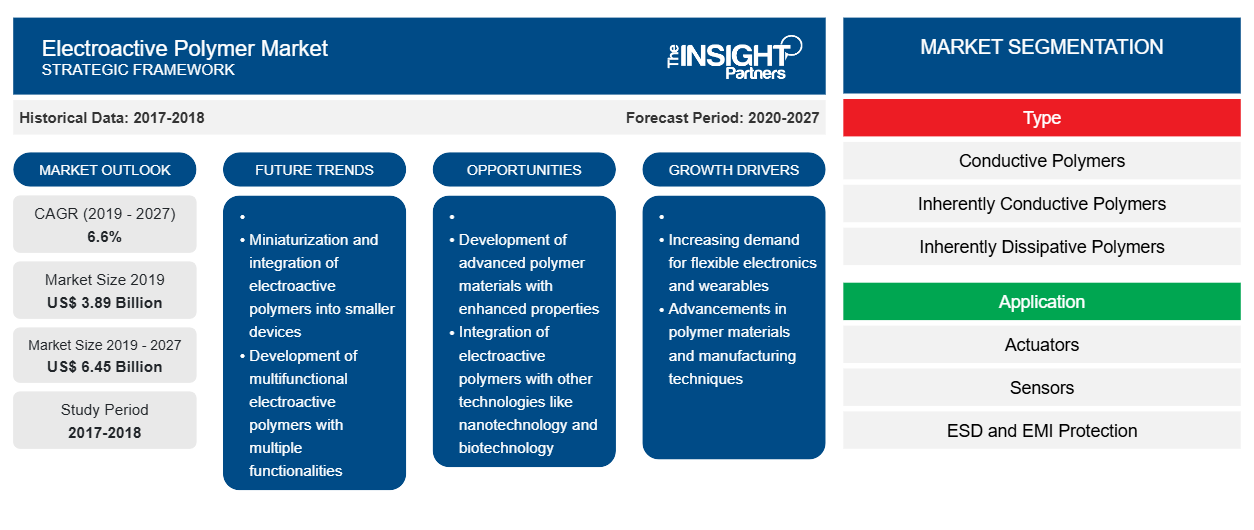

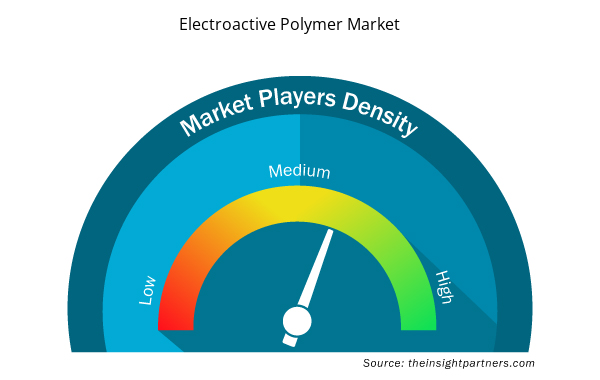

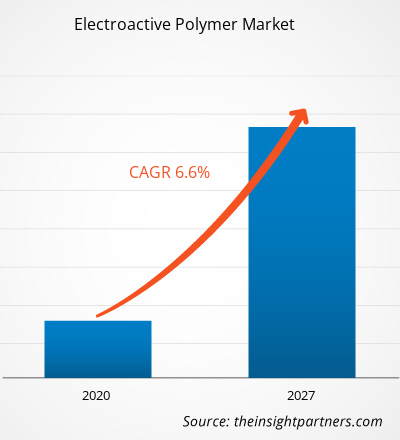

The electroactive polymer market was valued at US$ 3,890.00 million in 2019 and is projected to reach US$ 6,449.55 million by 2027; it is expected to grow at a CAGR of 6.6% from 2020 to 2027.

The electroactive polymer market is highly profitable for semiconductor and polymer producers, though the manufacturers would require high initial investment to alter from silicon to polymers. There are several forces that effect the electro-active polymers market. Cost is the most considerable factor prompting the electro-active polymers industry growth. The use of polymers in luminescent and robotics applications is cost-effective than the use of semiconductor and metals materials. The usage of electroactive polymers in the field of biomedicine and biomimetics could help address the global problem of rising healthcare costs.

