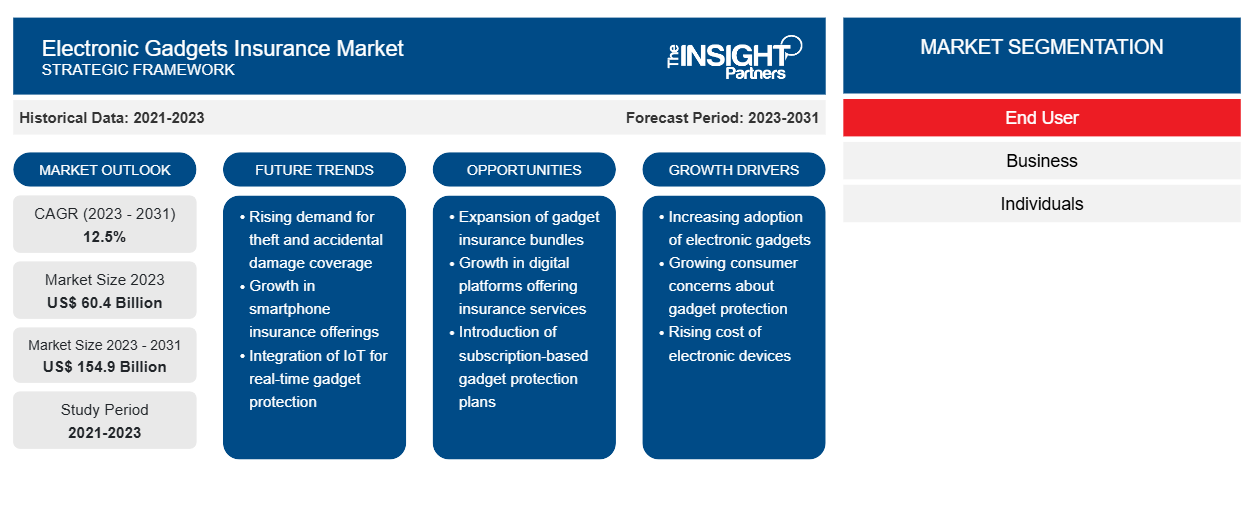

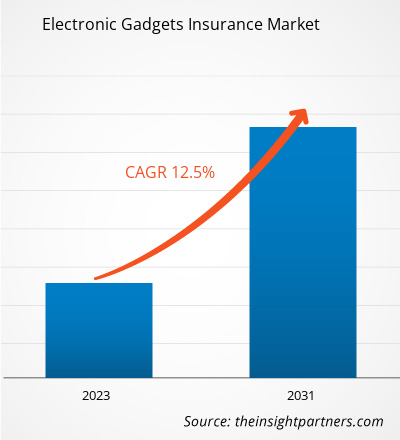

The electronic gadgets insurance market size is expected to grow from US$ 60.4 billion in 2023 to US$ 154.9 billion by 2031; it is anticipated to expand at a CAGR of 12.5% from 2023 to 2031. The market is influenced by the increase in the incidents of accidental damage and virus infection. Electronic gadget insurance offers users repair services.

Electronic Gadgets Insurance

Market Analysis

The growth of the electronic gadgets insurance market is primarily driven by factors such as an increase in incidents of accidental damage, phone thefts, virus infection, and device malfunction. Additionally, the surge in adoption of high-quality smartphones contributes to the market's expansion. The high replacement cost of various parts of gadgets also plays a significant role in driving the growth of the gadget insurance market. However, the decline in the sale of PCs due to the increased penetration of smartphones and tablets acts as a major restraint to market growth. Conversely, there is an expected surge in demand for innovative multiple gadget insurance services, which is expected to bring new electronic gadgets insurance market trends.

Electronic Gadgets Insurance

Industry Overview

- Gadget insurance is a contractual service that offers repair services for electronic gadgets sold by retailers and service providers. It typically includes additional coverage for unauthorized usage, malicious damage, e-wallet payments, and theft. Gadget insurance also provides coverage for the costs and inconveniences associated with mechanical and electrical failures. Furthermore, the rising trend among customers to "cover my gadget" has significantly contributed to the electronic gadgets insurance market growth.

