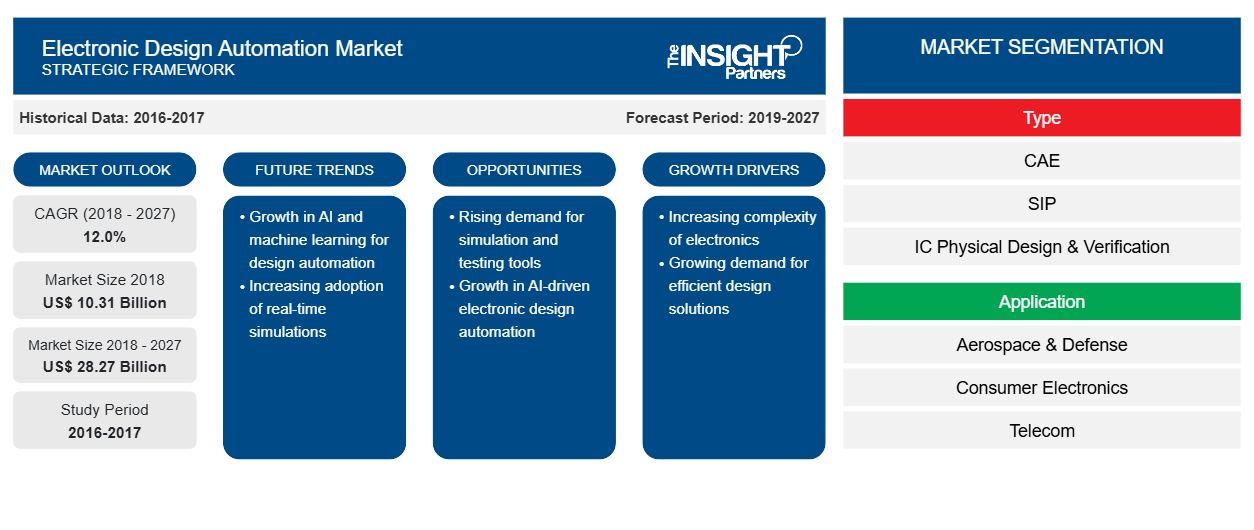

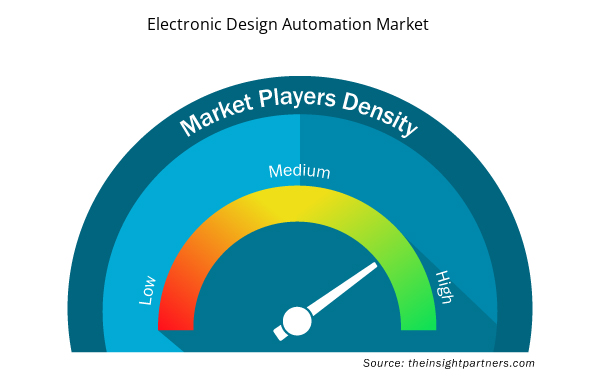

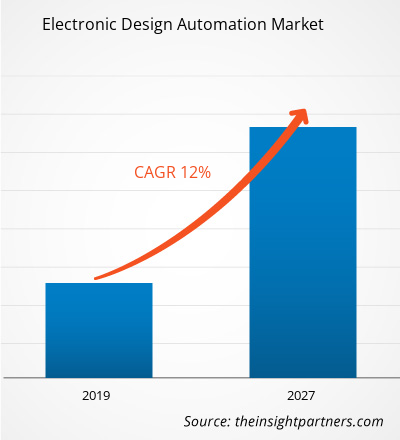

The electronic design automation market accounted to US$10.31 Bn in 2018 and is expected to grow at a CAGR of 12.0% during the forecast period 2019 – 2027, to account to US$28.27 Bn by 2027.

