surveillance, and target identification. In addition, the growing number of territorial conflicts and border issues increases the risk for maritime assets, leading to an increasing emphasis on surveillance, threat detection, and target identification at sea. Moreover, navy forces are increasingly focusing on incorporating and integrating sophisticated and advanced sensor systems into their naval vessels. Additionally, it has become important for navy vessels to obtain motion imagery from electro-optic sensors that provide day-night and long-range eyes on the target. Also, it improves vessel’s ability to identify targets, supports weapon engagement through automatic tracking and fire control solutions through line-of-sight, and performs threat assessment. Moreover, the constant tensions among the countries such as China-India, India-Pakistan, China-Taiwan, Russia-China, US-Russia; also, the ongoing conflicts among the countries such as Russia-Ukraine, India-China, and China-Taiwan are some of the major factors generating the demand for electro-optic systems across the defense forces of these countries. Such tension among the countries have been pushing the requirement of naval vessel operations which is in turn driving the demand for electro-optic cameras, sensors, and laser range finders across different regions.

Electro-Optics in Naval Market Report Segmentation Analysis

Key segments that contributed to the derivation of the electro-optics in naval market analysis are technology, application and end use.

- Based on technology, the global electro-optic in naval market is segmented into camera, sensor, and laser range finders. The camera segment held a larger market share in 2023.

- Based on the application, the global electro-optic in naval market is segmented into target detection, identification, and tracking; surveillance; fire control; and others. Furthermore, the increasing inclination towards surveillance is accelerating segment growth at highest CAGR rate.

- Based on end use, the global electro-optic in naval market is segmented into defense and commercial. The defense segment held a larger market share in 2023.

Electro-Optics in Naval Market Share Analysis by Geography

The global electro-optics in naval market is segmented into five major regions— North America, Europe, APAC, Middle East and Africa (MEA), and South America (SAM). North America held the largest share of the global electro optic in the naval market in 2021. Over the years, countries in North America, have experienced a rise in their military expenditure for enhancing their land, sea, and air troop capabilities, which is leading to the adoption of advanced technologies among the military forces. In February 2022, the US Navy awarded a contract to Teledyne FLIR, a subsidiary of Teledyne Technologies, to maintain and supply BRITE Star II multi-sensory imaging systems for the US Navy’s H-1 program. Also, there is increased adoption of advanced camera and sensor technologies in naval ships for applications such as target detection, tracking, surveillance, and fire control. All these factors are collectively boosting the market growth.

Electro-Optics in Naval Market Regional InsightsThe regional trends and factors influencing the Electro-Optics in Naval Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Electro-Optics in Naval Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Electro-Optics in Naval Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 9,268.34 million |

| Market Size by 2031 | US$ 12,980.06 million |

| Global CAGR (2023 - 2031) | XX% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Electro-Optics in Naval Market Players Density: Understanding Its Impact on Business Dynamics

The Electro-Optics in Naval Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Electro-Optics in Naval Market top key players overview

Electro-Optics in Naval Market News and Recent Developments

The electro-optics in naval market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In November 2022, Naval Undersea Warfare Center (NUWC) announced a $173.2 million contract to SAAB to build, test, and deliver drones. Which can evaluate the behavior and sensor signature of the enemy. (Source: Naval Undersea Warfare Center, Press Release)

- In June 2022, A team led by L3Harris Technologies (NYSE:LHX) was selected to provide the Shipboard Panoramic Electro-Optic/Infrared (SPEIR) system to the U.S. Navy that will provide improved fleet protection. The initial $205 million contract has a potential value of $593 million if all options are exercised through March 2031. (Source: L3Harris Technologies, Press Release)

Electro-Optics in Naval Market Report Coverage and Deliverables

The “Electro-Optics in Naval Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Electro-optics in naval market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities

- Electro-optics in naval market trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Electro-optics in naval market analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments

- Electro-optics in naval market landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments.

- Detailed company profiles

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For