- Gadget insurance can be obtained through different channels, such as retailers, service providers, or standalone insurance policies. It is worth noting that some existing insurance policies, like homeowners' or renters insurance, may already provide coverage for electronic devices under the personal property section. However, these policies may have limitations, such as not covering damages caused by accidents or only providing coverage up to a certain sublimit.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electronic Gadgets Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electronic Gadgets Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Electronic Gadgets Insurance

Market Drivers and Opportunities

Increase in Incidents of Accidental Damage, Theft, and Device Malfunction to Drive the Electronic Gadgets Insurance

Market Growth

- Accidental damage is a common occurrence when it comes to electronic gadgets. With the growing use of smartphones, tablets, laptops, and other gadgets in our daily lives, the chances of accidental damage also increase. Accidents such as dropping the device, spilling liquids on it, or even a simple mishap can result in costly repairs or replacements. Therefore, individuals are more inclined to opt for gadget insurance to protect themselves from the financial burden of such incidents.

- Theft is another major concern for gadget owners. As the value and popularity of electronic devices continue to rise, they become attractive targets for thieves. The risk of having a gadget stolen is higher in public places, crowded areas, or even from homes or vehicles. Gadget insurance provides coverage against theft, ensuring that individuals are not left empty-handed if their device is stolen.

Electronic Gadgets Insurance

Market Report Segmentation Analysis

- Based on coverage type, the electronic gadgets insurance market forecast is segmented into physical damage, theft and loss protection, virus and data protection, and others.

- The physical damage segment is expected to hold a substantial electronic gadgets insurance market share in 2023 This can be attributed to several factors, including the increase in repairing and replacing costs of gadgets and the rise in awareness among the youth regarding physical damage coverage.

- The repairing and replacing costs of electronic gadgets have been on the rise. As gadgets become more advanced and sophisticated, the cost of repairing or replacing damaged components also increases. This includes expenses related to screen repairs, circuit board damages, or other physical damages. To avoid bearing these high costs themselves, individuals are opting for gadget insurance that covers physical damage. This coverage provides financial protection and peace of mind in case of accidental damage to their devices.

Electronic Gadgets Insurance

Market Share Analysis by Geography

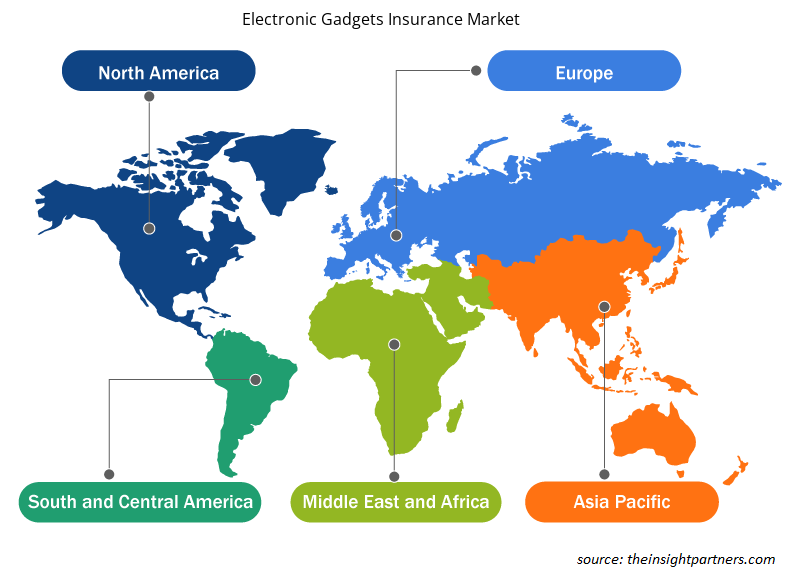

The scope of the electronic gadgets insurance market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant electronic gadgets insurance market share. Firstly, there has been an increase in incidents of accidental device damage, phone thefts, virus infection, device malfunction, and other malicious activities in the region. With the growing reliance on electronic gadgets in daily life, the risk of such incidents has also increased. Additionally, North America has a significant number of smartphone users, with nearly 10% of global smartphone users residing in the region, amounting to 320 million users in 2020. The high number of smartphone users poses a greater risk of phone theft, especially in crowded areas such as public transport and festivals.