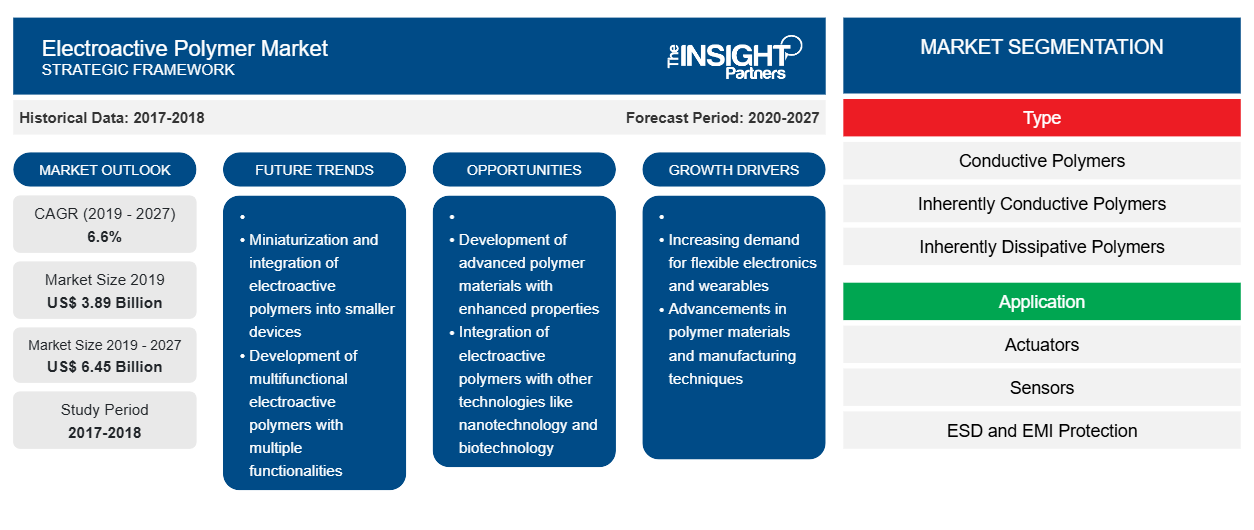

In 2019, Asia Pacific is the largest market for electroactive polymer. The largest electroactive polymer market share of the region is primarily attributed to the presence of well-established players such as 3M, Arkema Group, and Solvay S.A. These countries are experiencing rising demand for the manufacturing and automotive industry. Apart from the electroactive polymers application in the automotive industry, electroactive polymers are extensively utilized in medical devices, aircrafts, electronics & appliances, industrial, and other industries. This wider application of electroactive polymers in the end-use industries in this region is further influencing the market growth.

COVID-19 outbreak first began in Wuhan (China) in December 2019, and since then, it has spread at a fast pace across the globe. As of March 2021, the US, India, Brazil, Russia, the UK, France, Spain, Italy, Turkey, Germany, Colombia, and Argentina are some of the worst affected countries in terms of confirmed cases and reported deaths. According to the latest WHO figures, there were 120,915,219 confirmed cases and 2,674,078 total deaths globally on 18th March 2021. The COVID-19 outbreak has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The chemicals & materials industry is amongst the major industries suffering serious disruptions such as supply chain breaks, production facility shutdowns, etc., as a result of this outbreak. The shutdown of various plants and factories in leading regions such as North America, Europe, Asia Pacific, South America, and the Middle East and Africa has affected the global supply chain and negatively impacted the manufacturing, delivery schedules, and sales of various chemicals and materials. Further, various companies have already announced possible delays in product deliveries and slump in future sales of their products. In addition to this, the global travel bans imposed by countries in Europe, Asia, and North America are affecting the business collaborations and partnerships opportunities. All these factors are anticipated to affect the chemicals & materials industry in a negative manner, thus act as a restraining factor for the growth of various markets related to this industry in the coming months.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electroactive Polymer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electroactive Polymer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Surging Demand for Smart Electronics

Developments in science and technology, especially in the electronics and semiconductors sector, have led to the advent of smart polymers that are capable of changing shape when stimulated by current. Smartphone is a key example of smart electronics that use components made from electroactive polymers, such as batteries, capacitors, proximity sensors, fingerprint sensors, and touchscreen sensors. Electroactive polymers also find use in smart computers, laptops, and tablets. With the ongoing research and development activities, companies are likely to come up with the use of electroactive polymers in computers for blind people via braille. Electroactive polymers are being used in electronic devices to expand the character limit while using braille and thus help the visually impaired people in communicating. According to a report by The Insight Partners, the global smart electronics market is expected to register a notable CAGR of ~7% during 2020–2027, thus depicting a strong potential for electroactive polymers in smart electronics.

Type Insights

Based on type, the electroactive polymer market is segmented into conductive plastic, inherently conductive polymers, inherently dissipative polymers, and others. The inherently conductive polymer segment led the electroactive polymer market with the highest market share in 2019. The inherently conductive polymer is a family of specialty conductive thermoplastic compounds, which fulfill uniform and precise surface resistivity throughout a resistivity spectrum from strong ESD to strong anti-static. These polymers are quite suited for disk-drive components, wafer processing, and cleanroom applications. They are advantageous in automotive applications needing static discharge protection like fuel system components. Other automotive uses of these polymers are body attachments such as mirror housings, door handles, bumpers, wheel covers, fenders, and interior parts.