Electronic design automation software comprises of multiple tools and applications. Integrating these tools according to the customers’ demand sometimes becomes a complicated job. The complex requirements of the end-users regarding highly stable and accurate product positioning is addressed with the help of EDA. Rising complexities and cost challenges faced by the industries for implementation of expensive complex designs is key influencer driving the demand of EDA.APAC is expected to be the dominant region in the electronic design automation market. The major reason for this is the huge electronics and semiconductor hub in China coupled with the large population density of the region. Also China accounts for the largest shipments for semiconductors across the world, the new market initiatives and strategic partnerships are expected to continue during the forecast period, contributing to high growth of the electronic design automation market in the region.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electronic Design Automation Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electronic Design Automation Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Growth of semiconductor industry

The SIA (Semiconductor Industry Association) in October 2018, while representing the U.S leadership in semiconductor research, design and manufacturing had charted an increase of 12.7% from 2017 and marked the total revenue of US$ 41.8 Bn. Furthermore, the WSTS also forecasted a trajectory of 15.9% in 2018 and 2.6% in 2019. This growth in the semiconductor industry has raised the confidence of the electronic design automation market players in terms of revenue growth. The companies operating in the semiconductor landscape are not only anticipating a substantial rise in the revenue but are also respectively increasing their R&D spending. The year on year increase in R&D spending has have imposed a noteworthy thrust to the electronic design automation market during the recent past and is projected to continue to drive the market in the coming years.

As the semiconductor industry continues to be in strong up-cycle, the leaders in the electronic design automation market are expected to adopt a future-oriented approach by considering unconventional end-market such as artificial intelligence, autonomous vehicle and IoT. Additionally, the memory companies are also likely to witness a raise sales owing to bolstering demand for data centers smartphones and autonomous vehicle technologies. Convergence of myriad semiconductor end-user markets has resulted in significant industry expansion, which in response has driven the electronic design automation market for technology, software and automation.

Rising Penetration of IoT, Artificial Intelligence and virtual Reality

Smart homes, TVs, smartphones, Internet of Things, connected cars, artificial intelligence are that every aspect of human life that the consumer electronics industry has pervaded. The demand for consumer electronics across the globe has been largely driven by the desire of the consumers for bigger, newer and enhanced capabilities, which in turn has encouraged the sector to constantly explore innovations and technologies that not only encapsulate imagination of the people but are also affordable and relevant in terms of catering to their daily needs. In such cases the EDA software providers the electronic component manufacturers and technologists to design suitable prototype of the devices. Therefore, evolving consumer expectation and burgeoning demand of consumer electronics is expected to drive the EDA market in coming years.

Few of the recent strategies by some of the players in electronic design automation market landscape are listed below:

2018:Cadence Design Systems, Inc. announced a strategic partnership with Green Hills Software to accelerate embedded safety and security. Cadence Design Systems, Inc. invested $150 million that is about 16% ownership interest in GreenHill.

2018:Keysight technologies was selected by ON Semiconductor for as an EDA partner for delivering a design solution for power devices that is expected to increase reliability and accelerate time-to-market.

2018:Synopsys, Inc. and Siemens AG announced a collaboration for wide range of EDA projects. Additionally, the Siemens and Synopsys settled all outstanding patent litigation between Synopsys and Mentor Graphics.

The report segments the global electronic design automation market as follows:

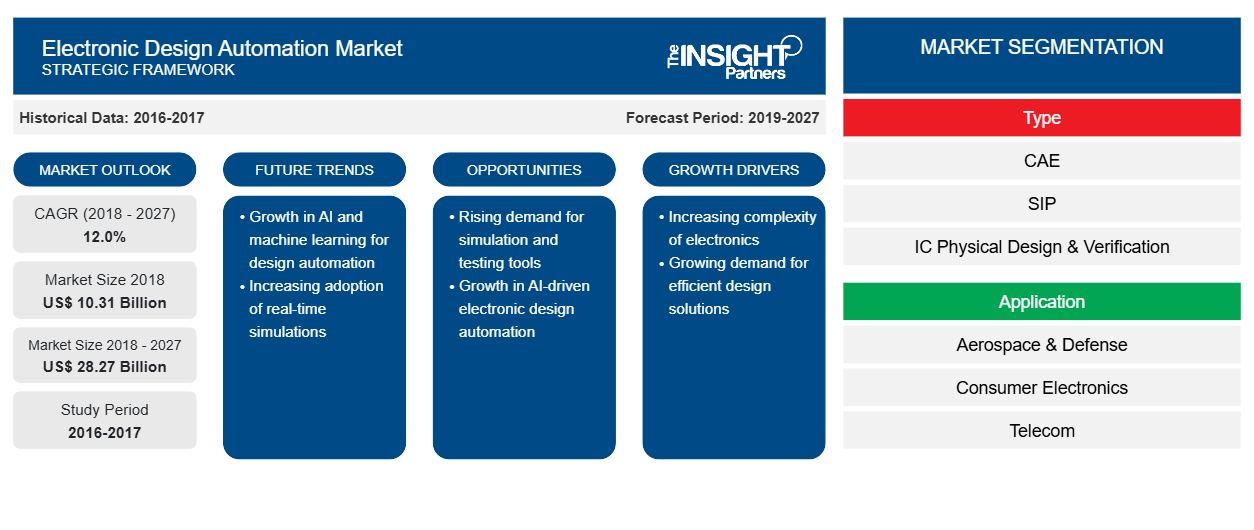

Electronic Design Automation Market Regional Insights

Electronic Design Automation Market Regional Insights

The regional trends and factors influencing the Electronic Design Automation Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electronic Design Automation Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electronic Design Automation Market

Electronic Design Automation Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 10.31 Billion |

| Market Size by 2027 | US$ 28.27 Billion |

| Global CAGR (2018 - 2027) | 12.0% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

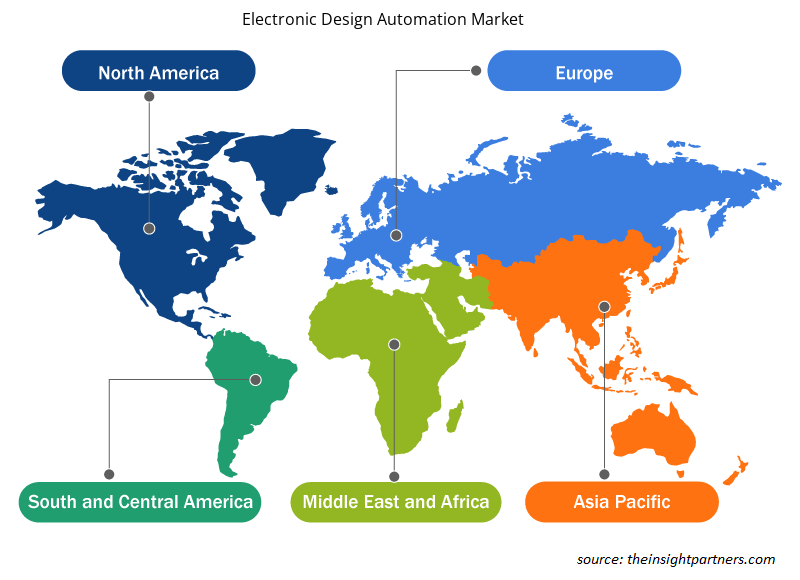

Electronic Design Automation Market Players Density: Understanding Its Impact on Business Dynamics

The Electronic Design Automation Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electronic Design Automation Market are:

- Agnisys Inc.

- Aldec, Inc.

- Autodesk, Inc.

- Cadence Design Systems, Inc.

- Labcenter Electronics Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electronic Design Automation Market top key players overview

Global Electronic Design Automation Market - By Type

- Computer Aided Engineering (CAE)

- Semiconductor IP (SIP)

- IC Physical Design & Verification

- Printed Circuit Board (PCB) & Multi-Chip Module (MCM)

Global Electronic Design Automation Market - By Application

- Aerospace & Defense

- Consumer Electronics

- Telecom

- Automotive

- Industrial

- Others

Global Electronic Design Automation Market - By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Rest of Europe

- Asia Pacific (APAC)

- China

- India

- Japan

- South Korea

- Rest of APAC

- Rest of the World (RoW)

- South America

- Middle East and Africa

Global Electronic Design Automation Market - Company Profiles

- Agnisys Inc.

- Aldec, Inc.

- Autodesk, Inc.

- Cadence Design Systems, Inc.

- Labcenter Electronics Ltd.

- Keysight Technologies

- Mentor Graphics Corporation

- Silvaco, Inc.

- Synopsys, Inc.

- Zuken Inc.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies

- Agnisys Inc.

- Aldec, Inc.

- Autodesk, Inc.

- Cadence Design Systems, Inc.

- Labcenter Electronics Ltd.

- Keysight Technologies

- Mentor Graphics Corporation

- Silvaco, Inc.

- Synopsys, Inc.

- Zuken Inc.

Get Free Sample For

Get Free Sample For