Electronic Gadgets Insurance

Electronic Gadgets Insurance Market Regional Insights

The regional trends and factors influencing the Electronic Gadgets Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electronic Gadgets Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electronic Gadgets Insurance Market

Electronic Gadgets Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 60.4 Billion |

| Market Size by 2031 | US$ 154.9 Billion |

| Global CAGR (2023 - 2031) | 12.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By End User

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

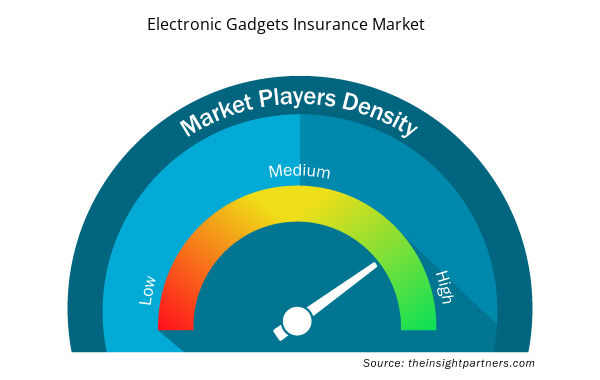

Electronic Gadgets Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Electronic Gadgets Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electronic Gadgets Insurance Market are:

- Apple Inc.

- Asurion

- AXA

- AT&T Inc.

- Bajaj Allianz General Insurance Company

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electronic Gadgets Insurance Market top key players overview

The "Electronic Gadgets Insurance Market Analysis" was carried out based on coverage type, device type, end users, and geography. By coverage type, it is segmented into physical damage, theft & loss protection, virus & data protection, and others. On the basis of device type, it is divided into laptop & PCs, mobile phones & tablets, and others. Based on end users, the market is segmented into business, and individuals. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Electronic Gadgets Insurance

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the market. A few recent key market developments are listed below:

- In November 2023, Chubb, the world's largest publicly traded property and casualty insurer, unveiled a new developer portal as part of its Chubb Studio global integration technology. This developer portal aims to simplify the process for its B2B2C partner companies to access and evaluate Chubb's digital insurance products and capabilities. With this initiative, Chubb aims to enhance collaboration and foster innovation within its partner ecosystem.

- In September 2022, Axa UK Retail introduced Moja, a digital-only insurance brand targeting customers who make purchases or utilize services through their smartphones or tablets. This launch aims to provide customers with the flexibility to customize their insurance coverage according to their specific requirements and financial capacities. Additionally, Moja offers various supplementary options, including coverage for personal belongings such as satnavs, audio equipment, and children's car seats, thereby enhancing its value proposition.

Electronic Gadgets Insurance

Market Report Coverage & Deliverables

The market report “Electronic Gadgets Insurance Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Water Pipeline Leak Detection System Market

- Non-Emergency Medical Transportation Market

- Extracellular Matrix Market

- Blood Collection Devices Market

- Artificial Intelligence in Healthcare Diagnosis Market

- High Speed Cable Market

- Nuclear Decommissioning Services Market

- Aircraft Landing Gear Market

- Enzymatic DNA Synthesis Market

- Smart Mining Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Coverage Type, Device Type, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding the majority of shares in the global electronic gadgets insurance market are Apple Inc., Asurion, AXA, AT&T, Inc., and Bajaj Allianz General Insurance Company.

The global electronic gadgets insurance market is expected to reach US$ 154.9 billion by 2031.

The electronic gadgets insurance market size is expected to grow from US$ 60.4 billion in 2023 to US$ 154.9 billion by 2031; it is anticipated to expand at a CAGR of 12.5% from 2023 to 2031

Rapid technological advancements and corresponding increases in gadget prices are anticipated to play a significant role in the global electronic gadgets insurance market in the coming years.

The electronic gadgets insurance market is influenced by the increase in the incidents of accidental damage, and virus infection.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Apple Inc.

- Asurion

- AXA

- AT&T Inc.

- Bajaj Allianz General Insurance Company

- Bolttech

- Chubb

- CloudClover Insurance

- Gadget Cover

- Samsung

Get Free Sample For

Get Free Sample For