Application Insights

Based on application, the electroactive polymer market is segmented into actuators, sensors, ESD and EMI protection, antistatic packaging, robotics, and others. The ESD and EMI protection segment led the electroactive polymer market with the highest market share in 2019. Side effects caused due to an electrostatic discharge (ESD) is an induced EMI (electromagnetic interference). The effects of undesired electromagnetic radiation or EMI on ungrounded or unshielded conductors are commonly underestimated. An ESD protection device can protect a circuit from an electrostatic discharge (ESD) to prevent a malfunction or breakdown of any electronic device. Electroactive polymers are utilized in such devices for EDS protection since these polymers have high physical and mechanical strength, and anti-static properties.

Lubrizol Corporation; Arkema Group; Solvay S.A.; Parker Hannifin Corp; Celanese Corporation; Avient Corporation; Agfa-Gevaert Group; Kenner Material & System Co., Ltd.; 3M; and Premix Group are among the key market players. Major players in the electroactive polymer market are focused on strategies such as mergers and acquisitions and product launch to increase the geographical presence and consumer base globally.

Report Spotlights

- Progressive industry trends in the global electroactive polymer market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the global electroactive polymer market from 2017 to 2027

- Estimation of the demand for electroactive polymer across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the competitive market scenario and the demand for electroactive polymer

- Market trends and outlook coupled with factors driving and restraining the growth of the electroactive polymer market

- Decision-making process by understanding strategies that underpin commercial interest with regard to the global electroactive polymer market growth

- Electroactive polymer market size at various nodes of market

- Detailed overview and segmentation of the global electroactive polymer market as well as its dynamics in the industry

- Electroactive polymer market size in various regions with promising growth opportunities

Electroactive Polymer Market Regional Insights

The regional trends and factors influencing the Electroactive Polymer Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electroactive Polymer Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electroactive Polymer Market

Electroactive Polymer Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 3.89 Billion |

| Market Size by 2027 | US$ 6.45 Billion |

| Global CAGR (2019 - 2027) | 6.6% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Electroactive Polymer Market Players Density: Understanding Its Impact on Business Dynamics

The Electroactive Polymer Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electroactive Polymer Market are:

- 3M Company

- Agfa-Gevaert Group

- Arkema S.A.

- Celanese Corporation

- Kenner Material and System Co. Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electroactive Polymer Market top key players overview

Global Electroactive Polymer Market, byType

- Conductive Polymers

- Inherently Conductive Polymers

- Inherently Dissipative Polymers

- Others

Global Electroactive Polymer Market, by Application

- Actuators

- Sensors

- ESD and EMI Protection

- Antistatic Packaging

- Others

Company Profiles

- Lubrizol Corporation

- Arkema Group

- Solvay S.A.

- Parker Hannifin Corp

- Celanese Corporation

- Avient Corporation

- Agfa-Gevaert Group

- Kenner Material & System Co., Ltd.

- 3M

- Premix Group

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type , and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Electrically conductive & static dissipative plastics guard components from failures also breakage prompted by uncontrolled electrostatic discharge (ESD) in electronics production & logistics. The electroactive plastics guarantee longer operating life for electronic devices. Conductive particles such as graphite and nanofillers are uniquely attractive to be applied as cases of electronic devices with electrostatic discharge properties (ESD) and electromagnetic shielding (EMI). Another attractive employment with a high technology result of conductive plastics is their potentialities as electronic sensors, actuators, which also react against an external stimulus, in this case, a deformation. The biggest advantage of electroactive polymers is their processability, mainly through dispersion. Some of the conductive plastics are polycarbazoles, polyindoles, polyazepines, and others.

The major players operating in the global avocado oil market are Lubrizol Corporation, Arkema Group, Solvay S.A., Parker Hannifin Corp, Celanese Corporation, Avient Corporation, Agfa-Gevaert Group, Kenner Material & System Co., Ltd., 3M, and Premix Group.

In 2019, Asia Pacific contributed to the largest share in the global electroactive polymer market. The market for electroactive polymers in APAC is witnessing growth owing to owing to the growing demand for the consumer electronics industry in the region. Furthermore, the growing urbanization coupled with the increasing population in Asia Pacific countries such as China, India, Japan, and South Korea is the major factor driving the demand for electroactive polymers. Moreover, North America also holds a significant market share of the electroactive polymers market owing to the rising medical device industry. According to the Select USA, the U.S. medical device industry is projected to rise to $208 billion by the year 2023. Therefore, with the growing medical device industry, the demand for electroactive polymers will also subsequently increase, which is projected to fuel the electroactive polymers industry in the North America and Asia Pacific during the forecast period.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Electroactive Polymer Market

- 3M Company

- Agfa-Gevaert Group

- Arkema S.A.

- Celanese Corporation

- Kenner Material and System Co. Ltd.

- NOVASENTIS, INC

- Parker-Hannifin Corporation

- PolyOne Corporation

- Solvay SA

- The Lubrizol Corporation

Get Free Sample For

Get Free Sample For